Is online banking safe? Yes, if you follow these best practices

Mobile- and browser-based banking is convenient and relatively safe, but there are risks to your finances and personal information if you don’t take the proper steps to protect your online accounts. Learn how to stay safer while banking online, and securely review all your accounts at once with Norton Money.

Most people in the U.S. manage their finances through online banking. According to the American Bankers Association, 77% of consumers prefer using a mobile app or computer to access their accounts, with most of the rest opting either for in-person or over-the-phone banking. And, in general, online banking is considered secure.

Still, high-profile data breaches could lead some customers to question whether they can really trust online banking: one major incident at Alliance Bank affected 22,000 customers, whose driver’s license information, tax identification numbers, and other data points were exposed.

This post will address the risks of online banking and provide essential tips on how to protect yourself while managing your money online.

How banks keep your money and data secure

Banks secure your funds and data by following Federal Deposit Insurance Company (FDIC) standards, monitoring transactions for signs of fraud, and relying on advanced encryption technology to ensure that data sent between your computer and banking servers is confidential.

Below is a detailed list of the ways banks secure money and data:

- Fraud monitoring: Banks watch for and flag unusual transactions, sometimes freezing your account or calling you to verify purchases if something seems suspicious.

- Advanced encryption and firewalls: Banks store user data behind secure firewalls and use advanced encryption to scramble data when sending it over the internet, making it unreadable to prying eyes.

- Zero-trust frameworks: A zero-trust framework requires internal representatives to verify themselves before accessing sensitive data, minimizing the risk of insider threats stealing or leaking your information.

- Customer education: Many banks teach customers cybersecurity best practices, educating them through newsletters, blog posts, and videos on how to recognize phishing attacks and other social engineering tricks.

- Card freezing: Mobile banking apps often allow customers to freeze their lost or stolen cards, helping prevent unauthorized transactions.

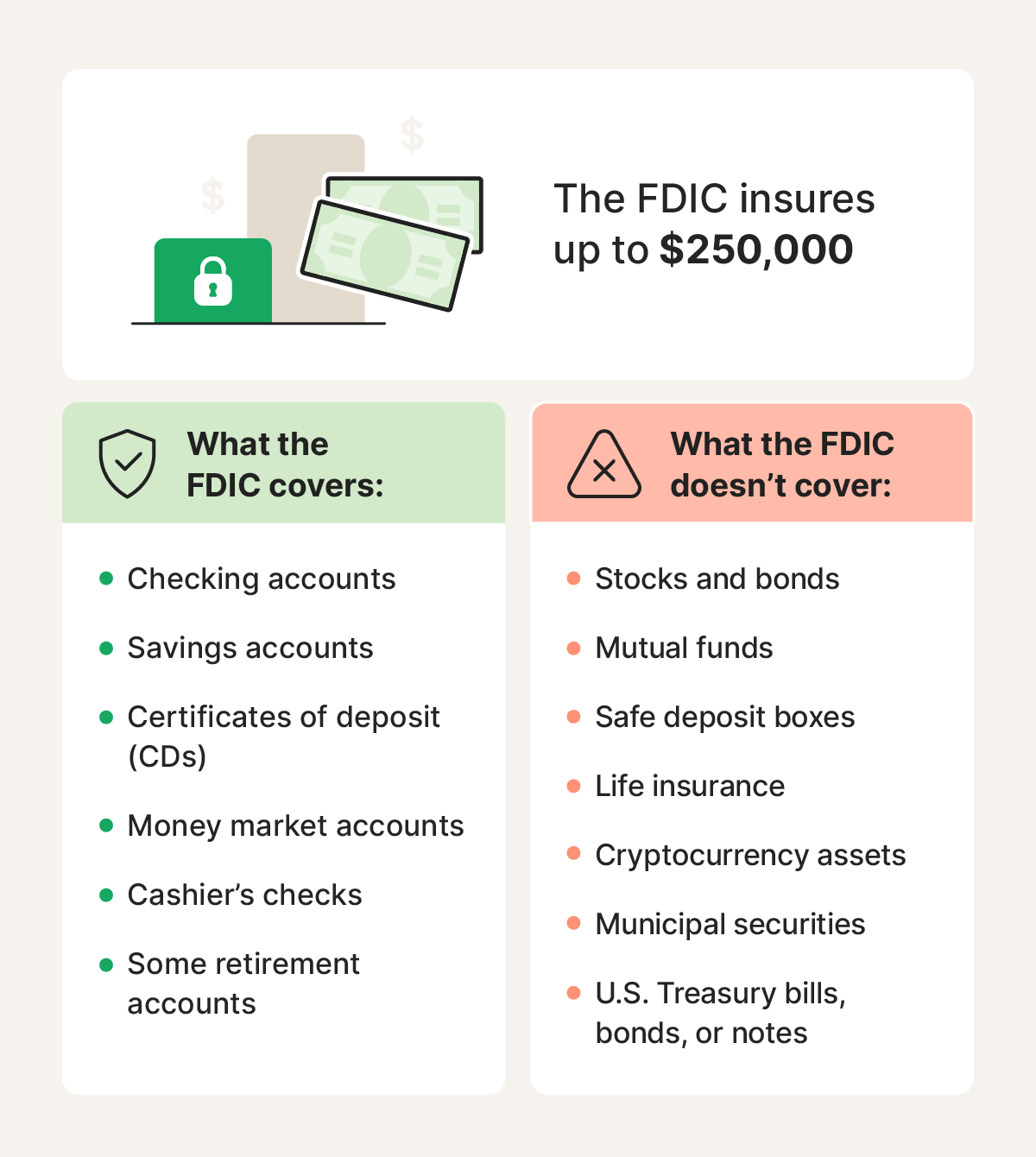

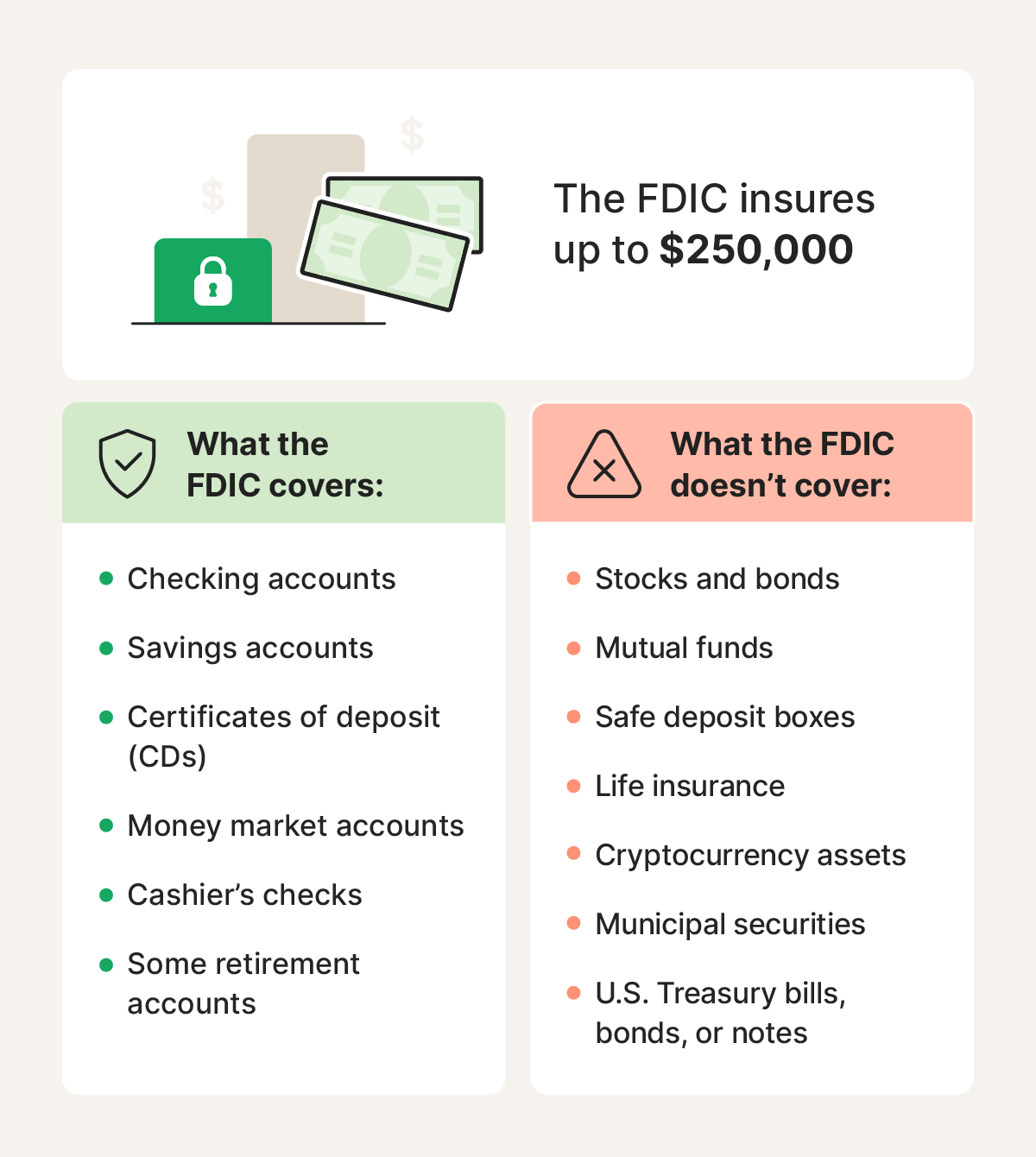

- FDIC protection: The FDIC, a banking regulator, oversees banks and insures deposits up to $250,000 per person. It helps ensure that banks follow industry standards that keep clients’ data and finances safe.

- Incident response plans: The FDIC requires banks to have plans in place for handling stolen funds and cybersecurity incidents; it obliges them to notify customers within 36 hours of detecting such events.

- Regular audits: Auditors review financial statements, internal safety controls, regulatory compliance, and risk management to ensure banks are meeting requirements for protecting their clients’ finances and information.

- AI-powered threat detection: Some banks are using AI to detect and stop cybercrime. For example, Deutsche Bank uses an AI called Black Forest to uncover fraud, money laundering, and other financial malfeasance.

- Secure login: Many banks require strong passwords and two-factor authentication (2FA) to create an online account, meaning users need to connect their phone, email, or an authentication app to verify account ownership.

- Automatic logout: Online banking accounts often log you out after a few minutes of inactivity, which can be helpful when using a shared computer.

How does FDIC insurance work?

FDIC insurance protects your money in the event that an FDIC-insured bank fails. It covers up to $250,000 per depositor, per account type, per insured bank. This means that if your bank were to go under, the FDIC would reimburse you for insured deposits, such as those in checking, savings, and CDs, up to the coverage limit.

This insurance applies whether your bank operates online or has physical branches, as long as it’s FDIC-insured. If you deposit money at a non-insured bank, you risk losing all your funds if it goes under.

How safe is online banking compared to P2P payment apps or crypto?

Online banking is a much safer way to store and manage your money than P2P payment apps like Venmo, Zelle, and Cash App — as long as you choose a reputable, well-established bank insured by the FDIC. That’s because banks tend to offer stronger data security and more robust fraud protection: in many cases, they’re required to reimburse customers for unauthorized transactions.

In contrast, scammers love P2P apps because payments are typically instant and irreversible, making it more difficult for users to recover funds sent to fraudsters. For example, Cash App clearly states that it cannot cancel or refund a completed payment. If your friends or family send you money on one of these apps, transfer the balance to an online bank to help keep it secure.

Some proponents argue that cryptocurrency offers a promising alternative to traditional online banking — especially in regions with limited access to established financial institutions. But while digital currencies like Bitcoin and Ethereum can provide decentralized access to funds, they also come with significant risks. Their value is highly volatile, and the space is rife with crypto scams.

Risks of online banking

While online banking is generally safe, there are risks, which could include potential data breaches, software vulnerabilities in banking apps, and malware attacks directed at you or bank employees.

Social engineering

Cybercriminals can use social engineering tricks to persuade you or a bank employee to disclose sensitive information. For instance, a fake text claiming your account is compromised could be a phishing attack mimicking the bank’s automated alert system. Falling for ruses like this could give hackers access to your online accounts.

AI-powered scam detection tools included in Norton 360 Deluxe can help alert you to cleverly disguised phishing attempts and social engineering attacks.

Data breaches

Data breaches occur when cybercriminals exploit website issues, human errors, or system vulnerabilities to access sensitive banking information. In April 2025, MainStreet Bankshares, a financial holding company, experienced a data breach that left the data of nearly 5% of its customers exposed due to a vulnerability in a merchant’s payment card environment.

Fake mobile banking apps

Some apparent mobile banking apps are actually malware in disguise. These fake apps closely mimic the design of legitimate banking apps, complete with convincing login screens. Once you enter your credentials, the app may display a fake error message like “system temporarily unavailable” to avoid suspicion.

Meanwhile, behind the scenes, it’s already harvesting your login details and sending them to cybercriminals, potentially granting them full access to your real bank account. Always download banking apps from official app stores, and verify the developer before installing.

Hacked public Wi-Fi

Unsecured public Wi-Fi hotspots could leave your internet traffic exposed to credential-stealing attacks. Hackers can exploit these networks to intercept your data, especially during sensitive activities like online banking. If you must use public Wi-Fi, protect yourself by using a VPN, which encrypts your connection and helps defend against man-in-the-middle (MITM) attacks.

For better protection on public Wi-Fi, consider installing Norton VPN. It encrypts your data before it leaves your device, helping shield your online activity from prying eyes, keeping sensitive information — like banking details — private and secure, even on unsecured networks.

Weak security

Cybercriminals often target accounts with weak passwords and no two-factor or multi-factor authentication (2FA/MFA). Using brute force attacks, they repeatedly try password combinations until they gain access, then transfer funds to their own accounts. Fortunately, most banks have safeguards that lock accounts after multiple failed login attempts and now require 2FA, adding an essential layer of account protection.

Software vulnerabilities

Running outdated software can leave your banking app exposed to known vulnerabilities that hackers exploit. Regular updates patch these security flaws, strengthen defenses, and help keep your data protected. To reduce your risk, always keep your operating system, apps, and security software up to date.

Vulnerability to malware

Cybercriminals use malware to exploit software flaws or human error, infecting phones and computers with programs designed to steal sensitive information. Keyloggers, for instance, can record everything you type — including banking credentials. Other types of malware can corrupt your system, spread across networks, or hold your data hostage in a ransomware attack.

Malware is still a serious threat, even if it doesn’t always make headlines. That’s why powerful antivirus protection remains essential. Norton 360 Deluxe features an advanced threat detection engine that helps defend your device against evolving threats — so you can bank, browse, and shop with greater confidence and peace of mind.

How do you bank online safely?

To bank online safely, choose trusted, FDIC-insured banks, enable bank notifications to stay abreast of potential fraud, and turn on multi-factor authentication to help ensure your account is safe from hackers even if your password is exposed. Installing antivirus software with built-in scam detection can also help stop cybercriminals in their tracks.

Use trusted banks

Choose a bank that’s FDIC-insured to help protect your deposits in case of failure. Look for the FDIC logo on the bank’s website or verify its status on the official FDIC site. You should also consider the bank’s reputation; established institutions typically offer stronger cybersecurity protections and more reliable fraud prevention protocols.

Enable bank notifications

Most banks offer real-time alerts for transactions and suspicious activity. Enabling these notifications can help you spot unauthorized charges quickly, so you can take immediate action — such as reviewing recent activity, changing your password, or freezing your card — before further damage is done.

Alerts can also notify you about low balances, large withdrawals, or login attempts from unfamiliar devices or locations. You can usually customize these in your bank app or online account settings. If not, check with your bank to see which alert options are available.

Secure your account

Secure passwords and multi-factor authentication (MFA) work together to make your accounts significantly harder to compromise. A strong password at least 15 characters long with a mix of letters, numbers, and symbols helps prevent brute-force or guessing attacks.

MFA adds a critical second layer of defense. Whether it’s a one-time code sent to your email, a trusted phone number, or an authentication app, it ensures that even if someone steals your password, they still can’t access your account without that second step.

Biometric identification, like fingerprint or facial recognition, add both security and convenience. Even if your phone is stolen, a thief won’t be able to log in without your unique biometric data. It’s a powerful way to keep your mobile banking access locked down.

Use secure Wi-Fi

Avoid using unsecured public Wi-Fi networks like those found in hotels, airports, or cafes when accessing your bank accounts. These networks are often unencrypted, making it easy for hackers to intercept your data. If you're banking on a mobile device, use your cellular network instead. Mobile data is typically more secure, thanks to built-in encryption managed by your carrier.

Use a VPN

Use a VPN, especially when connected to public Wi-Fi networks. VPNs encrypt your internet data, making it harder for anyone to access it without permission. Good VPNs include a kill switch, which automatically disconnects you from the internet if the VPN connection drops, so your real IP address remains private.

Install antivirus software

Real-time antivirus protection helps block malware by scanning files, apps, and websites as you access them, immediately alerting you to potential threats. This proactive layer of defense helps prevent data theft, spyware infections, and other attacks before they compromise your device or personal information.

Leading antivirus software like Norton 360 Deluxe offers powerful malware protection alongside advanced security tools that help block phishing websites, alert you to scams, and stop account takeovers.

Use AI-powered scam detection

AI-powered scam detection tools such as Norton Genie can help spot malicious emails and texts before you accidentally provide information to a criminal. AI scam detection algorithms rely on large datasets of criminal messaging to identify questionable patterns, warning you when the message is suspicious.

Spot suspicious charges faster

Online banking threats are more common and sophisticated than ever, ranging from phishing scams and malware to large-scale data breaches.

Norton Money brings everything into one secure view to help you spot unusual activity, hidden costs, and suspicious transactions before they drain your account. Use Norton Money to stay on top of your spending and catch problems early, all with the backing of Norton’s trusted security expertise.

FAQs

Are online-only banks safe to use?

Online-only banks can be safe, provided they are reputable and FDIC-insured. Before signing up, check for the FDIC logo and research the bank’s security features, customer reviews, and history of service to ensure reliability.

Can your online banking be hacked?

Banking websites’ robust security measures make them very difficult to hack directly. However, hackers may target individual user accounts through phishing attacks, malware infections, or unsecured Wi-Fi networks. For example, a cybercriminal might trick you into clicking a fake login link or install malware on your device to capture your banking credentials as you type them.

Which banks have been hacked in the past?

Many banks have suffered data breaches, including JPMorgan, Capital One, and Bank of America. These have mainly resulted in the exposure of user data, such as names, Social Security numbers, bank account numbers, and addresses. Bank hacks involving direct loss of funds are rare, though not unheard of.

Editorial note: Our articles provide educational information for you. Our offerings may not cover or protect against every type of crime, fraud, or threat we write about. Our goal is to increase awareness about Cyber Safety. Please review complete Terms during enrollment or setup. Remember that no one can prevent all identity theft or cybercrime, and that LifeLock does not monitor all transactions at all businesses. The Norton and LifeLock brands are part of Gen Digital Inc.

Want more?

Follow us for all the latest news, tips, and updates.