How to track expenses: 4 steps for success

Expense tracking may seem like a headache, but without it, your financial situation can easily spin out of control. Discover how to track your expenses in four simple steps. Then let Norton Money help you track your expenses by providing an overview of all your costs, your monthly spending, and a drill-down into different expense categories.

According to the Bank of America, around one-quarter of U.S. households live paycheck to paycheck. This challenge impacts both low-income and higher-income earners alike.

Tracking your spending is a key strategy for breaking free from the paycheck-to-paycheck cycle. Learning where your money goes can help you create a budget that aligns with your current responsibilities and future goals, paving the way toward greater financial stability.

Here are four crucial steps to help you master expense tracking.

1. Choose a tracking method

There are different methods you can use to track your spending and expenses. Some people like to use apps that can be linked to their bank accounts. Others prefer spreadsheets like Excel or even old-fashioned pen and paper. Choose a method that works best for your skills and stick with it.

Here are a few popular tracking methods to choose from.

Budgeting apps

Budgeting apps allow you to keep track of expenses and manage your finances from your smartphone. Some can even be linked to your bank accounts and credit cards, to automatically sync and categorize transactions, giving you a clear, real-time view of your spending.

Budgeting app pros:

- Automatic syncing: Connects directly to your financial accounts, making transaction tracking effortless.

- Real-time monitoring: Updates your spending and balances instantly, providing up-to-date financial information.

- Easy categorization: Automatically sorts expenses into categories, helping you understand where your money goes.

- Time-saving: Reduces the need for manual data entry, saving time compared to spreadsheets.

- Accessibility: Available on smartphones, making it easy to access your finances anywhere, anytime.

Budgeting app cons:

- Subscription costs: Some apps require a paid subscription to access premium features.

- Dependence on technology: Requires a smartphone and an internet connection, limiting access for some users.

- Limited customization: Some apps may not offer the same level of flexibility or customization as spreadsheets.

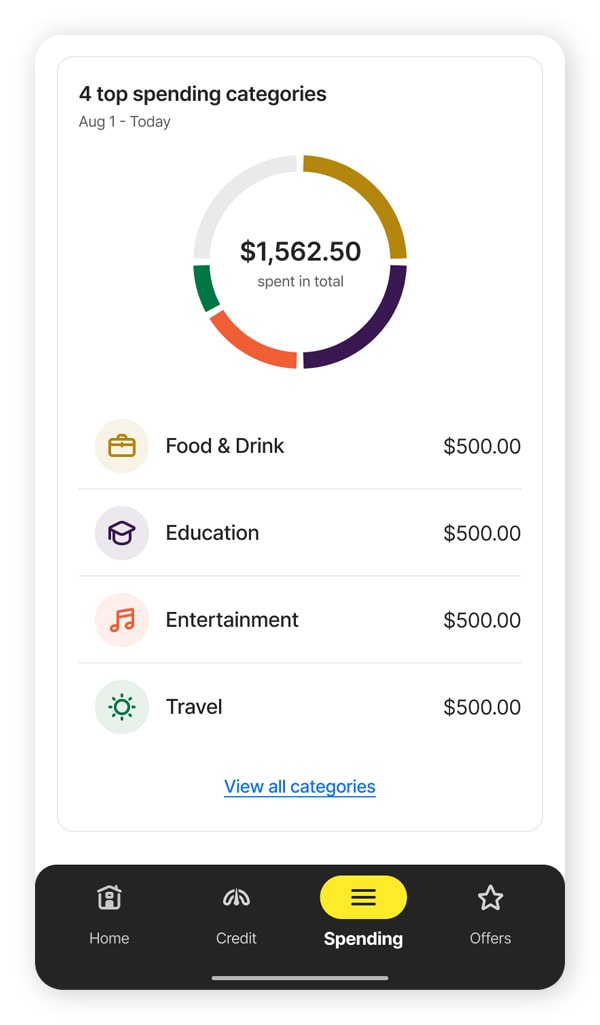

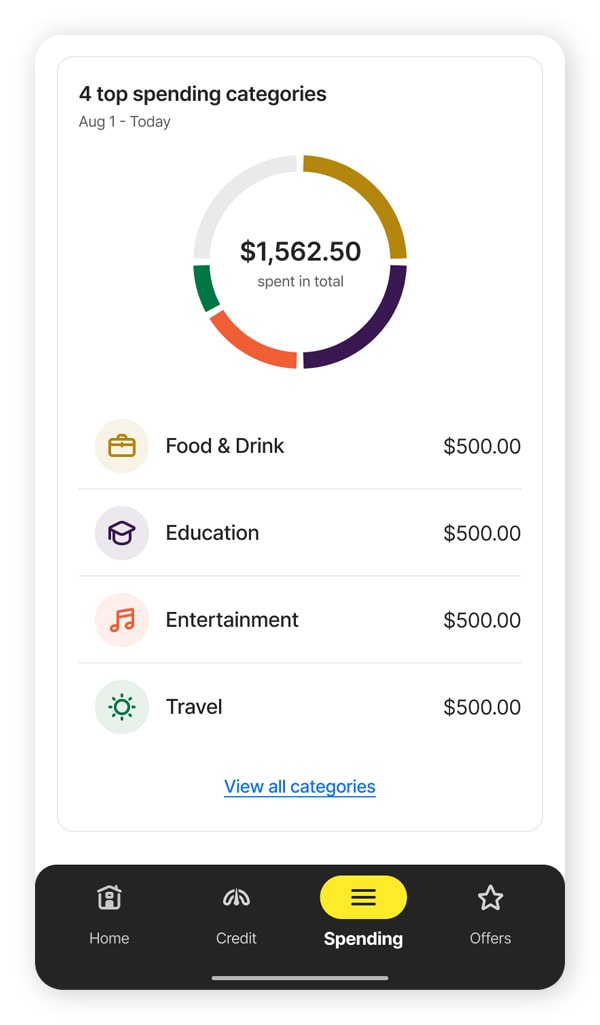

Norton Money tip: Unlike generic budgeting apps, Norton Money's free built-in Spending Tracker gives you an instant view of where your money goes. It’s part of your existing Norton 360 subscription, so you can try it for free.

On the Norton Money home screen, you’ll see your monthly cash flow at a glance: what’s coming in, what’s going out, and how much is left to cover your important bills.

Expenses are automatically sorted into clear categories like Food & Drink, Education, and Entertainment, with easy-to-read charts. You can look deeper into any category, spot recurring payments like subscriptions, and even edit categories if something doesn’t look right.

Instead of hunting through spreadsheets or statements, Norton Money checks your spending in real time, helping you stay on track week by week.

Computer spreadsheets

With comprehensive organization and calculation features, spreadsheet programs like Microsoft Excel, Apple Numbers, or Google Sheets provide a flexible way to track income and expenses. You can start with a pre-designed template or create a customized spreadsheet tailored to your needs.

Spreadsheet pros:

- Customizable: Tailor the spreadsheet to meet your unique financial goals. Create categories for subscriptions, monthly bills, savings, vacations, and more.

- Cost-effective: Google Sheets is free with a Google account, and Microsoft Excel is often bundled with Office 365 subscriptions many people already own.

- Collaborative: Some spreadsheet programs, like Google Sheets, allow multiple users to access and edit the budget in real time.

Spreadsheet cons:

- Time-consuming: Requires consistent manual entry to stay accurate and up to date.

- Learning curve: Learning the intricacies of spreadsheet software — especially regarding calculations — isn't entry-level, it takes extra effort to learn the nuances.

- Prone to human error: Mistakes in data entry or formulas can lead to inaccuracies, causing budgets to misrepresent available funds or spending limits. Over time, this can result in overspending.

- No automation: Unlike many budgeting apps, spreadsheets don’t automatically sync with bank accounts.

Pencil and paper

Tracking expenses with pencil and paper is a straightforward, no-tech approach to budgeting. You simply record each expense manually in a notebook, along with the date, amount, and spend category.

Pencil and paper pros:

- Simple and accessible: No need for a smartphone or internet access.

- Free: There are no subscription fees or software costs involved.

- Helps with mindfulness: Manually writing purchases down can make you more aware of your spending habits.

Pencil and paper cons:

- Time-consuming: Requires manual entry for every expense, which can become tedious.

- Prone to human error: Mistakes in calculations without software or forgetting to write down expenses can easily lead to inaccuracies.

- No automation: Unlike digital methods, this method doesn’t offer real-time updates or automatic syncing.

Compare money tracking methods

Type |

Cost |

Resources needed |

Best for |

|---|---|---|---|

Budgeting apps |

Cost varies |

Mobile device |

Automated budgeting |

Computer spreadsheets |

Cost varies |

Computer spreadsheet software |

A hands-on approach |

Pencil and paper |

Free |

Writing tools, notepad |

A tech-free approach |

2. Record your income

Before you can create a budget, it’s important to know your take-home pay, also called net income. This is the amount deposited into your account each pay period after taxes and other deductions. Building your budget around your net income rather than your total pay can help prevent overspending.

Recording income is a bit more complicated for freelancers and gig economy workers. Start by tracking all income sources and noting fluctuations in earnings. Use your average monthly income as a baseline for budgeting, but also set aside a portion of your earnings for taxes.

3. Set a budget

Once you've chosen your tracking method, it's time to establish a budget. Budgeting sets clear guidelines on how much you can spend in different areas of your life, simplifying financial management. In a survey conducted by Debt.com, 89% of respondents reported that using a budget has “helped them get out or stay out of debt.”

Popular budgeting methods include the following:

- 50/30/20: This method divides your after-tax income into three categories: 50% for needs (like housing and groceries), 30% for wants (such as entertainment and dining out), and 20% for savings and debt repayment.

- Zero-based budget: With this method, every dollar of your income is assigned a specific job — whether it's for expenses, savings, or debt — leaving you with a zero balance at the end of the month.

- Pay yourself first: In this method, you prioritize saving by automatically setting aside a portion of your income for savings or investments before covering other expenses.

- The envelope method: This cash-based approach involves allocating a specific amount of money for different spending categories into physical envelopes. Once the money in an envelope is gone, no more spending is allowed in that category.

“Conscious spending isn’t about cutting your spending on everything. That approach wouldn’t last two days. It is, quite simply, about choosing the things you love enough to spend extravagantly on — and then cutting costs mercilessly on the things you don’t love.”

Ramit Sethi, I Will Teach You To Be Rich

4. Review and adjust regularly

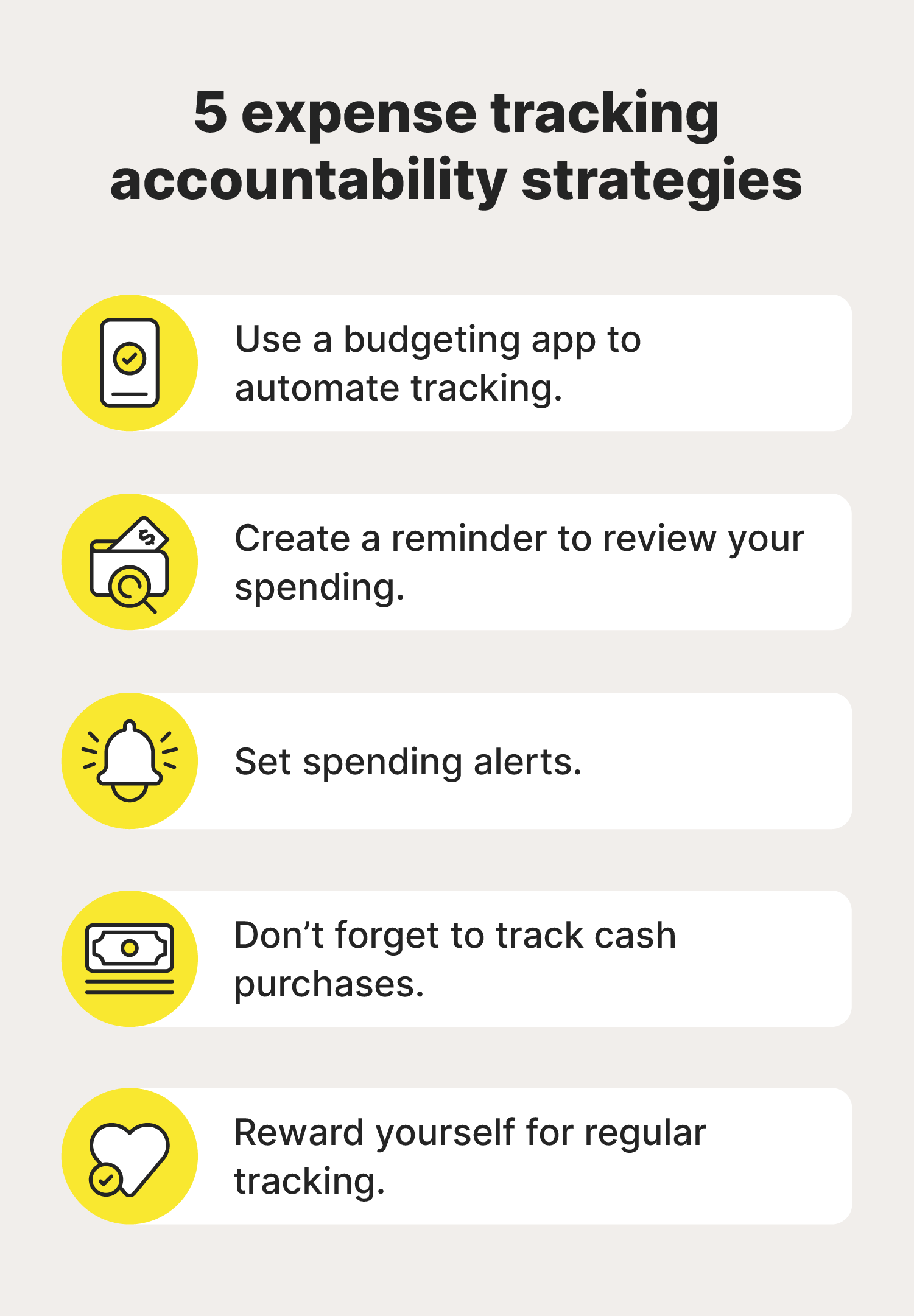

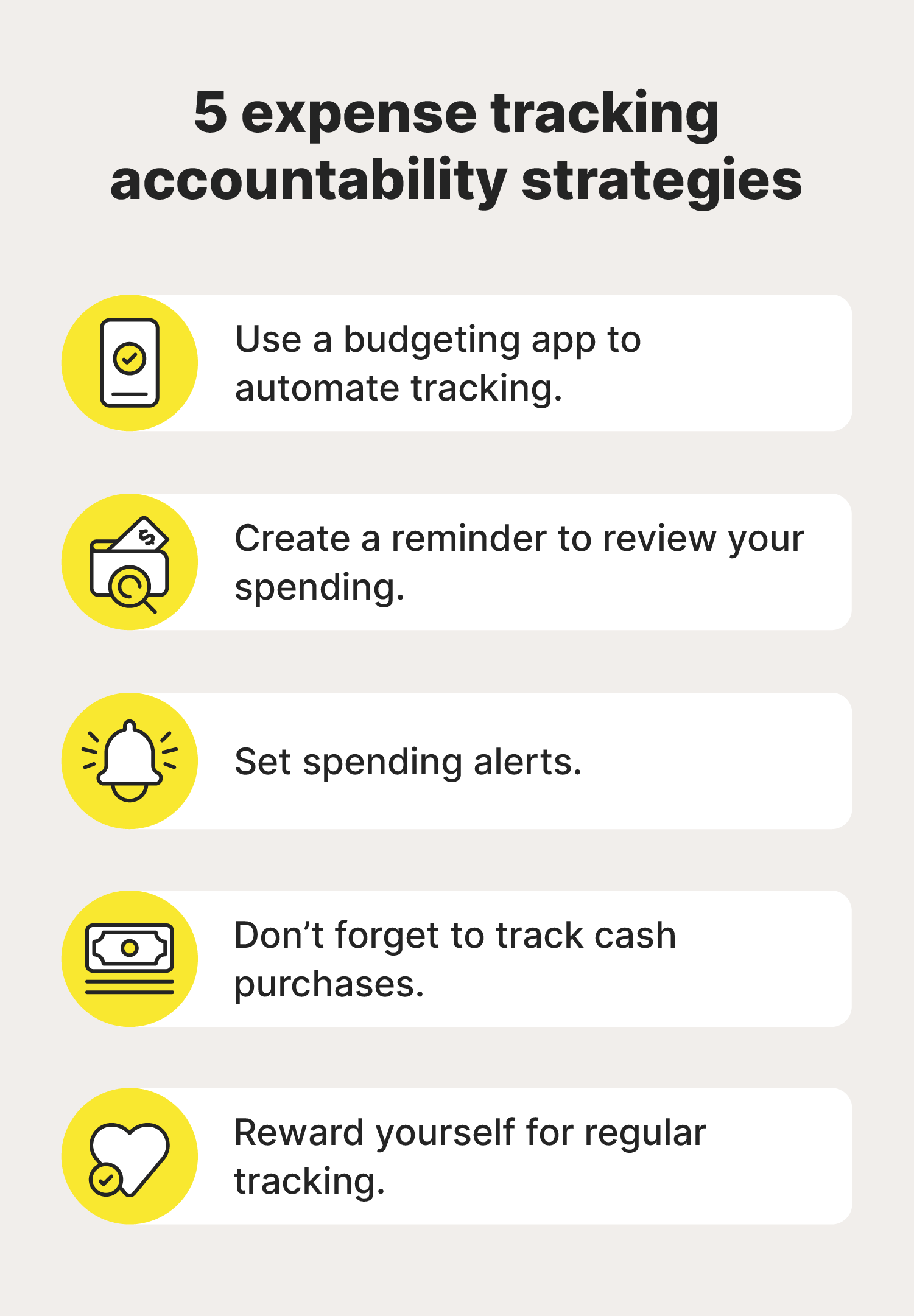

Creating a budget is just the first step toward financial wellness — sticking to it and reviewing your progress is just as crucial. Check your budget at least once a week to stay on top of your finances, reconcile transactions with your bank accounts, and keep your spending on track.

If you’re overspending in certain categories, adjust by reducing spending in areas where you typically spend less. Budgets should be flexible tools that support your goals, so don’t hesitate to make changes as needed.

Why is tracking your expenses important?

According to a 2024 survey by the personal-finance website Bankrate, 47% of U.S. adults reported that money concerns negatively impacted their mental health. While finances are a significant source of stress for many, you can help mitigate that stress by tracking your expenses.

Understanding where your money goes helps you make more educated decisions about your spending, which can reduce feelings of uncertainty or anxiety. Plus, it can help you spot ways to adjust your spending so you can save for the future while enjoying a better quality of life now.

Here’s a closer look at the various benefits of tracking expenses:

- Prevent overspending: Tracking your expenses helps you avoid spending more than you can afford, potentially reducing financial stress and avoiding debt accumulation.

- Improve credit score: Staying on top of your spending helps you pay bills on time, avoid late fees, and reduce your debt utilization ratio, which can improve your credit score.

- Save for big goals: Monitoring your expenses allows you to find opportunities to save, helping you reach big financial goals like buying a home or saving for retirement.

- Pay off debts: Expense tracking helps you find extra money to put toward paying down debts, allowing you to reduce financial obligations.

- Help with tax preparation: Tracking your spending helps with tax preparation by ensuring accurate record-keeping, maximizing deductions, and reducing the risk of errors or audits.

Take control of your financial wellbeing

Tracking your spending is the first step toward taking control of your financial health and making more informed decisions about your money. Norton Money can help you do this, and more, all for free. Track your expenses, spending, and boost your savings today.

FAQs

What is the best way to track expenses?

The best way to track expenses varies from person to person based on needs, wants, debts, and income. If you prefer a simple, automated approach, a budgeting app like Norton Money can handle it for you. If you’re comfortable with spreadsheets, consider Excel or Google Sheets. If you want a tangible record for your files, use a graph-paper notebook.

How often should I track expenses?

Ideally, you should track your expenses weekly, especially if you have a tight budget. Regular reviews help you monitor your progress toward financial goals and identify areas where you might need to adjust your budget.

Are expense tracking apps safe?

Expense-tracking apps are generally safe if they use strong encryption, two-factor authentication, and secure cloud storage. However, to help minimize security risks such as data breaches and unauthorized access, choose a reputable app with strong privacy policies and regularly update your password.

Editors’ note: The purpose of this article is to provide general financial education. It is not to provide specific investment advice. Any company, product name, or investing strategy is used for descriptive purposes only and does not imply endorsement by Norton. Please seek out a licensed investment professional for your specific situation.

Editorial note: Our articles are designed to provide educational information for you. They may not cover or protect against every type of crime, fraud, or threat we write about. Our goal is to increase awareness about Cyber Safety. Please review the complete Terms during enrollment or setup. Remember that no one can prevent all identity theft or cybercrime, and that LifeLock does not monitor all transactions at all businesses. The Norton and LifeLock brands are part of Gen Digital Inc. For more details about how we create, review, and update content, please see our Editorial Policy.

Want more?

Follow us for all the latest news, tips, and updates.