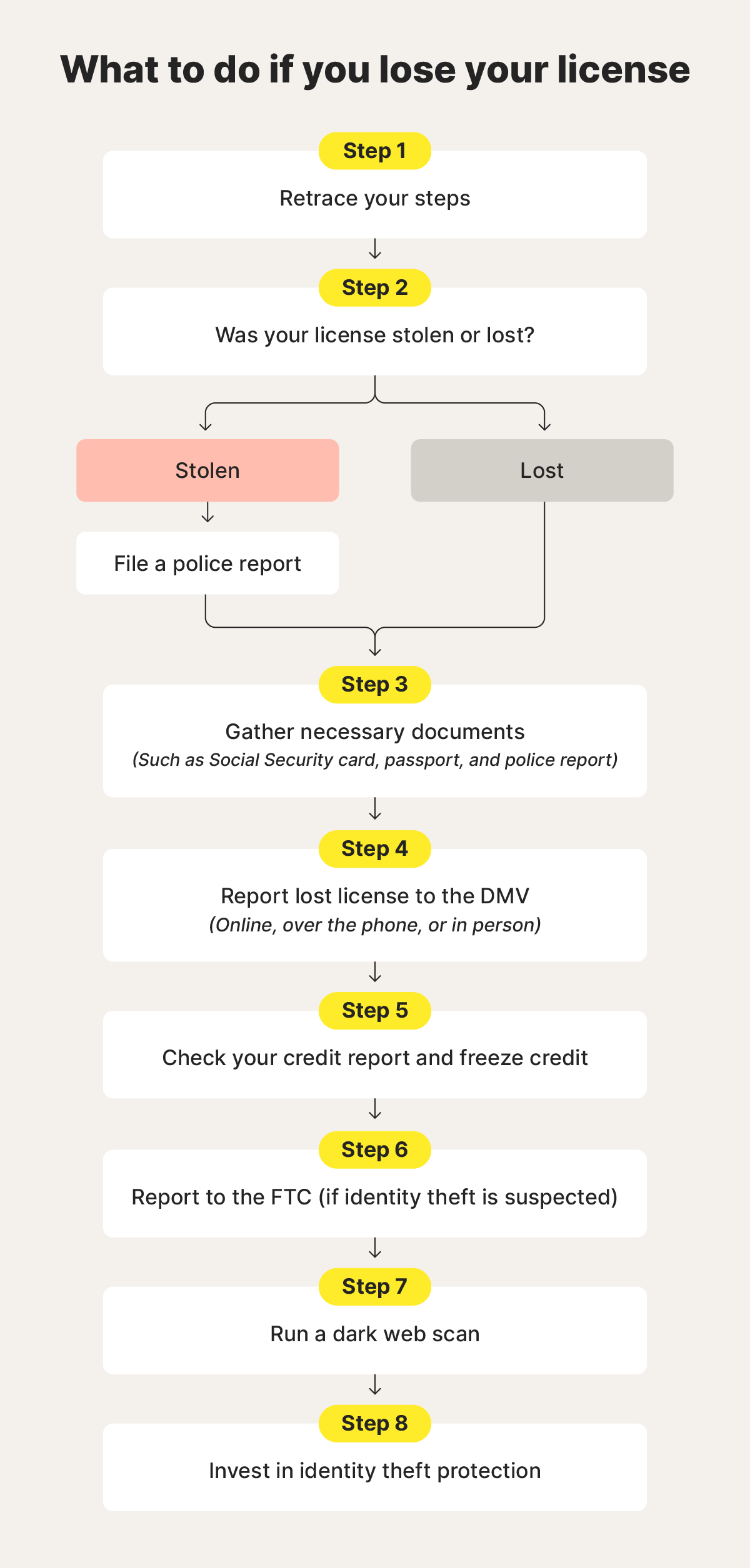

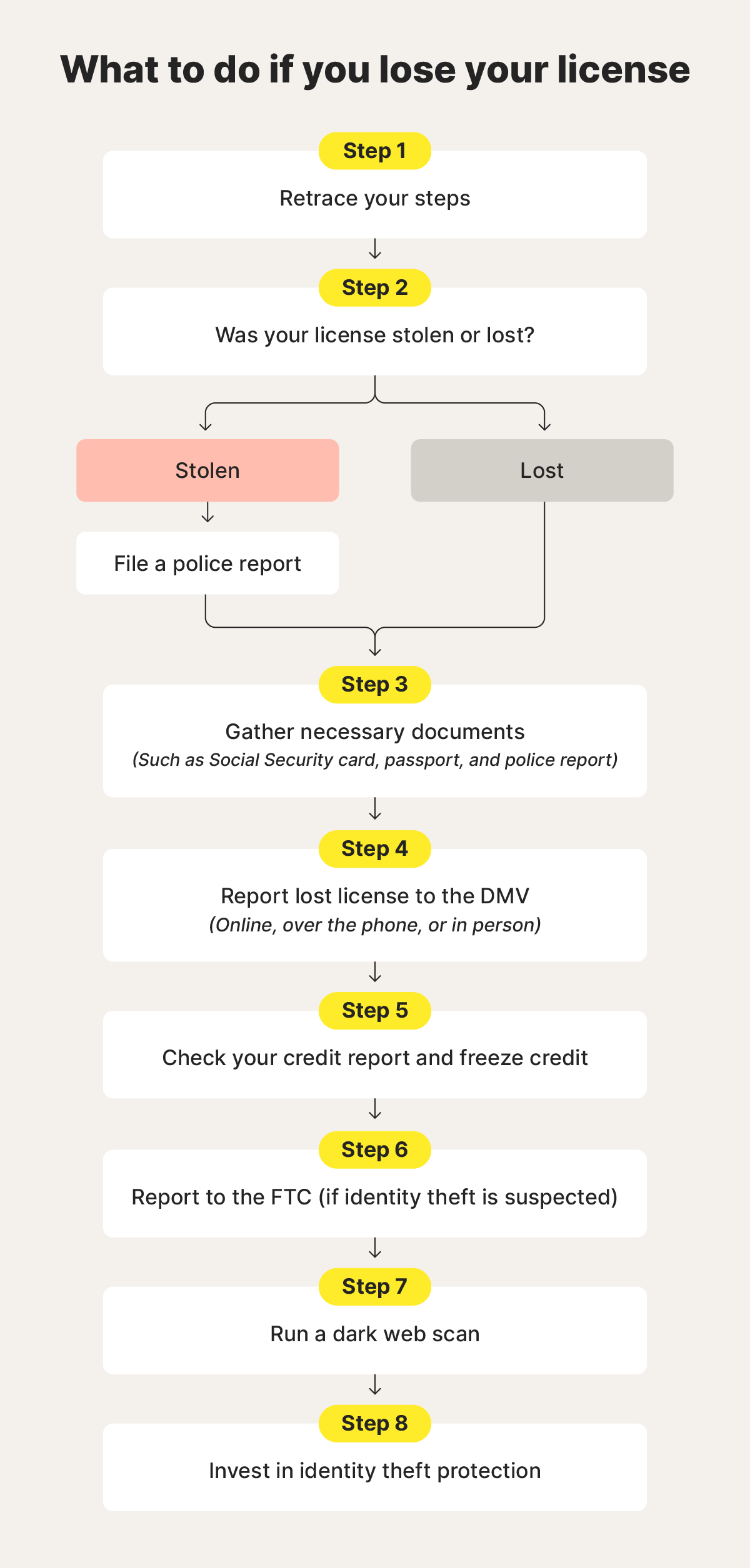

What to do if you lose your license: 8 essential steps

If criminals get hold of your driver's license, it can set off a chain of events ending in financial fraud or identity theft. But taking the right steps can help protect your info and get you back on the road. Learn what to do if you lose your license and how Norton 360 with LifeLock can help safeguard your identity.

Your driver’s license contains sensitive details (like your birthday and home address) that bad actors could use to open credit cards or take out loans in your name. That’s why it’s important to protect your information by reporting a lost or stolen license to the Department of Motor Vehicles (DMV) and filing a police report.

Keep reading to learn what other steps to take if you lose your license, so criminals have a harder time misusing your personal information.

1. Retrace your steps

Before assuming the worst, take a moment to retrace your steps. Check recent locations like your home, car, workplace, or any stores or restaurants you’ve visited. Sometimes, a misplaced license turns up in a pocket, bag, or between car seats.

If you still can’t find it, follow the remaining steps to help protect your driver's license information from criminals who could use it to commit identity theft.

2. File a police report

Filing a police report for a stolen license helps protect you if someone tries to steal your identity to commit crimes, open accounts, or avoid traffic violations using your name. It provides official documentation that you weren’t responsible. While not always required, reporting the loss can help if you need to dispute fraudulent activity later.

To file a report, visit your local police station or check if online reporting is available. Be prepared to provide alternative identification, a description of the incident, and other supporting documents.

3. Gather necessary documents

Once you’ve confirmed that your license is missing, you’ll need to gather any documentation required for the Department of Motor Vehicles (DMV) to replace your license.

Rules for replacing driver's licenses vary by state, but all states require proof of identification to issue a new license. Depending on where you live, you may need to provide different forms of documentation to verify your identity and payment for your new license.

Here’s a list of common documents you may need:

- Proof of identity such as a passport or birth certificate.

- Your Social Security number on an official document like your Social Security card or a tax form.

- Proof of residency such as a utility bill or lease agreement.

- A police report if your license was stolen.

Check your state's DMV website ahead of time to ensure you have everything you need before applying for a replacement.

4. Report your lost license to the DMV

Reporting a lost or stolen license to the DMV as soon as possible helps prevent identity theft and ensures you remain compliant with state laws.

The DMV can help you replace your license quickly or provide a temporary one you can use as an ID while taking the next steps. The process of getting a replacement license varies by state — some allow you to apply online, while others require an in-person visit. Check with your DMV to confirm the process and what documentation you need to provide.

While communicating with the DMV, ask if they can place a “Verify ID” flag on your license to alert law enforcement in case someone tries to misuse it. This works similarly to a fraud alert you can place with the credit bureaus, which alerts creditors to verify your identity before issuing you new lines of credit.

It's important to wait until you receive your replacement license before driving again, as driving without a valid license could lead to fines or legal trouble.

5. Check your credit report and freeze your credit

If you lose your license or someone has your driver’s license number, check your credit report for suspicious activity or errors.

Banks and other financial institutions always require identification to open accounts or apply for credit. And, criminals may be able to do this more easily if they have your driver’s license in hand.

Look out for signs of fraud on your credit report, such as:

- Unfamiliar accounts: Any accounts you don't recognize could be a sign of fraud.

- Credit inquiries you didn’t make: Watch for inquiries from creditors you haven’t contacted.

- Incorrect missed payments: If you notice missed payments that you didn’t make, it could indicate fraudulent activity.

As an added layer of security, consider freezing your credit. This helps prevent criminals from opening new accounts in your name. You can freeze your credit by contacting each of the three major credit bureaus: Equifax, Experian, and TransUnion.

To help monitor your credit report, get Norton 360 with LifeLock Select. With its one-bureau credit monitoring feature, you’ll be able to spot suspicious activity quickly so you can take steps to help prevent further damage.

6. Report theft to the FTC

Reporting a stolen license to the Federal Trade Commission (FTC) can help protect against identity theft. If your wallet was stolen along with other sensitive information, like your Social Security number, a thief could use them to commit fraud.

Filing a report at IdentityTheft.gov creates an official record of potential identity theft, which may be useful when placing fraud alerts, disputing fraudulent accounts, or taking other credit protection measures. The FTC also provides tools to help you manage and recover from identity theft.

7. Run a dark web scan

The dark web is a hidden part of the internet where criminals often trade stolen information, such as IDs and credit card details. Your personal information could end up there if your license is lost or stolen.

Running a dark web scan can help you identify if your information is being sold on a dark web marketplace. The Dark Web Monitoring feature in Norton 360 with LifeLock scans the dark web and alerts you if your details are found, allowing you to take action quickly and protect your personal information.

8. Invest in identity theft protection

Identity theft protection tools monitor your personal information online, helping you detect potential risks that could lead to fraud or identity theft. Norton 360 with LifeLock Select offers this protection and more, scanning the internet for your personal data and providing up to $25,000 in coverage for financial losses caused by identity theft.

What can someone do with your driver’s license number?

If your driver’s license number falls into the wrong hands, criminals can use it fraudulently for fake IDs, employment fraud, or other forms of identity theft.

Here are some ways criminals can use your driver's license number:

- Identity theft: Criminals can use your driver's license number, along with other personal information, to steal your identity and open credit accounts in your name.

- Employment fraud: Your license number could be used to fraudulently secure jobs in your name, potentially damaging your employment record.

- Traffic violations: Someone could use your license number to avoid penalties for traffic violations, leading to a damaged driving history.

- Fake IDs: Fraudsters may use your number to create counterfeit identification for illegal purposes.

- License number sales: Criminals can sell your license number on the dark web to other thieves, further exploiting your personal information.

Help protect your identity with Norton

By taking the steps above, you can safeguard your personal information if your license is lost or stolen. For extra protection, get Norton 360 with LifeLock Select. It alerts you if we find your license information online or on the dark web, so you can act quickly to start securing your identity.

Plus, Norton helps you cancel and replace important documents like your driver’s license, credit cards, and insurance cards if your wallet is stolen.

FAQs

What should I do if I lose my driver’s license in another state?

If you lose your driver's license while in another state, contact the DMV in your home state. Many states offer online services for reporting and replacing lost licenses, simplifying the process while you’re out of town.

Can someone steal your identity with your driver’s license?

It's hard to steal your identity solely with a driver's license. However, a fraudster getting their hands on your driver's license along with other personal information like your Social Security number could lead to identity theft.

Can someone get my driver’s license number from a data breach?

Yes. If a data breach includes DMV records or other databases storing your information, your driver's license number could be exposed.

Editorial note: Our articles provide educational information for you. Our offerings may not cover or protect against every type of crime, fraud, or threat we write about. Our goal is to increase awareness about Cyber Safety. Please review complete Terms during enrollment or setup. Remember that no one can prevent all identity theft or cybercrime, and that LifeLock does not monitor all transactions at all businesses. The Norton and LifeLock brands are part of Gen Digital Inc.

Want more?

Follow us for all the latest news, tips, and updates.