How to invest in stocks: A beginner’s guide

Are you interested in investing but unsure where to start? Don’t let a lack of knowledge keep you from building wealth. Learn how to invest in stocks using eight simple steps. Then, get Norton Money to help manage your finances as you grow your investments.

Investing in the stock market is one of the most effective strategies for building wealth. By purchasing shares of a company, you become a part owner of the business and can benefit from its success.

This gives you the opportunity to grow your money over time, earn higher returns than traditional savings accounts, and stay ahead of inflation. But, investing presents certain risks, so if you've never dabbled in stocks before, you’re almost certainly unsure where to start.

That’s why we’ve put together eight tips to help you learn how to invest in stocks and start building your portfolio more confidently.

1. Set investment goals

The first step to investing is figuring out what you want to accomplish. Think about your long-term goals and how they might shape your approach to investing, including the level of risk you're comfortable taking.

If you’re younger and want to maximize returns with a more aggressive strategy, you might lean toward riskier investments, like stocks in fast-growing companies. But if you're nearing retirement, a more cautious strategy of protecting the savings you’ve worked hard to build may be wiser.

No matter your goals, diversifying your investments is a smart move. This could mean investing in mutual funds or exchange-traded funds, which include a mix of different stocks. Or it might involve investing in larger, well-established companies like IBM or Apple — so-called “blue-chip” stocks.

Create a plan that helps you achieve your goals. Do you want to actively manage your investments, or would you prefer a more hands-off approach? Do you want a diversified portfolio, or are you interested in a few specific stocks? Among other factors, your risk tolerance, age, current financial responsibilities, and how much you know about the market can help guide your decision-making.

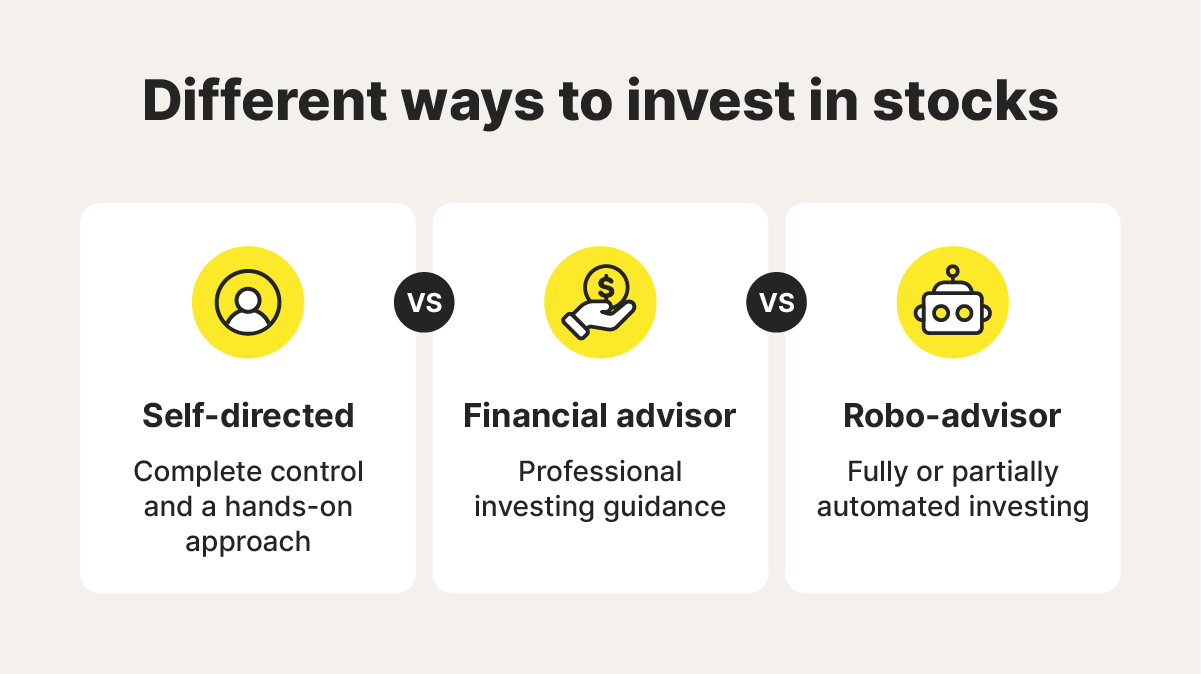

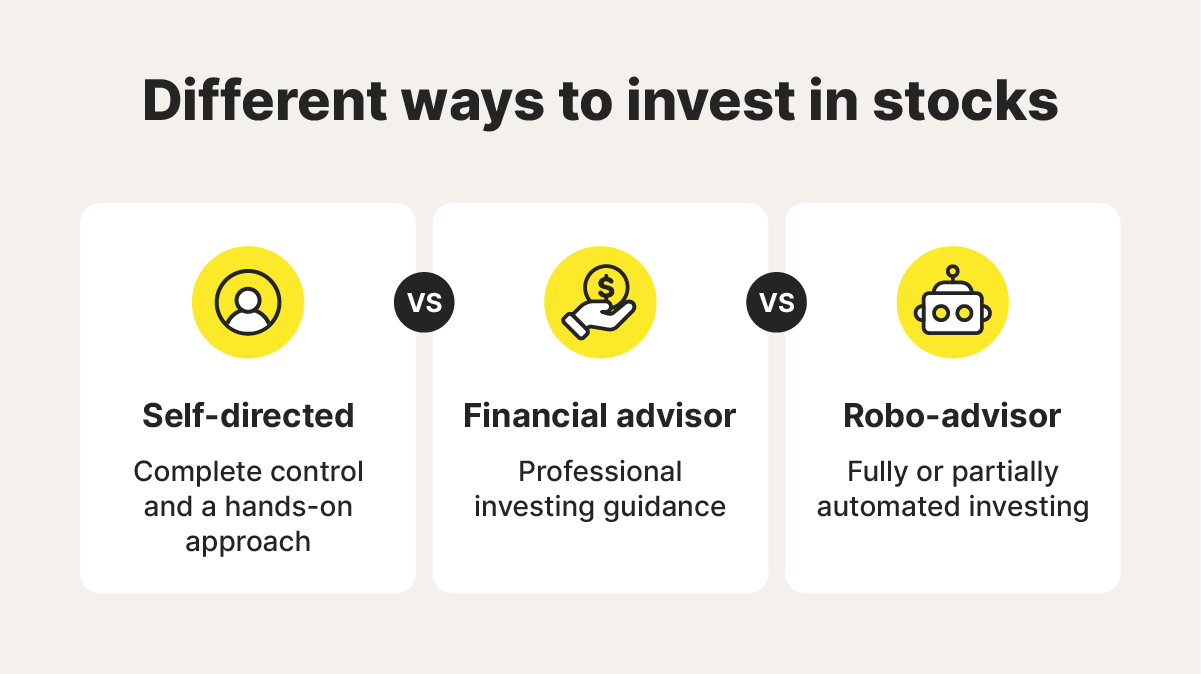

2. Decide how you want to invest

There are three main ways to invest your money in stocks: an active approach through self-directed investments, using a professional financial advisor, or automating decisions with a robo-advisor. How you proceed will depend on whether you prefer a hands-on or hands-off investing style.

Self-directed

Self-directed stock investing, also known as DIY investing, involves choosing your own stocks and investment opportunities and managing your portfolio directly through an online brokerage platform that lets you make trades and track performance.

There are a variety of electronic trading platforms you can use — Fidelity, E*TRADE, and Charles Schwab are a few popular options. Or you can use a digital finance app like Revolut that lets you store money, track spending, budget, and invest.

|

|

|

|---|---|

Full control over investments |

Time and effort required |

No management fees |

Higher risk of mistakes |

Diverse investment opportunities |

Can be overwhelming for beginners |

Financial advisor

A financial advisor’s job is to help you grow your money by guiding your investment decisions. When you invest in stocks through a financial advisor, they’ll create a strategy based on your financial goals and actively manage your investments to help you reach them.

|

|

|

|---|---|

Expert advice and personalized strategies |

Management fees |

In-depth research and monitoring |

Less direct control over investments |

Broader financial planning |

Minimum investment limits |

Robo-advisor

A robo-advisor is an automated digital financial tool that uses algorithms to create and manage investment portfolios on your behalf. They offer low fees, diversified portfolios, and hands-off investing, making them a potentially appealing option for beginners or passive investors.

|

|

|

|---|---|

Lower fees than financial advisors |

Limited personalization and flexibility |

Automates investing for you |

More expensive than self-directed |

Easy to use |

Lack of human guidance |

3. Open an investment account

After laying out your goals and choosing how you want to invest, it’s time to open an investment account. There are several different account types to choose from, each offering a different mix of pros and cons. The right option for you depends on your specific goals and personal preferences.

Explore the options below to discover what type of account best fits your needs:

Brokerage accounts

A brokerage account is an investment account you open through a brokerage firm, which is a financial institution that acts as an intermediary to help you buy and sell stocks. These accounts are generally accessed through an online platform or app, allowing you to buy, sell, and manage your investments from your computer or phone.

There are typically no limits to how much you can contribute to a brokerage account, and you can withdraw your money at any time. However, unlike some retirement accounts, standard brokerage accounts don’t offer tax benefits, meaning profits from selling investments are subject to capital gains taxes.

There are lots of brokerage firms to choose from — popular options in the U.S. include:

- Charles Schwab

- Fidelity

- Vanguard

- JP Morgan

Each stock brokerage firm offers unique features and fee structures, so do a little research to find the best option. Here are a few key factors to consider:

- Fees and commissions: High fees can eat into your investment returns, so competitive pricing and low transaction costs can be an attractive draw.

- Ease of use: A user-friendly interface that’s easy to navigate and offers tools to simplify portfolio management makes investing easier, especially if you’re a beginner.

- Reputation: Choosing a firm with a strong track record and positive reviews improves the chances that it’ll offer reliability, security, and quality customer support.

- Additional resources: Brokers that offer educational materials, research tools, and financial planning resources can help you make better decisions and become a more knowledgeable investor.

Retirement accounts are designed to help you build a pot of wealth through the course of your working life that you can draw from during retirement. 401(k) plans and Individual Retirement Accounts (IRAs) are two of the most common options.

You can use both account types simultaneously, allowing you to maximize their separate contribution limits and tax benefits.

401(k)

A 401(k) is an employer-sponsored account that lets you set aside a portion of your paycheck for retirement. 401(k) plans typically offer a range of investment options, such as mutual funds, ETFs, and index funds, but not all plans allow investments in individual stocks.

The IRS sets annual contribution limits for 401(k) plans — currently $23,500 for those under 50, with an additional $7,500 catch-up contribution allowed for folks 50 and over. Many employers also match a percentage of your 401(k) contributions, boosting your savings.

A traditional 401(k) is funded with pre-tax income, deferring taxes until withdrawal, while a Roth 401(k) uses after-tax income, making retirement withdrawals tax-free. So make your choice based on your tax expectations — a Roth 401(k) benefits those expecting higher taxes later, while a traditional 401(k) suits those anticipating a lower tax rate in retirement.

IRA

IRAs are retirement accounts that aren’t tied to an employer, making them a great choice if you’re self-employed or want to boost your 401(k) savings. IRAs generally offer more flexibility than 401(k)s, with the ability to invest in a wider range of assets, including individual stocks, bonds, mutual funds, and ETFs.

IRAs also have annual contribution limits — currently $7,000 for people under 50, with an additional $1,000 catch-up contribution allowed for those 50 and older.

Just like 401(k) accounts, traditional IRAs are tax-deferred, so you don’t pay taxes until you take money out, while contributions to Roth IRAs involve after-tax income, meaning you’ll enjoy tax-free withdrawals in retirement.

Education accounts

Education investing accounts, like 529 plans and Coverdell ESAs, help you save for a child’s future school expenses. They typically offer tax-free growth and withdrawals for qualified costs like tuition and room and board, as well as potential state tax benefits.

529 plans generally offer pre-set investment portfolios, such as mutual funds and index funds, but they usually don’t allow investments in individual stocks.

Coverdell ESAs, by contrast, usually allow you to invest in individual stocks, offering more flexibility if you prefer a hands-on approach to portfolio management.

Health savings accounts

Health savings accounts (HSAs) offer three types of tax advantages: pre-tax contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses. Funds can cover doctor visits, prescriptions, and over-the-counter (OTC) items. However, using HSA money for non-medical expenses may result in a 20% penalty and income tax.

HSAs can be used as traditional savings accounts, paying tax-free interest that compounds over time. This is the most common use of the account, with only 12% of HSA account holders invested in non-cash assets, according to the Employee Benefit Research Institute. But this approach may mean you miss out on the full potential of your HSA.

Investing your HSA savings in stocks can help your money grow faster over time, preparing you for the higher healthcare costs that often come with age. Just bear in mind that investing your HSA savings can be riskier than keeping them in cash, so consider what split makes sense for you.

4. Figure out how much you can afford to invest

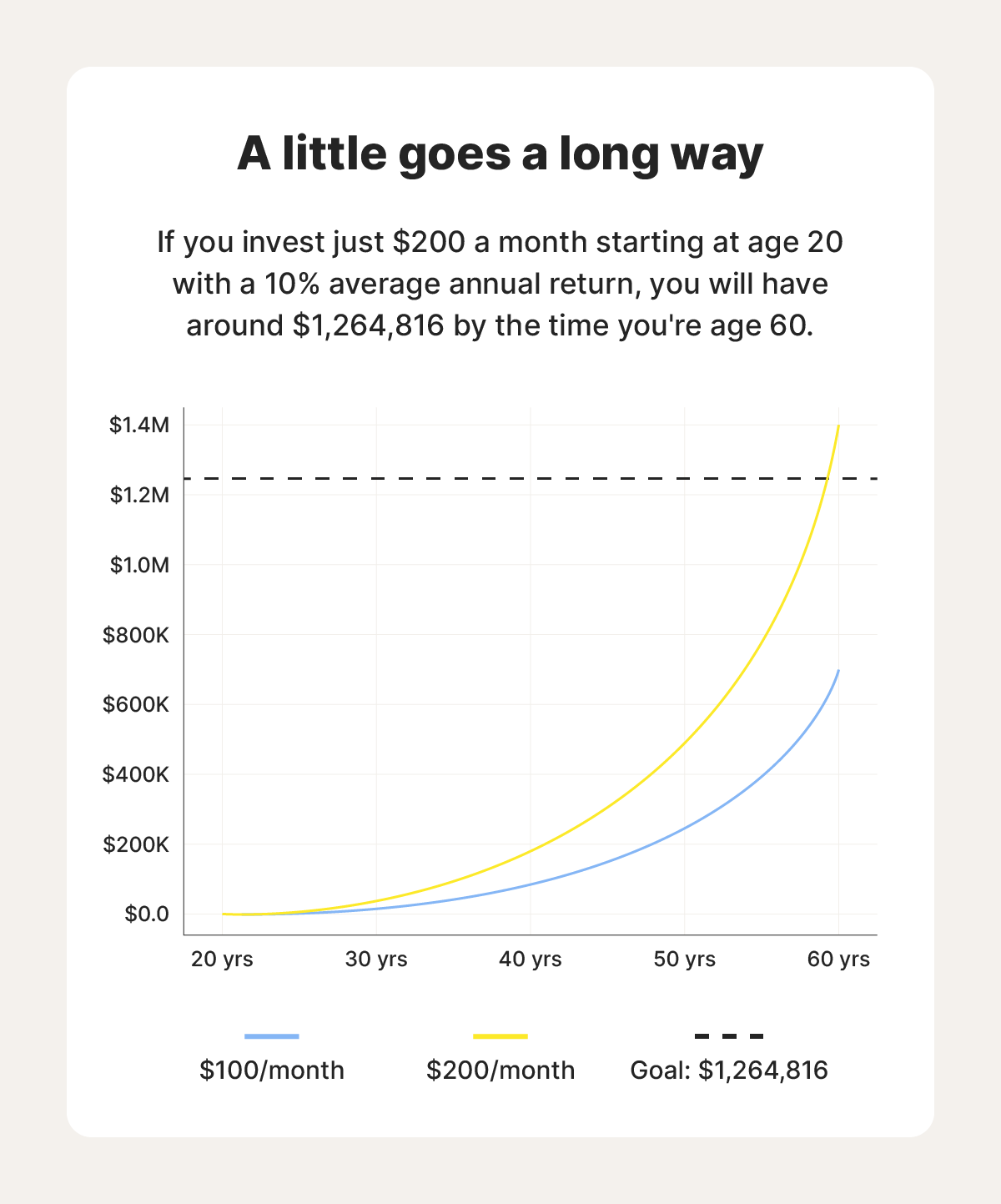

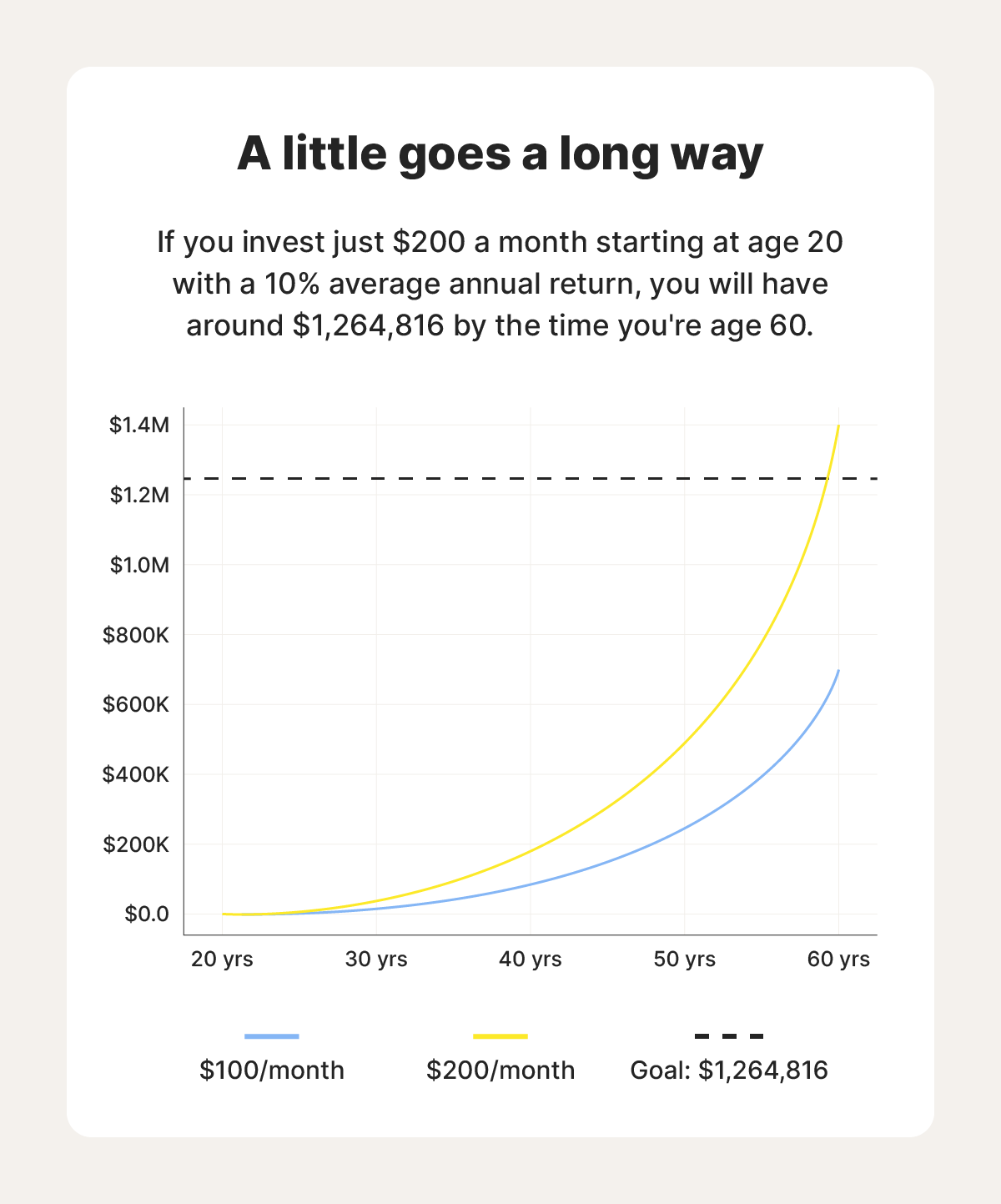

Before investing in stocks, review your budget to determine how much disposable income you can use. Even if you can’t commit to the 10–20% of your pre-tax income recommended by financial experts, starting small is better than not investing at all. And thanks to compounding, even modest contributions can grow significantly over time.

If you're struggling to cover essentials, don’t have an emergency fund, or have a lot of debt, shore up those areas of your finances before starting to invest.

5. Determine your risk capacity

Your risk capacity is the level of risk you can tolerate in your investment strategy based on your financial situation and goals. Younger investors saving for retirement often have a higher risk capacity than those nearing retirement, as they have more time to recover from stock value losses.

To assess your risk capacity, consider your financial stability, savings, and investment timeline. Those with stable incomes and long-term goals can generally take on more risk, while those nearing their goal or with limited savings might prefer safer investments.

A common guideline is the “100 Minus Age” rule, suggesting you allocate a percentage of your portfolio to stocks based on 100 minus your age. For instance, at 30 years old, you might invest 70% in stocks and 30% in bonds, shifting toward more conservative investments as you age.

6. Add funds to your investment account

Depending on the type of account you have, you can add funds by linking your bank account to your investment account and making a one-time deposit or setting up automatic regular contributions. If you have a retirement account provided through your employer, you should be able to set up contributions during onboarding.

Any money you transfer into your investment account will typically be added as cash. Some brokerages offer cash or money market accounts, which allow you to earn a return on these funds even when they’re not invested in stocks.

7. Choose which stocks to invest in

With money in your account, you can finally choose what to invest it in. It’s important to understand that some investment vehicles are inherently riskier than others. Each option has different characteristics that can affect both your potential returns and the level of risk involved.

Here's a breakdown of some common investment options:

- Individual stocks: Investing in individual stocks allows you to directly own shares in specific companies. This can offer high returns but also exposes you to volatility as stock prices can fluctuate significantly.

- Exchange-traded funds: ETFs are collections of stocks that track an index like the S&P 500 or Nasdaq. While ETFs can be traded like regular stocks, they spread risk throughout a variety of companies and provide lower volatility than investing in individual stocks.

- Index funds: Index funds are similar to ETFs in that they represent a collection of stocks and are typically passively managed. They also track broad market indexes, offering diversification. But index funds differ from ETFs in that they can’t be bought and sold throughout market hours.

- Mutual funds: Mutual funds pool money from investors to buy stocks, bonds, or other securities. Unlike ETFs, they are actively managed, which can result in higher fees, but they offer professional management of your investments.

If you choose to invest in individual stocks, do your research so you can make informed investment decisions. Publicly available data offers insights into a company’s financial health, market position, and growth potential, so you can weigh the risks and rewards more smartly.

Here are some important things to keep in mind during stock research:

- Stock type: Stocks are categorized by risk, with blue-chip stocks offering reliable performance and defensive stocks helping protect against market risk.

- Company news: Stay informed about any developments or changes within the company that could affect its performance.

- Financials: Review the company’s financial statements and valuation metrics, including revenue, profit margins, price-to-earnings ratio, and debt levels, to assess its overall health.

- Trends: Consider broader market and industry trends that could impact a company’s future growth.

8. Review and monitor your investments

Good investing doesn’t just involve choosing the right stocks to buy. You should also regularly review and monitor your investments to keep track of their performance.

Bear in mind that short-term fluctuations are normal and don’t always reflect a stock’s long-term potential. If you notice a dip, stay calm and focus on the long game. Avoiding rash decisions, like overreacting to a minor decline and selling your stocks, can help your investments grow over time.

If you own dividend-paying stocks, consider reinvesting the dividends you receive. This will help fuel compounding growth, making your investment grow faster over time.

The risks of investing in stocks

While investing in stocks can be a great way to build wealth, it isn't risk-free. Here are a few common investing risks to be aware of as you build your investing strategy.

- Market risk: Market or “downside” risk refers to the potential for your investment to lose value due to factors like poor company performance or market downturns. It represents the chance of losing money on your investment.

- Economic risk: Economic risk is the potential for your investments to lose value due to larger, structural economic conditions like recessions or slowdowns. When the economy struggles or interest rates rise, companies may earn less or their debt obligations may increase, causing stock prices to drop.

- Inflationary risk: Inflation happens when prices rise over time, reducing the purchasing power of your investment returns. If inflation grows at a higher rate than the stock market, the real value of your investments may decrease.

- Political risk: Political risk refers to how government actions, such as policy changes, regulations, or elections, can affect stocks and the market. For example, tax laws, trade tariffs, or political instability can influence stock prices and potentially harm your investments.

Tips when investing in stocks

Once you grasp the fundamentals of stock investing, you can think about fine-tuning your investments. To help guide your strategy, we’ve compiled a list of top investing tips for beginners:

- Start as soon as possible: The earlier you begin investing, the more time your money has to grow. Even small contributions early on can lead to significant gains over time, thanks to the power of compounding.

- Diversify your portfolio: Asset diversification means spreading investments across various stocks or funds to minimize the impact of any single investment's performance. This strategy helps reduce risk and volatility by ensuring you're not overly reliant on individual assets.

- Don't time the market: Aim to invest for long-term growth instead of trying to predict and trade short-term fluctuations. Attempting to time the market can sometimes lead to buying high and selling low, which can harm your overall returns.

- Consider tax implications: Be aware of taxes on gains and dividends, and use tax-advantaged accounts to reduce tax impact. Taking advantage of retirement accounts like IRAs or 401(k)s, for example, can help you defer taxes, maximizing your long-term growth.

- Avoid hype investments: Avoid following trends or “hot tips” and focus on investments that align with your risk tolerance and long-term goals. Make informed decisions based on research instead of chasing investment fads.

Protect your finances with Norton

Investing in stocks is more accessible than ever, but protecting your broader financial picture still matters. Norton Money helps you stay informed by tracking your credit score and alerting you to key changes in your credit profile, so you can spot potential issues early and maintain visibility into your financial health as you build and manage your investments.

FAQs

What is a stock?

A stock, also known as an equity, is a security that represents a share of ownership in a company. Stocks are fungible financial instruments, or legal documents, that can be bought, sold, or exchanged. Buying stock makes you a partial owner, and if the company grows in value, its stock price typically rises, allowing you to profit from its success.

How much do I need to start investing?

Depending on the platform and investment type, you can start investing with as little as $1. Many apps and brokerages offer fractional shares, which make investing more accessible by allowing you to buy a portion of a stock.

What are the best stocks for beginners?

If you're new to investing with limited funds, consider focusing on established companies with strong financials and reliable performance for long-term stability. You can also invest in ETFs, index funds, or mutual funds to build a diversified, lower-risk portfolio without needing to buy multiple individual stocks.

Are investing apps safe?

Reputable stock investing apps are generally safe. When researching your options, look for platforms with strong account security measures, like vault encryption and two-factor authentication, to help protect your financial information. For added protection, consider using a scam, fraud, and identity protection service like Norton 360 with LifeLock Ultimate Plus.

Editors’ note: The purpose of this article is to provide general financial education. It is not to provide specific investment advice. Any company, product name, or investing strategy is used for descriptive purposes only and does not imply endorsement by Norton. Please seek out a licensed investment professional for your specific situation.

Editorial note: Our articles provide educational information for you. Our offerings may not cover or protect against every type of crime, fraud, or threat we write about. Our goal is to increase awareness about Cyber Safety. Please review complete Terms during enrollment or setup. Remember that no one can prevent all identity theft or cybercrime, and that LifeLock does not monitor all transactions at all businesses. The Norton and LifeLock brands are part of Gen Digital Inc.

- 1. Set investment goals

- 2. Decide how you want to invest

- 3. Open an investment account

- 4. Figure out how much you can afford to invest

- 5. Determine your risk capacity

- 6. Add funds to your investment account

- 7. Choose which stocks to invest in

- 8. Review and monitor your investments

- The risks of investing in stocks

- Tips when investing in stocks

- Protect your finances with Norton

- FAQs

Want more?

Follow us for all the latest news, tips, and updates.