What is a credit score and why does it matter?

A credit score is a number that represents how well you manage credit. It’s also the key to unlocking good borrowing terms. Learn more about what a credit score is and how it’s calculated, and discover how Norton Money’s credit score tracking can help you stay informed as you work to protect and improve it.

A lot in life depends on a good credit score. Banks, insurance companies, landlords, utility providers, and employers may check your credit to determine if you meet the approval criteria for loans, rentals, and even jobs. That means your credit score can influence your loan terms, interest rates, insurance premiums, credit limits, rental deposits, and more.

Learn more about credit scores, how they’re calculated, and how you can keep yours in good standing so you can make the most of opportunities when they come around.

How is your credit score determined?

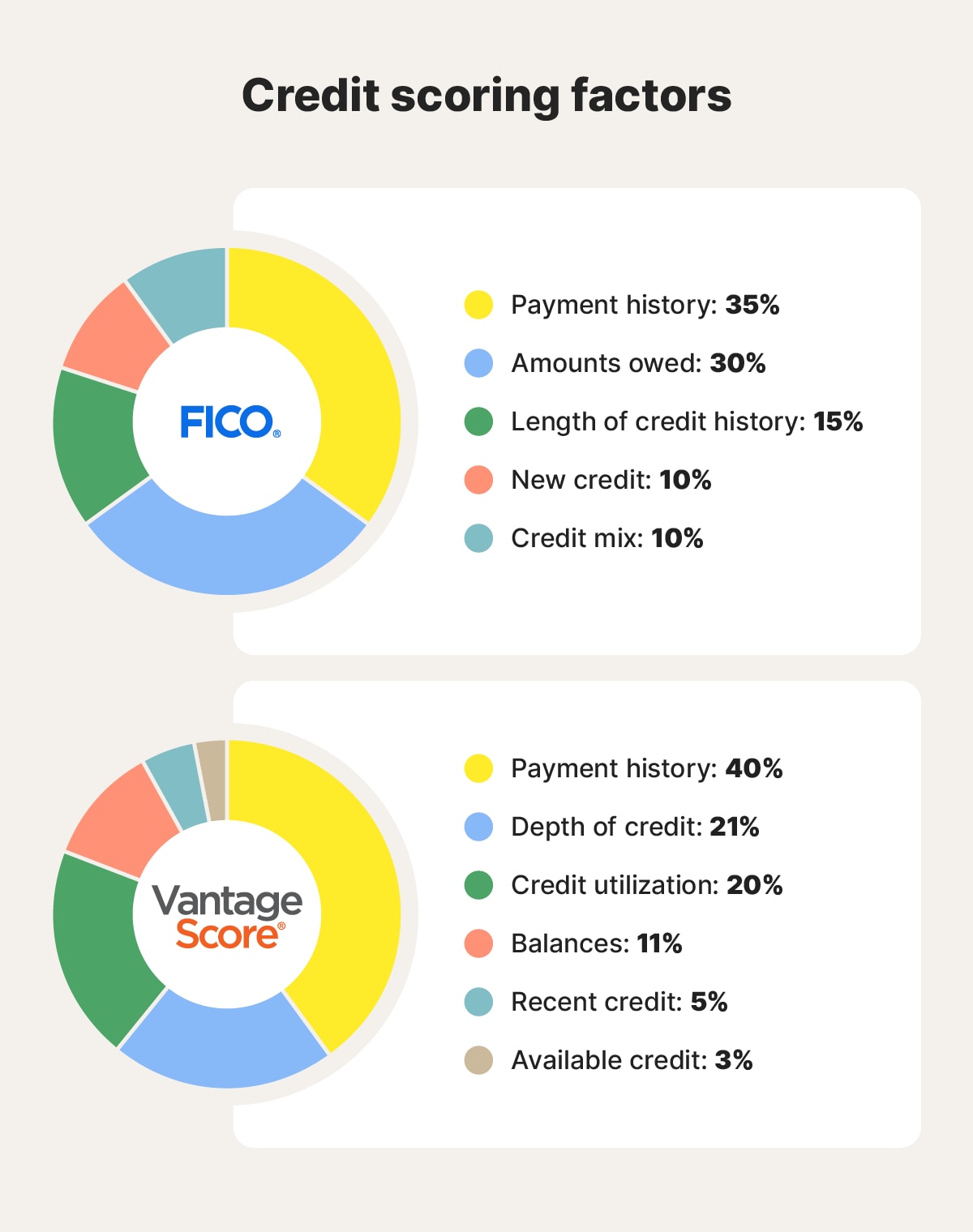

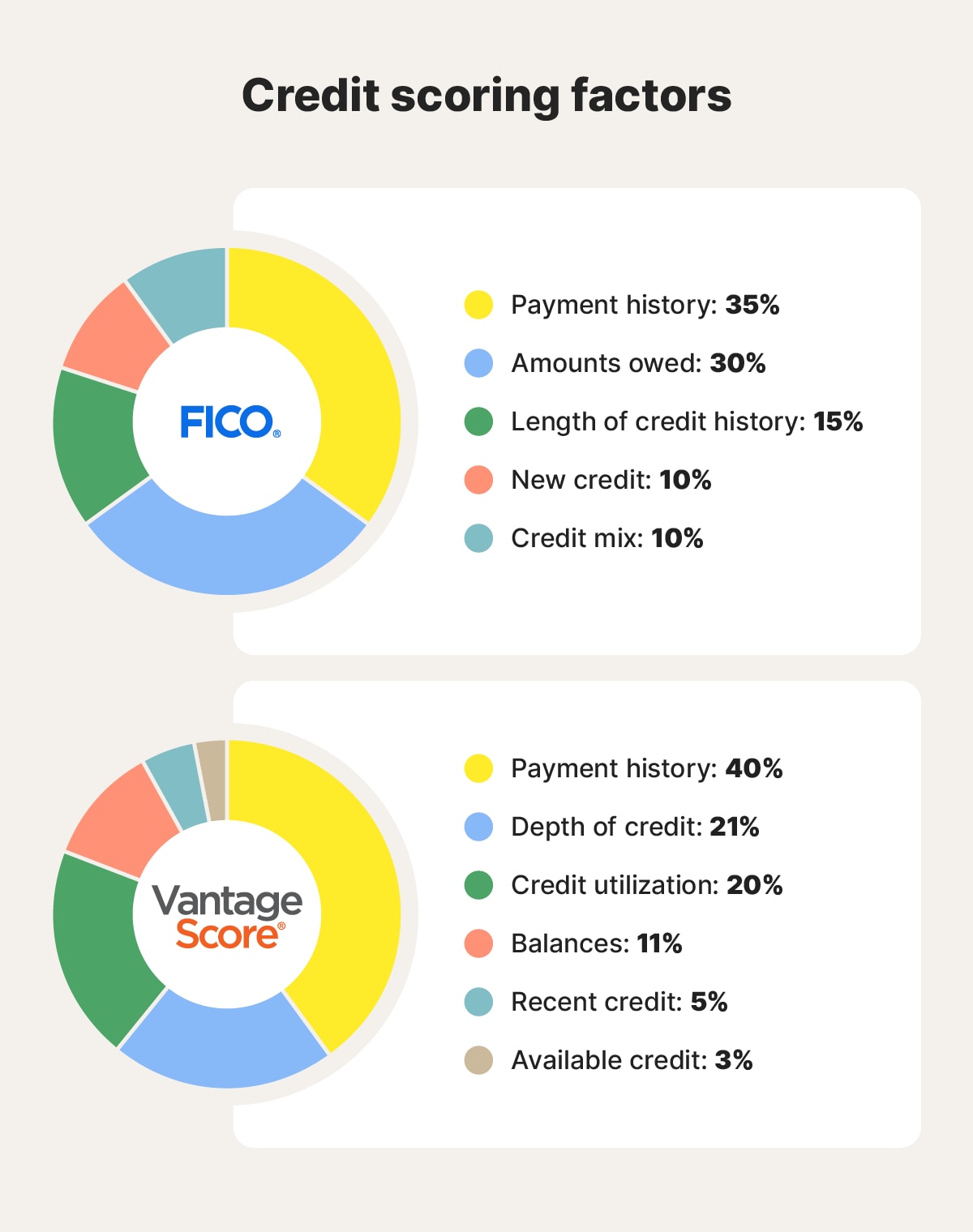

There are a range of credit scoring models, with each one using different factors and weighting to calculate scores. However, the FICO score, which 90% of top U.S. lenders use, weighs five factors in its calculation: payment history, amounts owed, length of credit history, new credit, and credit mix.

Here’s how much each factor contributes to your total credit score, what it considers, and why it’s important.

- Payment history (35%) analyzes your track record of making (or missing) credit card, loan, and mortgage repayments. It’s an important scoring factor because it helps predict how likely you are to repay your debts on time.

- Amounts owed (30%) is the total debt you owe. This variable also includes your credit utilization, which is the percentage of your total available credit that you’re using. A lower credit utilization ratio is generally seen as a positive indicator.

- Length of credit history (15%) assesses how many years of experience you have managing credit and debt, factoring in the age of your oldest account and the average age of all accounts. A longer credit history could represent reliability, which can improve your score.

- New credit (10%) considers the number of recent credit inquiries on your file and new accounts you’ve opened in the last 12 months. This scoring factor helps lenders determine if you’re a “risky borrower” who might be overextending themselves financially.

- Credit mix (10%) measures the diversity of your credit accounts, with a mix of revolving credit (like credit cards) and installment loans (like mortgages) generally acting as a positive indicator to lenders that you can manage varied types of debt.

Another popular credit scoring model, VantageScore, uses similar factors but weighs them slightly differently. Depending on which model a credit bureau or service uses, your credit score may vary slightly.

Why do I have different credit scores?

Your credit score may differ across bureaus and tools because each of the dozens of credit scoring models interprets factors and weights differently. Also, each model also has different versions for lenders to choose from depending on the criteria they care about.

For example, there are multiple FICO scores currently in use. An auto loan lender cares more about your vehicle payment history than other factors, so they may use the FICO Auto Score 9. A credit card issuer may check your FICO Bankcard Score 9 because that focuses more on your history of managing credit card debt.

Your credit score is probably different under these two models because each model weighs factors differently to try to accurately reflect your creditworthiness in a specific context.

Here are some examples of credit scoring models you might encounter and how lenders use them:

Scoring model and range |

Used for |

How it’s different |

|---|---|---|

FICO Score 8 |

|

|

FICO Bankcard Score 8 |

|

|

FICO Auto Score |

|

|

VantageScore 3.0 |

|

|

Note: This is not an exhaustive list. In certain situations, you may encounter other credit scoring models.

What is a good credit score?

The FICO scoring model defines credit scores between 670 and 739 as “Good,” with scores between 740 and 799 deemed “Very good” and scores of 800+ labeled “Excellent.”

That means if your credit score is 670 or higher, most lenders will consider you a low-risk borrower and you may be more likely to qualify for loans and credit cards with favorable terms.

Here’s a breakdown of the typical FICO score range:

- Poor: 300-579

- Fair: 580-669

- Good: 670-739

- Very good: 740-799

- Excellent: 800-850

Having a “Good” credit score under the FICO model doesn’t necessarily mean all lenders will extend credit. However, it should put you in better standing than if your score was “Fair” or “Poor.”

How to check your credit score

There are multiple ways to check your credit score, including by requesting a copy of your credit report from a credit bureau, checking if your credit card issuer offers credit scores, or using a dedicated credit monitoring service.

Here’s a more detailed look at some of the best ways to check your credit score:

- Credit bureaus: AnnualCreditReport.com is a website managed through a collaboration among the three major credit bureaus — Equifax, Experian, and TransUnion. You can use it to request a free weekly copy of your credit report, including your credit score, from each bureau.

- Credit card companies: Some credit card issuers will share your credit score on statements or in your credit card app, providing an easy way of keeping up with your creditworthiness.

- Bank or credit unions: Many banks and credit unions offer members the option to check their credit score online or in-app.

- Credit monitoring services: Tools with credit-focused monitoring features, like Norton Money, help you track your credit score and stay informed about your credit profile, making it easier to spot potential issues early.

How to build your credit score

Whether you’re starting from scratch or working toward a new goal, demonstrating consistent financial responsibility is the key to building your credit score. This typically involves paying all of your bills on time, maintaining a favorable credit utilization ratio, and managing different types of credit.

Here are some tips to help you increase your credit score:

- Pay your bills on time.

- Keep revolving balances low.

- Get different types of credit.

- Keep old accounts open.

- Limit hard inquiries.

- Dispute credit report inaccuracies.

- Pay off collections.

- Get collections removed from your credit report.

Why does your credit score matter?

Your credit score matters because lenders, property owners, insurance companies, and utility companies may use it to assess your financial responsibility and decide whether to approve you for credit products like loans, mortgages, and credit cards.

The higher your credit score, the greater the likelihood you’ll be approved and qualify for better interest rates, loan terms, credit limits, rental deposits, and more.

Monitor your credit score for signs of identity theft

A sudden drop in your credit score can be one of the clearest signs of identity theft. If a fraudster steals your identity and takes out loans in your name, they can ruin your credit score, affecting your ability to get credit, secure a rental property, or even find a job.

That’s where Norton Money comes in. Designed to help you stay informed about your financial health, Norton Money lets you track your credit score and see key changes to your credit profile as they happen. With clearer visibility into your credit, you can spot potential issues early and better understand how your financial decisions — and any unexpected activity — may affect your credit over time.

FAQs

What’s the difference between a credit score and a credit report?

A credit report is a detailed record of your credit history; a credit score is a numerical representation of the information in your credit report.

How do you get your first credit score?

To get your first credit score, you typically need to establish a credit history by opening a credit card or taking out a loan. After about six months, you should get a credit score reflecting your activity.

What does it take to achieve a perfect credit score?

Achieving the highest credit score requires 10+ years of credit history, a strong track record of on-time payments, low credit utilization, a diverse mix of credit accounts, and no recent hard inquiries.

Editorial note: Our articles are designed to provide educational information for you. They may not cover or protect against every type of crime, fraud, or threat we write about. Our goal is to increase awareness about Cyber Safety. Please review the complete Terms during enrollment or setup. Remember that no one can prevent all identity theft or cybercrime, and that LifeLock does not monitor all transactions at all businesses. The Norton and LifeLock brands are part of Gen Digital Inc. For more details about how we create, review, and update content, please see our Editorial Policy.

Want more?

Follow us for all the latest news, tips, and updates.