How to improve your credit score quickly

A good credit score makes it easier to access new credit at favorable rates and can even increase your chances of qualifying for jobs or housing. Peruse these 10 tips to help improve your credit score quickly, then use Norton Money to monitor your credit, track your progress, and get more visibility into factors affecting your finances.

While it’s not possible to dramatically improve your credit score overnight, there are some strategies you can use to improve your credit score fast, especially compared to a passive approach. Using these strategies can put you in a better position to prepare for an upcoming big-ticket purchase, refinancing opportunity, or potential emergency.

We’ve listed 10 of the most practical ways to boost your credit so you’ll be able to take steps in the right direction, whether you’re a credit beginner or a seasoned pro striving for an “Excellent” score.

1. Make payments on time

Making at least your minimum payment on credit cards, mortgages, and other bills by the due date is one of the most effective ways to improve your credit score. While each of the three credit bureaus weighs credit scoring factors differently, payment history is consistently a key component, typically accounting for 35% to 40% of your credit score.

Even a single missed payment reported to the credit bureaus can cause your credit score to drop by 100 points or more. The good news is that payments less than 30 days late generally won’t show up on your credit report and therefore won’t affect your credit score. Just remember that lenders may still charge you a late fee.

- Impact on credit: High.

- Time commitment: It should take less than 30 minutes to pay your bills every month, or you can set up autopay to handle all payments automatically.

- Time to impact: Consistently paying your bills on time should result in gradual credit score improvement but missed payments can stay on your credit report for up to seven years.

- Key actions: Prioritize bills that get reported to the credit bureaus and set up autopay if you can. Try to budget so you can pay your bill in full each month. If that’s not possible, make at least the minimum payment.

2. Pay down balances

Paying down revolving credit balances, like credit card debt, can significantly improve your credit score. This is because it lowers your credit utilization ratio — a factor used in most credit scoring models that represents the amount of credit you use compared to your total available credit.

Generally speaking, your credit score will benefit from your credit utilization ratio decreasing. For a healthy credit score, you should use less than 30% of your total credit limit. For an exceptional score, aim to keep your utilization under 10%. However, try to avoid dropping your credit utilization all the way to 0%, as that can have a reverse effect and slightly harm your credit score.

- Impact on credit: High.

- Time commitment: You can make payments in as little as a few minutes online or over the phone. Depending on the type of credit, you can also use autopay to speed up this process.

- Time to impact: If you can pay off an account or make a large payment, you’ll usually see credit score growth within 30 to 45 days. However, getting your credit utilization down to where it needs to be can take months, if not years.

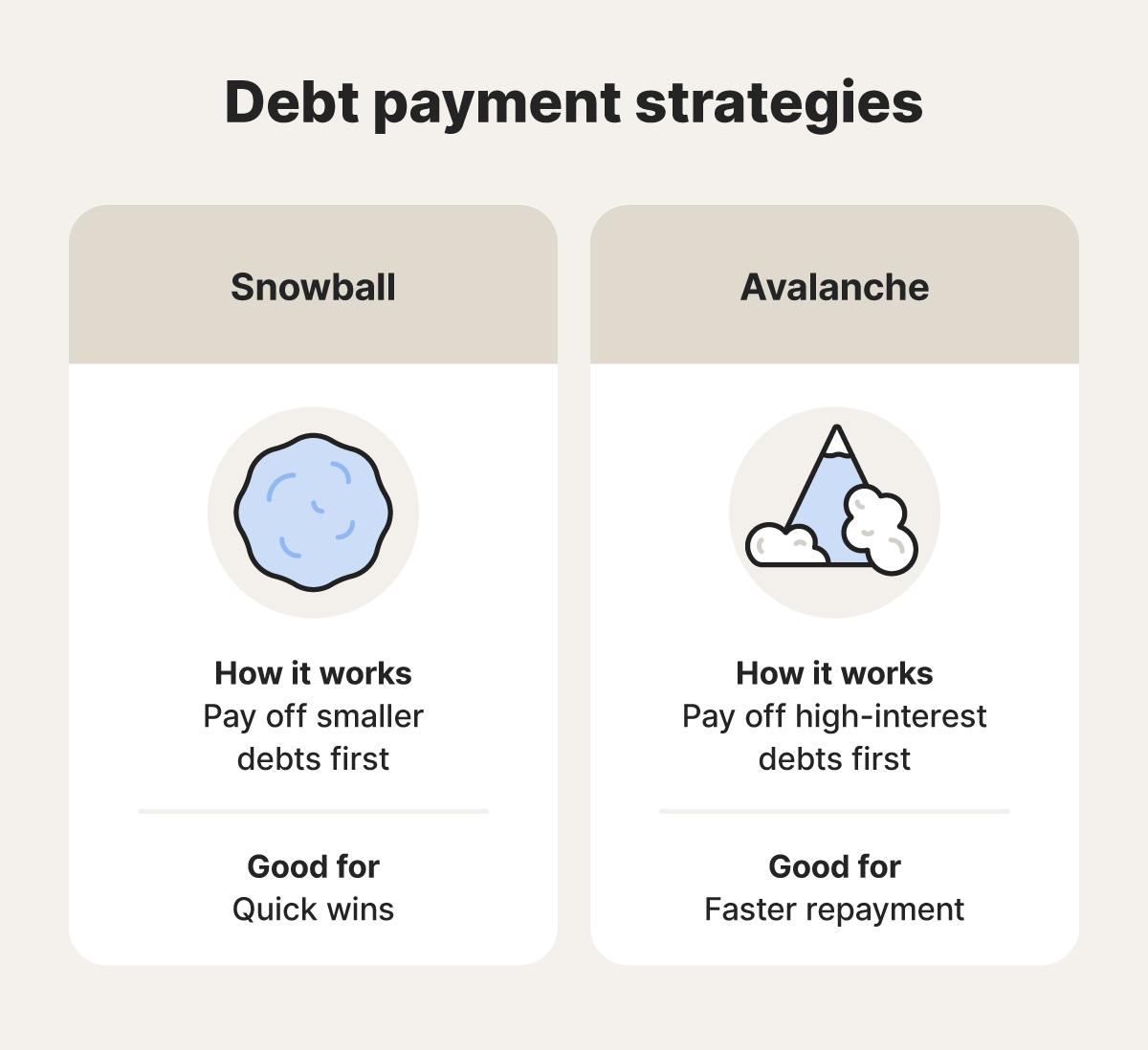

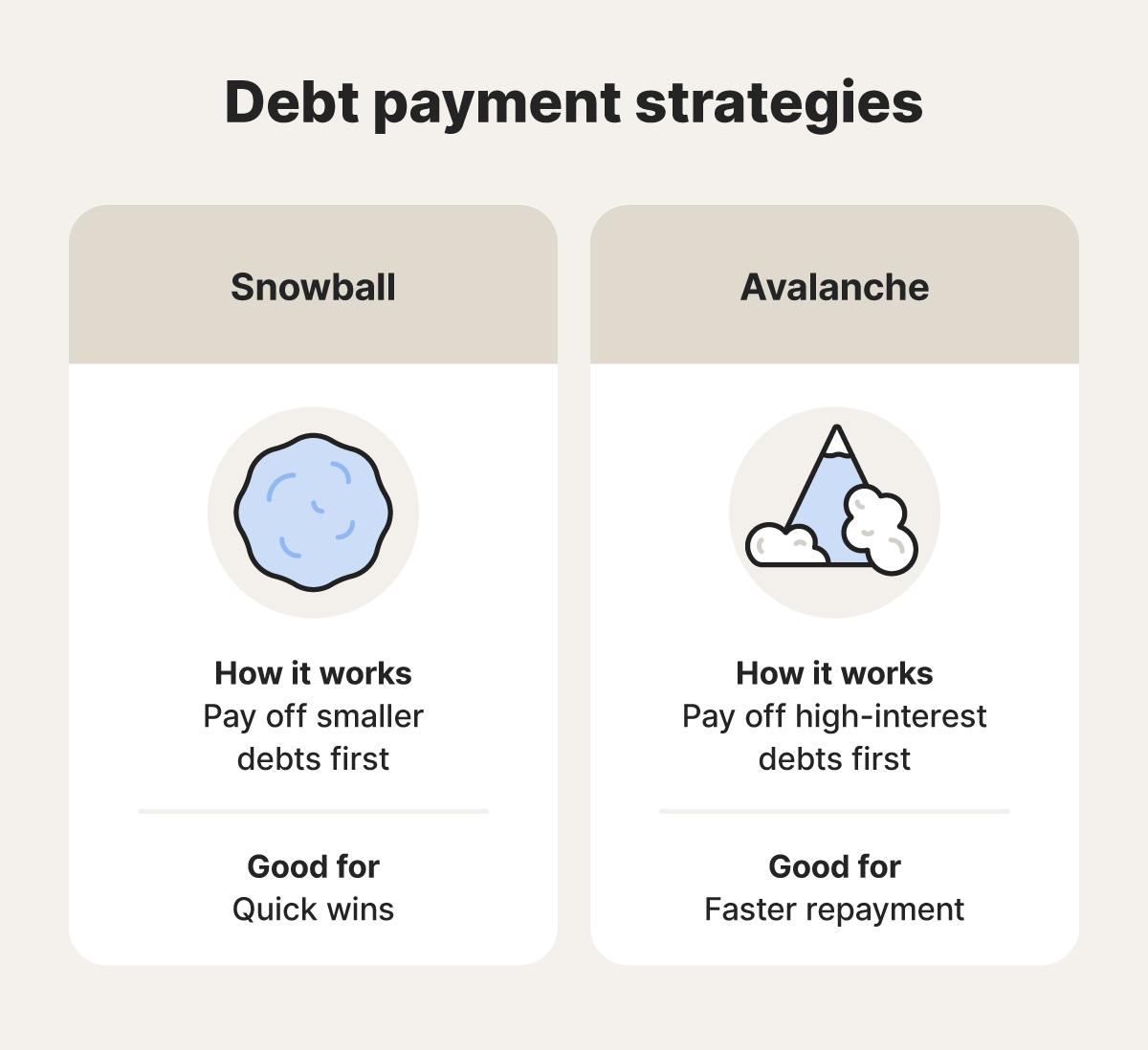

- Key actions: Choose and commit to a debt repayment plan to strategically lower your balances. For example, you can pay off accounts with the lowest balances first to secure quick wins (snowball method) or prioritize accounts with the highest interest rates to pay down your total debt faster (avalanche method).

3. Get a credit increase

Increasing your credit limit can help lower your credit utilization, in turn improving your credit score. There are a couple of ways to do this:

- Increase your existing credit limits: If your income has grown since you first got a credit card, reporting your new salary to your credit card issuer may prompt them to offer a credit limit increase. Check your issuer’s website for instructions on formally requesting a credit limit increase.

- Apply for a new credit card: Successfully applying for a new credit card will increase your total available credit. However, since the application process involves a hard credit check that will temporarily harm your credit score, prioritize increasing existing credit limits before resorting to this tactic.

The best thing about this credit-building strategy is that it can help you boost your credit score without paying a penny. Just remember that for it to work, you should avoid increasing your spending proportionately with your credit limit increase.

- Impact on credit: Moderate.

- Time commitment: Both options only take a few minutes online or over the phone and, in many cases, your creditor will approve or reject your application on the same day.

- Time to impact: You may start to notice credit score growth within 30 days of increasing your total credit limit. However, if you’re subject to a hard credit inquiry as part of the application process for a new credit card, it can stay on your credit report for up to two years, but usually only impacts your score for one year.

- Key actions: Look into your credit card issuer’s process for requesting a limit increase, and aim to expand your credit when your income increases.

4. Keep old accounts open

Credit age, also known as length of credit history, measures the average age of all your credit accounts and the age of your oldest account. Lenders use it to gauge how much experience you have managing credit responsibly. Credit age typically accounts for 15% to 20% of your credit score, so keeping old credit accounts open, even if you no longer use them, can help boost it.

Closing credit accounts can negatively impact your credit score, especially if they have a long history, because it decreases your average credit age. To keep creditors from closing your revolving credit accounts for inactivity, try to use them to pay small bills occasionally.

- Impact on credit: Low.

- Time commitment: None.

- Time to impact: Keeping old accounts open has a slow but gradual positive impact on credit scores. In contrast, opening a new credit account will reduce your average credit age and may have a minor negative impact in the short term.

- Key actions: Retain aged credit accounts where possible, and pay balances and annual fees on time to keep them in good standing.

5. Mix up your credit

A diverse credit mix including various types of revolving and installment credit accounts like credit cards, auto loans, and mortgages, can help boost your credit score. Lenders view a diverse credit mix as a sign of responsible financial behavior, because it shows that you can manage different types of debt well.

Credit mix is a common factor in various credit scoring models, accounting for around 10% of your FICO score, for example. However, it's important to add new credit responsibly. Consider factors like your financial situation, debt-to-income ratio, and long-term financial goals when deciding to take on new credit.

- Impact on credit: Moderate to high.

- Time commitment: It can take up to a few days to apply for and get approved for different types of credit.

- Time to impact: You may start seeing credit score growth within 30 days after a successful application for new credit, as your credit utilization drops and your credit mix diversifies. However, if your application involves a hard inquiry, you may also face a slight credit score drop in the short term.

- Key actions: Take stock of the types of credit you have and consider adding a new kind when it makes sense.

6. Limit hard inquiries

Hard inquiries are lender-run credit checks that help companies assess how likely you are to pay your bills. They’re a normal part of the process when you apply for a new line of credit and the lender reviews your credit report. For most people, one hard credit check will knock less than five points off your credit score, which can take up to one year to recover, even if your application is successful.

- Impact on credit: Moderate.

- Time commitment: None.

- Time to impact: Avoiding hard credit inquiries won’t change your credit score. If you do incur a hard inquiry, you’ll likely see an immediate credit score decline.

- Key actions: If you have multiple similar hard credit checks coming up — for example, applying for different car loans or mortgages — try to concentrate them all in a 14-day period. This allows you to benefit from a “rate shopping window” during which credit bureaus count all inquiries related to one loan as a single pull, limiting damage to your credit score. However, applying for multiple credit cards or debt consolidation loans has the opposite effect.

7. Dispute credit report inaccuracies

Correcting credit report errors like accounts or payments that aren’t yours, closed accounts reported as open (or vice versa), or payments incorrectly marked as late can help keep incorrect information from dragging down your credit score. These errors can be the result of simple mistakes or something more sinister, like credit fraud.

The dispute process can take some time as you’ll typically need to prove your claims by gathering and presenting documentation like receipts or cleared checks. Then, the credit bureaus generally have 30 days to investigate a dispute — up to 45 calendar days in some cases.

However, the effort can be rewarded with a credit score boost. If your dispute is successful, the credit bureaus will wipe the entry from your credit report and you should see your score rise.

- Impact on credit: Moderate to high.

- Time commitment: Filing a credit report dispute may take several hours but you may have to wait up to 45 days for a resolution.

- Time to impact: If the credit bureaus find there’s merit to your claim, they’ll remove the incorrect information from your credit report and you’ll generally see positive credit score movement within 30 days.

- Key actions: Review your credit report to identify errors, gather relevant documents to support your claim, and file a dispute with the credit bureau(s).

8. Become an authorized user

Becoming an authorized user allows you to use someone else’s revolving credit facility, like a credit card. Piggybacking on an established account, particularly if it features a strong payment history or high credit limit, can help improve your credit score, especially if you're a credit newcomer.

The primary account holder is typically legally responsible for all payments, so it’s important to reimburse them for any charges you make. If all payments are made on time, it will reflect positively on your payment history, and you should start to see your credit score grow.

- Impact on credit: Low to moderate.

- Time commitment: It only takes a few minutes for the account holder to add you as an authorized user, but the credit card issuer’s processing time could take a few weeks.

- Time to impact: If you don’t have a credit score yet, generating one can take three to six months. It could take longer still to see upward momentum. If you already have a credit score, you may see score growth after becoming an authorized user as soon as the next reporting cycle — usually 30 to 45 days.

- Key actions: Talk to the account holder about expectations and concerns and make sure to pay your bills responsibly.

9. Deal with collections

Creditors may pass your debt to a debt recovery company if you wait too long to pay your bill. At this point, you should verify the debt to ensure it belongs to you and it’s the right amount. If you notice errors or believe the debt isn't yours, you can dispute it. You must send a dispute letter to the collection company within 30 days of their first contact. You should also let the credit bureaus know.

If the debt is yours and accurate, talk to the debt collector and negotiate a payment plan with smaller monthly payments if you’re struggling to pay. If you have a lump sum of money available, try negotiating a settlement for less to close the account.

- Impact on credit: Moderate to minimal.

- Time commitment: If you plan to pay the bill in full, it could take just a few minutes. But if you need to negotiate a payment plan, it could take hours or days.

- Time to impact: If you successfully dispute a collection, your credit score will improve after the credit bureaus remove the delinquent account from your credit report and update it. Paying off an account that’s gone to collection may improve your credit score but it depends on the scoring model used — the record will still stay on your credit report for up to seven years but will be marked as paid.

- Key actions: Verify the debt to ensure you actually owe money and discuss payment options with the collection agency.

10. Get credit for recurring payments

If you’re paying your bills every month, you might as well get a credit score boost for it. Services like Experian Boost, Piñata, or Boom allow you to report recurring payments like rent and utilities to the credit bureaus, potentially improving your credit score. Some of these services charge a monthly fee but they may be worth considering if you need to increase your credit score fast.

- Impact on credit: Moderate to minimal.

- Time commitment: Setting up a credit reporting service online only takes a few minutes. In most cases, the service will scan your bank account for recurring payments and report the information to the credit bureaus.

- Time to impact: After reporting your rent and utility payments through a credit reporting service, you may start seeing a positive impact on your credit score within 30 days.

- Key actions: Research credit reporting services to find out which are free or what fees they charge and which scoring models or lenders consider these payments (not all do). Then, sign up and connect your accounts.

How to monitor your credit

Monitoring your credit is an important part of working to increase your credit score. It’ll help you understand the factors that influence your score and catch any potential errors or fraudulent activity early.

There are several ways to monitor your credit. At a minimum, you can manually check your credit report and credit score on a regular basis. Alternatively, you can use a dedicated credit monitoring service that does the hard work for you, alerting you if changes are found that may impact your credit score.

Here’s a more detailed look at some of the best ways to monitor your credit:

- Claim your free credit report: You can claim one free credit report from each credit bureau weekly for a detailed breakdown of your credit file, including information like open accounts, credit utilization, and payment history. You can also use these reports to identify errors or inconsistencies that may be bringing down your credit score, but they won’t display your score.

- Check your credit score: You can check your credit score using bureau–provided tools or a dedicated credit score monitoring service to keep up to date with fluctuations. This will help you notice trends in your score and check that what you’re doing is working to improve it.

- Use a credit monitoring service: You can sign up for a credit monitoring service that provides regular credit reports and credit score updates. This is an easy way to track your score and can also help you catch fraud, like someone opening a new credit card in your name, because many credit monitoring services offer automatic alerts for suspicious activity.

Monitor and protect your credit

Improving your credit score takes commitment and patience, but the right tools can make the journey smoother. Norton Money is a free financial wellness app that lets you connect your accounts, track your spending and upcoming payments, and monitor your VantageScore credit score over time — so you can see how your everyday money decisions may affect your credit profile and overall financial health.

FAQs

How long does it take to rebuild a poor credit score?

Rebuilding a poor credit score can take months to years, depending on the severity of the damage. However, making timely payments, decreasing your credit utilization ratio, broadening your credit mix, and limiting hard credit inquiries can help you reach your goal faster.

How long does it take to build a credit score from scratch?

It can take up to six months after first opening a credit account to establish a credit score. However, your initial credit score is likely to be low, and it can take years to build your score up to the Good or Excellent range.

How quickly can I grow my credit score by 100 points?

The speed of improving your credit score by 100 points depends on your current score and financial situation. If you’re starting from 400, you’ll likely be able to achieve a 100-point increase more quickly than someone starting at 725. However, in either scenario, it’s likely to take months or years to raise your credit score by 100 points.

Editors’ note: The purpose of this article is to provide general financial education. It is not to provide specific investment advice. Any company, product name, or investing strategy is used for descriptive purposes only and does not imply endorsement by Norton. Please seek out a licensed investment professional for your specific situation.

Editorial note: Our articles are designed to provide educational information for you. They may not cover or protect against every type of crime, fraud, or threat we write about. Our goal is to increase awareness about Cyber Safety. Please review the complete Terms during enrollment or setup. Remember that no one can prevent all identity theft or cybercrime, and that LifeLock does not monitor all transactions at all businesses. The Norton and LifeLock brands are part of Gen Digital Inc. For more details about how we create, review, and update content, please see our Editorial Policy.

- 1. Make payments on time

- 2. Pay down balances

- 3. Get a credit increase

- 4. Keep old accounts open

- 5. Mix up your credit

- 6. Limit hard inquiries

- 7. Dispute credit report inaccuracies

- 8. Become an authorized user

- 9. Deal with collections

- 10. Get credit for recurring payments

- How to monitor your credit

- Monitor and protect your credit

- FAQs

Want more?

Follow us for all the latest news, tips, and updates.