What is a home equity loan and how does it work?

Home equity loans allow you to access the equity in your home to help cover large or unexpected expenses in a bind. Learn how they work, what you can use them for, and what the alternatives are. Then use Norton Money to help manage your finances smartly and securely.

A home equity loan is a type of secured loan that allows you to use the equity in your home as collateral. That means you can borrow money you’ve already paid toward your home, but if you miss loan payments, your lender can foreclose on your home to recover the outstanding debt.

Plenty of homeowners already take advantage of this lending option, with home equity lending currently the highest it’s been since before the housing market crash in 2008. Read our guide to learn what a home equity loan actually is, how it works, and whether getting one is a good idea.

Key terms

- Equity: The portion of your home that you own outright — or the difference between the current market value of your home and the amount you still owe on your mortgage.

- Fixed interest rate: An interest rate that remains the same throughout the entire loan term.

- Loan-to-value (LTV): A ratio that compares the amount of money you're borrowing to the value of your collateral (in this case, your home).

- Secured loan: A loan where the borrower uses another form of capital or valuables as collateral in return for money.

- Term: The length of time it takes to repay a loan in full, based on the amount borrowed, the interest rate, and the repayment schedule.

What is a home equity loan?

A home equity loan (HEL or HELOAN) is a type of second mortgage that lets homeowners tap into the portion of their home they own outright to fund things like home renovations, debt consolidation, or major expenses.

Many lenders allow you to borrow up to 80% of your home's value, minus the amount you still owe on your mortgage. However, service members, their families, and Department of Defense civilian personnel may be able to borrow as much as 100% through the Navy Federal Credit Union’s special financing options and member benefits.

Eligibility criteria for a home equity loan typically require that you have at least 15% to 20% equity in your home, but this baseline varies depending on your lender and other factors.

Home equity loan facts:

- The total loan amount is provided to the borrower in one lump sum.

- They have a fixed interest rate, so your monthly payment will be the same throughout the loan term.

- They don’t affect your primary mortgage’s term or interest rate.

- They typically have higher interest rates but lower closing costs than mortgages.

- Term lengths generally range from five to thirty years.

- If you sell your home before paying off the HELOAN, the lender will recoup the unpaid loan value from the proceeds.

- If you use HELOAN money to buy, build, or improve your home, it may be tax deductible.

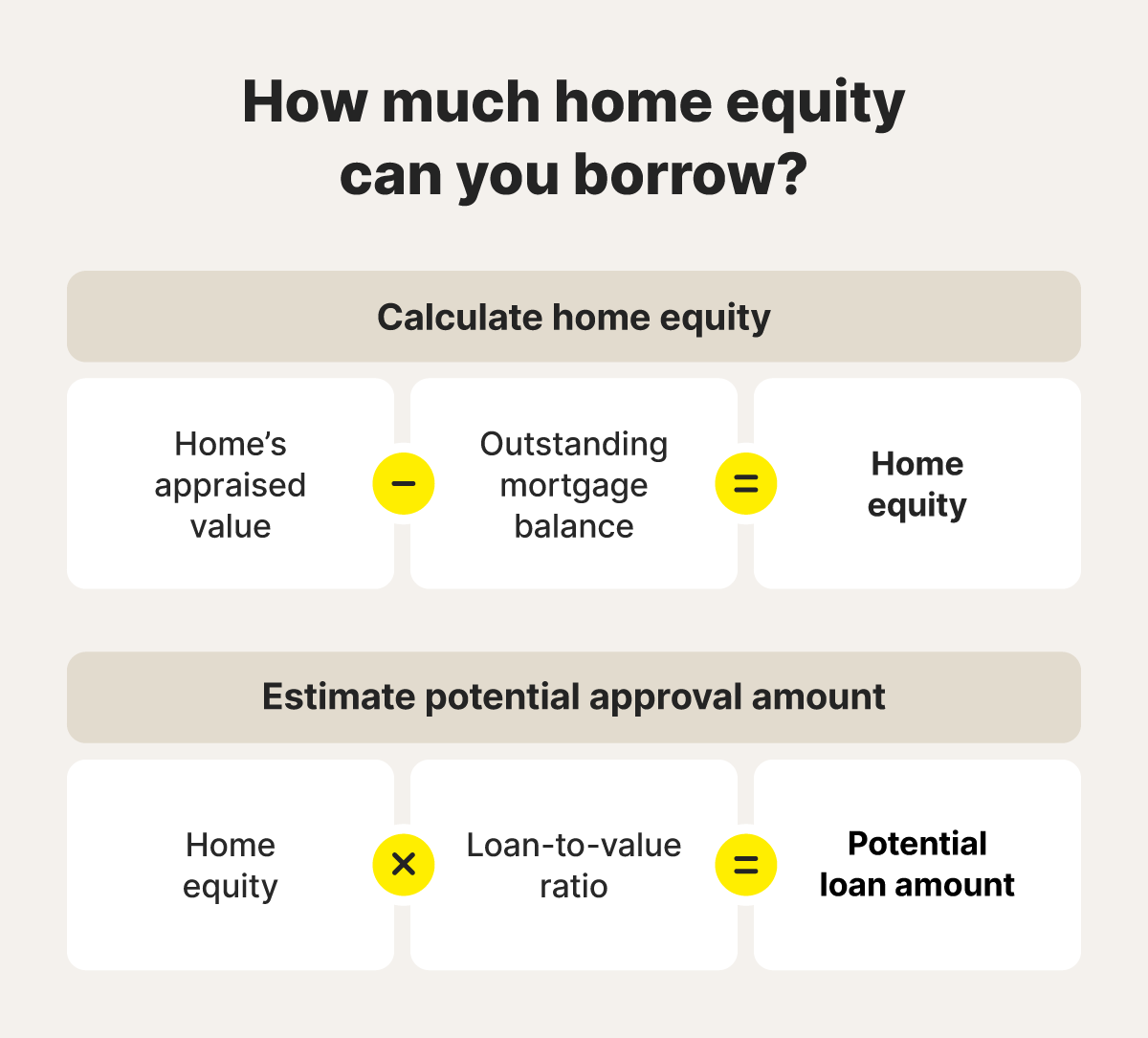

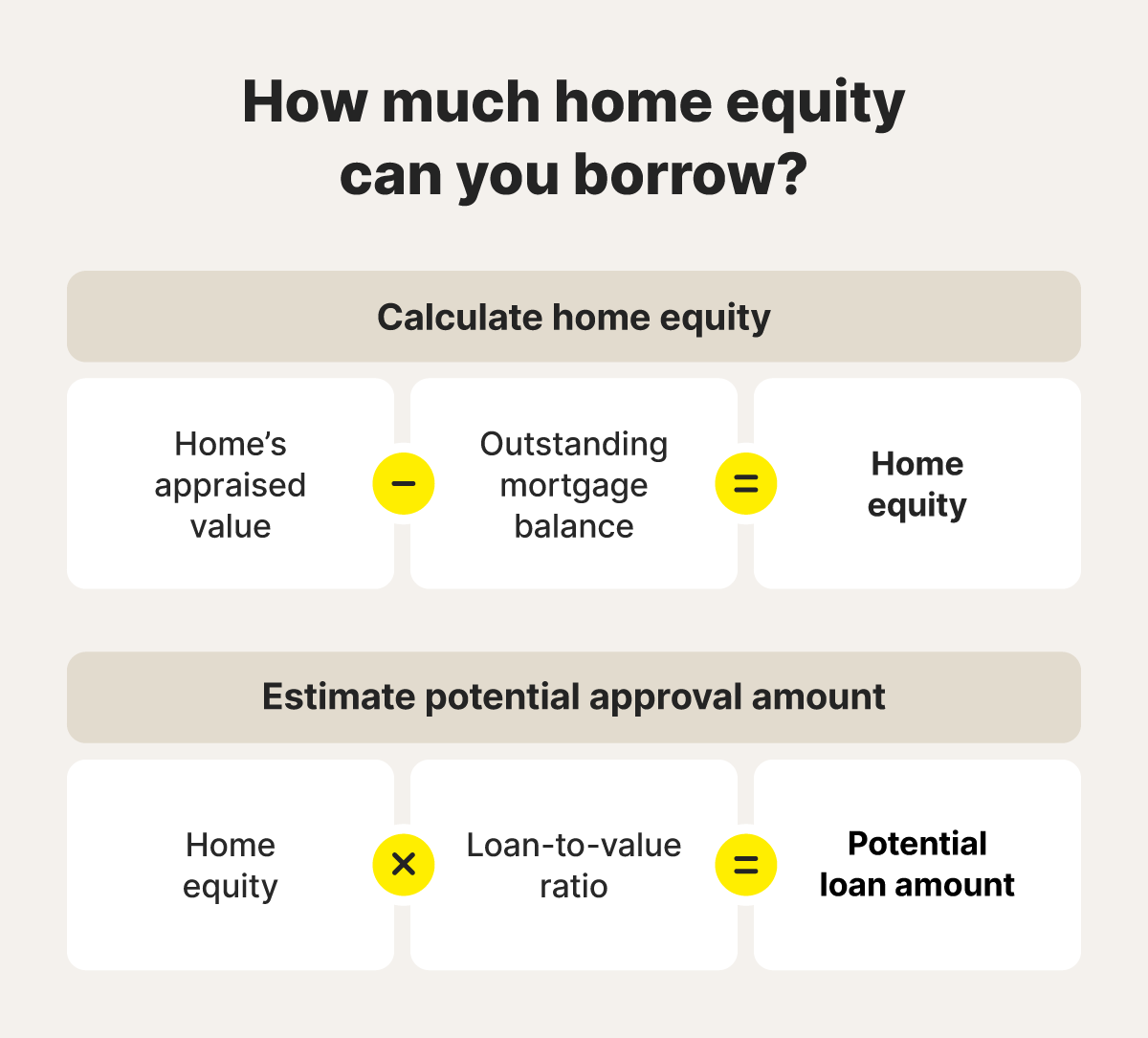

How much can you borrow?

As long as you meet all of the home equity loan requirements, the loan-to-value ratio of your HELOAN can be up to 80%. In other words, you can borrow up to 80% of the equity you own in your home.

You can use your chosen lender’s online home equity loan calculator to figure out the exact amount. You can also calculate the number by multiplying your home equity by the lender's set LTV ratio.

For example, imagine your home is currently worth $300,000, you owe $150,000 on your mortgage, and your lender will allow you to borrow up to 80% of your home’s equity. Let’s figure out how much you could get from a home equity loan.

- Subtract the amount you owe from your home’s market value: $300,000 (home value) − $150,000 (mortgage balance) = $150,000. This means your home equity is $150,000 or 50%.

- Multiply your home’s equity by the LTV: Assuming you plan to borrow the available 80%, the formula would be $150,000 (home equity) × 0.8 (LTV expressed as a decimal) = $120,000 (potential loan amount).

Using these calculations with your own figures will give you a baseline estimate of the value of a loan that a home equity loan lender may grant you. However, the final amount will likely vary based on factors like your credit score, debt-to-income ratio, LTV ratio, and current interest rates.

Home equity loan requirements

To qualify for a home equity loan, you typically need sufficient equity in your home, proven income, good credit history, and homeowners insurance. Here’s more detail on common requirements HELOAN lenders may use to qualify borrowers:

- Home equity: Criteria vary by lender, but you typically need a minimum of 15% to 20% equity in your home.

- Credit score: While it varies significantly depending on the lender and the amount being borrowed, you’ll typically need a credit score of at least 620 to qualify for a home equity loan.

- Income verification: Your lender will need to confirm you meet their income requirements by reviewing your paystubs or income tax return.

- Debt-to-income (DTI) ratio: Many lenders require a DTI ratio of 43% or less, but others are more flexible.

- Appraised home value: Lenders will generally schedule a professional home appraisal to confirm the market value of your home and set a loan amount.

- Proof of homeowners insurance: HELOAN lenders require you to insure your home so it’s covered in case of damage or disaster, protecting their investment in the property.

The specific criteria for home equity loan qualification depend on your chosen lender’s policies. If you’re in doubt, contact them directly to confirm their requirements.

What disqualifies you from getting a home equity loan?

You may not be eligible for a home equity loan if you don’t meet your lender’s specific requirements. Some common reasons lenders may not consider you for a HELOAN include:

- Insufficient home equity: Depending on your lender’s requirements, having less than 15% to 20% equity in your home may mean you’re not eligible for a HELOAN.

- Poor credit score: Lenders typically require a minimum credit score or around 620 or higher to grant a HELOAN. You may need to spend some time improving your credit score if it’s below that level.

- High debt-to-income ratio: If your monthly debt payments exceed a certain percentage of your gross income, you may not qualify.

How does a home equity loan work?

After approving your home equity loan application, lenders offer a maximum lump sum based on the equity you have in your home. You take the amount you need and repay the loan in fixed monthly installments over a set term, usually from five to thirty years.

If you default on your home equity loan, the lender can place a lien on your home, evict you, and possibly begin foreclosure proceedings, which could result in the loss of your home.

Here’s how the process of getting a home equity loan works from start to finish:

- Calculate your home’s equity: Knowing how much equity you have in your home helps you determine what amount you can borrow, understand your loan options, and make informed decisions about your finances.

- Estimate how much you need to borrow: Borrow only what you need. Consider your budget, repayment plan, and any potential upcoming financial risks before deciding on a loan amount.

- Consider home equity loan options: Comparing lenders is key, as interest rates and loan terms can vary greatly. Spend time looking for the best deal and consider getting pre-approved by multiple lenders so you can compare their offers side-by-side and choose the one with the most favorable terms (lowest interest rate, lowest fees, best repayment options).

- Verify that you meet your preferred lender’s criteria: Generally, you need to have 15% to 20% equity in your home, a 620+ credit score, and a debt-to-income ratio under 43%.

- Apply for a home equity loan: You typically apply for a home equity loan online or in person. The lender will review your application, order an appraisal, and verify your income and credit history. Be prepared to provide financial documents, and be aware that the application process may take several weeks.

- Close on your home equity loan: Closing on a home equity loan involves signing the final loan documents and receiving the loan funds, either at a lender's physical branch or remotely using electronic signatures. The closing process may take up to eight weeks.

- Receive funds: You’ll receive a lump sum payment through a direct deposit or check, depending on the lender's specific procedures and your preferences.

- Repay the loan: You’ll then make fixed monthly payments for a set period of time (usually five to thirty years). These payments will gradually reduce the principal remaining until you’ve paid the loan off in full.

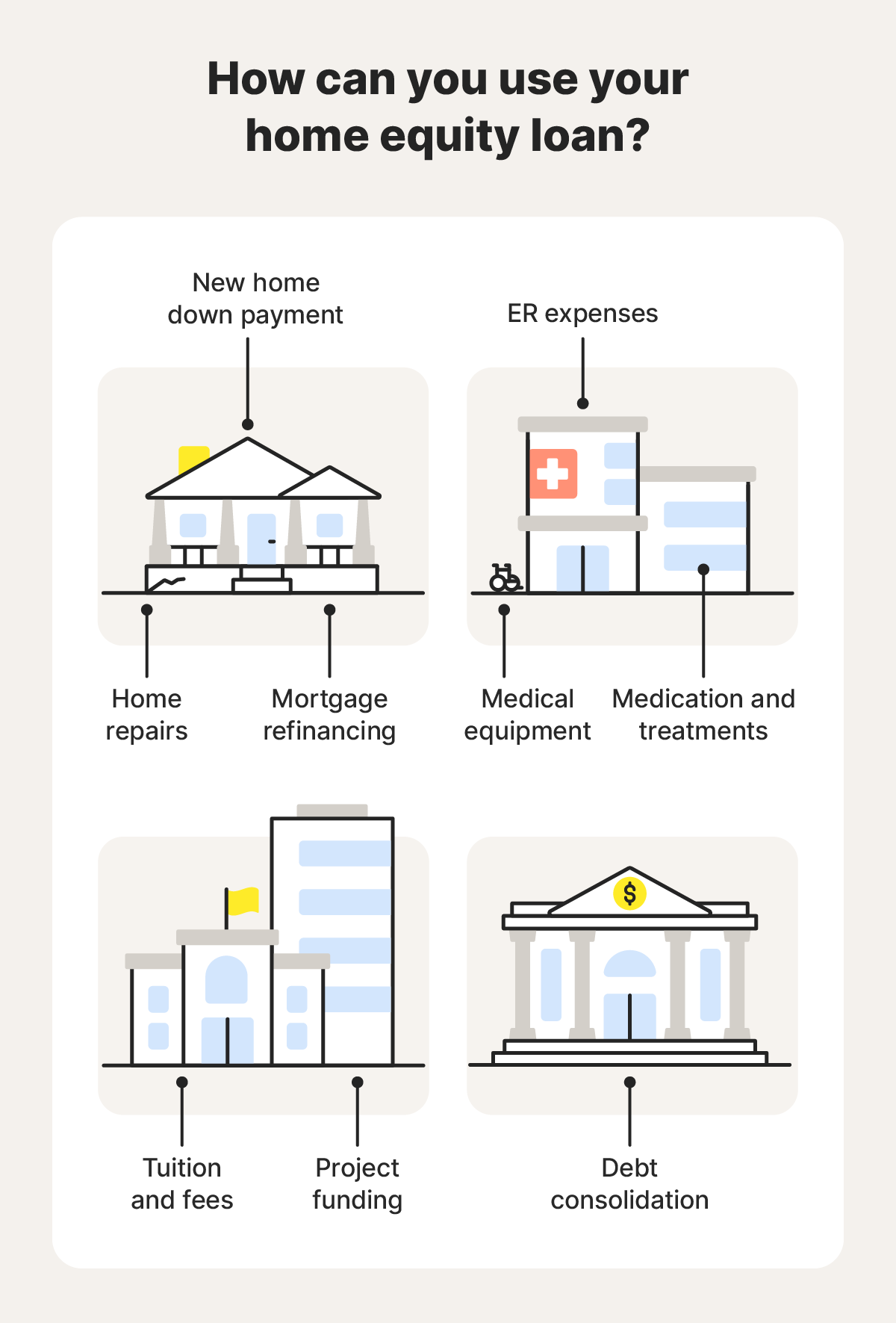

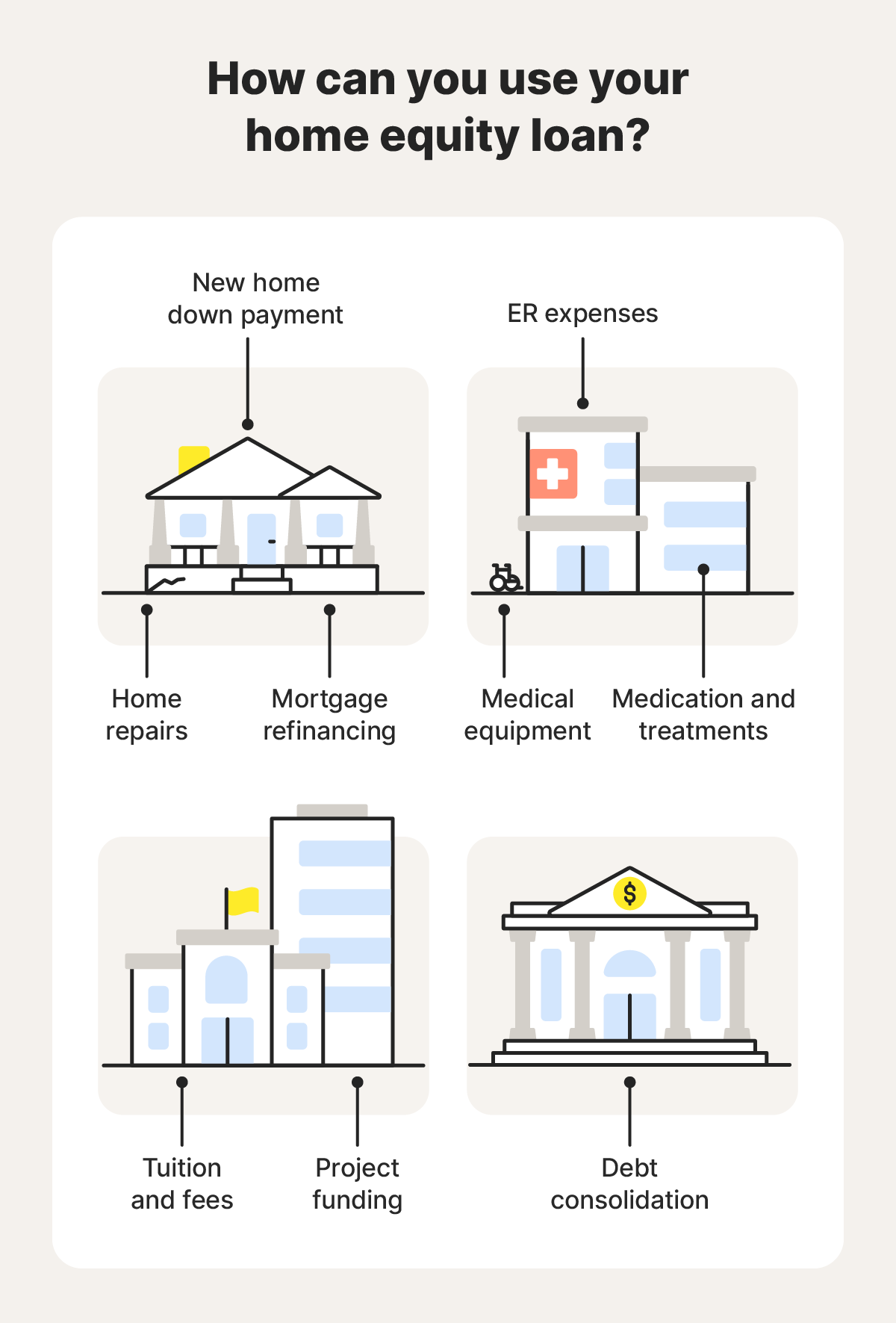

What can you use a home equity loan for?

You can use a home equity loan for a variety of major expenses like home improvements, tuition and educational fees, medical expenses, down payments, project funding, and refinancing. According to lenders like Bank of America and Citizens Bank, home improvements and debt consolidation are the top uses of home equity loans.

It’s generally not advised to use funds raised through a home equity loan for investments, day-to-day cash flow, vacations, or to consolidate debt if the interest rate on the home equity loan is higher than the interest rate on the existing debt.

Using HELOAN money for those purposes exposes you to the risk of being in an unsustainable financial position. Ultimately, that can increase your overall debt and potentially result in you losing your home if you can't make the payments.

Home equity loan vs. HELOC and other alternatives

If a HELOAN isn’t right for you, you can also try securing funds through an alternative like a home equity line of credit (HELOC), cash-out refinancing, a personal loan, a 401(k) loan, or a life insurance loan.

Here’s what you need to know about these options:

Financing method |

Description |

Borrowing limit |

|---|---|---|

HELOC |

Revolving line of credit secured by your home's equity |

Up to 95% of your home’s equity |

Cash-out refinance |

Mortgage refinancing option to borrow more than you owe on an existing mortgage, paid as a lump sum |

Up to 80% of your home’s equity |

Personal loan |

Unsecured lump sum loan with variable interest rates and repayment terms |

Typically up to $100,000, depending on your financial situation |

401(k) loan |

Money you borrow from your 401(k) retirement account, paid as a lump sum |

$10,000 or 50% of your 401(k) fund, whichever is highest ($50,000 limit) |

Life insurance loan |

Secured lump sum loan to borrow against a life insurance policy |

Up to 90% of your policy’s cash value |

HELOCs are arguably the closest alternatives to HELOANs, but there are some key differences in their disbursement and repayment structure.

A HELOAN provides a lump sum of money upfront with a fixed interest rate and fixed monthly payments. A HELOC functions as a revolving line of credit (like a credit card) with a variable interest rate, allowing you to borrow funds as needed during a specified draw period and then settle the debt during a repayment period.

Is a home equity loan a good idea?

Whether a home equity loan is a good idea depends on your specific financial situation and what you plan to use the loan for.

It can help you fund home renovations or college tuition if you have significant equity, a stable income, and a plan to repay the loan responsibly. However, it carries risks, including potential foreclosure if you default, and should be carefully considered.

Here’s a look at some of the pros and cons of taking out a home equity loan:

Pros of a HELOAN |

Cons of a HELOAN |

|---|---|

Lower interest rates than some other loan types |

Risk of home foreclosure |

Potential tax benefits |

Potential for high fees |

Can be used for diverse purposes |

Stringent qualification criteria |

Help manage your finances the smart way

Whether you’re using a home equity loan, a HELOC, or another form of funding, visibility into your financial health is essential. Norton Money helps you track your credit score and monitor key changes to your credit profile — so you can stay informed, spot potential issues early, and make more confident decisions as you optimize your finances.

FAQs

Can you refinance a home equity loan?

Yes, you can refinance a home equity loan. This involves replacing your existing loan with a new one, potentially at a lower interest rate, with different terms, or borrowing more money. Monitoring interest rate announcements from the Federal Reserve can help you determine whether refinancing your home equity loan might be a good idea in the near future.

Is home equity loan interest tax deductible?

Home equity loan interest may be tax-deductible. However, there are limitations. Generally, the interest is only deductible if the funds are used for buying, building, or substantially improving the home that secures the loan. Consult with a tax professional to determine if you qualify for a tax break when you file.

Do you need an appraisal for a home equity loan?

Yes, lenders typically require an appraisal to determine the current market value of your home, which is an important part of assessing your equity and ensuring the loan amount doesn't exceed the property's value.

Can I use a home equity loan to buy another house?

Yes, in most cases you can use a home equity loan to buy a second home. Since home equity loans provide a lump sum of cash, you can use those funds as a down payment, cover closing costs, or even contribute toward the overall purchase price of a second property.

Editors’ note: The purpose of this article is to provide general financial education. It is not to provide specific investment advice. Any company, product name, or investing strategy is used for descriptive purposes only and does not imply endorsement by Norton. Please seek out a licensed investment professional for your specific situation.

Editorial note: Our articles provide educational information for you. Our offerings may not cover or protect against every type of crime, fraud, or threat we write about. Our goal is to increase awareness about Cyber Safety. Please review complete Terms during enrollment or setup. Remember that no one can prevent all identity theft or cybercrime, and that LifeLock does not monitor all transactions at all businesses. The Norton and LifeLock brands are part of Gen Digital Inc.

Want more?

Follow us for all the latest news, tips, and updates.