How to get out of debt: 10 practical steps

Some debt can help you reach your financial goals, but without proper management it can easily spin out of control. If you feel trapped by high interest rates and costly minimum payments, read on for tips to get out of debt fast. Then, get a credit monitoring tool to track and support your debt repayment journey.

In 2024, household debt including mortgages, credit cards, and loans reached a record high of almost $18 trillion. While this figure might seem shocking, much of this debt helps people make important financial decisions and it often gets paid off on time.

However, 3.5% of U.S. family debt is in a stage of delinquency, fueled in part by rising costs of living and increased interest rates. That means around $630 billion is currently unpaid and overdue. Unfortunately, the longer debts go unpaid, the more difficult it becomes to catch up.

If you have a low income, struggle with budgeting, or feel overwhelmed, but want to try your best to get out of debt fast, follow along for strategies and resources that can aid your debt repayment progress.

1. Avoid taking on new debt

The first step to getting out of debt is to avoid further borrowing. This means no longer charging your credit card, purchasing items with buy-now-pay-later apps (like Afterpay or Klarna), or taking out new loans.

If you continue to borrow while paying off existing debt, your total debt might not go down, and it may even pile up. This can increase your financial burden and add years to your loan repayment journey.

Avoiding borrowing may feel difficult, especially if you initially racked up debt due to financial struggles. But there are a few steps you can take to make things easier:

- Make budget cuts: If you’re struggling to make ends meet, review your budget and consider trimming down non-necessities. This may be inconvenient and uncomfortable, but it can give you some breathing room to focus on paying down your debt.

- Live below your means: If you manage to secure a pay increase, aim to keep your living expenses as they are so you can focus on saving and paying off debts. Try to prevent spending more just because you’re earning more.

- Invest in insurance: Investing in auto, disability, health, home, and life insurance can help ensure you don’t have to pay out of pocket for large unforeseen expenses down the road.

2. Verify or dispute collections

If a collector contacts you chasing debt payments, you can request a debt validation to confirm that you actually have to pay. If there’s a mistake in the debt validation letter, you should dispute it and try to have the debt written off.

Debt collectors are legally obliged to provide you with comprehensive information about the debt, including the creditor’s name and the amount owed. If you don’t get this information, respond to the collector with a request for a debt validation letter within 30 days of the first collection notice.

Include your full name, account number, and a clear statement requesting verification of the debt, such as “I am requesting validation of this debt and an accounting of how the amount was determined.”

When you receive a debt validation letter, confirm that:

- There’s proof of the debt.

- The debt belongs to you.

- You haven’t already paid the debt.

- The amount owed is correct.

- The debt isn’t too old to collect (the statute of limitations for debts is typically three to six years, depending on your state).

If a single detail is incorrect, you can send a dispute letter to the debt collector and may be able to avoid having to repay the balance. Credit bureaus will also remove the negative remark on your credit report after a successful dispute.

3. Negotiate with debt collectors

If you owe a debt that can’t be disputed, ask the debt collector if they’d be willing to accept a lower amount. If they agree, you could potentially get rid of the debt by paying as little as half of the original amount through a settlement or debt relief program.

Here are some tips to help negotiate a more affordable payment plan or discounted settlement:

- Confirm the debt: Tell the debt collector the outstanding balance is yours.

- Explain your financial situation: Candidly and politely explain your financial position and why you can’t pay the full amount. Collectors may be more flexible if you can prove you’re dealing with cash flow problems, job loss, or health issues.

- Propose a repayment plan: Collection agencies typically buy up debts for pennies on the dollar. This means they have more leeway to negotiate than original creditors. If you ask, you may be able to clear the debt by paying 25% to 50% of the total amount.

4. Consider consolidating your debt

Debt consolidation involves combining multiple debts into a single loan or balance transfer credit card. This can help make managing your debt easier by simplifying monthly payments and potentially lowering your interest rates. You may find debt consolidation helpful if you have high-interest debt from multiple creditors and a good credit score.

It’s important to understand the distinction between debt consolidation and debt relief programs. Debt consolidation combines multiple debts into a single debt “instrument,” like a loan or credit card. Debt relief programs typically involve negotiating with creditors to settle debts for less than the full amount owed. Which one makes the most sense for you depends on your specific financial situation.

Debt consolidation is generally free from drawbacks, as it simply involves combining separate debts into a single, more easily manageable debt. Certain debt relief programs, however, may expose you to potential financial risks, including credit score damage, if you miss a payment or don’t follow the terms of the program.

5. Choose a debt repayment strategy

If you’re balancing multiple debts, committing to a repayment strategy is essential to prioritize them, track your progress, and stay on course. If you’re inconsistent, it could mean you end up paying more interest than you need to, potentially adding years to your debt repayment journey.

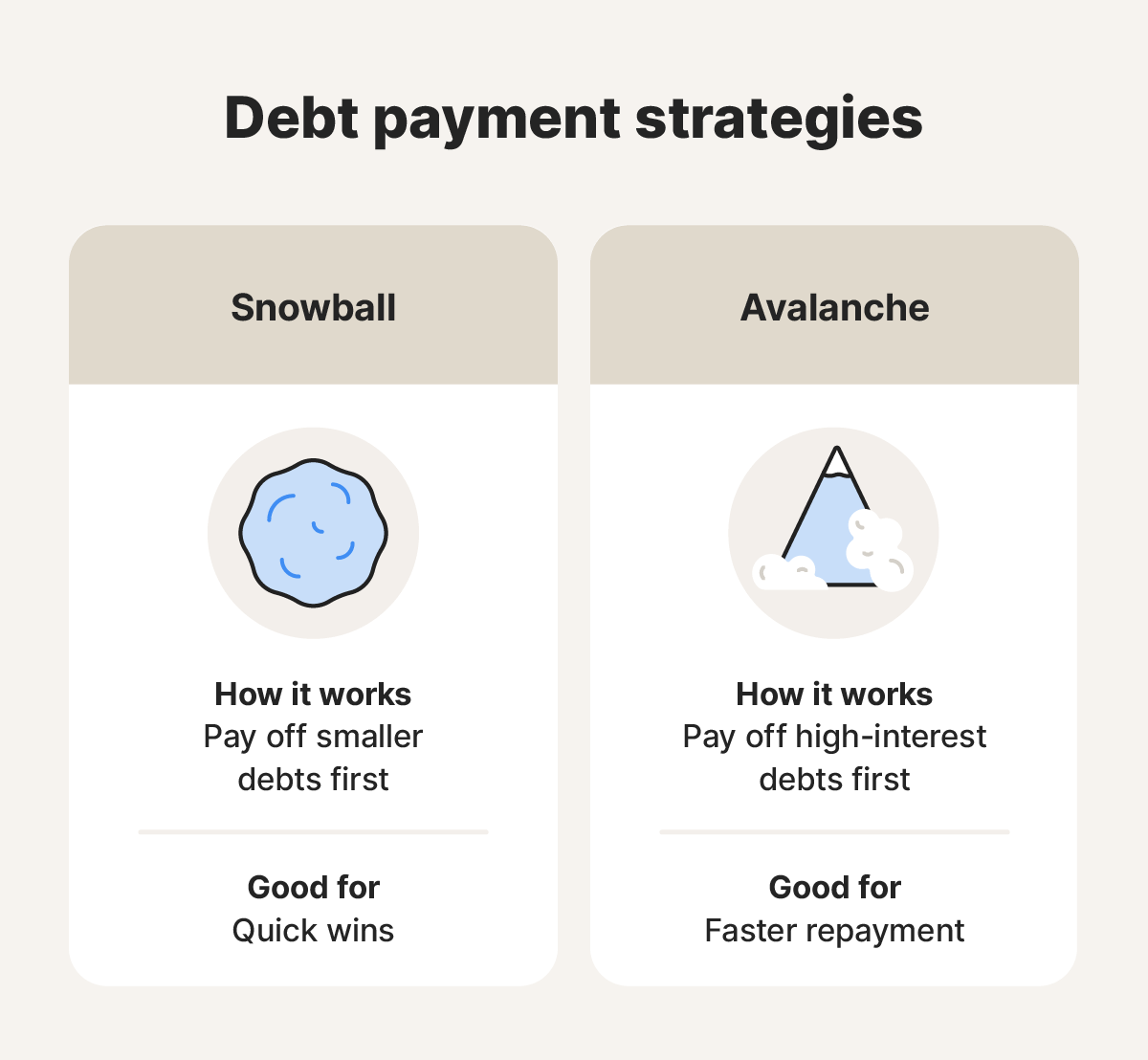

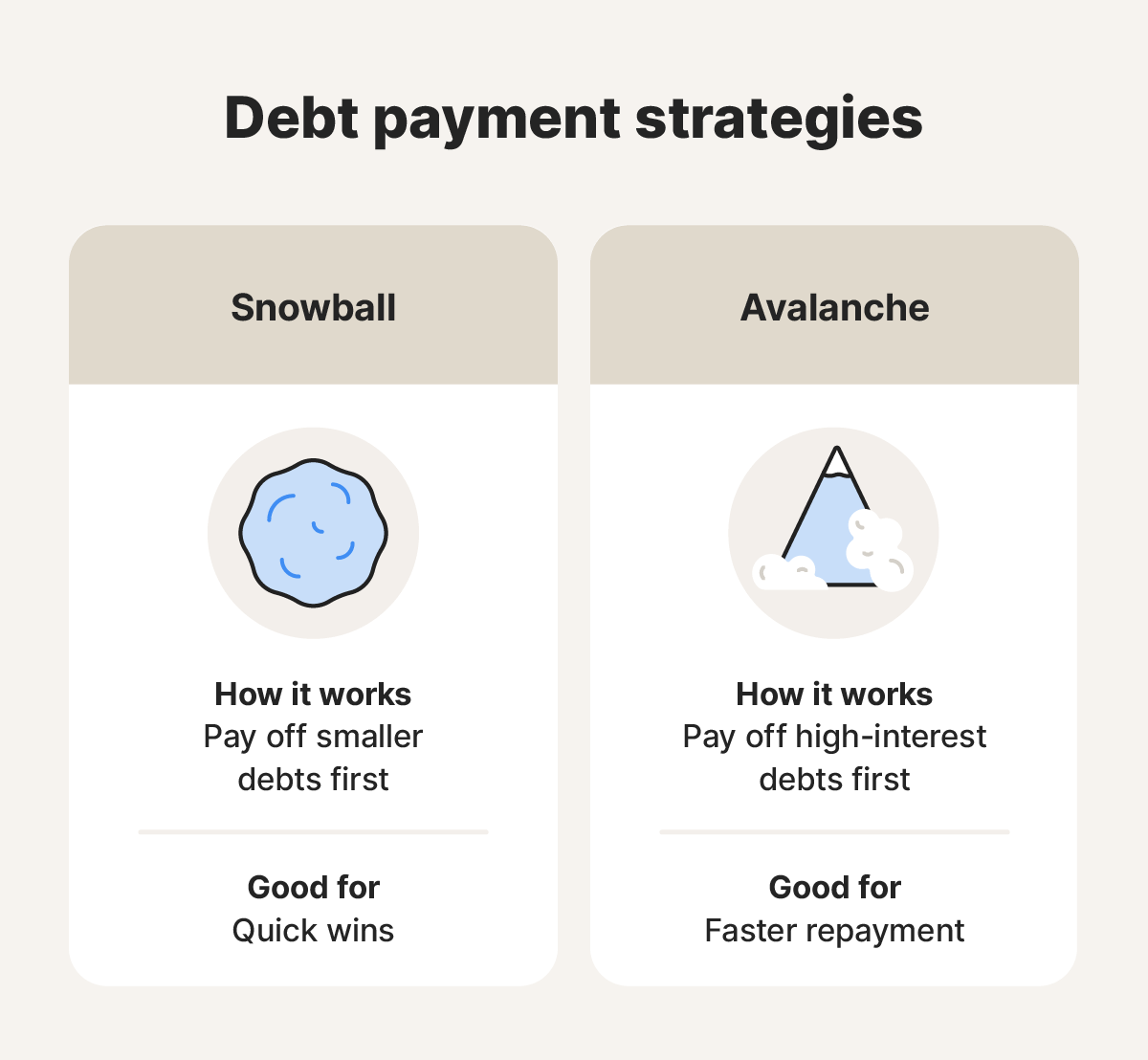

There are two main debt payment strategies to consider:

- The snowball method involves focusing on paying off your smallest debts first, regardless of interest rate. This option is good if you have low interest or similar interest between accounts, or if you’re motivated by small wins.

- The avalanche method means focusing on paying off high-interest debts like credit cards first. This is a good option if you want to take the most efficient route to minimize the total amount of interest you pay. However, it can sap your motivation by extending the amount of time it takes you to get rid of smaller debts.

6. Create a budget

Once you know what debts you owe and how you want to tackle them, it’s time to create a budget. This will give you a clearer picture of how much money is coming in and where it needs to go.

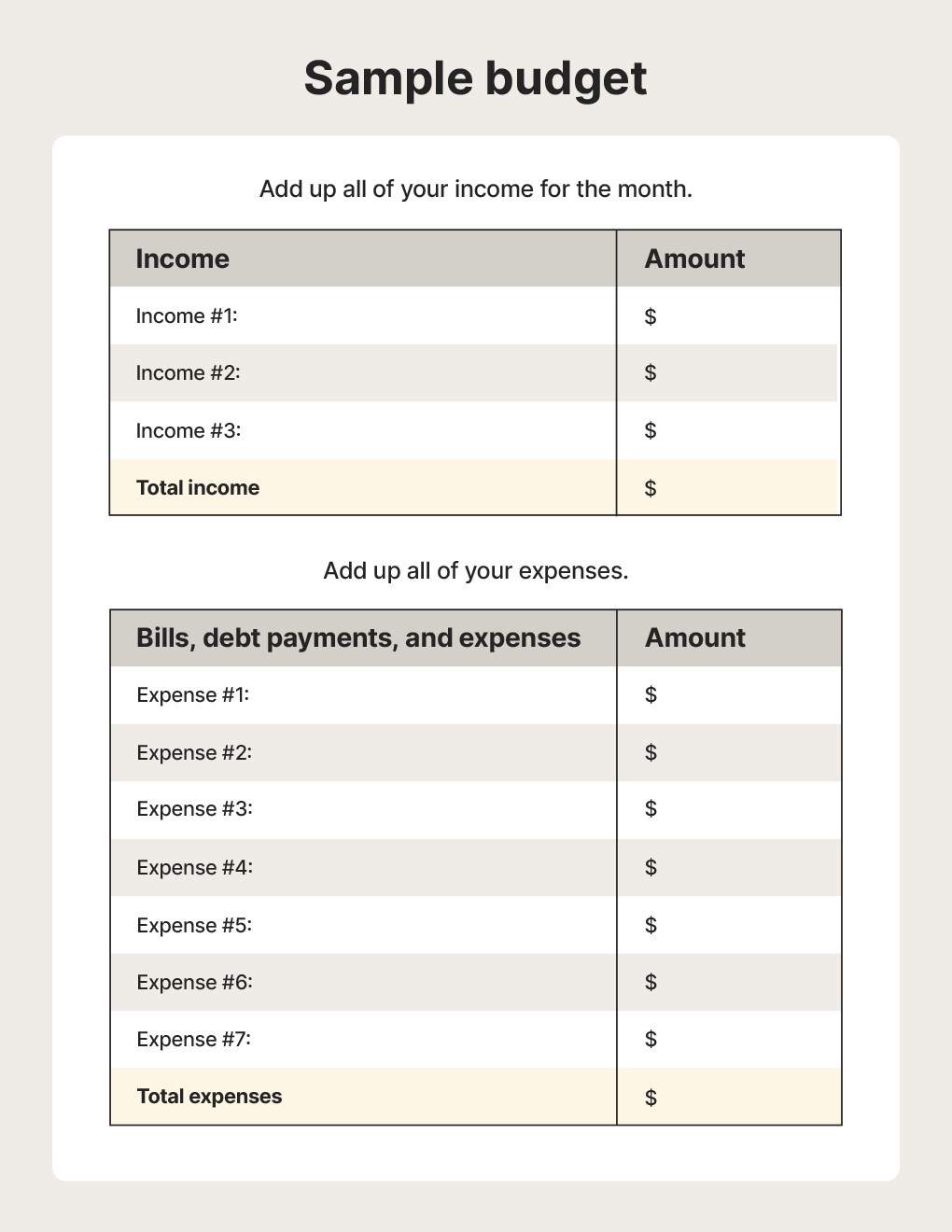

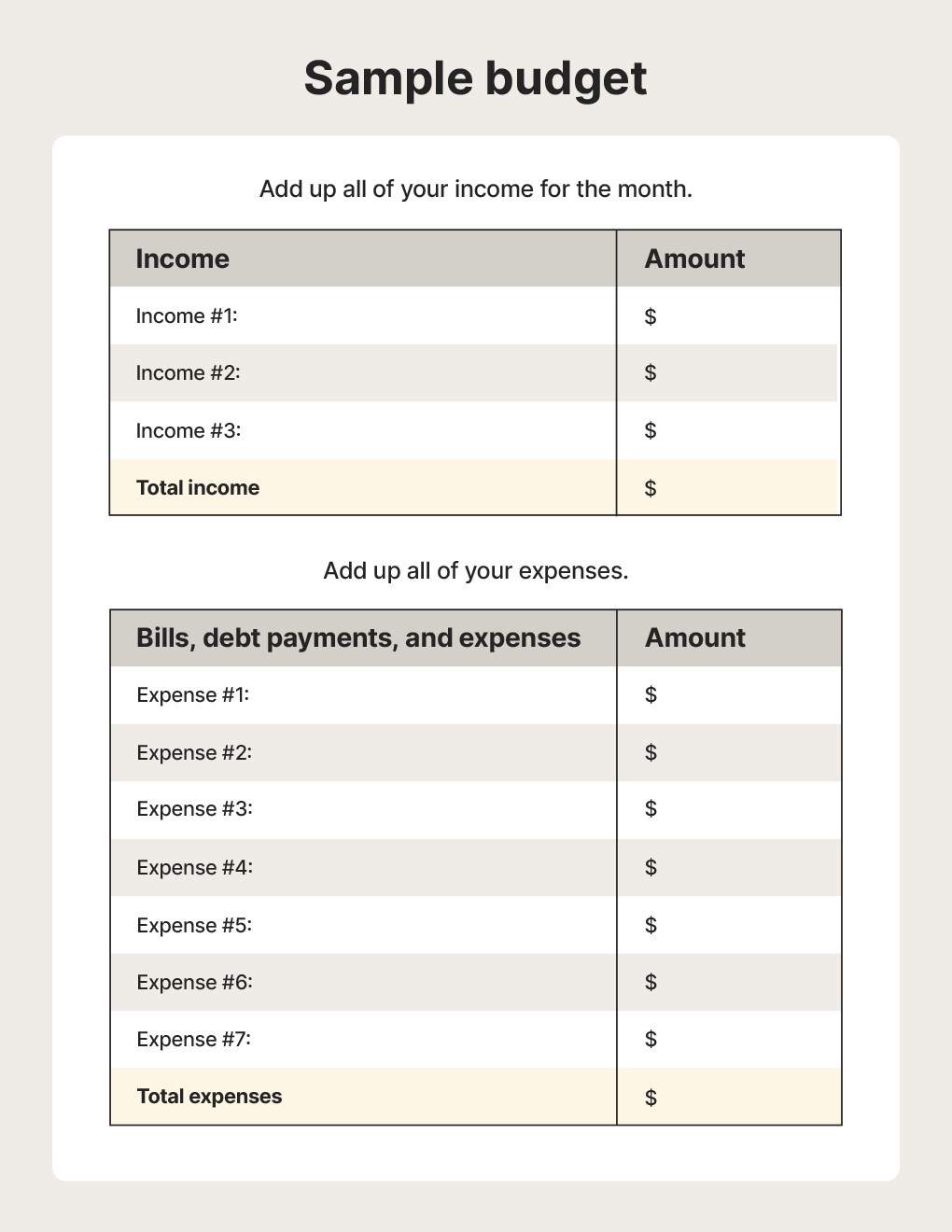

We’ve created a simple resource you can use to aid your debt repayment strategy. Download our free budget template and follow these steps to outline your monthly income and expenses and start tracking your budget.

1. Calculate your after-tax earnings

Add up any income or other money you expect to come in this month. This can be from your day job, side hustles, government benefits, or other sources.

2. List all of your bills

Start by outlining necessities like rent, utilities, groceries, and transportation. Then, list your monthly payments for all debts, including credit cards, loans, medical bills, student and personal loans, co-signed debts, and open collection accounts. From there, find areas in your budget to fit in your “wants” like gym memberships and streaming services.

3. Pick a budgeting ratio

Budgeting ratios divide income into categories (needs, wants, savings) and suggest ideal spending percentages, which you should adjust based on your individual financial situation and goals.

The 50/30/20 method is particularly common, suggesting that you allocate 50% of your after-tax income to needs, 30% to wants, and 20% to savings and debt reduction. If you can’t cover your debts with 20% of your income, you may have to pull from your “wants” fund.

4. Find areas to cut back

If your spending, including your monthly debt servicing payments, exceeds your income or budgeting ratio, you may have to make tough decisions about how to cut back. Spending categories where you can look for saving opportunities include dining, takeout, entertainment, subscriptions, and shopping.

If you can’t easily cut anything, do your best to “trim” your budget. For example, if your car loan is eating up a big chunk of your income, consider getting a cheaper vehicle.

5. Budget to zero

Budgeting to zero means allocating all of your income to a specific category, even if it's just savings or an emergency fund to help avoid future situations that could put you in even more debt. Taking this approach helps you be mindful of how you spend every dollar.

7. Find a credit counselor

A credit counselor is a financial professional who can provide valuable debt management guidance. While they may not be able to find a way for you to secure debt forgiveness or erase your debts, they should be able to provide strategic advice that makes it easier for you to build and manage an effective repayment approach.

A credit counselor can give you tips and guidance on how to:

- Create a realistic budget so you can identify areas to reduce spending and prioritize essential expenses.

- Develop a debt repayment plan and explore different debt repayment strategies, such as the snowball or avalanche methods, depending on your specific financial situation.

- Negotiate with creditors to help lower interest rates, reduce fees, or arrange for more manageable payment plans.

- Gain financial literacy and learn valuable money management skills, such as budgeting, saving, and investing.

It’s important to note that these services typically come at a cost, which may be the last thing you’re looking to incur as you stick to a more stringent budget. However, you may be able to secure free credit counseling by contacting non-profit organizations like the National Foundation for Credit Counseling (NFCC) or the Consumer Credit Counseling Service (CCCS).

Alternatively, you can find lots of free online resources covering how to get out of debt, including on the Federal Trade Commission’s (FTC) Credit and Debt hub, the Consumer Financial Protection Bureau website, and forums used by other people in similar situations, like the /r/debtfree subreddit.

8. Look into assistance programs

If you don’t make enough money to pay for your basic expenses and debts, look into federal, state, and community assistance programs.

Some options, like SNAP (Supplemental Nutrition Assistance Program, which provides food assistance) and TANF (Temporary Assistance for Needy Families, which provides financial assistance), only aid people hovering near the poverty line. Others, like local food pantries, generally provide help to anyone who asks — often with no income verification needed.

Here are some other assistance programs you may qualify for that can help alleviate some of your financial burdens, allowing you to focus on repaying your debts:

- Bill-paying assistance: Many local charities and non-profits have funds set aside to help people in need pay their rent and utility bills. Search online for “bill assistance,” ignoring any sponsored results, and browse for government programs or reputable organizations potentially willing to help.

- Children’s Health Insurance Program (CHIP): You’re legally required to have health insurance for your children, which can cost hundreds of dollars monthly. CHIP eligibility criteria vary by state but, if you qualify, you can get free or low-cost government-funded health insurance. If you’re pregnant, you may also be able to apply for CHIP to fund prenatal care.

- Food assistance programs: The average U.S. family spends $1,080 on groceries every month. This can feel unmanageable, especially when tackling debt. To free up funds, look for local food pantries that offer donations — many don’t verify income.

- Head Start: Head Start is a federally funded program that provides early childhood education, health, nutrition, and family support services to low-income children. If your children meet the eligibility criteria, you may be able to get childcare support.

- Medicaid: If you have low income or limited resources, you may qualify for Medicaid health insurance, which is free or low-cost. To confirm your eligibility and apply, contact your state’s Medicaid agency.

- Section 8: This rental assistance program provides housing vouchers to low-income households to rent a private home for a fraction of the typical cost, freeing up more income for debt repayment.

9. Look for additional earning opportunities

While often easier said than done, earning more money is one of the best ways to get out of debt. If you’re facing challenging financial circumstances but need an income boost, consider how you may be able to find employment that fits your needs.

- If you have children: Consider looking for work at a gym, daycare, or healthcare facility that offers on-site child care.

- If you already work or go to school full-time: Search for a flexible job such as a house sitter, server, cashier, or dog walker.

- If you have mobility difficulties: Consider positions that let you work from home like a virtual assistant, copywriter, or tech support specialist.

- If you don't have a vehicle: Think about where you can find jobs easily reached on public transportation, like in malls, grocery stores, and restaurants.

- If you struggle with your mental health: Look for a job that offers an Employee Assistance Program (EAP) and flexible PTO.

- If you have chronic pain: Search for jobs that offer a generous sick leave policy, remote work, and a budget for ergonomic home office equipment.

- If you don’t have a high school diploma or GED: Look into jobs that typically don’t require qualifications, such as housekeeping, construction, or telemarketing.

If you have creative skills, contractor job sites like Fiverr or Upwork are good places to look for ad hoc work that may help you earn a little extra. You can also get in touch with a recruiter or temporary work agency to find a job that suits your needs.

10. File for bankruptcy

Bankruptcy is a last resort that relieves or reorganizes some of your debts. This legal process should only be considered after exploring all other options, like credit counseling, debt consolidation, and negotiating with creditors. And if your debt has become unmanageable, impacting your daily life and mental well-being, filing for bankruptcy may be your best option.

There are two primary kinds of bankruptcy you can file for: Chapter 7 and Chapter 13. These bankruptcies have different eligibility criteria and handle debt differently — here’s what you need to know about them:

Chapter 13

Chapter 13 bankruptcy or “reorganization bankruptcy” lets you and your attorney propose a structured and manageable multi-year repayment plan. This plan suggests how much you’ll pay each month and for how long.

The court will review it, make adjustments as needed, and typically grant you three to five years to pay a set portion of your unsecured debts (like credit cards and medical bills) under court supervision. Here’s a breakdown of Chapter 13 bankruptcy:

- Who qualifies: People with a regular income who are facing difficulty paying all of their debts.

- Debts you’ll still owe: Child support and secured debts like mortgages and auto loans.

- Consequences: Chapter 13 bankruptcies hurt your credit score and can remain on your credit report for up to 7 years. If your payments are high, you may also have to live with a restrictive income for a few years.

Chapter 13 bankruptcy is sometimes seen as more favorable than Chapter 7 due to the built-in repayment plan — lenders can view this as you trying to repay your debts in good faith. This type of bankruptcy also doesn’t typically involve asset loss and has a shorter reporting period.

Chapter 7

With Chapter 7 bankruptcy or “liquidation bankruptcy,” a court-appointed trustee decides which assets are exempt from liquidation (such as your primary residence and vehicle, up to certain limits). Then, they sell any non-exempt assets through auctions or other appropriate methods. Money raised through the sale of non-exempt assets is used to pay creditors. Here’s a breakdown of Chapter 7 bankruptcy:

- Who qualifies: People who earn less than the median income in their state and can prove they can’t afford to repay a substantial portion of their debts through a Chapter 13 repayment plan.

- Debts you’ll still owe: Child support, alimony, recent tax debt, student loans, and fraudulently obtained debt.

- Consequences: Chapter 7 bankruptcies hurt your credit score and can remain on your credit report for up to 10 years.

Track your debt repayment progress

Even if your debt feels overwhelming, creating a repayment plan using the tips above can help you make steady progress toward your financial goals.

Norton Money supports that journey by helping you stay on top of your credit score, monitor meaningful changes to your credit profile, and track your progress, so you can see how your efforts are paying off as you work toward becoming debt-free.

FAQs

Should I pay more than the monthly minimum?

Yes, if possible you should aim to pay more than the minimum payment on your credit cards or loans. Exceeding the minimum payment can significantly reduce the interest you pay over the term of the debt, allowing you to pay it off faster and save money.

Does the U.S. government have a debt relief program?

Yes, the U.S. government offers several national debt relief programs, such as income-driven repayment plans for student loans and programs for specific types of debt, like those incurred by farmers or small businesses.

Are debt relief programs scams?

No, many debt relief programs are trustworthy and reputable. However, it’s crucial to research and choose programs carefully, as some debt relief programs may be scams.

Is $20,000 a lot of debt?

Whether $20,000 is a lot of debt depends on several factors, including your income, expenses, and overall financial situation. To put it into context, if your interest is around 18% and you can consistently pay $600 a month, it would take you around 47 months (nearly four years) to repay your debt.

How can I pay off $50,000 in debt in one year?

Paying off $50,000 in debt within a year requires aggressive action. This likely involves a combination of significantly increasing your income (e.g., finding a second job), drastically reducing expenses (e.g., cutting non-essentials from your budget), and potentially exploring debt consolidation options.

Editors’ note: The purpose of this article is to provide general financial education. It is not to provide specific investment advice. Any company, product name, or investing strategy is used for descriptive purposes only and does not imply endorsement by Norton. Please seek out a licensed investment professional for your specific situation.

Editorial note: Our articles are designed to provide educational information for you. They may not cover or protect against every type of crime, fraud, or threat we write about. Our goal is to increase awareness about Cyber Safety. Please review the complete Terms during enrollment or setup. Remember that no one can prevent all identity theft or cybercrime, and that LifeLock does not monitor all transactions at all businesses. The Norton and LifeLock brands are part of Gen Digital Inc. For more details about how we create, review, and update content, please see our Editorial Policy.

- 1. Avoid taking on new debt

- 2. Verify or dispute collections

- 3. Negotiate with debt collectors

- 4. Consider consolidating your debt

- 5. Choose a debt repayment strategy

- 6. Create a budget

- 7. Find a credit counselor

- 8. Look into assistance programs

- 9. Look for additional earning opportunities

- 10. File for bankruptcy

- Track your debt repayment progress

- FAQs

Want more?

Follow us for all the latest news, tips, and updates.