How many bank accounts should I have?

Having multiple bank accounts can help you organize your spending and saving by separating money for bills, everyday expenses, and long-term goals. But how many bank accounts should you actually have? Learn how to decide based on your financial situation, and get an all-in-one personal finance app to help manage your money more effectively.

General advice says that you should have at least two bank accounts: one for everyday spending and one for saving. However, for some people, more accounts can make it easier to budget or pursue financial growth goals. That explains why, on average, Americans have about five financial accounts.

Alongside an everyday checking account, many people have separate savings accounts for different purposes — like short-term financial goals, vacation funds, future home purchases, or emergencies. But this approach doesn’t make sense for everyone. Read on to discover how to decide what number of bank accounts is right for you, starting with the basics.

How many checking accounts should you have?

At minimum, you should have at least one checking account. But there’s a decent case for having two, with one dedicated to consistent, fixed expenses like bills or groceries and another for “wants,” like entertainment or days out.

If you have a significant other, you might also consider keeping a joint checking account for household costs alongside individual accounts for personal spending. And, if you’re self-employed, you could benefit from a separate business checking account to simplify bookkeeping and taxes.

How to choose the right checking account for you

The right checking account for you depends on your spending habits, financial goals, and how you access your money. Choosing wisely can help you minimize fees, stay organized, and make budgeting easier. Key factors to consider include:

- Minimum balance requirements: Some accounts require a minimum balance to avoid fees or earn interest. If you don’t meet that minimum, these accounts don’t tend to be worth it.

- Access to funds: Check the availability of local ATMs, how well-regarded the mobile banking app is, and what types of online transfers are available to ensure convenience.

- Fees: Look out for monthly maintenance fees, overdraft charges, and other hidden costs. These can seriously inhibit your financial progress, especially if you’re starting with a low balance.

- Interest rates: Some checking accounts offer interest, which acts as a reward for keeping your money with the bank. Compare available rates to maximize your returns.

- Additional features: Consider perks such as cashback schemes, reward programs, credit features, or budgeting tools that align with your personal goals.

How many savings accounts should you have?

Having at least one dedicated savings account is generally recommended, but it can be beneficial to expand that to two or three accounts, depending on your approach to savings. Ramit Sethi, host of Netflix’s How to Get Rich and the I Will Teach You to Be Rich podcast, suggests “anything beyond that usually just makes your life unnecessarily complicated.”

Different savings accounts can serve different purposes, helping to create a clear distinction between money for emergencies, short- to mid-term goals like vacations or holiday gifts, and long-term goals such as a home down payment.

How to choose the right savings account for you

Which savings account will suit you best depends on your goals, how often you need access to your funds, and how much you want your money to grow. Consider the following factors when choosing an account:

- How much your money grows: Savings accounts shouldn’t just keep your money safe — they can also help it grow. Compare interest rates to maximize growth over time, especially for long-term savings.

- Minimum balance: Some accounts require a minimum balance to avoid fees or earn interest. Make sure it aligns with what you can realistically maintain.

- Fund access: Some savings accounts have limits on fund access so make sure to check how easily you can transfer or withdraw money, especially if the account is for an emergency fund or short-term financial goal.

- Fees: Check whether your chosen account has any monthly maintenance fees or penalties that could eat into your savings.

Why you should consider having multiple bank accounts

The main reason to have multiple bank accounts — and, more specifically, a checking and a savings account — is that it allows you to earn higher rates of interest on money you don’t need immediately. Any funds that won’t be spent before your next paycheck can sit in a savings account and grow, rather than earning little to nothing in a checking account.

Beyond that very practical benefit, having multiple accounts can also help create clearer boundaries between money that’s for everyday expenses and long-term goals. You can monitor balances across accounts at a glance, stay on budget, and reduce the risk of overspending by knowing exactly what each account is for.

And it can be useful if you have ad hoc income from freelance work or side hustles. Each income stream can have its own “home,” making it easier to track earnings, set aside funds for taxes, and plan for both short- and long-term goals.

Here’s a more detailed summary of the key benefits of having multiple bank accounts:

- Budgeting and organization: Maintaining separate accounts can make it easier to track spending, stick to budgets, and prevent accidentally mixing funds.

- Emergency fund: Keeping emergency savings in their own account reduces the temptation to dip into them for everyday expenses.

- Joint accounts: Couples can maintain joint accounts for shared bills while keeping personal accounts for individual spending.

- Flexibility: Different accounts can serve different purposes, like high-yield savings, short-term goals, or everyday spending.

- Fraud protection: If one account is compromised, others may remain secure, limiting potential financial disruption.

- Income management: Separate accounts make it easier to manage multiple income streams, such as a side hustle or irregular paycheck.

On the flipside, having too many accounts can become confusing and take extra time to manage. Without a clear plan, accounts may overlap, fees can add up, and it can be harder to see your total financial picture, turning what’s meant to simplify your money into an unnecessarily complicated process.

So don’t open new accounts for the sake of it — figure out how many you need to suit your financial situation and your goals. You can always open more in the future if your position changes.

How to determine the ideal number of bank accounts for you

To determine the ideal number of bank accounts for your current situation, consider how you currently earn and manage money. If you have a steady paycheck, one checking and one savings account may be enough.

However, freelancers or those with irregular income often benefit from separate accounts to track each income stream.

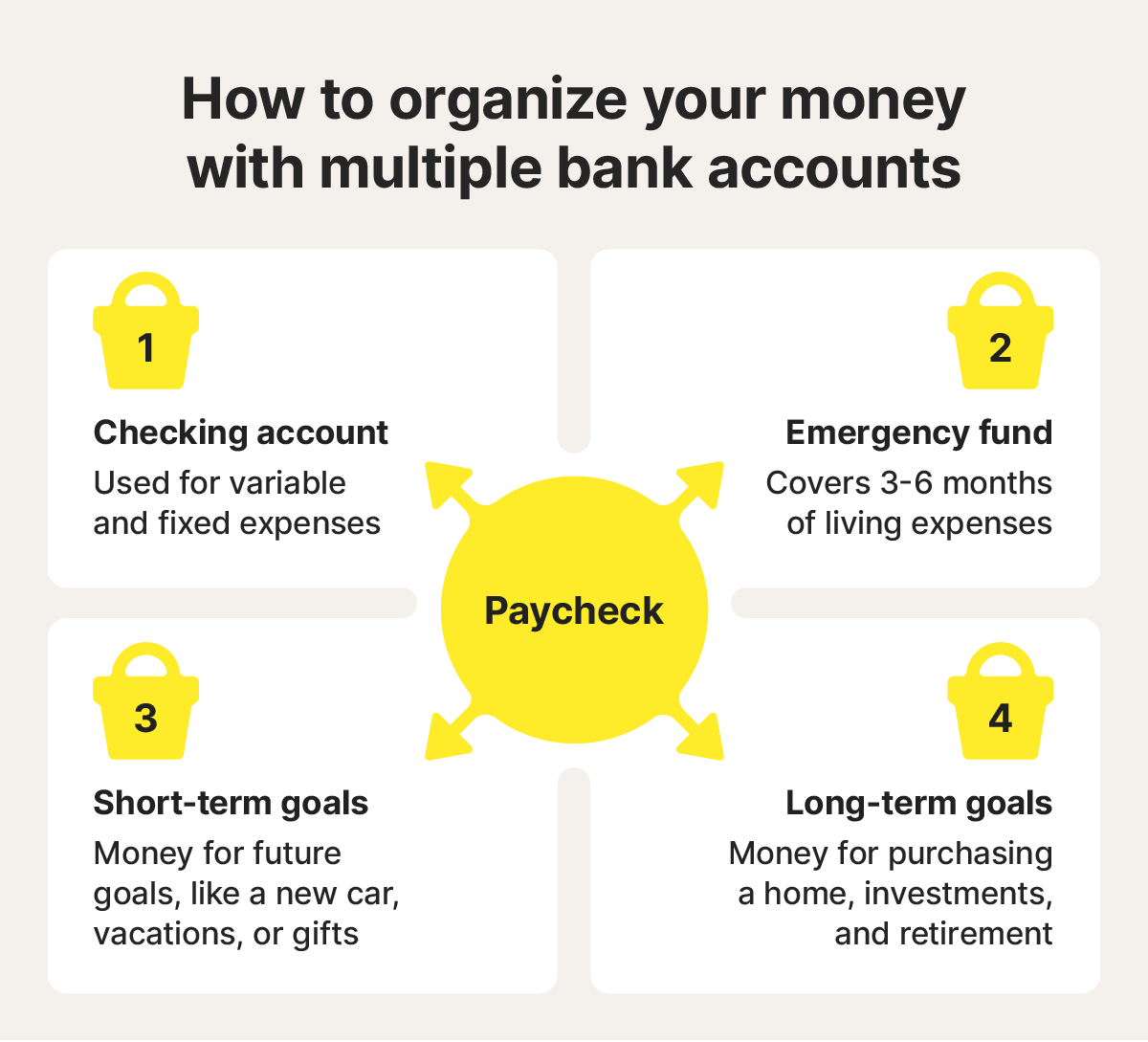

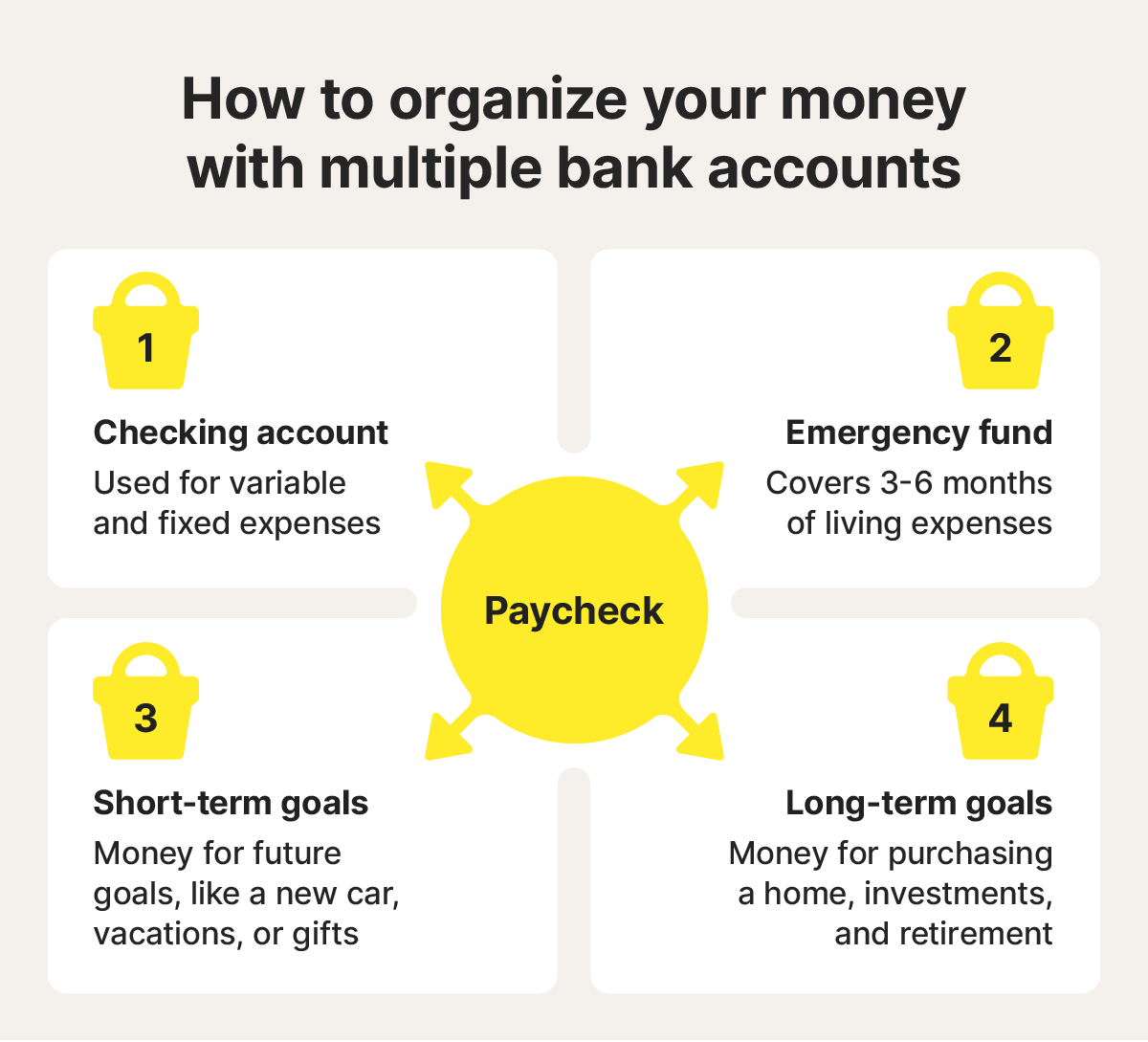

Your budgeting style also plays a role. Minimalist planners may stick to one to two accounts to simplify tracking expenses. But, if you prefer a “bucket” approach with separate accounts for specific purposes like emergencies, travel, debt repayment, or long-term goals, more accounts might make sense.

Remember, as your financial position changes, your account needs might, too. For example, if you only have two accounts but just got a pay increase and want to start saving towards a house down payment, it might make sense to create a new high interest savings account. Don’t be afraid to adjust your setup as your income, goals, or spending habits develop.

Types of bank accounts

Checking accounts, savings accounts, money market accounts, and certificates of deposit all serve different purposes. Here’s a closer look at what each type of account typically does and how it can be useful:

- Checking accounts: Designed for everyday spending and bill payments. They offer easy and immediate access to your funds via debit cards, checks, and online transfers, but typically earn little to no interest.

- Savings accounts: Meant for storing money you don’t need immediately. Money in savings accounts generally earns more interest, making them ideal for building an emergency fund or saving towards short-term goals. However, some high-interest savings accounts might limit access to your funds.

- Money market accounts: A hybrid between checking and savings accounts, money market accounts (MMAs) often offer higher interest rates than regular savings accounts. But, they still allow easy access to funds through check-writing or debit cards.

- Certificates of deposit (CDs): CDs are accounts that lock your money up for a set time period in exchange for higher interest rates. They’re best for long-term savings you won’t need to access even in emergencies.

Five tips for keeping track of multiple bank accounts

If you grow beyond three or four accounts, keeping them all organized and topped up with the right amount of money can get tricky. But you can use some simple strategies to make managing them easier, from using mobile personal finance apps to setting up alerts and automating transfers.

Here are some quick tips that can help you manage multiple bank accounts more effectively:

- Use mobile apps: Most banks have mobile apps that allow you to check your account balances, transfer funds, and track transactions on the go. For more insights into your finances, get an all-in-one personal finance app like Norton Money to monitor multiple accounts from one dashboard, track your spending, and check your credit.

- Sign up for text alerts: Many banks offer automated text notifications for low balances, large transactions, or upcoming payments. These alerts can help you avoid going overdrawn, and could even help you catch fraudulent bank activity early.

- Review your bank statements: Regularly checking your account statements as they come through will mean you’re more likely to spot errors early. You will also get a better view of your spending patterns, making it easier to stay on budget.

- Set recurring transfers: Automating transfers to your savings account or an account dedicated to bill payments helps you stick to your financial goals, ensuring your money goes where it’s needed without any manual work.

- Label accounts clearly: Name each of your accounts according to its specific purpose, such as “Vacation Fund” or “Emergency Savings,” to avoid confusion and stay intentional with your money.

Keep your bank accounts protected

Managing multiple bank accounts doesn’t have to be complicated. Norton Money allows you to see them all from one app, making it easier to track your spending, budget for the month ahead, discover new financial offers, and spot unusual activity like fraudulent transactions.

With your entire financial life centralized in one place, achieving your budget goals just got a little bit easier.

FAQs

How many checking accounts should I have?

One to three checking accounts usually work best: one for bills, one for everyday spending, and a joint account if needed. Self-employed individuals might add a separate business account to keep finances organized.

Is it good to have multiple bank accounts?

Yes. Multiple accounts can help you stay organized, budget more intentionally, and keep savings for different goals separate, making it easier to track progress and avoid overspending.

Is seven bank accounts too many?

Probably. While how many bank accounts is “too many” depends on your personal preferences and financial situation, seven separate accounts may be hard to manage unless each has a clear and specific purpose.

Does having multiple bank accounts affect your credit score?

Generally speaking, the number of bank accounts you have won’t impact your credit score because checking and savings accounts aren’t reported to credit bureaus. Only accounts tied to loans, credit cards, or overdraft lines that report activity can affect your score.

Editorial note: Our articles provide educational information for you. Our offerings may not cover or protect against every type of crime, fraud, or threat we write about. Our goal is to increase awareness about Cyber Safety. Please review complete Terms during enrollment or setup. Remember that no one can prevent all identity theft or cybercrime, and that LifeLock does not monitor all transactions at all businesses. The Norton and LifeLock brands are part of Gen Digital Inc.

Want more?

Follow us for all the latest news, tips, and updates.