9 social media scams to watch out for

Con artists have long exploited social media sites to perpetrate various scams, including identity theft, fraudulent shopping schemes, and impersonation scams disguised as online romances. Learn about the most common social media scams. And get Norton 360 Deluxe to help fight scams, block malware, and stay safer online.

If you spend a lot of time on social media, it’s important to be aware of how widespread social media scams are. Between January 2021 and June 2023, Americans lost a combined $2.7 billion due to different types of social engineering scams on social media.

Research by Gen Digital (Norton’s parent company) on the riskiest social media platforms suggests that Facebook especially struggles to deal with scams: 63% of all social-media-related threats identified by Gen products (including Norton) stemmed from the Meta platform. Malicious or scam ads, aka malvertising, were particularly prominent.

Below, we cover some of the most common social media scams to know about, along with tips for learning how to spot a scammer and help prevent online scams before any damage is done.

How to spot a social media scam: 5 red flags

It’s easier to avoid a social media scam when you know what warning signs to look for. Fortunately, the same red flags tend to show up on every platform.

Whether you’re using a professional social media site like LinkedIn, a casual platform such as Instagram, or a sales site like Facebook Marketplace—these are some examples of suspicious behavior you should look out for:

- Urgent messages or pressure tactics: Scammers often pressure their victims to act quickly to take advantage of a deal or take immediate action to avoid supposed negative consequences.

- Too-good-to-be-true offers: Some scammers lure their victims in with promises of incredible deals, prizes, or investment opportunities. If an offer appears too good to be true, chances are it is.

- Spelling or grammar errors in account names or URLs: An easy way to spot a scammer advertising fake social media apps, or impersonating popular brands, websites, or people is by looking for bad grammar and clear misspellings in their name or messages.

- Requests for a wire transfer: This red flag may appear in several different social media scams. If someone asks you to initiate a wire transfer for any reason, that’s an immediate red flag

- Overly eager romantic connections: If someone you’ve connected with online appears to be quickly escalating the relationship or is overly eager to talk with you, this is a red flag.

1. Social media fraud (shopping scams)

Among social media scams, online shopping scams on websites like Amazon are the most common, according to the FTC. In this scamming example, scammers will create fake online stores, often mimicking popular brands. They then lure people in with enticing deals or offers. Once victims make a payment, they may receive a subpar product—or nothing at all.

Signs of social media fraud

Look out for these warning signs that can tip you off to social media fraud and shopping scams:

- Unbelievably low prices: Be cautious of deals that seem too good to be true.

- Limited or no contact information on the website: Scammers often provide vague or nonexistent contact details.

- Negative reviews or no reviews: Prioritize sites with genuine customer reviews; negative reviews (or no reviews at all) may signal a scam.

- No secure payment options: Legitimate sellers will always provide secure payment options. Avoid sites that lack secure connections.

How to avoid

The tips below can help you avoid social media fraud and shopping scams:

- Research the seller: Always verify the seller's legitimacy by checking reviews and their online presence.

- Use secure payment methods: Use payment apps and secure options like credit cards and avoid wire transfers.

- Look for HTTPS: When visiting an online store, ensure the website has "https://" in the URL, indicating a secure connection.

- Check return policies: Legitimate sellers have clear return and refund policies.

- Verify contact information: A legitimate business always provides contact details. Avoid those with vague or no information.

2. Fake social media accounts

Many social media scammers utilize fake social media profiles to carry out their attacks. They may target users for various reasons:

- Impersonation: Scammers may create fake profiles mimicking real individuals or organizations.

- Phishing: These accounts may send messages containing malicious links to steal personal information.

- Spreading misinformation: Fake accounts often spread false information, creating confusion.

Signs of fake social media accounts

The following warning signs can tip you off to fake social media accounts:

- Inconsistent profile information: Look for discrepancies in profile details, such as conflicting names or vague descriptions.

- Unusual friend requests or follows: Be cautious of requests from accounts with limited connections, unusual follower patterns, or incomplete profiles (or even blank profiles with just a profile picture).

- Generic or stolen profile pictures: To confirm whether a profile picture is authentic and not stolen, you can do a reverse image search on Google Images. Go to Google’s image search page, click the camera icon in the search bar, and either paste the URL or upload the image to search for it online. This can show you if the photo has been used multiple times or was stolen and repurposed.

- Requests for personal information: Legitimate accounts won't ask for sensitive information.

How to avoid

Avoid falling for a fake social media account with these tips:

- Review profile details: Carefully review someone’s profile information for inconsistencies, like strange usernames or missing details.

- Check out their content: Authentic accounts typically share high-quality, relevant content.

- Avoid clicking on suspicious links: Never click a link sent from an unknown account.

- Update your privacy settings: Adjust your privacy settings to control who can see your personal information.

3. Romance scams

Romance scams are rampant on social media and messaging platforms like WhatsApp, where scammers create fake personas, play on victims’ emotions, and spin convincing stories. After investing time in cultivating emotional relationships and gaining a victim’s trust, they often ask them for money under the guise of fake emergencies or travel needs. Victims may send money to the scammer, only for the scammer to take the money and never be heard from again.

Signs of romance scams

Look out for these warning signs to spot a potential romance scam on social media:

- Unrealistic photos: Watch out for photos that look too polished or professional, as romance scammers often steal photos to cover up their fake persona.

- Requests for money: Be wary of any requests for financial assistance or money to cover a trip (often spun as a trip to visit the victim).

- Inconsistent stories: If you’re chatting with someone online and notice conflicting details or sudden changes in their stories, keep your guard up.

- Avoidance of face-to-face interaction: Be cautious if someone you’re chatting with online consistently makes excuses to avoid in-person meetings or video calls.

How to avoid

Avoid falling into a romance scam on social media with these tips:

- Be skeptical of unknown profiles: If someone initiates a conversation with you seemingly out of the blue, exercise caution before revealing personal information.

- Never send money to strangers: Never send money or personal financial information to someone you've met online—no matter how well-meaning they seem.

- Verify identities: An easy way to confirm whether someone is authentic is by asking them to video chat with you. If they refuse or make excuses, there’s a good chance they’re not who they say they are.

- Beware of rushed relationships: Scammers often push for quick commitments; take your time to build trust.

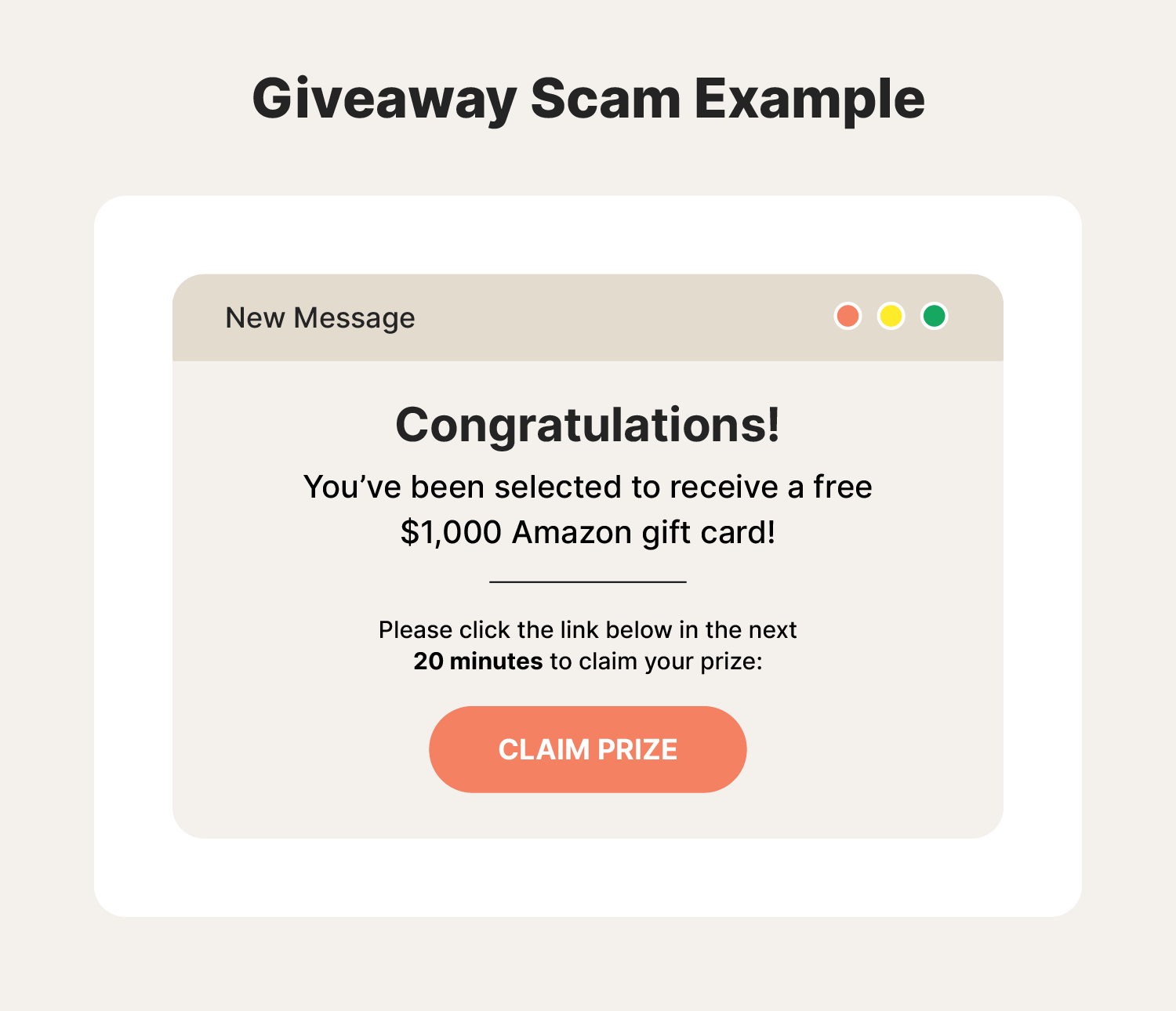

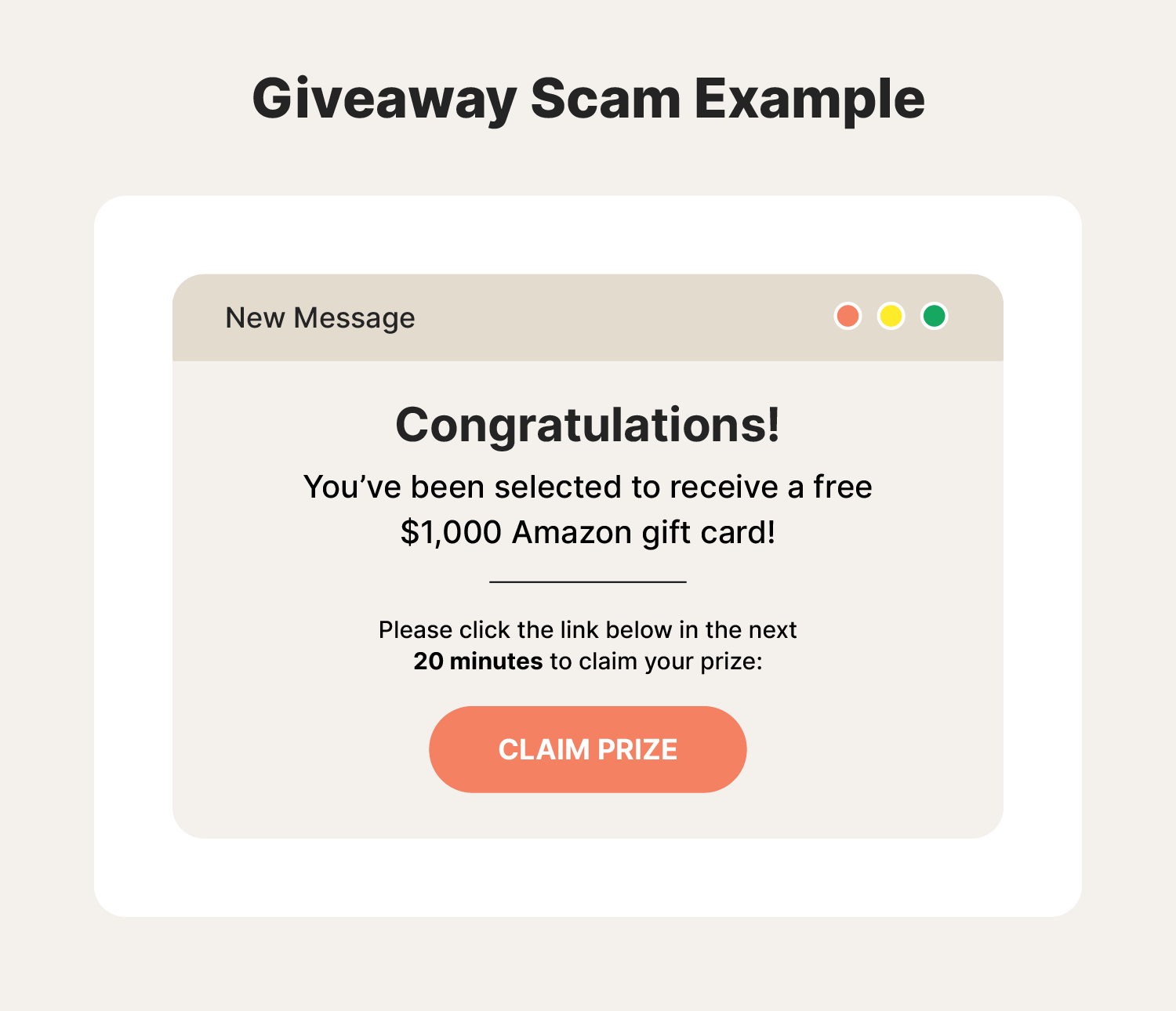

4. Lottery and giveaway scams

Have you ever come across a post for the chance to win a gift card or $500 worth of free clothes from a favorite retailer? Unfortunately, these social media giveaways are often scams, and the creators aren't giving away any real prizes.

Once these posts attract enough likes and shares, scammers may edit the post to include a link to malware that will infect the devices of any victims who click on it. Other scammers might erase the post's original content once they've earned likes and replace it with ads for illegitimate or illegal products.

Signs of lottery and giveaway scams

The warning signs below can help you sniff out lottery and giveaway scams on social media:

- Unexpected notifications: Be cautious if you receive notifications of winning a lottery or prize you didn't enter.

- Urgent payment requests: Scammers often pressure victims to pay fees urgently to claim their winnings.

- Too-good-to-be-true prizes: If the prize seems excessively generous for minimal effort, it's likely a scam.

- Incomplete contact information: Lack of clear and verifiable contact information is a red flag.

How to avoid

Here’s how to avoid a potentially costly lottery or giveaway scam:

- Verify legitimacy: Always confirm the legitimacy of the lottery or giveaway by researching the organization and checking official channels. Legitimate organizations should always provide clear contact details—be suspicious if this information is vague or missing.

- Never pay upfront: Legitimate lotteries won’t require upfront payments for claiming prizes. Be cautious if asked for money.

- Only trust official communication: Official announcements should come directly from a legitimate organization, not through unexpected emails or messages.

- Incomplete contact information: Lack of clear and verifiable contact information is a red flag.

5. Investment or ‘money flipping’ scams

Money flipping scams promise big bucks for little effort. Con artists share posts on social media sites, promising recipients they can make quick cash by contacting the poster to find out more. When victims reach out, scammers will ask them to add money to a prepaid debit card, unknowingly sharing their card number and PIN with the scammer.

The con artist then promises to "flip" this initial investment from victims into a much larger payday. Unfortunately, once victims make a payment, they’ll likely never hear from the scammer again. Cryptocurrency scams are also common on social media and operate in much the same way.

Signs of investment or ‘money flipping’ scams

The following red flags can help you recognize financial scams:

- Guaranteed high returns: Be cautious if the investment promises unrealistically high returns.

- Pressure to act quickly: Scammers often create a sense of urgency to push victims into making hasty decisions.

- Requests for upfront payments: Legitimate investments don't require upfront payments for participation and won’t involve loading money onto a prepaid debit card.

- No professional guidance: It may be a scam if the opportunity lacks professional advice or verifiable financial backing

How to avoid

Use these tips to avoid investment and money flipping scams:

- Do thorough research: Thoroughly research any investment opportunity, verifying the legitimacy of the company or individual.

- Beware of high returns with no risk: Be skeptical of promises of high returns with little or no risk—these offers are often too good to be true.

- Never send upfront payments: Legitimate investments don't require you to pay upfront without first having a legitimate account with the organization.

- Seek professional advice: Always consult with financial professionals or advisors before making significant investment decisions.

6. Quiz and survey scams

While there are many legitimate surveys, scammers may create seemingly innocent quizzes or surveys to extract personal information from unsuspecting participants. In these surveys, victims may encounter gradually intrusive questions, asking for personal details like addresses, birthdates, and even financial information.

Driven by promises of potential rewards or prizes, victims are encouraged to share more personal data. In truth, this is just a tactic for scammers to access sensitive personal information that they can later exploit for identity theft, phishing attacks, or fraud.

Signs of quiz and survey scams

Before you participate in that survey or quiz, know the signs of a potential scam:

- Overly personal questions: Be cautious if a quiz asks for excessive personal information beyond what's necessary (you shouldn’t ever need to release your bank account details, for example).

- Too-good-to-be-true rewards: If a reward or prize seems too good to be true, it probably is.

- Unverified sources: Only engage with quizzes from reputable and known sources. Research the organization before participating.

- Unexpected pop-ups or redirects: Scams may lead to pop-ups or redirects, attempting to gather additional information.

How to avoid

Here’s how you can avoid quiz and survey scams:

- Limit personal information: Provide only necessary information and avoid sharing sensitive personal details (like your bank account information).

- Verify the source: Do a quick Google search to verify the quiz or survey is from a reputable platform.

- Ignore unsolicited quizzes: Avoid clicking on quizzes or surveys sent by unknown sources, especially if they come out of the blue.

- Check permissions: Review the data permissions requested by a quiz or survey and avoid those seeking unnecessary access.

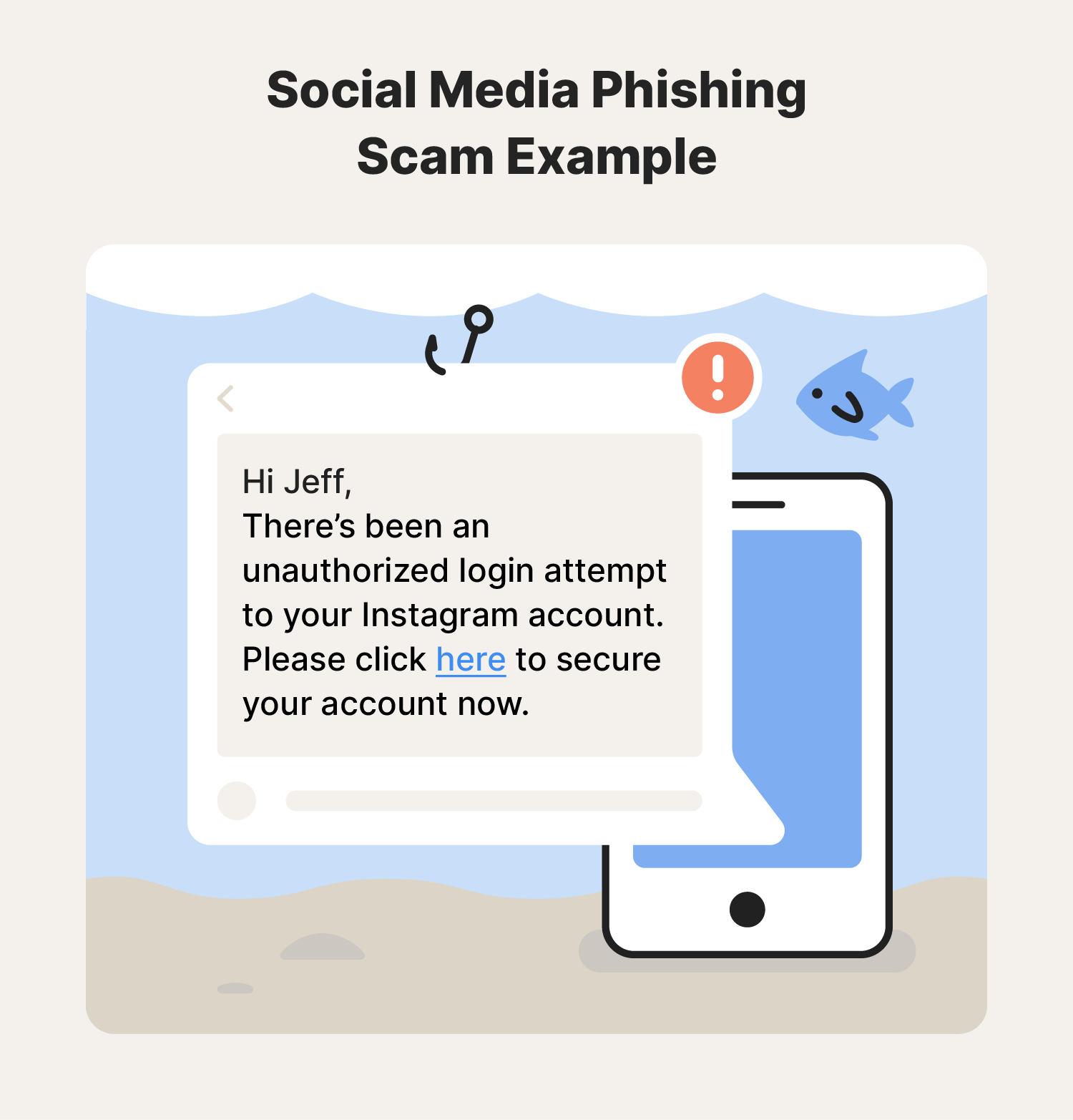

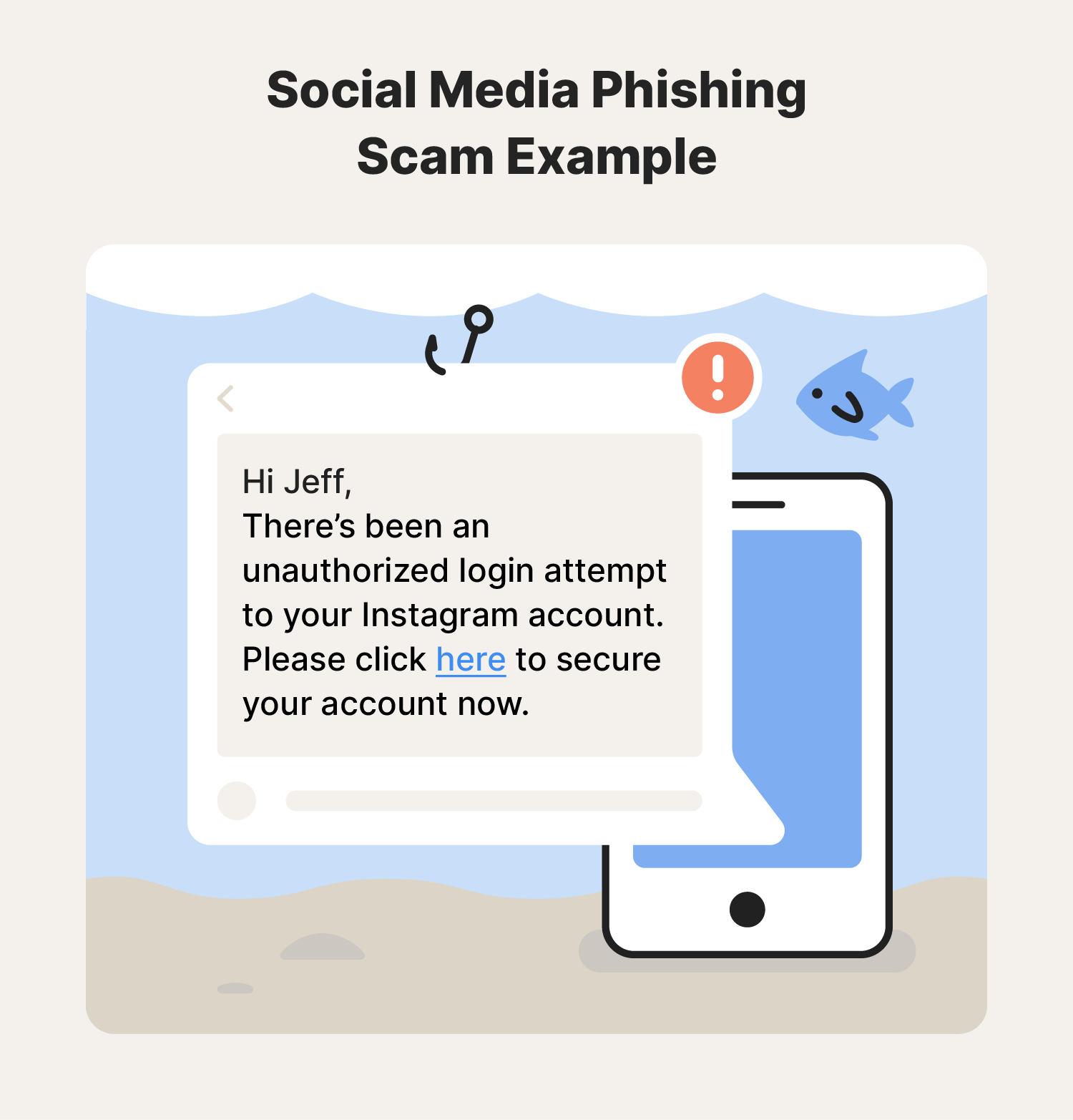

7. Social media phishing scams

A phishing scam is a scamming method used to steal data. Scammers will send messages on social media platforms to victims who appear to be from a trustworthy source but are meant to trick users into clicking malicious links. Once a link is clicked, scammers can access victims’ sensitive data, account credentials, or bank account information.

If victims click on a phishing link, the scammer gains access to personal information or data they will use for identity theft or other types of fraud.

Signs of social media phishing scams

Social media phishing scams can be subtle in their deception, but these warning signs can tip you off:

- Unsolicited messages: Be cautious if you receive random, unsolicited messages from people you don’t know on any social media platform.

- Generic content: Phishing messages may appear to be from an official source but typically lack personalization, often using generic language.

- Incorrect spelling and grammar: Phishing messages often contain noticeable errors in spelling and grammar.

- Mismatched URLs: Website links in a phishing message often have subtle discrepancies or unusual characters that differ from official sources.

How to avoid

To avoid a social media phishing scam, follow these tips:

- Verify the sender’s identity: Confirm the sender's identity before clicking on any links or providing information.

- Hover over links: Before clicking, hover over links to preview the URL and ensure it matches the expected destination.

- Enable two-factor authentication: Add an extra layer of security by enabling two-factor authentication for your accounts.

- Use security software: Consider using security software or antivirus to detect and block phishing attempts.

8. Job scams on social media

Scammers can exploit job seekers by posing as legitimate employment opportunities on social media platforms. They post enticing job opportunities that seem authentic at first glance but will often promise unrealistically high salaries or benefits to lure in victims. For those who apply, scammers may ask for upfront payments or sensitive personal information, claiming they’re needed to cover processing fees or conduct background checks.

Signs of job scams on social media

There are a few giveaways that can alert you to a potential job-posting scam on social media:

- Unsolicited job offers: Be cautious if you receive job offers out of the blue without having applied.

- Unrealistically high salaries: A job that promises a high salary but requires minimal qualifications is likely a scam.

- Payment requests: Legitimate employers won't ask for upfront payments or personal financial information. You’ll never need to pay for an interview or job screening.

- Incomplete job details: Vague job descriptions and a lack of clear information on the company is a sign of a scam

How to avoid

Keep yourself safe from a job scam online with the following tips:

- Research the company: Thoroughly research a company by checking its website, reviews, and online presence.

- Verify job details: Make sure job postings provide comprehensive details about responsibilities, qualifications, and expectations.

- Beware of unrealistic offers: Be cautious if a job offer seems too good to be true, doesn't align with industry standards, or requires minimal qualifications.

- Avoid upfront payments: Legitimate employers never ask for money upfront. Never pay for any job opportunity, no matter how enticing it seems.

9. Credit repair scams

You know that having a strong credit score is one of the most important factors in whether you qualify for loans and credit cards at lower interest rates. Scammers know you know this, too, which is why credit repair scams are so common. In this scam, con artists place ads on social media sites or contact you directly. They promise to boost your credit score—often by 100 points or more—instantly if you pay them.

If you pay them, they’ll either do nothing and disappear, or they’ll simply take the steps—such as ordering your free credit reports at AnnualCreditReport.com and looking for errors—that you can do on your own for free.

Signs of credit repair scams

Use these tips to spot a credit repair scam in its tracks:

- Guaranteed results: Be wary if a service promises guaranteed and rapid improvements to your credit score.

- Upfront fees: Legitimate credit repair services typically charge after providing the agreed-upon services, not before.

- Pressure tactics: Scammers may pressure you to act quickly or send money as soon as possible.

- Identity verification requests: Avoid services that request personal information that scammers could use for identity theft.

How to avoid

Here’s what you can do to avoid credit repair scams:

- Research companies thoroughly: Always check for credentials to make sure credit repair services are legitimate.

- Question guarantees: Legitimate credit repair services will never guarantee or promise specific results in a short period—be skeptical if you come across a supposed service that does.

- Know your rights: Familiarize yourself with your rights under the Credit Repair Organizations Act (CROA).

- Keep your personal information secure: Only share personal information with reputable and verified credit repair services.

What to do if you’ve been scammed on social media

Discovering that you’ve fallen into a social media scam can be distressing, but taking quick action is the best way to move forward. Here’s what you can do:

- Document everything: Take screenshots of the scam messages, profiles, or any relevant details. This documentation can be crucial when reporting the incident.

- Cease contact: Immediately stop all communication with the scammer. Block and report their account to prevent further interaction.

- File a report with the social media platform: Report the scam to whatever social media platform the incident took place on. This usually involves flagging the account and providing details about what happened. Your screenshots can come in handy here.

- File a complaint with the FTC: To report the scam to the FTC, visit their official website. Provide as much detail as possible about the incident.

5 tips to avoid social media scams

Protecting yourself on social media is crucial in today's digital landscape. Follow these tips to avoid internet scams and enhance your overall cybersecurity:

- Stay skeptical: Always question unsolicited messages or offers, especially from accounts you don’t recognize. If it seems too good to be true, it probably is.

- Never send upfront payments: Avoid sending money upfront in response to unsolicited requests. Legitimate transactions don't require upfront payments.

- Use strong passwords: Use strong, unique passwords for each platform.

- Think before you click: Hover over links to preview URLs. Avoid clicking on suspicious links, especially from unknown sources.

- Use two-factor authentication: Add an extra layer of security to your accounts by enabling two-factor authentication.

Defend your digital space

Guarding against social media scams is a shared responsibility. Stay vigilant, follow these tips, and report suspicious activity promptly to help keep social platforms safe and secure.

Further, empower yourself online with protection from Norton 360 Deluxe. It helps protect you from hackers by scanning your devices to help keep you safe from viruses, malware, ransomware, and hackers. It also includes a password manager and VPN to help you secure your passwords and keep your browsing activity private.

Editorial note: Our articles are designed to provide educational information for you. They may not cover or protect against every type of crime, fraud, or threat we write about. Our goal is to increase awareness about Cyber Safety. Please review the complete Terms during enrollment or setup. Remember that no one can prevent all identity theft or cybercrime, and that LifeLock does not monitor all transactions at all businesses. The Norton and LifeLock brands are part of Gen Digital Inc. For more details about how we create, review, and update content, please see our Editorial Policy.

- How to spot a social media scam: 5 red flags

- 1. Social media fraud (shopping scams)

- 2. Fake social media accounts

- 3. Romance scams

- 4. Lottery and giveaway scams

- 5. Investment or ‘money flipping’ scams

- 6. Quiz and survey scams

- 7. Social media phishing scams

- 8. Job scams on social media

- 9. Credit repair scams

- What to do if you’ve been scammed on social media

- 5 tips to avoid social media scams

- Defend your digital space

Want more?

Follow us for all the latest news, tips, and updates.