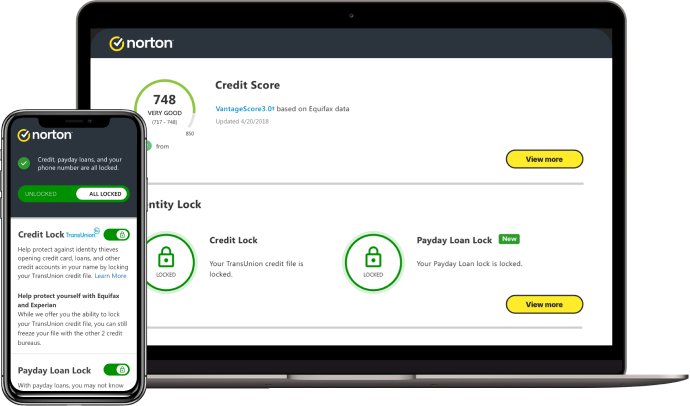

Identity Lock

Identity Lock gives you a proactive way to help protect against unauthorized account openings by locking your credit file.

Screens are simulated and subject to change.

Credit Lock

Could an identity thief use your credit to open an account?

Have you ever opened an account or new loan and been surprised how easy it was for your credit to be checked and approved?

If they can get your personal information, identity thieves could use your credit to open an account. Your personal information could be accessible through data breaches, information shared on social media, or for sale on the dark web.

Identity Lock gives you a way to be proactive against these types of threats. With just one click, you can lock your TransUnion credit file, and unlock it again when you want to use it.

Lock vs. freeze

What’s the difference? Credit locks and credit freezes are two ways to help protect against accounts being opened fraudulently in your name.

Credit locks make it easy to lock and unlock your credit file with a single click. Unlock when you want to apply for a loan or open a new account, and lock it again when you’re done.

Credit freezes require you to contact the credit bureau directly to freeze your credit file. The credit bureau would provide a PIN that you would use to unfreeze your credit file when needed.

Identity Lock is available in

Get more expert tips.

Related articles

- Details: Subscription contracts begin when the transaction is complete and are subject to our Terms of Sale and License & Services Agreement. For trials, a payment method is required at sign-up and will be charged at the end of the trial period, unless canceled first.

- Renewal: Subscriptions automatically renew unless the renewal is canceled before billing. Renewal payments are billed annually (up to 35 days before renewal) or monthly depending on your billing cycle. Annual subscribers will receive an email with the renewal price beforehand. Renewal prices may be higher than the initial price and are subject to change. You can cancel the renewal as described here in your account or by contacting us here or at 844-488-4540.

- Cancellation and refund: You can cancel your contracts and get a full refund within 14 days of initial purchase for monthly subscriptions, and within 60 days of payments for annual subscriptions. For details, visit our Cancellation and Refund Policy. To cancel your contract or request a refund, click here.

3 If your plan includes credit reports, scores, and/or credit monitoring features ("Credit Features"), two requirements must be met to receive said features: (i) your identity must be successfully verified with Equifax; and (ii) Equifax must be able to locate your credit file and it must contain sufficient credit history information. IF EITHER OF THE FOREGOING REQUIREMENTS ARE NOT MET YOU WILL NOT RECEIVE CREDIT FEATURES FROM ANY BUREAU. If your plan also includes Credit Features from Experian and/or TransUnion, the above verification process must also be successfully completed with Experian and/or TransUnion, as applicable. If verification is successfully completed with Equifax, but not with Experian and/or TransUnion, as applicable, you will not receive Credit Features from such bureau(s) until the verification process is successfully completed and until then you will only receive Credit Features from Equifax. Any credit monitoring from Experian and TransUnion will take several days to begin after your successful plan enrollment.

12 Identity Lock cannot prevent all account takeovers, unauthorized account openings, or stop all credit file inquiries. The credit lock on your TransUnion credit file and the Payday Loan Lock will be unlocked if your subscription is downgraded or canceled.