Ways to avoid identity theft and ID theft statistics

This comprehensive identity theft protection guide overviews ways to avoid identity theft, types of identity theft, as well as identity theft statistics.

Knowing ways to avoid identity theft is everything in today’s digital age. Why? Because no one wants to wake up to calls about unauthorized credit card charges or Instagram alerts about fake accounts created in your name. However, with 2020 raking in more than 1.4 million ID theft reports in the U.S. alone, this has become an unexpected reality for many people—and that’s just one of many eye-opening identity theft statistics from the past couple of years.

We compiled a list of more than 30 hard facts and ugly truths about ID theft to help you grasp how prevalent identity theft really is and paired them with identity theft protection tips to help prevent yourself from becoming a target both online and off.

What is identity theft?

Identity theft occurs when a criminal steals your personal information and uses it to impersonate you, looking to take your money, sensitive data, and other personal assets.

When cybercriminals commit identity fraud, they might use a stolen identity to:

- Open new accounts and/or credit lines

- Receive medical care with your stolen insurance information

- Steal tax refunds

- Provide your personal credentials in the event of an arrest (name, date of birth, address, etc.)

What the identity thief is after will determine what kind of theft you’ll have to deal with. Understanding the different kinds of identity theft tactics can help you learn what identity theft warning signs you should be on the lookout for and who is most vulnerable.

5 types of identity theft + ID theft warning signs

Put yourself ahead of today’s identity thieves by learning about five of the most common types of identity theft used to compromise your sensitive data and replicate your identity.

1. Financial identity theft

Many know financial identity theft as the most common type of identity theft—with 47 percent of surveyed Americans saying they were targets in 2020. This happens when an identity thief attempts to steal passwords, phone numbers, emails, addresses, Social Security numbers, and other types of personal data to use for their own financial gain.

ID theft warning signs:

- Unexplained charges on your credit card/bank statement

- Notifications of a new credit card or loan

- Calls from debt collectors

How it occurs: An identity thief gets your personal information and uses it to make purchases, open accounts, and steal your money.

Potential victims: Adults, seniors

2. Criminal identity theft

Criminal identity theft occurs when a person arrested by law enforcement provides your name and other identifiable information instead of their own. They could potentially do this by getting their hands on a stolen driver's license or creating a fake ID.

ID theft warning signs:

- Court summons received in the mail

- Unexpected bench warrants for your arrest

- Failed background checks

How it occurs: A criminal provides your personal information at the time of their arrest instead of their own.

Potential victims: Adults, seniors, minors

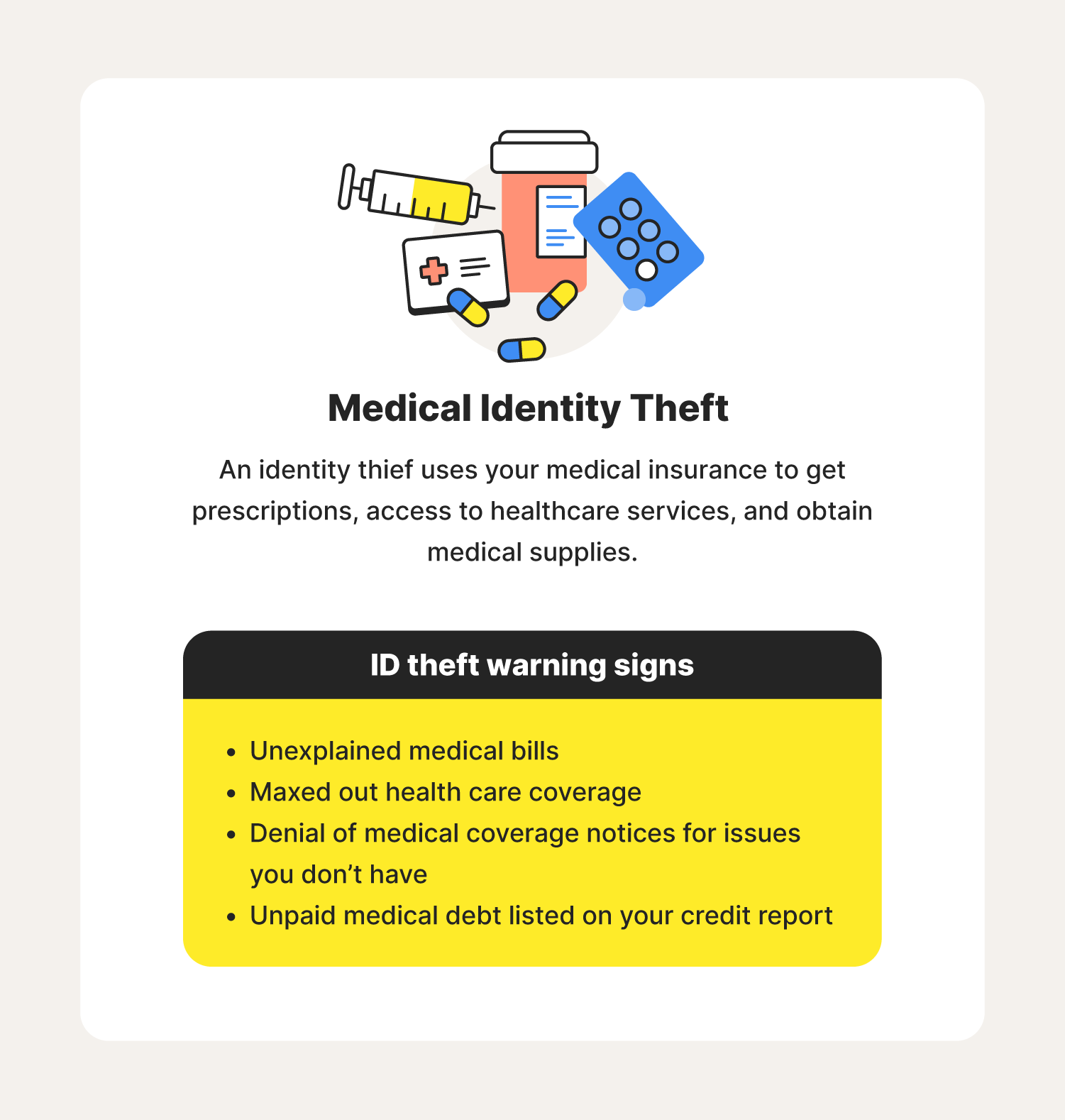

3. Medical identity theft

As surprising as it may seem, medical identity theft is a very present threat—with healthcare data breaches affecting nearly 45 million people this past year. You’ll see this when someone attempts to use another person’s exposed medical insurance information to receive the care they may not be able to afford on their own.

ID theft warning signs:

- Unexplained medical bills

- Maxed out health care coverage

- Denial of medical coverage notices for issues you don’t have

- Unpaid medical debt listed on your credit report

How it occurs: An identity thief uses another person’s medical insurance to get prescriptions, access healthcare services, and obtain medical supplies.

Potential victims: Adults, seniors

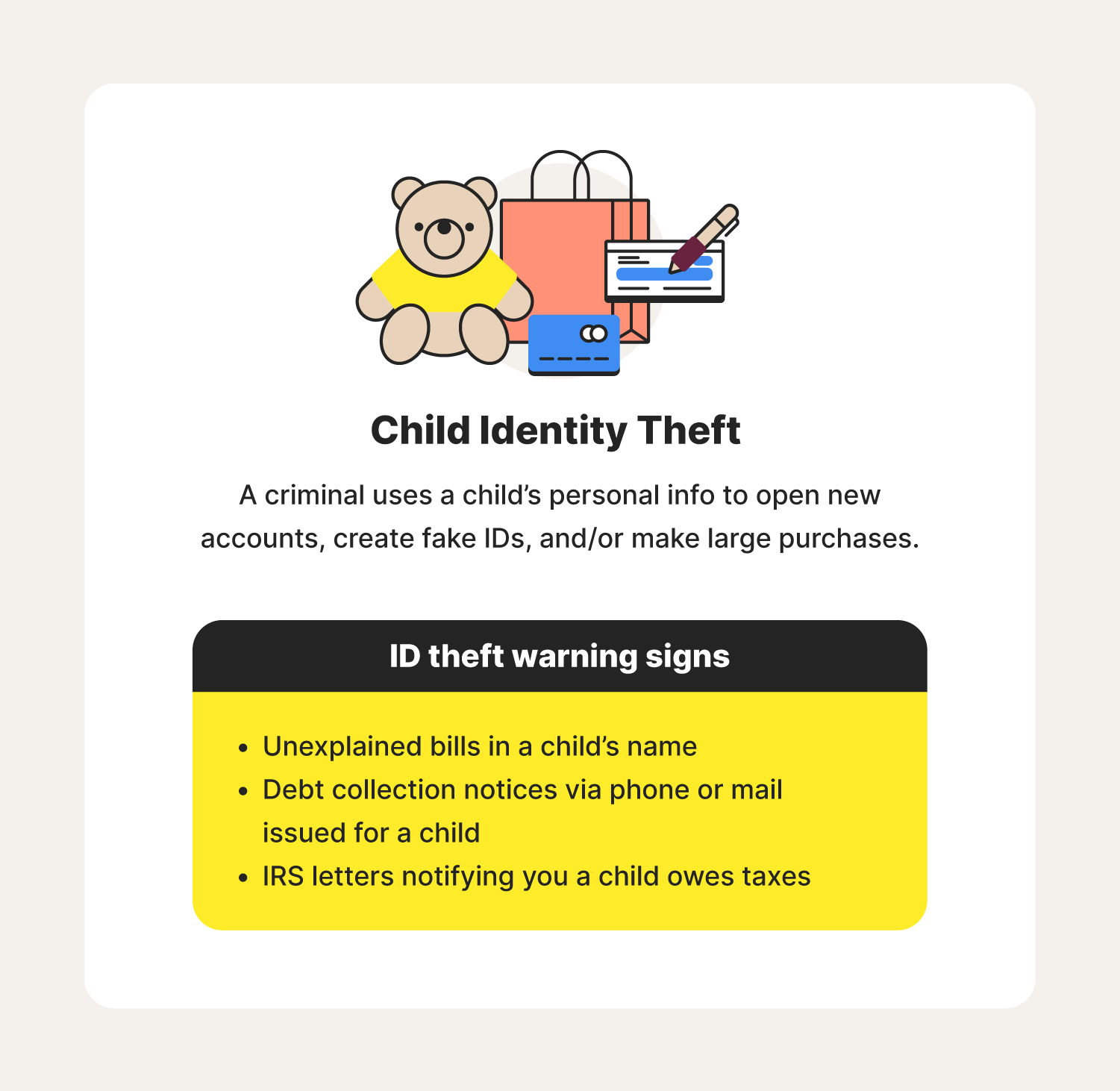

4. Child identity theft

It’s hard to believe someone would target a young one to pursue their own malicious endeavors. However, child identity theft has become a genuine issue, reaching more than 1.2 million victims in 2021. Criminals may attempt to use a minor’s name, address, and/or Social Security number to open a new line of credit, create a fake driver’s license, or even purchase a home. Victims often only become aware once they try to apply for a student loan or open their first credit card.

ID theft warning signs:

- Unexplained bills in a child’s name

- Debt collection notices via phone or mail issued for a child

- IRS letters notifying you that a child owes taxes

How it occurs: A criminal uses a child’s personal information to open new accounts/lines of credit, create fake IDs, and/or make large purchases.

Potential victims: Minors

5. Synthetic identity theft

Labeled as the fastest-growing type of identity fraud, synthetic identity theft involves creating fake identities with real people’s information. Identity thieves can blend stolen addresses, birthdates, and Social Security numbers to make fake personas. They may then use those identities to carry out the usual crimes associated with identity fraud, such as credit card and insurance fraud.

ID theft warning signs:

- Compromised Social Security number

- Notifications of a new credit card or loan

- Calls from debt collectors

How it occurs: An identity thief blends stolen credentials together to create fake personas from real identities.

Potential Victims: Adults, seniors, minors

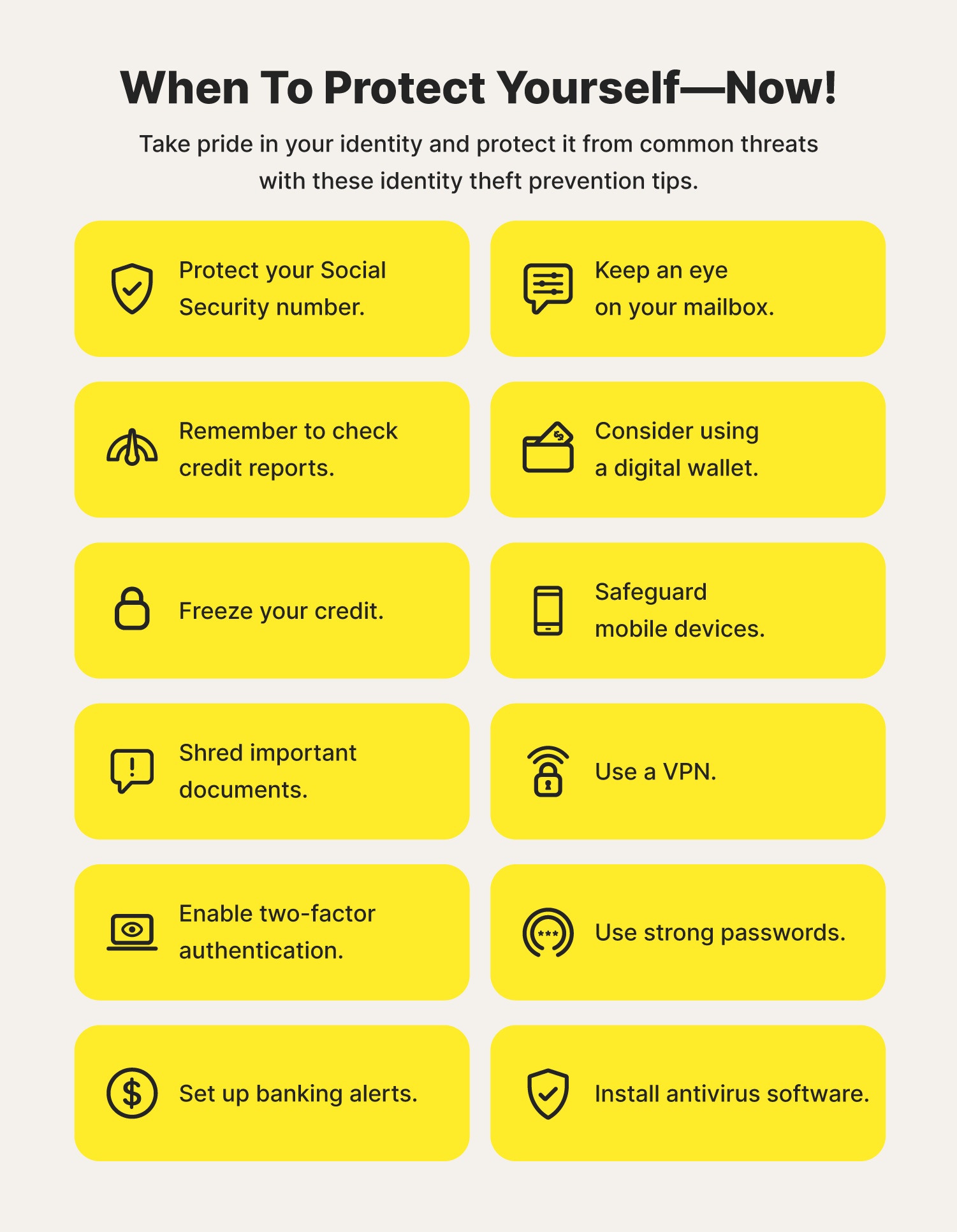

How to prevent identity theft

Use these identity theft protection tips to send a message to cybercriminals at large that they might want to find another line of work.

1. Protect your Social Security number

Always protect your Social Security number—to identity thieves, it's like finding a pot of gold. If someone asks you to provide your SSN, always ask why and never hand it over if you can’t guarantee its protection. Other best practices include storing it in a safe place and shredding all paperwork containing it before throwing them away.

2. Remember to check credit reports

Keeping an eye on your credit score and reviewing reports on a regular basis can help you to catch any suspicious activity early on. Additionally, some institutions offer free weekly credit reports until April 20, 2022—all in an effort to help you stay vigilant and try to put fears of identity theft at bay.

3. Freeze your credit

Freezing your credit temporarily restricts access to your credit history. This helps prevent identity thieves from opening new lines of credit or taking out loans in your name. It’s one of the best ways to put a stop to identity thieves because it's free to do with all three of the major credit bureaus.

4. Shred important documents

You should always shred important documents and remember to delete any unneeded files containing financial documents from your desktop and trash folder. Identity thieves often fish through trash cans and hack into computers for sensitive documents in order to put their plans in motion.

5. Set up banking alerts

Many banks offer you the option of opting in to email and text notifications. These alert you when you or someone else makes charges on your account. You should enable these notifications to stay on top of what transactions hit your account and where they’re from in case you run into any unexplained purchases.

6. Keep an eye on your mailbox

Mail theft affected almost 1,100 U.S. homes this past year. One of the best ways you can avoid mail fraud is remembering to check your at-home mailbox and email inbox daily. Also consider getting a U.S. Postal Service-approved lockable mailbox, put a vacation hold on mail when traveling, or keep an eye out for signs that someone is also using your account.

7. Consider using a digital wallet

To ensure your information remains encrypted when making a purchase, you should use a digital wallet. This is an app—typically pre-installed into the software of your smartphone—that stores secure, digital versions of your redit and debit cards on your phone.

8. Safeguard mobile devices

It’s important to secure your mobile devices to protect against identity theft, as spyware is among the main threats to your mobile security. Remember to always lock your phone and to only download trustworthy apps.

9. Use a VPN

Identity thieves often monitor public Wi-Fi networks to try and steal unprotected information from vulnerable users. If you are on public Wi-Fi, use a VPN. These encrypt your data and activity so cybercriminals can’t track your digital footprint.

10. Use strong passwords

Creating strong, unique passwords for all of your online profiles can make it difficult for identity thieves to use hacking methods like credential stuffing and password spraying to break into your accounts. Password managers are great at helping you create and organize hack-proof passwords.

11. Enable two-factor authentication

Enabling two-factor authentication on your accounts can help prevent identity thieves from getting into accounts and databases that hold your most important information. With the help of biometric protection from fingerprint scanning and facial recognition, replicating your identity becomes next to impossible.

12. Install antivirus software

Antivirus software is another tool you can use to add an extra layer of protection against common identity thieves. This can make getting access to your private information much harder and allow you to use your devices with a sense of confidence.

How to report ID theft

Help protect your personal information and bring criminals to justice by submitting a report if you become a victim of identity theft. Here are the steps you can take:

- Contact a credit bureau: TransUnion, Equifax, and Experian are legally required to report instances of identity fraud with one another once notified.

- Contact the authorities: The Federal Trade Commission offers personalized recovery plans, guidance, and pre-filled letters and forms on IdentityTheft.gov to assist you once you contact the police. You can also speak to someone for assistance if you call by phone at 1-877-438-4338.

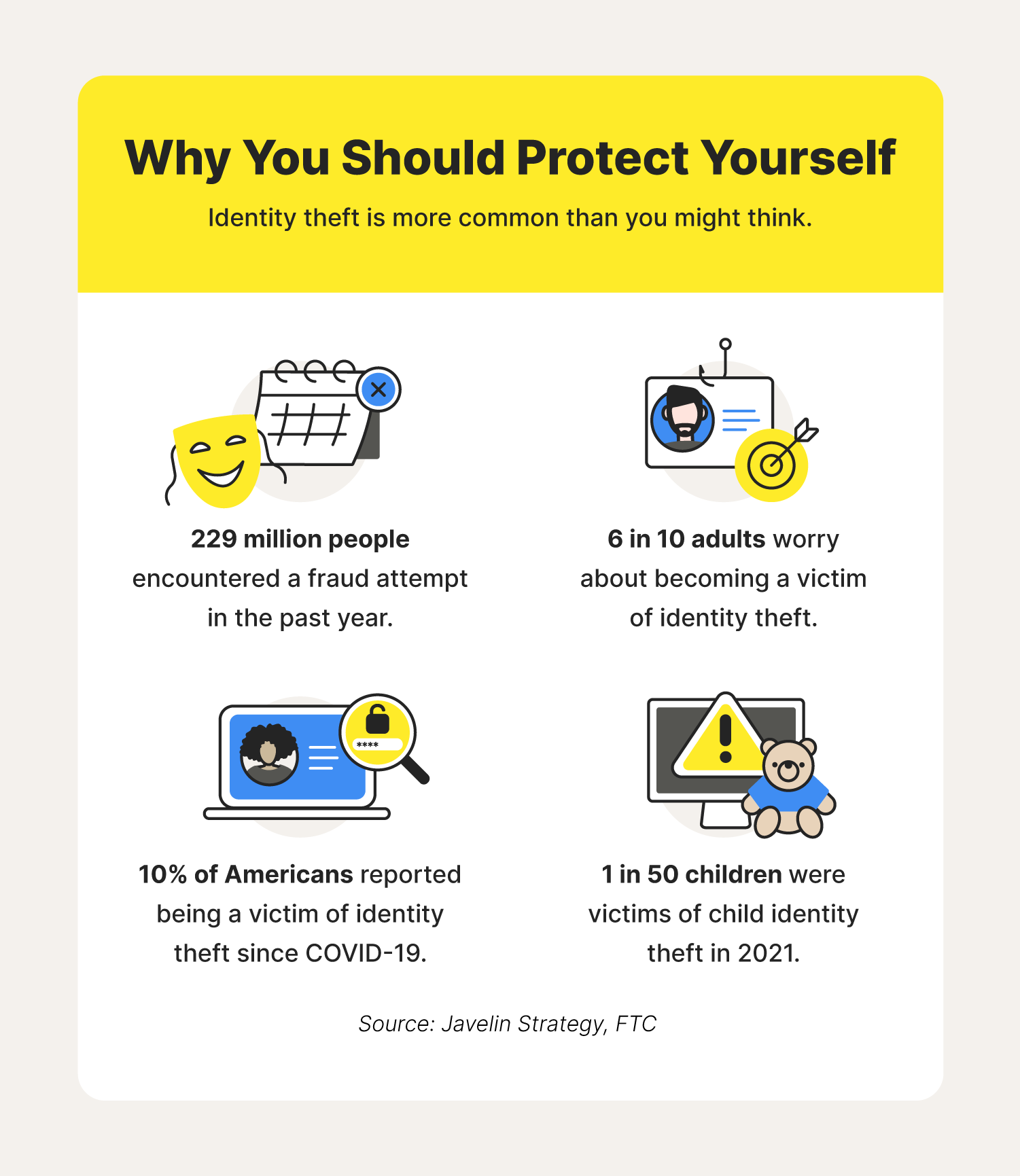

30+ identity theft statistics

Getting some context about the impact of identity theft can allow you to understand why protecting yourself is so important. Check out these identity theft statistics to see why educating yourself on ways to avoid identity theft should be one of your main priorities in 2022 and beyond.

How common is identity theft?

Criminals are about as diligent at compromising identities as we are dedicated to protecting them. Here’s a snapshot of their persistence over the past couple of years.

- Consumers filed 1.4 million identity fraud reports in 2020. (FTC, 2021)

- 229 million people encountered a fraud attempt in the past year. (AARP, 2021)

- 208 million people world wide experienced some form of identity theft in 2021. (Norton, 2021)

- An estimated 9 million people have their identities stolen each year. (FTC, 2021)

- The number of data breaches involving the compromise of Social Security numbers increased to 83%. (ITRC, 2021)

- Identity theft saw a 73% increase in 2020. (FTC, 2021)

- 6 in 10 adults worry about becoming a victim of identity theft. (Norton, 2021)

- 1 in 5 Americans have experienced identity theft. (Norton, 2021)

- 13.5 million Americans became victims of identity theft within the past year. (Norton, 2021)

- 20% of Americans began using an identity theft protection service this past year. (Norton, 2021)

- FTC received more than 405,000 identity theft reports of personal information used to apply for a government document or benefit. (FTC, 2021)

- There were more than 55 million reports of identity theft around the world in the past year. (Norton, 2021)

- There were more than 390,000 reports of credit card fraud in 2020. (FTC, 2021)

- Credit card fraud saw a 44% increase from 2019 to 2020. (FTC, 2021)

- Identity theft was the most frequent complaint reported by consumers in 2020. (FTC, 2021)

- Nearly 50% of people reported losing money to cybercrimes including identity theft. (Norton, 2021)

- 75% of adults wish they had more information on what to do if someone steals their identity. (Norton, 2021)

- Social Security numbers were the second most compromised credential in 2020. (ITRC, 2021)

- Roughly 10% of Americans reported being a victim of identity theft since the start of COVID-19. (TransUnion)

- Identity theft made up about about 30% of the complaints received by the FTC. (FTC, 2021)

The cost of identity theft

We all know identity fraud is dangerous, but why so? Here are a few identity theft statistics to help paint a clearer picture.

21. Reports predict the global identity theft services market to reach $34 billion by 2028. (Fortune Business Insights, 2021)

22. 34% of people have reported losing money due to fraud in 2020. (FTC, 2021)

23. It could require up to six months and 200 hours of work to undo the damages of identity theft. (Experian)

24. Losses from identity theft increased by 42% in 2020. (Aite Novarica, 2021)

25. People spent an estimated 2.7 billion hours fixing issues related to identity theft and/or other cybercrimes. (Norton, 2021)

Identity theft target victims

Identity thieves know that some people are more susceptible to identity theft scams than others. Browse these identity theft statistics to get insight into who are the main targets.

26. The top five states for identity theft are Kansas, Rhode Island, Washington, and Nevada. (FTC, 2020 Consumer Sentinel Network)

27. 16% of Gen Z reported being a victim of identity theft. (TransUnion)

28. There were almost 24,000 complaints of identity theft reported by people ages 19 and under (FTC, 2020 Consumer Sentinel Network)

29. The group targeted most for identity theft in 2020 were 30 – 39-year-olds with 306,090 reports submitted. (FTC, 2020 Consumer Sentinel Network)

30. The second most targeted group for identity theft in 2020 were 40 – 49-year-olds with 302,678 reports submitted. (FTC, 2020 Consumer Sentinel Network)

31. Millennials are the most common victims of credit card fraud in 2020.

(FTC, 2020 Consumer Sentinel Network)

At the end of the day, your identity is, well, yours. And it's your job to protect it. Use the tips and information gathered to lead a life where your privacy and cybersecurity always come first.

The freedom to connect more securely to Wi-Fi anywhere

With Norton™ VPN, check email, interact on social media and pay bills using public Wi-Fi without worrying about cybercriminals stealing your private information

Try Norton VPN for peace of mind when you connect online

Editorial note: Our articles are designed to provide educational information for you. They may not cover or protect against every type of crime, fraud, or threat we write about. Our goal is to increase awareness about Cyber Safety. Please review the complete Terms during enrollment or setup. Remember that no one can prevent all identity theft or cybercrime, and that LifeLock does not monitor all transactions at all businesses. The Norton and LifeLock brands are part of Gen Digital Inc. For more details about how we create, review, and update content, please see our Editorial Policy.

Want more?

Follow us for all the latest news, tips, and updates.