Credit report vs. credit score: Key differences explained

Lenders check both your credit report and credit score to determine your creditworthiness, but they’re not the same thing. Learn the difference, and see how Norton Money can help you monitor your credit and spot suspicious activity, so you can keep your finances safer.

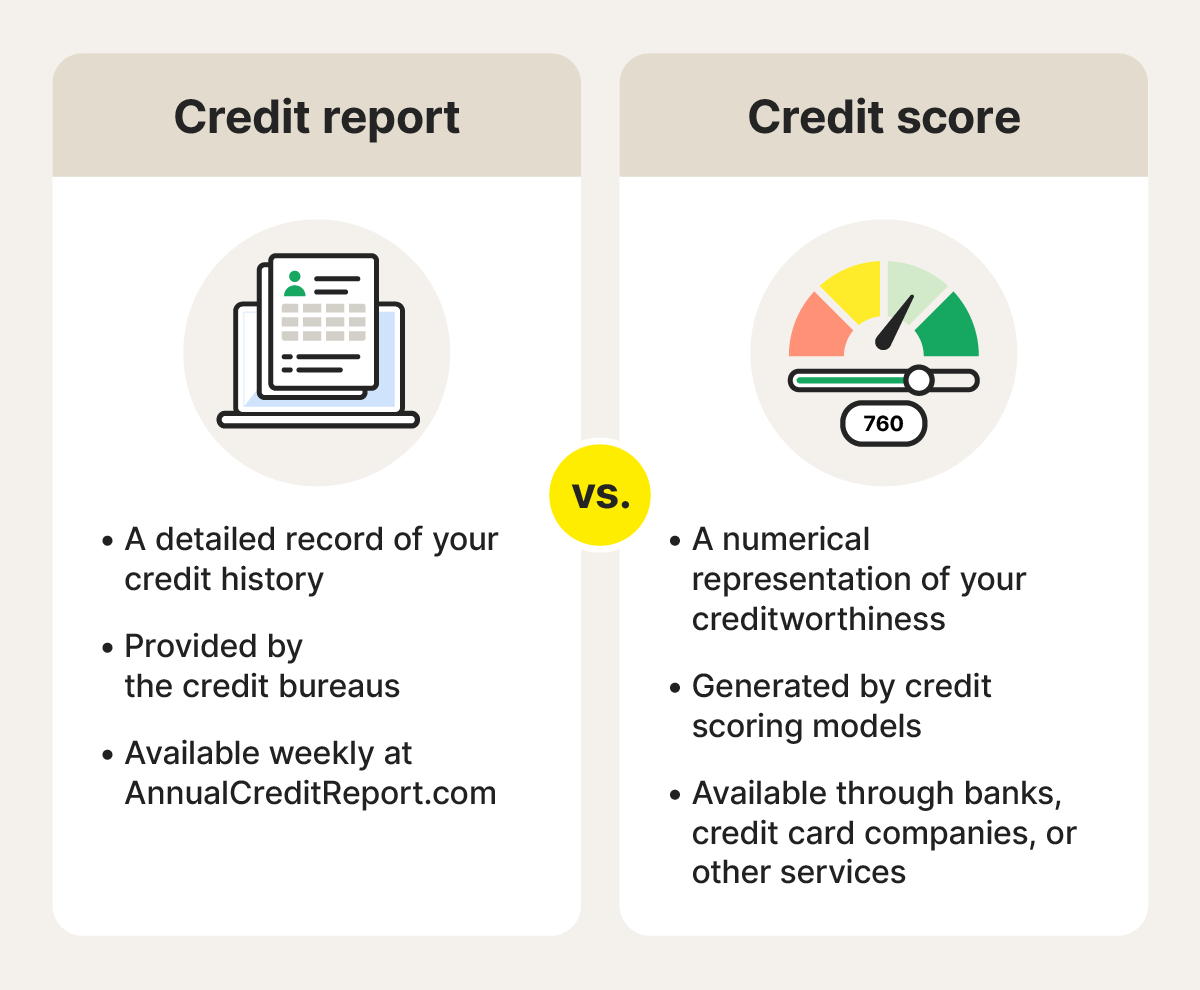

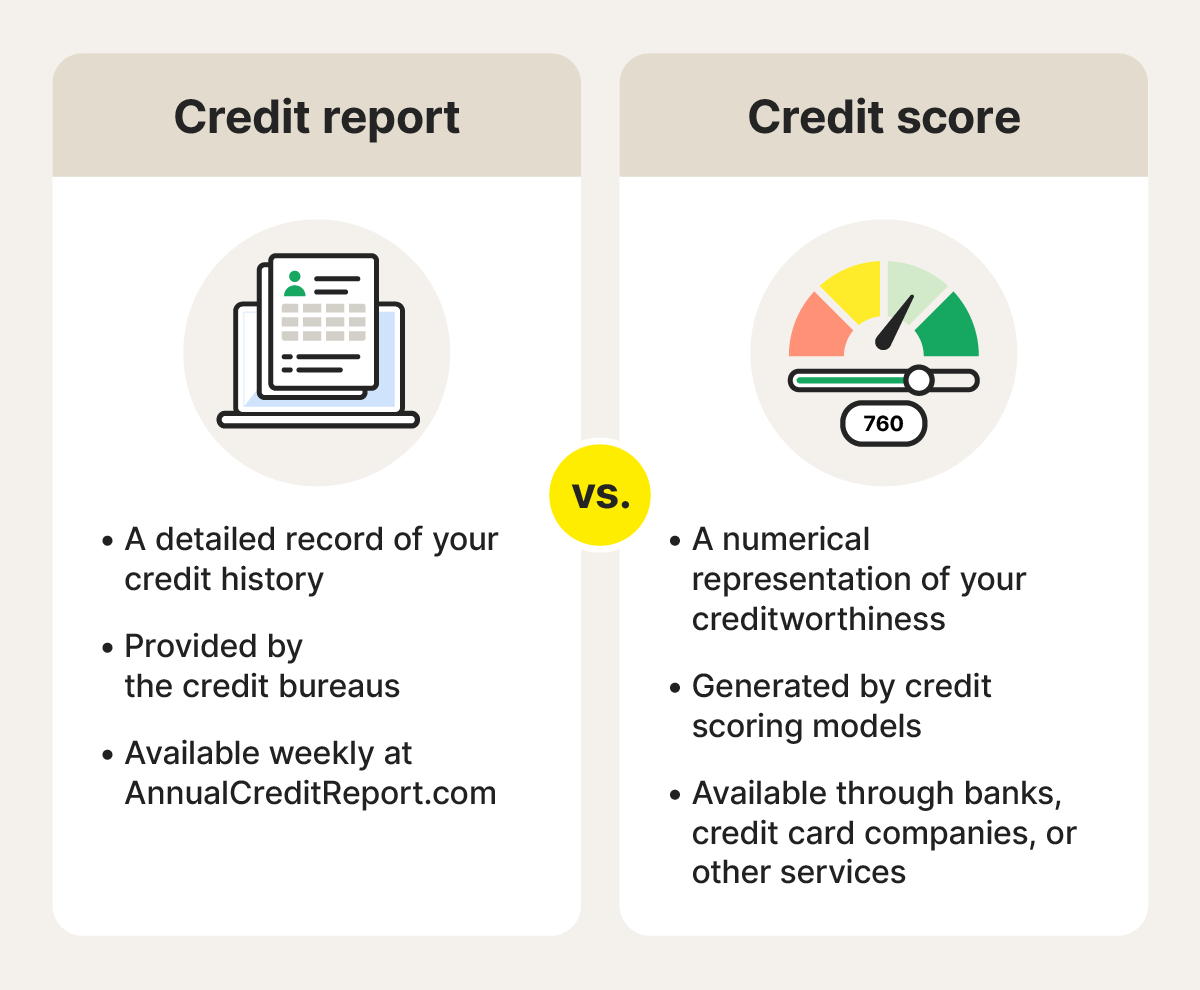

What is the difference between a credit report and a credit score?

A credit report is a detailed record of your credit activities, including accounts and payment history. A credit score is a number that represents your creditworthiness based on the information in your credit report.

The three credit bureaus — Equifax, TransUnion, and Experian — compile your credit reports, whereas your credit score is calculated based on scoring models like FICO and VantageScore.

Lenders review both your credit report and credit score when assessing your credit risk. While your credit score gives a snapshot of your creditworthiness, your credit report provides a more comprehensive look at your financial behavior. For instance, even if you have a high credit score, a lender may hesitate to approve you for certain loans if your credit report lacks a solid history of responsible borrowing.

What is your credit report?

A credit report is a detailed record of your credit activities. It includes personal details and data related to your credit accounts over the past seven to ten years, but does not typically include your credit score. Three major credit bureaus compile credit reports: Equifax, TransUnion, and Experian.

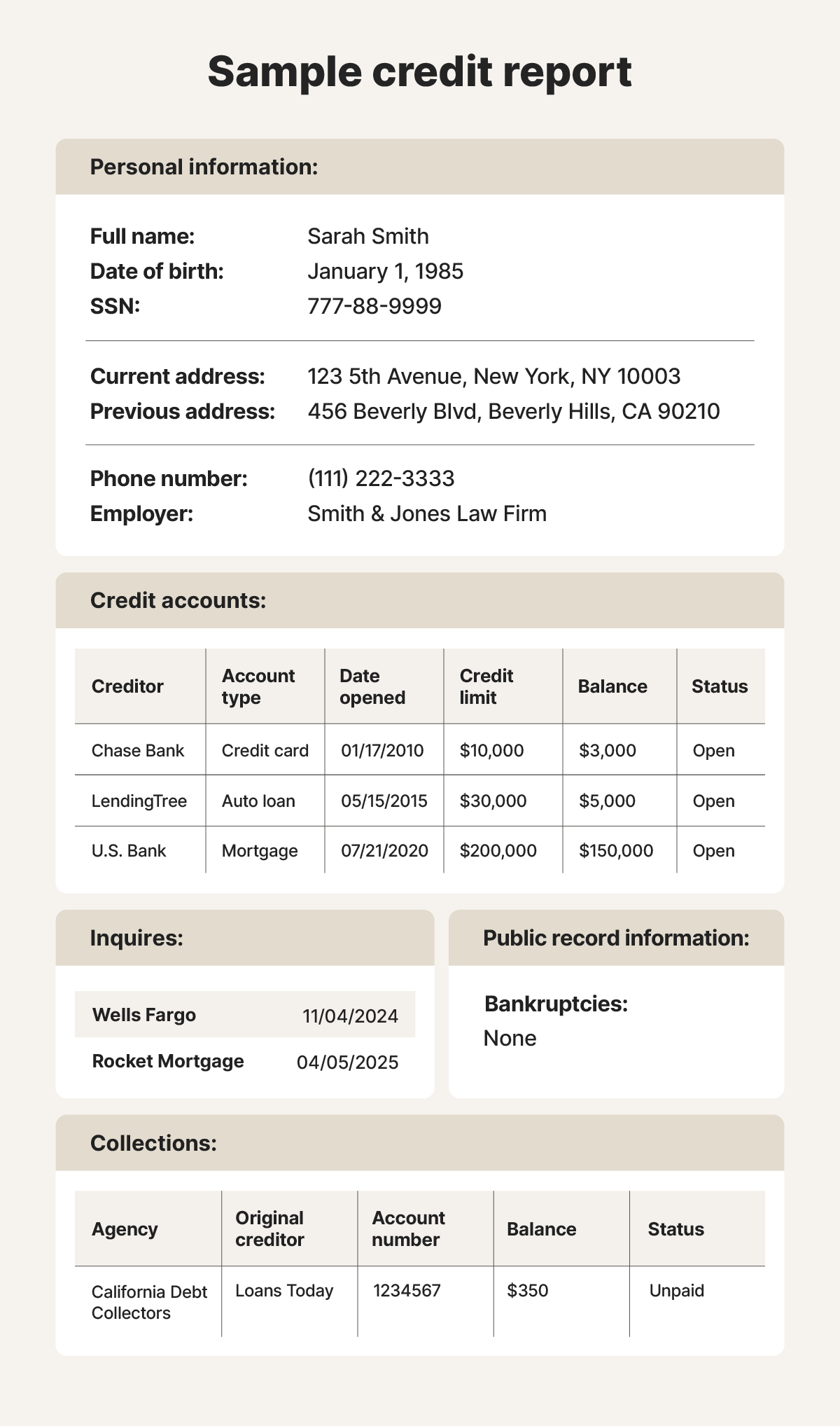

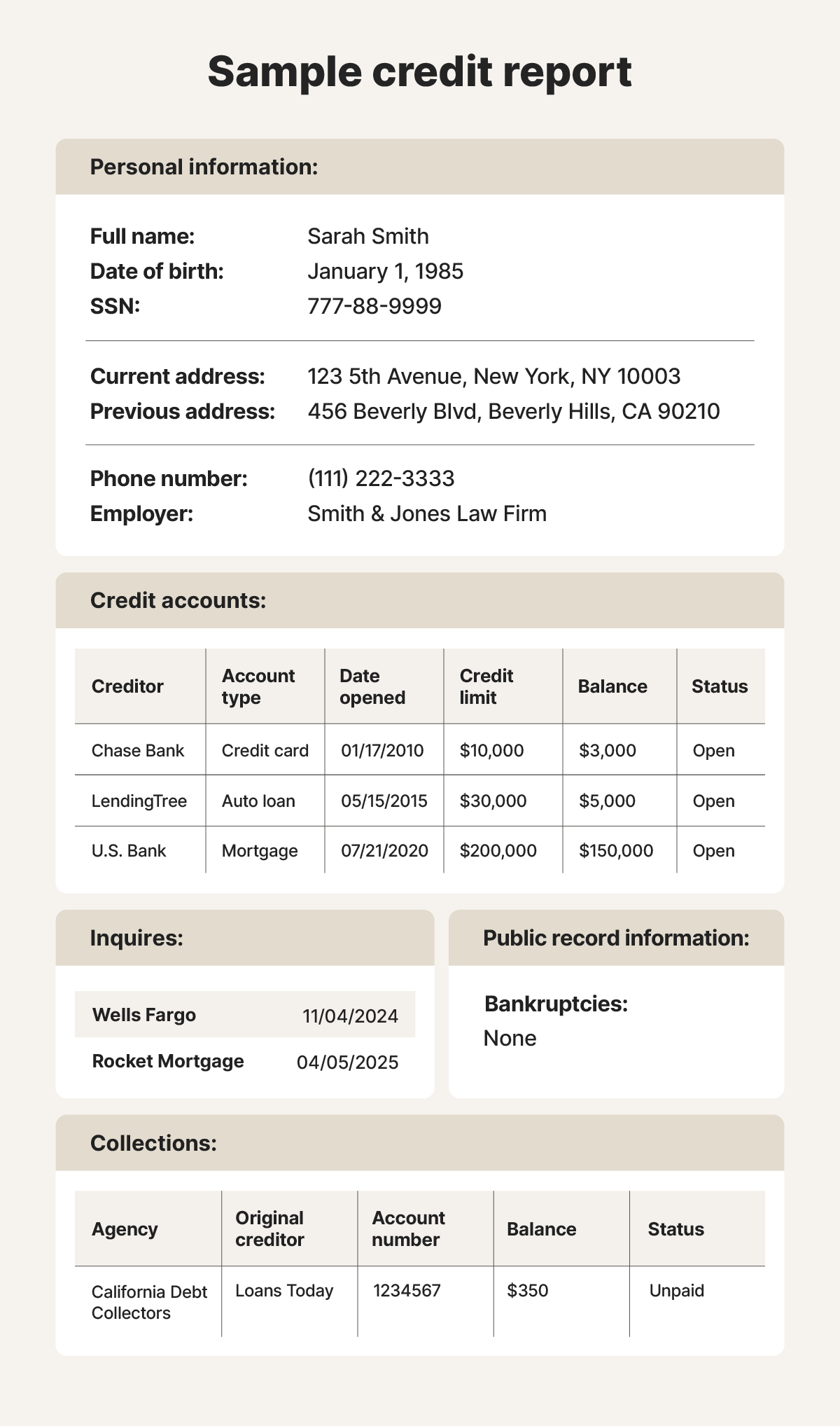

You’ll find the following information on your credit report:

- Personal information: Your name, current and past addresses, Social Security number, date of birth, phone number, and sometimes employment details.

- Credit accounts: Information about your open and closed accounts, such as credit cards, mortgages, auto loans, and student loans. This includes the date each account was opened, credit limits, loan amounts, current balances, payment history, and any late or missed payments.

- Credit inquiries: A list of entities that have accessed your credit report in the past two years, including both hard and soft inquiries.

- Public record information: Information related to financial legal matters, such as bankruptcies, which can significantly affect your creditworthiness.

- Collections: Accounts that have been sent to collections agencies due to nonpayment, often viewed as a red flag by lenders.

Lenders use this information to decide whether to approve you for credit and under what terms, including interest rates, repayment schedules, and loan amounts. In some cases, landlords, employers, and insurance providers may review your credit report when evaluating rental applications, job candidates, or insurance policies.

What is your credit score?

Your credit score is a three-digit number that reflects your creditworthiness. Lenders use it, along with your credit report, to help determine your eligibility for loans. A good credit score could help you qualify for loans with better interest rates.

Credit scores are based on the information in your credit report, even though it’s not usually visible in the credit report itself. The two main credit scoring models — FICO and VantageScore — calculate scores slightly differently, but they generally consider the same key factors.

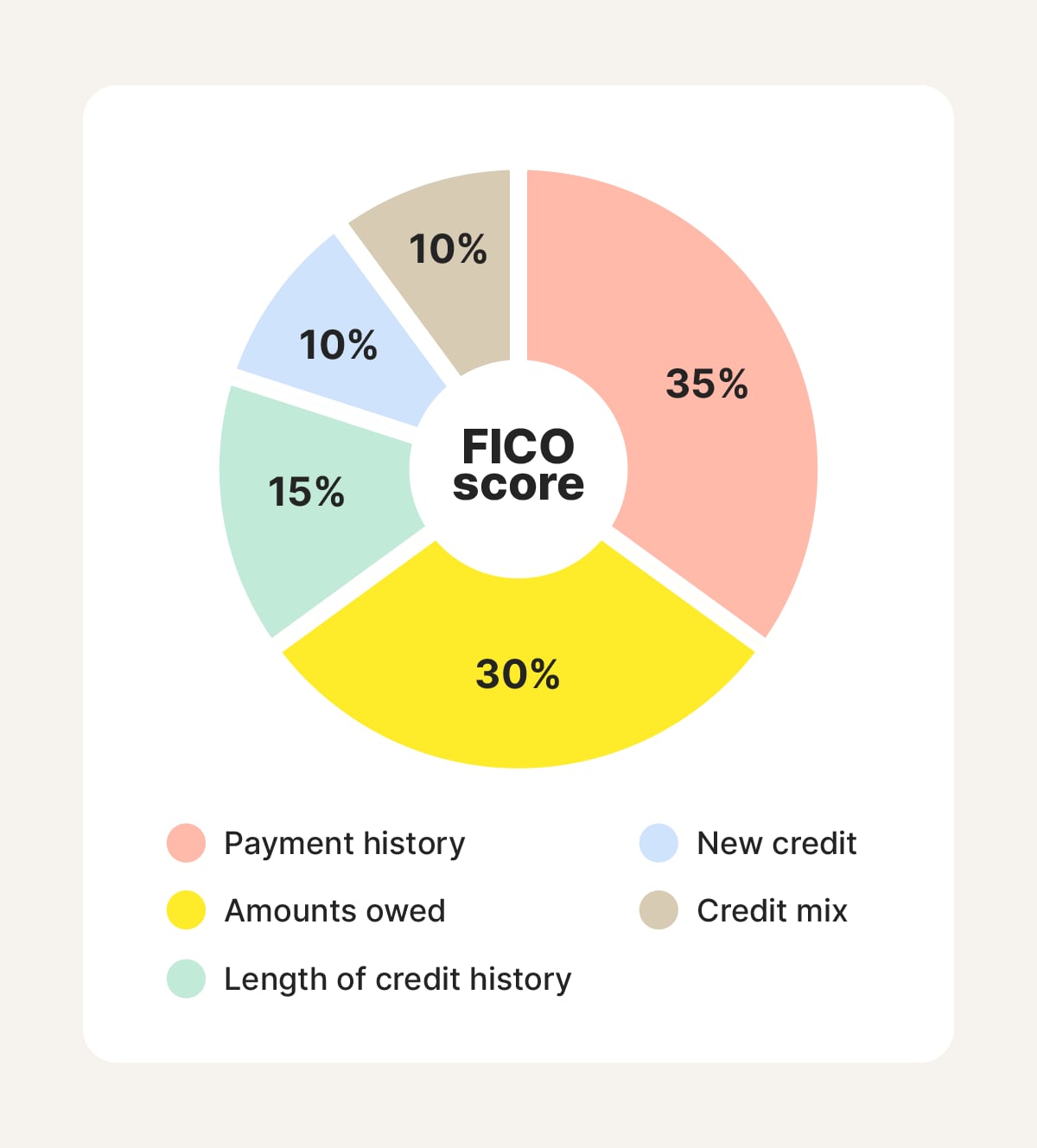

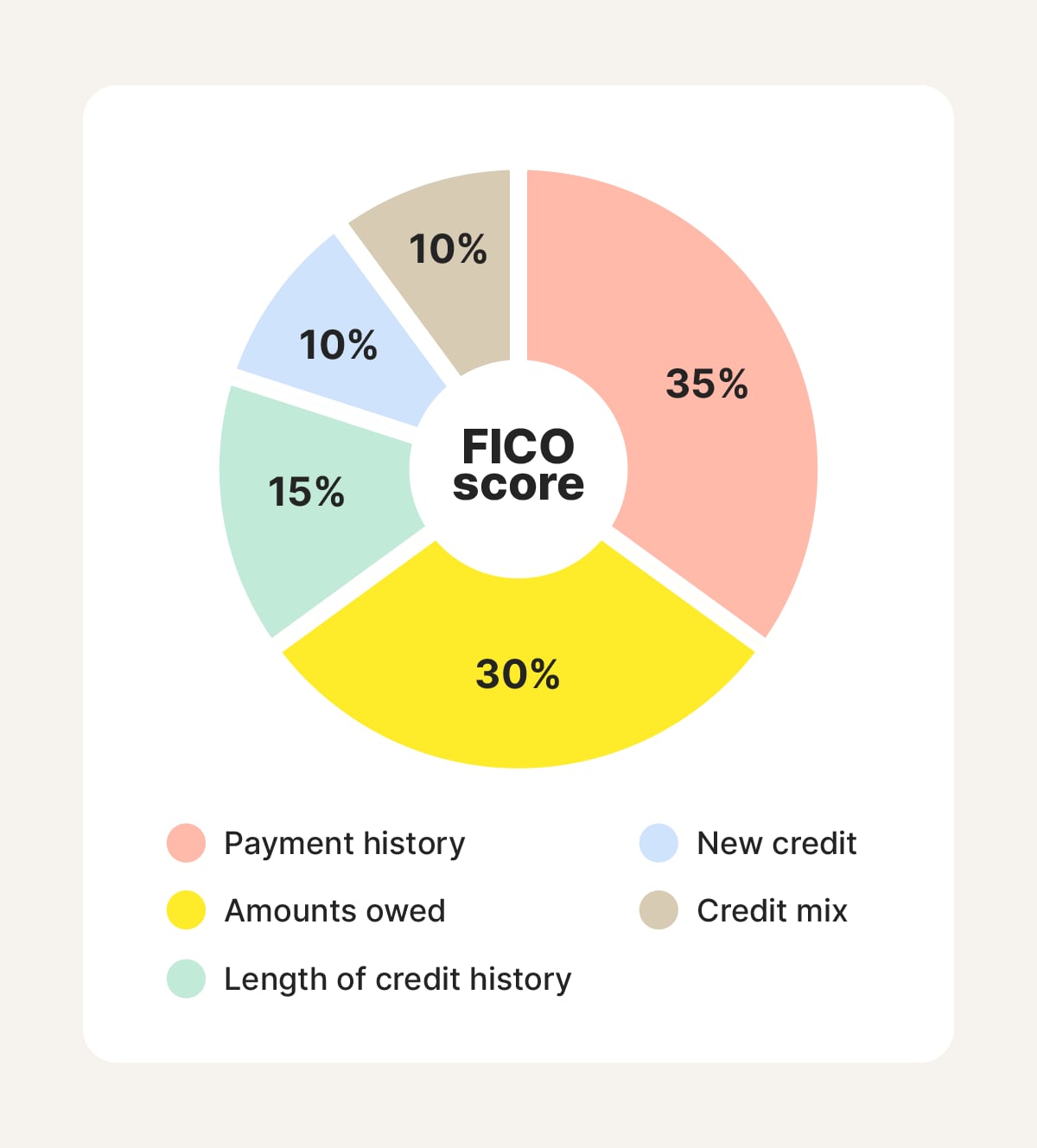

Below is a breakdown of what affects your credit score according to the FICO model:

- Payment history: Your history of making payments on time is the most influential factor. Missed or late payments can significantly harm your score.

- Amounts owed (credit utilization): This measures how much of your available credit you’re currently using. Keeping your utilization between 1% and 30% typically helps maintain or improve your score, because using too much credit can signal to bureaus and lenders that you might be financially overextended.

- Length of credit history: This factor comprises the amount of time your credit accounts have been open, factoring in the age of your oldest and newest accounts and the average age of all accounts. Lenders prefer to see a long credit history.

- Credit mix: This refers to the variety of accounts you have, including credit cards, installment loans, and mortgages. A diverse credit mix can help boost your score.

- New credit: Rapidly applying for a lot of new credit accounts can negatively affect your credit score.

Generally, higher credit scores indicate responsible credit usage, while lower scores signal greater risk. The FICO score, the most widely used scoring model among lenders, has the following credit score ranges:

- Poor: 300–579

- Fair: 580–669

- Good: 670–739

- Very Good: 740–799

- Excellent: 800–850

Your credit score is constantly changing, and you can improve it over time with positive credit habits.

How to check your credit report

You can check your government-authorized credit report by visiting AnnualCreditReport.com. By law, you’re entitled to a free credit report from each of the three major credit bureaus every year. But, all three bureaus have recently extended a program that lets you check your credit report weekly.

Here’s how you can request yours:

- Online: Visit AnnualCreditReport.com

- By phone: Call 1-877-322-8228

- By mail: Complete the Annual Credit Report Request Form and mail it to:

Annual Credit Report Request Service

P.O. Box 105281

Atlanta, GA 30348-5281

How to check your credit score

Your credit score typically updates monthly, and you can check it through various financial institutions and services. Here are a few ways to access your credit scores:

- Credit card companies: Many credit card issuers and lenders provide borrowers with free access to their credit scores. You can typically find this information in your online account or on your monthly statement.

- Credit bureaus: You can access your credit scores from the three credit bureaus, typically for a fee.

- Credit monitoring tools: Credit monitoring services can keep you updated about new activity on your credit report, and may also provide free credit scores.

Why checking your credit is important

Regularly checking your credit helps you to ensure the information reported in your credit report is accurate, detect potential fraud early, and stay informed about your overall financial health.

Here are some reasons to regularly check your credit:

- Identify errors that could harm your score, such as inaccurate payment dates or incorrect balances.

- Understand your creditworthiness and how it may impact your ability to qualify for certain loans or credit cards. Consider checking your credit before applying for a loan to determine if you can realistically qualify, or if you need to take steps to improve your score first.

- Spot signs of fraud and identity theft, such as accounts you don’t recognize that cybercriminals may have opened without your knowledge.

- Improve your credit and monitor your progress toward reaching your financial goals.

Safeguard your credit

Norton Money helps you take control of your financial life with real-time credit monitoring, identity insights, and a clear view of your overall financial health — all in one place. With alerts for key changes to your credit, Norton Money keeps you informed and empowered, without the hassle of manually tracking your finances or credit activity.

FAQs

Is your credit score on your credit report?

No, your credit score usually isn’t included in your credit report. However, it is calculated based on the information in your credit report.

Do lenders look at your credit score or credit report?

Lenders look at both your credit score and credit report to assess your creditworthiness and determine whether to approve your loan application.

Does checking your own credit report or score hurt your credit?

No, checking your own credit report or score is considered a soft inquiry and does not impact your credit score.

Editorial note: Our articles are designed to provide educational information for you. They may not cover or protect against every type of crime, fraud, or threat we write about. Our goal is to increase awareness about Cyber Safety. Please review the complete Terms during enrollment or setup. Remember that no one can prevent all identity theft or cybercrime, and that LifeLock does not monitor all transactions at all businesses. The Norton and LifeLock brands are part of Gen Digital Inc. For more details about how we create, review, and update content, please see our Editorial Policy.

Want more?

Follow us for all the latest news, tips, and updates.