What is a dark web scan and can it protect your identity?

Your personal information might be for sale on the dark web. A dark web scan can help you find out if your information has been exposed.

A dark web scan is a service offered by companies that will search the dark web for you, combing through its large databases of stolen usernames, passwords, Social Security numbers, and credit card numbers for sale.

The providers of these scans will then notify you if they find your personal information on the dark web. Even though there’s no way of removing your personal information from the dark web, once you know what information is exposed, you can take action to help protect yourself against identity theft.

What is the dark web?

The dark web is a network of sites that you cannot access through a typical search engine. Sites on the dark web use encryption software to hide their locations.

A good chunk of the dark web is devoted to the buying and selling of stolen financial and personal information. And if your information ends up on dark web sites — for instance, after a data breach — an identity thief could gain access to it.

This criminal might then use your sensitive information to buy flat-screen TVs and computers with your credit card data, take out loans or open new credit cards with your name and Social Security number, or transfer money from your bank account.

A quick note for clarity: The dark web is different from the deep web. Content on the deep web also is not accessible by search engines — but it includes things like your online banking account, your health insurance portal, or a company’s private database, all of which require you to enter personalized credentials to access.

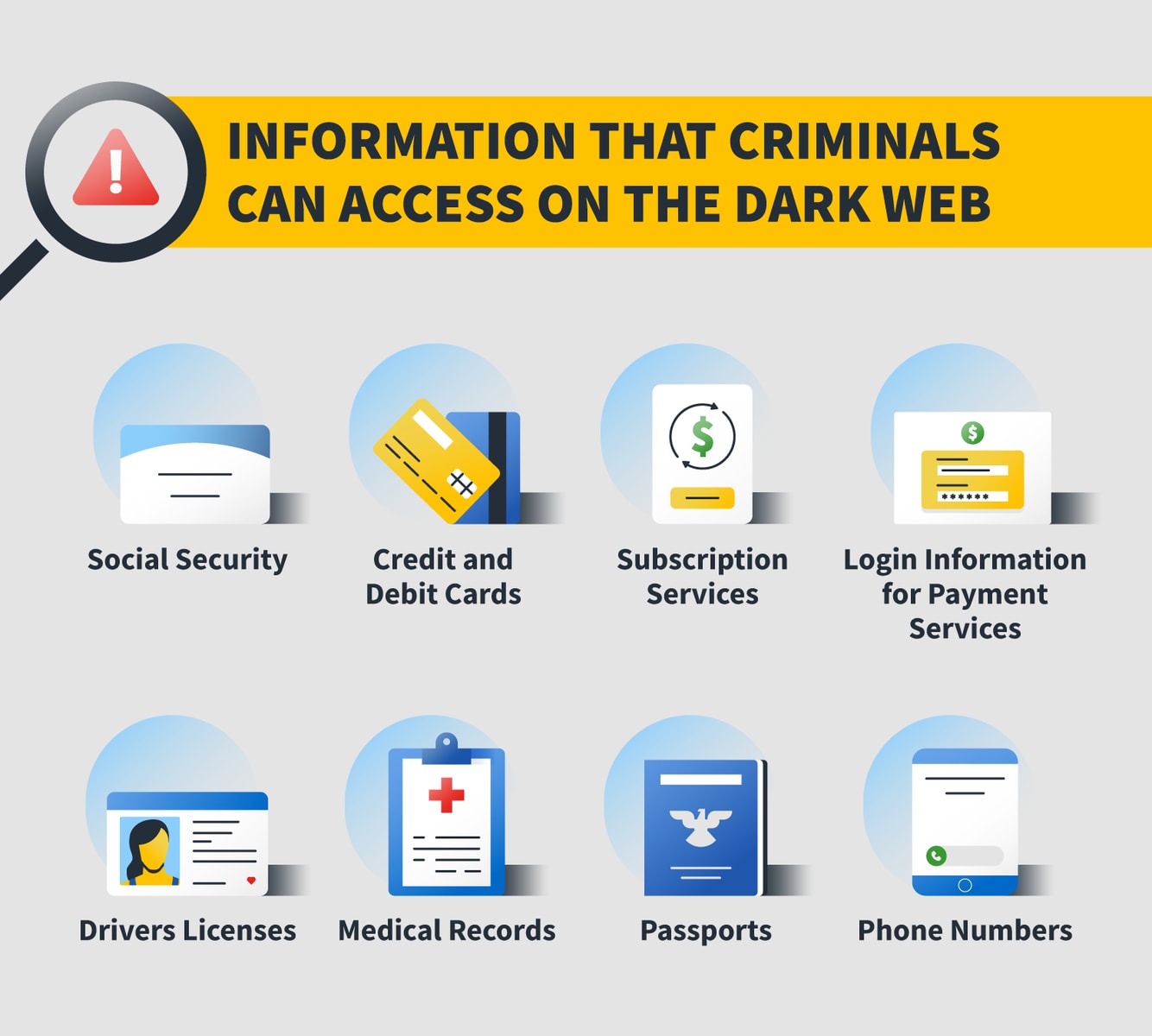

What kind of personal information is on the dark web?

Here is the personal information that thieves commonly access and sell on the dark web:

- Credit card and debit card account numbers

- Log-in information for payment services such as PayPal or Zelle

- Driver’s licenses

- Social Security numbers

- Medical records

- Passports

- Fake diplomas

- Phone numbers

- Log-in information for subscription services, like Netflix or Blue Apron

The prices that cybercriminals fetch for these items can vary. For instance, criminals might pay $1 for a stolen Social Security number or from $20 to $200 for log-in information for your PayPal account. They might pay $5 to $110 to access your stolen credit card information.

As you can see, fraudsters can get just about anything they want from the dark web, and that might include your personal information.

How does a dark web scan work?

A dark web scan works by scouring collections of stolen personal information and alerting you if your information is found. You can then take the appropriate steps to help mitigate resulting damage.

Be aware, though, that dark web scans can’t find everything. There is no way for any company to search the entire dark web. A scan can uncover when your data has been exposed. But it can’t find every instance of this because not all personal data is exposed in data breaches. For example, paper documents or forms containing your personal information may be left unprotected and exposed in an office or even in your home.

How can I scan the dark web for free?

Cybersecurity services sometimes offer dark web scans. If you’re worried that your financial information has been exposed on the dark web, such a service could help alleviate or confirm these fears.

What is dark web monitoring?

You can think of dark web monitoring as a continued dark web scan. It helps you more consistently monitor activity on the dark web that may compromise your personal information. You will receive an alert from your dark web monitoring service if your information is found.

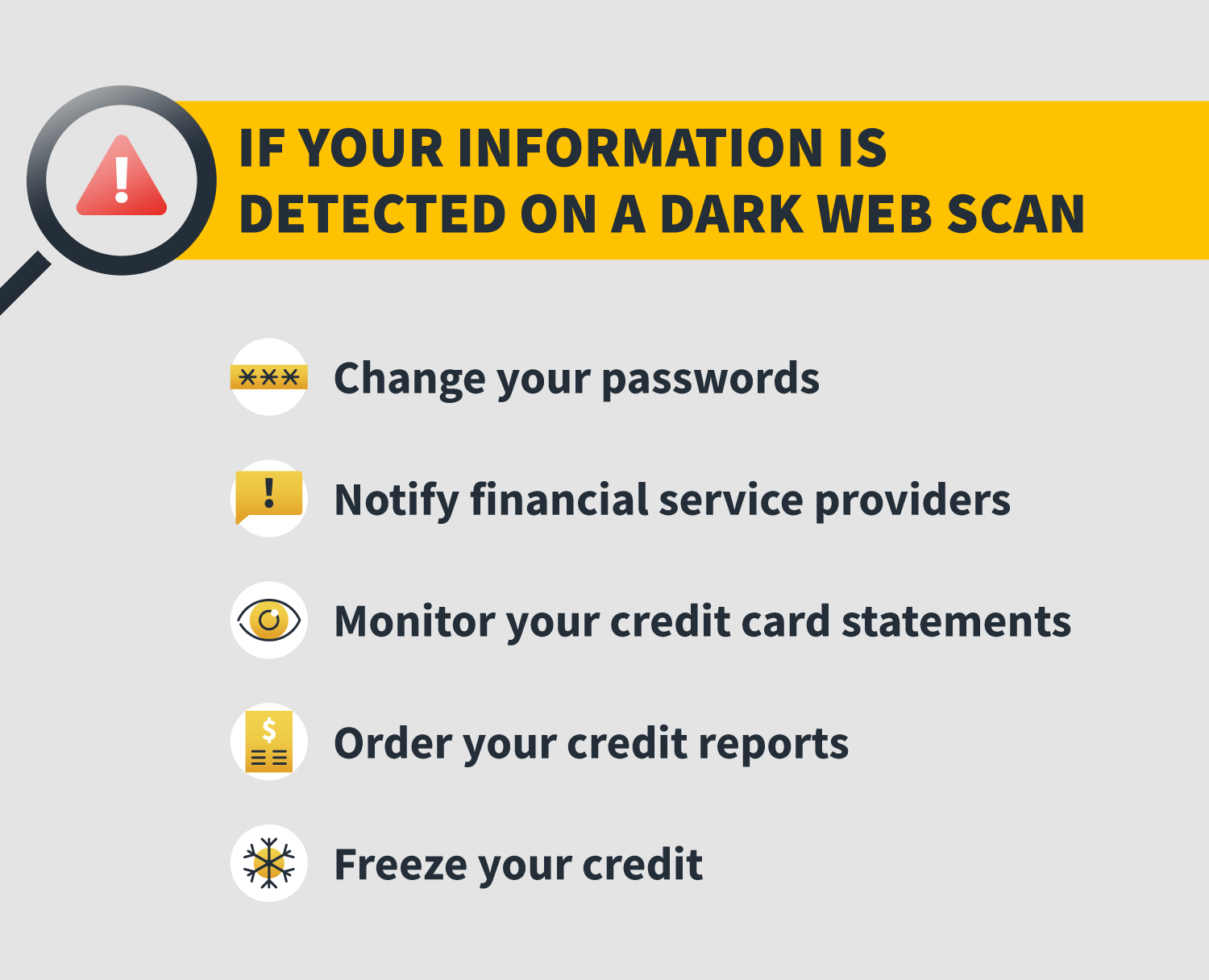

What should I do if my information is detected on a dark web scan?

You’ve ordered a dark web scan and discovered that your personal and/or financial information is for sale. What should you do now?

There are steps you can take to help minimize the damage.

1. Change your passwords

Security experts recommend you change your passwords every time you discover that your personal information has been exposed. Never use the same passwords on multiple sites, and make sure your new passwords are complex and difficult to guess.

The more complicated your passwords — using a series of letters, numbers, and symbols — the better.

2. Notify your financial services providers

If a scan finds that your credit card or bank account numbers have been exposed, call your financial services companies. This includes banks and credit card companies. You might need to cancel those accounts and open new accounts with new credit/debit cards to keep your financial information safe.

3. Monitor your credit card statements

Study your credit card statements carefully, looking for any suspicious purchases. If you do notice fraudulent charges, immediately contact your card provider. If you contact your bank or the card provider promptly upon discovering the charges, you may not be held liable for charges made by thieves.

It’s important to report fraud quickly: The Fair Credit Billing Act recommends that you report any suspicious purchases within 60 days.

If you do find fraudulent purchases, make sure to request a new credit card and account number from your card provider.

4. Order your credit reports

You’ll also need to monitor your three credit reports — one each maintained by Experian, Equifax, and TransUnion — for any accounts that might have been fraudulently opened in your name.

You can order one free copy of each of your reports once a year from AnnualCreditReport.com. When you order these reports, look them over carefully for credit card accounts or other loans that might have been opened in your name by fraudsters.

If you find unusual activity on any of your credit reports, contact the company that issued your card or loan and explain that you have been the victim of identity theft. You should also contact the Federal Trade Commission, or FTC, to file an identity theft report.

5. Freeze your credit

If you suspect that you have been the victim of identity theft, you should consider freezing your credit. Doing this will prevent fraudsters from opening further credit card accounts or taking out additional loans using your personal information.

Freezing your credit is free, but you must do it with all three credit bureaus. You can do this online at TransUnion, Equifax and Experian.

The threat of your personal information appearing on the dark web is real. Luckily, a dark web scan can help you take steps to mitigate future damage.

Try Norton 360 FREE 7-Day Trial* - Includes Norton VPN

7 days of FREE* comprehensive antivirus, device security and online privacy with Norton VPN.

Join today. Cancel anytime.

*Terms Apply

Editorial note: Our articles provide educational information for you. Our offerings may not cover or protect against every type of crime, fraud, or threat we write about. Our goal is to increase awareness about Cyber Safety. Please review complete Terms during enrollment or setup. Remember that no one can prevent all identity theft or cybercrime, and that LifeLock does not monitor all transactions at all businesses. The Norton and LifeLock brands are part of Gen Digital Inc.

Want more?

Follow us for all the latest news, tips, and updates.