How to build credit fast and responsibly

Building your credit and unlocking financial freedom might be easier than you think. Learn how to build credit fast, both with and without a credit card. Then see how Norton Money can help you stay on top of your progress with credit score tracking and tools designed to give you clearer insight into your overall financial health.

Building credit is essential if you’re preparing to buy a home, get a car, or qualify for another financial product or service. And contrary to popular belief, you don’t always need a credit card to do it.

If you don’t know where to start, follow along with our credit-building guide and learn practical ways to boost your credit score to a 670 or higher.

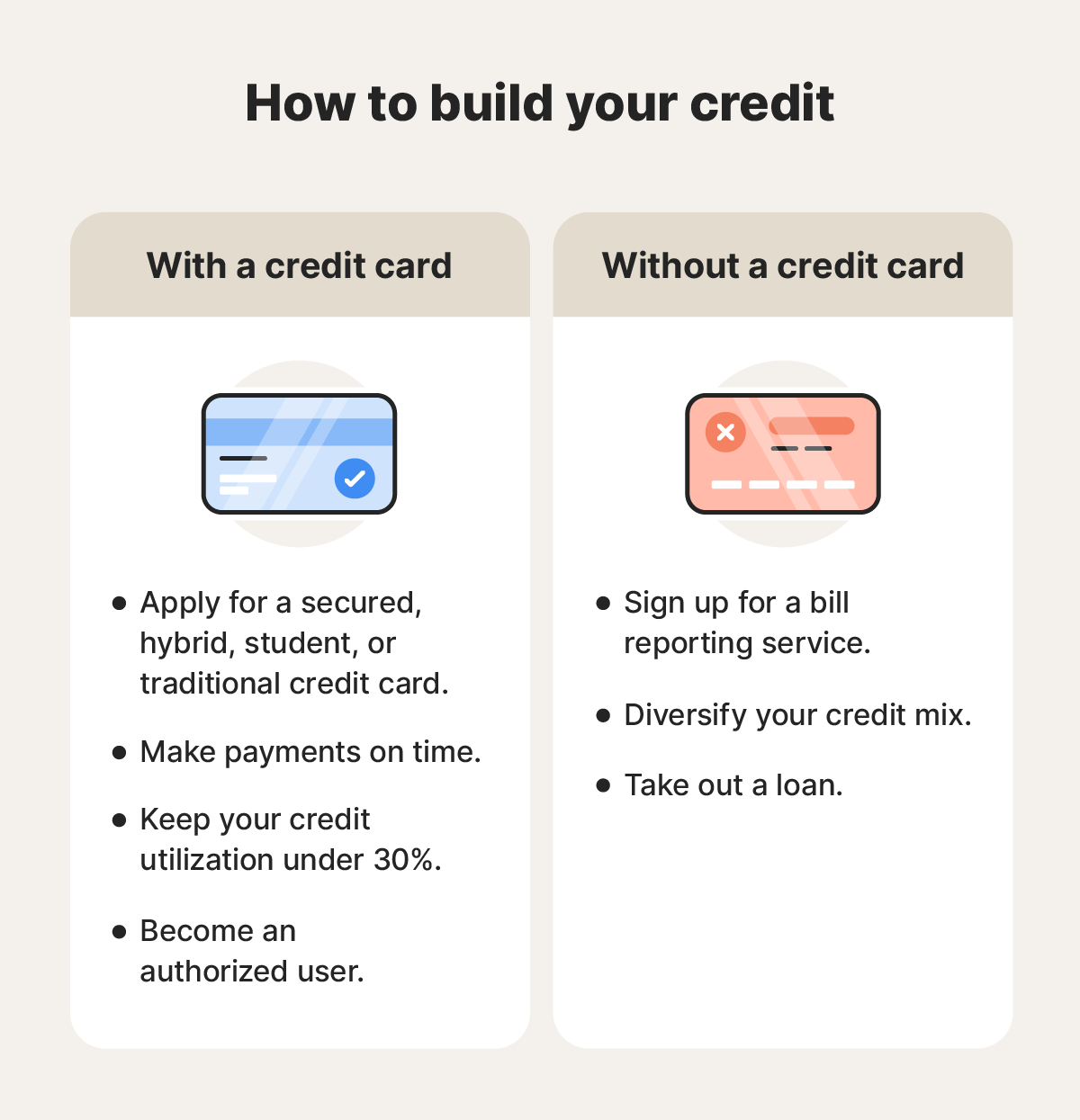

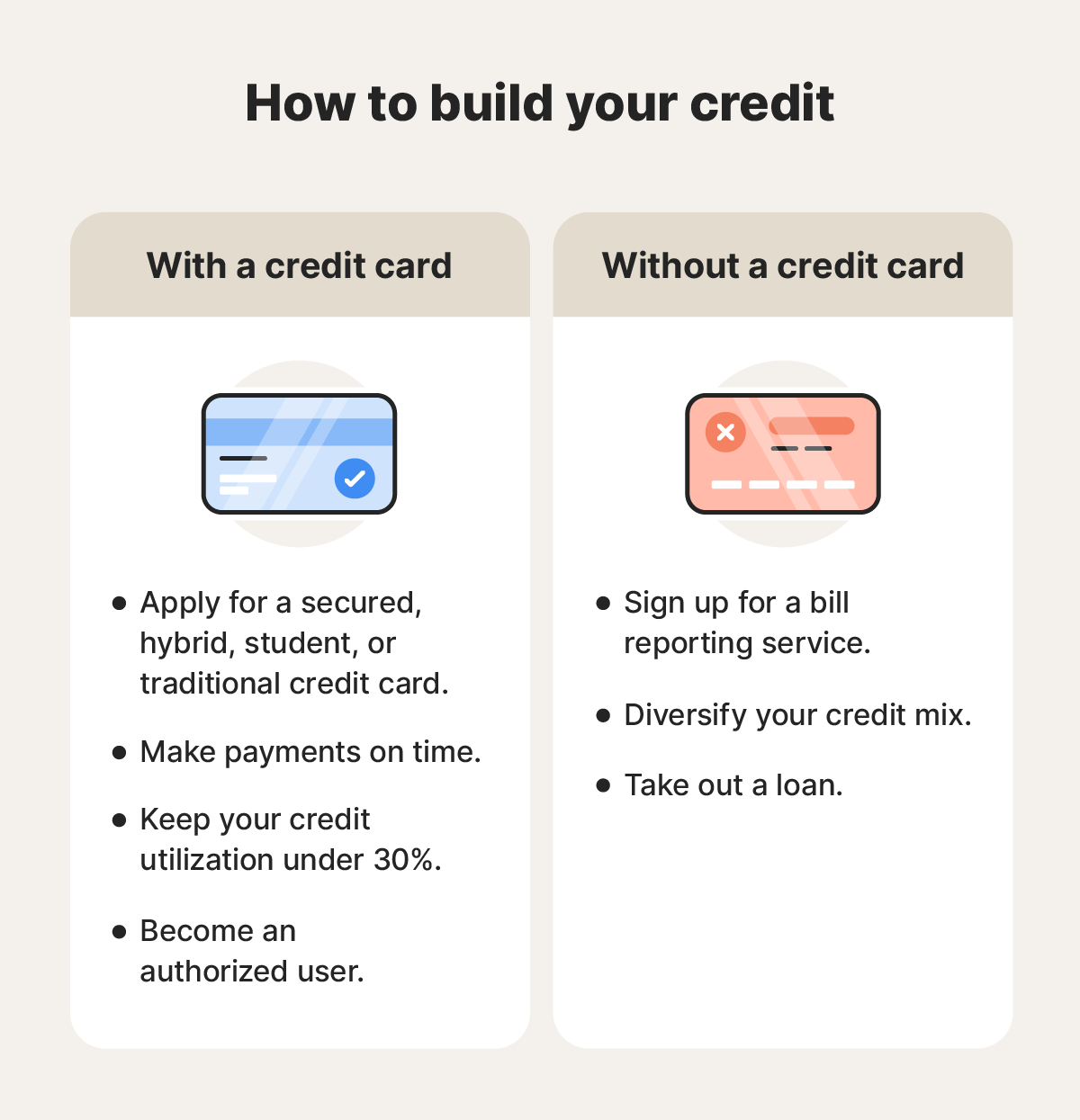

How to build credit with a credit card

To build credit with a credit card, use it responsibly and pay it off immediately. You can also build credit by becoming an authorized user on someone else’s credit card — though this comes with its own risks.

By choosing the right type of credit card for your situation and using it responsibly, a credit card can be one of the easiest and fastest ways to build credit. Regardless of what type of card you start with, only spend what you can pay off each month. And no matter what, aim to pay your bills on time.

Here’s how to build your credit with a credit card:

1. Get a credit card

The first step is to choose the type of card that best meets your needs, then apply for it. Don’t be alarmed if your credit takes a temporary hit; this is normal when you apply for a new credit card.

Once you’re approved, start using your card responsibly. This means charging things with the card throughout the month that you know you can afford, then paying off the bill immediately when your statement comes.

Positive payment history is reported to the credit bureaus, helping you build a strong credit profile over time. Paying your bills on time and in full also demonstrates to future lenders that you're a reliable borrower.

Here are a few types of credit builder cards that you can choose from to get you started:

Secured credit card

A secured credit card requires a refundable security deposit, which usually serves as your credit limit. This makes it a lower-risk option for lenders and easier for applicants to get approved, while encouraging responsible credit use. Your credit limit will probably be low, which can extend the time it takes to build your credit.

It’s an effective stepping stone toward an unsecured credit card (and overall credit building) as your spending is limited to the amount you’ve already deposited.

Secured credit cards are meant specifically for building credit, so they typically don’t include the rewards and perks that other cards may promise. And, they may include some annual fees.

Debit-credit hybrid card

A debit-credit hybrid card, also known as a “crebit card,” combines features of both debit and credit cards. It’s similar to a credit card because you make purchases and get a monthly bill. But, like a debit card, the spending limit is typically the amount of money in your bank account, which helps you prevent overspending.

Before getting a debit-credit hybrid card, check the restrictions on how and where you can use the card, as some issuers don’t allow you to freely choose which type of payment you use. And, be sure your chosen provider reports payments to at least one of the three credit bureaus, so you get credit for your timely payments.

Student credit card

Student credit cards are designed for college students and newly independent people. There’s generally a low barrier to acquiring these, but providers may require proof of enrollment as part of the application process. If you get approved for a student credit card, some providers offer great perks for students.

Often, student credit cards come with higher interest rates — so before you spend more just to take advantage of the perks, consider whether you’ll still be able to pay your bills on time. Luckily, most student cards come with lower credit limits than typical unsecured credit cards.

Traditional credit card

A traditional credit card allows you to borrow money up to a certain limit and pay it back later, often with interest if you don’t pay the full amount every month. It may be harder to get approved with a limited credit history, and it’s crucial to compare interest rates, fees, and rewards programs before choosing one, as they can vary significantly.

Most traditional credit cards have higher interest rates for people with lower credit scores, but the higher credit limits and better rewards can be a great incentive. Traditional credit cards are also widely accepted across the globe, so you should be able to use them mostly everywhere. Still, even with a traditional card, the most important part of credit building is paying your bills on time.

2. Pay your bills on time

Payment history is a significant credit scoring factor (35%), and even one late payment can have a major negative impact. Late fees typically kick in if you miss the payment deadline, but this generally doesn’t affect your credit score immediately. However, if your payment is more than 30 days late, most credit card companies will notify the credit bureaus, leading to a credit score drop.

Create and stick to a budget, setting up automatic payments or reminders to stay on top of your bills. If you ever have difficulty paying a bill on time due to unforeseen circumstances, contact the creditor immediately to discuss options. In some cases, they may offer a hardship program, including reducing your interest rate, waiving late fees, or allowing you to make lower payments for a set period.

3. Keep your credit utilization low

Your credit utilization ratio is the balance on your credit card compared to your credit limit. Having a low credit utilization means you’re spending a small percentage of your credit limit, which positively affects your credit score because it shows lenders you’re not overly reliant on credit. It also makes it easier for you to manage your finances and stay on top of payments.

To maximize your credit score, keep your credit utilization ratio at or below 10% — or at least under 30%.

4. Become an authorized user

Becoming an authorized user on someone else’s credit card can be a helpful way to build credit, especially if you have limited or no credit history. As an authorized user, you’re added to the account and can use the card. The account’s history appears on your credit report, potentially boosting your score.

But before doing this, it’s important to confirm that the account is in good standing (e.g., has a long history of timely payments and low credit utilization). Even though you’re not legally required to cover late payments, missteps can negatively affect your credit.

You can also ask someone close to you to co-sign a credit card application. Your co-signer should be someone you have a close and trusting relationship with, like a parent or spouse, because a co-signer will be responsible for paying late fees or bills if you can’t.

Before you ask someone to co-sign or someone adds you to an account as an authorized user, have an open and honest conversation about how you will:

- Use the card (if at all).

- Make good on missed payments.

- Ensure you won’t negatively impact their credit, or vice versa.

How to build credit without a credit card

You can build your credit without a credit card by reporting recurring payments to the credit bureaus through a service like Experian Boost or RentReporters. These services add your positive payment history to your credit report, demonstrating your financial responsibility.

Another option is to diversify your credit mix by taking out a small loan, such as a credit-builder loan or secured loan, and making consistent, timely payments. Responsible financial behavior, even without a credit card, can help you build a good credit history.

Now, let’s explore some specific steps to build credit without a credit card, starting with the lowest-risk options:

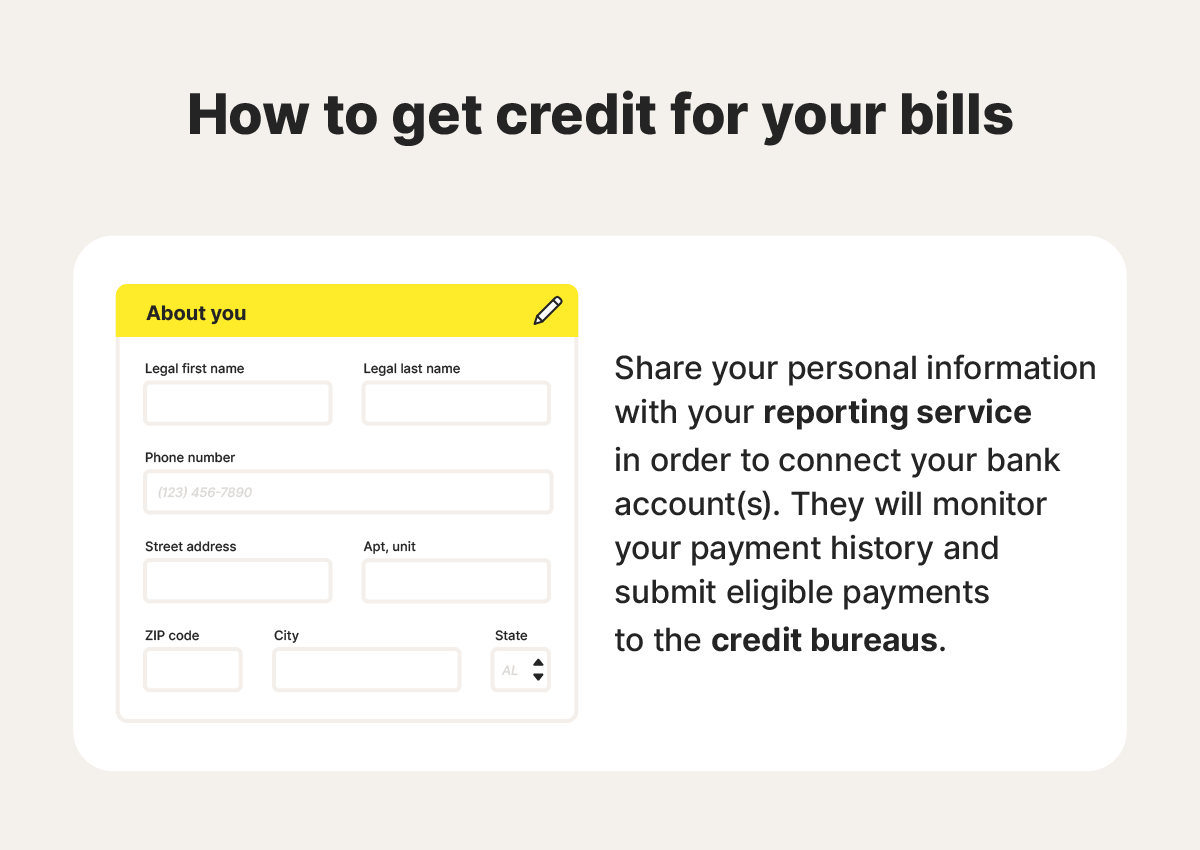

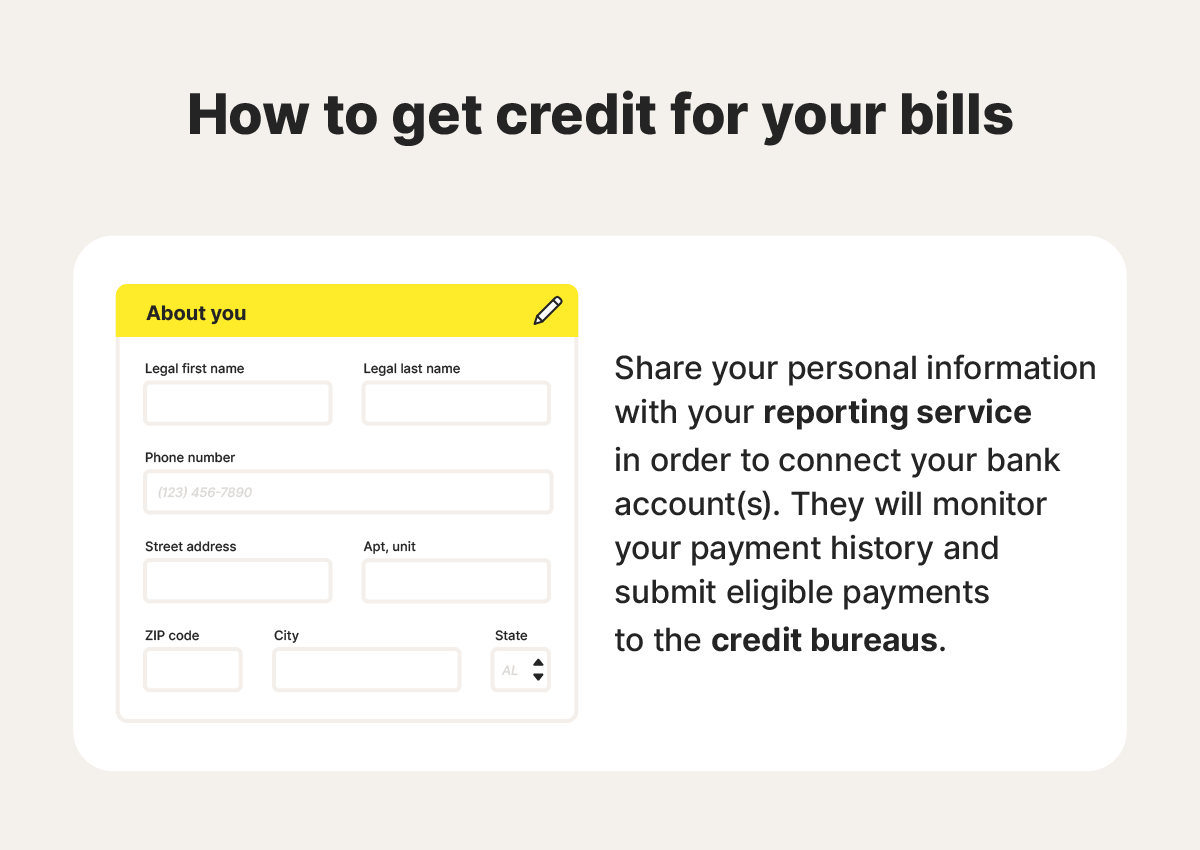

Get credit for your bills

Paying recurring bills on time is a sign of responsible financial behavior, and you should get credit for them. Unfortunately, timely payments aren’t typically reported to credit bureaus (even though missed payments are), so they don’t directly impact your credit score. However, you can get credit by using reporting services like Experian Boost, Rent Reporters, or LevelCredit.

Depending on the service you choose, you may be able to get credit for your rent, utilities, internet, or phone bills. This is especially easy and beneficial for those with a limited credit history who want to boost their credit score.

To get started, you just need to provide information like your name, address, phone number, and Social Security number. Then, you’ll connect your bank account(s), the bill reporting service will monitor your payment history, and they’ll submit eligible payments to the credit bureaus.

Diversify your credit mix

Diversifying your credit mix shows lenders you can handle different types of credit responsibly, which can improve your credit score. A healthy mix might include revolving credit (like credit cards or a home equity line of credit) or installment credit (like an auto loan or mortgage).

Here are some things to know about the two types of credit:

- Revolving credit: This type of credit allows you to borrow funds up to a certain limit on an ongoing basis.

- Installment credit: This is a type of loan where you borrow a fixed amount of money and repay it by making regular payments over a set period of time.

Take out a loan

Taking out a new loan or paying down an existing loan can improve your credit by showing a positive payment history, increasing your credit mix, and potentially lowering your credit utilization. You may need a co-signer for approval or better interest rates if you have a limited credit history or a lower score. But even so, responsibly managing the loan by making consistent, on-time payments can help you build a stronger credit profile over time.

However, you should only take this approach to grow your credit score if you genuinely need a loan and can comfortably afford the payments.

Here are a few examples of loans that may be a match for your current financial situation:

- Credit builder loan: A credit builder loan is a small loan designed specifically for building credit. The lender deposits the loan amount into a savings account, and you make payments over time. Once the loan is paid off, you receive the funds. These loans are often easier to qualify for than other types of loans, but they may have higher interest rates.

- Auto loan: An auto loan is a type of installment loan specifically for purchasing a vehicle. Because they are secured by the vehicle itself, auto loans are often easier to obtain for first-time borrowers with limited credit histories, making them a good option for building credit.

- Personal loan: A personal loan is a fixed amount of money borrowed from a lender that you repay with interest over a set term. You can use this type of loan for expenses like debt consolidation, home improvements, medical bills, unexpected emergencies, vacations, or large purchases.

- Secured loan: A secured loan requires you to place collateral (like a car or savings account) to ensure the lender can recoup their losses if you default on payments.

- Student loan: A student loan is a type of installment loan specifically for educational expenses. Student loans can be federal or private, with federal loans generally offering more favorable borrowing terms like fixed interest rates and income-driven repayment plans.

How long does it take to build credit?

If you’re just getting started and have no credit history, it can take six months to get your first credit score. When you do, it’s entirely possible you could see a good credit score (670 – 739). Recovering from a damaged credit score can take several years, especially if you have missed payments, foreclosures, collections, or repossessions on your credit report.

Ultimately, your credit score growth depends on your financial habits and activities.

What factors affect your credit score?

Several factors influence your credit score, but payment history and amounts owed are the most significant factors in the FICO scoring algorithm. Other factors include the length of your credit history, your credit mix, and new credit inquiries.

Here’s a breakdown of the popular FICO credit score’s scoring factors:

- Payment history (35%) reflects your track record of paying bills on time.

- Amounts owed (30%) evaluates how much you currently owe on your credit accounts.

- Credit age (15%) is the length of your credit history. It factors in the average age of your accounts and shows lenders how long you've been managing credit.

- Credit mix (10%) is the variety of credit accounts you have (e.g., credit cards, loans, and mortgages).

- New credit (10%) considers how many new credit accounts you've recently opened and the number of hard inquiries made on your credit report. Opening several new accounts in a short period can be seen as risky behavior by lenders and may lower your score.

7 common credit-building mistakes and how to avoid them

Making late payments, borrowing more than you can repay, and applying for too much credit at once are common mistakes people make when trying to build their credit.

Here are the details on common blunders and how to avoid them.

- Making late payments: Set up automatic payments or calendar reminders to ensure you pay your bills on time, every time.

- Overborrowing: Only borrow what you need and can comfortably repay.

- Using credit cards for large purchases: Save up for large purchases or explore alternative financing options like personal loans, which often have lower interest rates than credit cards.

- Only paying the minimum payment: Pay off your credit card balance in full each month. If you can’t, at least try to pay a bit more than the minimum balance to reduce your overall debt, lower your credit utilization, and minimize interest charges.

- Applying for too much credit: Take advantage of the rate shopping window (usually 14 – 45 days), where multiple inquiries for the same type of credit (like a mortgage or auto loan) count as one.

- Closing credit card accounts: Keep older accounts open, even if you don’t use them frequently.

- Not monitoring your credit report: Regularly check your report with annualcreditreport.com (which offers free weekly reports).

Monitor your credit growth

Building credit for the first time can feel overwhelming if you don’t know where to start. For extra support, Norton Money helps you track your credit score, monitor key changes to your credit profile, and stay informed with alerts — so you can follow your progress and spot potential issues early.

FAQs

How can 18-year-olds establish credit?

18-year-olds can establish credit by applying for credit cards (like student cards or secured cards), setting up bill reporting with a credit bureau, or exploring options like credit-builder loans.

How long does building a 700 credit score take?

It can take a month to a few years to build a 700 credit score. It all depends on your financial habits and where you’re starting from.

Why is credit building important?

Credit building is important because a good credit score can help you access financial products like loans and credit cards with better terms and lower interest rates.

Editorial note: Our articles provide educational information for you. Our offerings may not cover or protect against every type of crime, fraud, or threat we write about. Our goal is to increase awareness about Cyber Safety. Please review complete Terms during enrollment or setup. Remember that no one can prevent all identity theft or cybercrime, and that LifeLock does not monitor all transactions at all businesses. The Norton and LifeLock brands are part of Gen Digital Inc.

Want more?

Follow us for all the latest news, tips, and updates.