‘Double-Dip Deception Scams’ rob financial scam victims twice

Uncover the insidious nature of Double-Dip Deception Scams, where cybercriminals prey on the already victimized, exploiting hope and trust with sophisticated, targeted schemes.

In the financial world, "double-dipping" typically refers to the frowned-upon practice of earning income from two different sources in a manner that could be seen as unethical. But a far more insidious version of double-dipping has surfaced in the cyber world, one that preys on the vulnerability of scam victims not once, but twice. We've come to know this as "Double-Dip Deception Scams," a term that encapsulates the cruel strategy used by some cybercriminals to target individuals already hurt by financial scams.

What is a Double-Dip Deception Scam?

Imagine falling prey to a scam that promises big financial returns. You're out of pocket, feeling betrayed and seeking restitution. Then, out of the blue, you see an ad on social media promising to recover your lost funds from these very cybercriminals. They tout respect for your privacy and boast about a knowledgeable team ready to guide you through the recovery process.

It seems like a beacon of hope—except it's a mirage. This is the essence of a Double-Dip Deception Scam. Scammers—speaking Russian, English, and other languages—are targeting those who have already been financially victimized, offering fake recovery services that only lead to further losses.

How the scam works

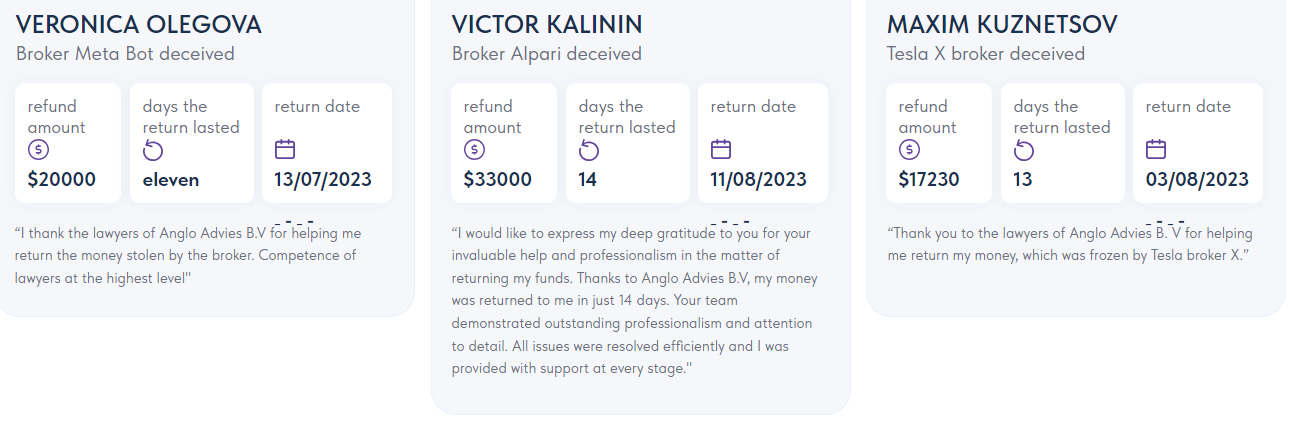

These scammers are sophisticated. They create websites and social media ads that look incredibly professional. These sites claim to offer financial recovery services and add heartening testimonials, impressive “recovered” funds, and a so-called founder who supposedly collaborates with security services of large financial institutions.

Testimonials offered by one of the scam websites

It's a well-orchestrated facade to gain trust. The message is clear: "We can reclaim your lost finances from cybercriminals!" But in reality, it's just a ploy to deceive victims all over again.

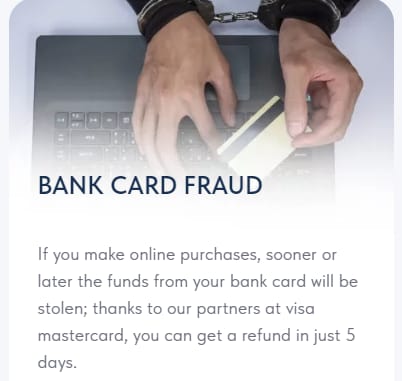

While these websites and ads may look legitimate at first glance, there are telltale signs that they're not to be trusted. Overly promising language, lack of verifiable information, and the urgency to act quickly are all classic signs of a scam. No legitimate service can guarantee the recovery of funds, especially not by using the personal data and sensitive financial information of already vulnerable individuals.

Scammers claiming they have partnerships with Visa and Mastercard

The role of social media ads in spreading scams

Social media platforms have transformed advertising with their ability to pinpoint an audience with laser precision. This feature, while beneficial for legitimate businesses, also serves as a potent tool for scammers. In the case of Double-Dip Deception Scams, the precise targeting of ads is a key factor in their malicious success. Scammers can manipulate platform algorithms to specifically target individuals based on age, interests, and even level of education—criteria that often correlate with vulnerability to financial risks.

By analyzing user behavior, scammers craft ads that resonate with those who have previously shown an interest in investment or financial opportunities, perhaps those who have engaged with related content or have been victims of financial scams in the past. These ads are designed to appear at moments when users are most receptive, exploiting the trust users place in the personalized nature of their social feeds. These ads can be particularly insidious on platforms like Facebook and Instagram, where users feel a sense of community and safety, blending seamlessly with genuine content.

The success of these scams is, in part, due to the sophisticated deception of the ads themselves. They often feature convincing testimonials, authoritative branding, and reassurances of legitimacy that can be hard to distinguish from the real thing. But it's the underlying strategy of exploiting the targeted advertising system that allows these scams to flourish, reaching users who are most likely to fall prey to the promise of recovering their lost funds.

Malicious ads in Instagram promoting the scam to lure potential victims

Protecting yourself

If you're seeking to recover from a financial scam, your best bet is to turn to a trusted and verifiable source. In any case make sure you are using a security solution that protects you against scams, and in any case If you're unsure about the legitimacy of a recovery service, ask Norton Genie, who can help distinguish between genuine aid and a scam in disguise. Your report can help protect not just you but also countless others who might fall for the same trap.

Conclusion

The Double-Dip Deception Scams represent a new low in the world of cybercrime, exploiting the hopes of those already impacted by financial scams. As cruel as it is cunning, this scam shows the lengths to which cybercriminals will go to exploit trust. Remember, in the fight against such deceit, knowledge is your best defense. Stay informed, stay skeptical, and when in doubt, reach out to trusted sources for help.

Special thanks to Alexej Savčin, Senior Malware Analyst, for his research and findings to uncover the Double-Dip Deception Scams.

Editorial note: Our articles provide educational information for you. Our offerings may not cover or protect against every type of crime, fraud, or threat we write about. Our goal is to increase awareness about Cyber Safety. Please review complete Terms during enrollment or setup. Remember that no one can prevent all identity theft or cybercrime, and that LifeLock does not monitor all transactions at all businesses. The Norton and LifeLock brands are part of Gen Digital Inc.

Want more?

Follow us for all the latest news, tips, and updates.