How to set a budget the smart way

Learning how to set a budget is essential if you want to avoid overspending and build long‑term financial security. Fortunately, budgeting gets much more manageable when you follow a few simple principles. Before we dive in, consider using Norton Money to connect your accounts, track your spending, and set your budget.

If you find it challenging to manage your spending, you’re not alone. According to NerdWallet research, 83% of U.S. adults overspend. This can make saving for long-term goals, paying off debt, and achieving financial stability difficult. Creating a budget is a simple way to take control of your finances and reduce overspending.

Keep reading to learn how to set a budget in six simple steps.

1. Calculate your net income

Your net income is the money you take home after taxes, deductions, and withholdings — essentially, the amount that actually lands in your bank account on payday. Looking at your net income instead of your total pay is important for creating a realistic budget and avoiding overspending.

When determining your net income, make sure to include all income sources. This may include:

- Your salary or hourly wages.

- Freelance or contract work.

- Bonuses or commissions.

- Rental income.

- Side hustle earnings.

- Any other regular income sources.

2. Categorize your expenses

Many online banking apps classify your outgoing payments automatically, grouping them into categories like “food,” “entertainment,” and “travel.” This is a helpful starting point for analyzing your spending habits and distinguishing between needs and wants.

By listing and categorizing your expenses, you can better understand your financial habits and identify areas where you might be overspending. It may feel painful, but reviewing your spending each month is important for determining a realistic budget.

Divide your expenses into four main categories: necessities, debt repayment, savings, and wants.

Necessities

These are essential expenses for your basic living needs. They are often relatively fixed and harder to adjust in the short term. Some examples include:

- Rent or mortgage payments.

- Utility bills.

- Groceries.

- Transportation costs.

- Health insurance and medical bills.

- Childcare or education expenses.

Debt repayment

Debt repayment covers any payments you make toward outstanding balances. Paying off debt as quickly as reasonably possible — especially high-interest debt — can save you money in the long run and possibly boost your credit score.

Debt repayment bills you may have include:

- Credit card payments.

- Student loans.

- Personal loans.

- Car loans.

- Mortgages.

Savings

Saving money is essential for building a financial safety net and working toward long-term goals, like buying a home or retiring comfortably. While saving money should be a priority no matter your situation, you can adjust the amount depending on your finances.

A good rule of thumb is to save at least 20% of every paycheck. However, even if you can’t set aside that much right now, saving any amount — no matter how small — can help you build momentum toward your goals.

Funnel your savings into the following channels:

- Emergency fund (at least six months' worth of expenses).

- Retirement contributions (e.g., 401(k), IRA).

- Savings for large purchases (house, car, etc.).

- Education or investment accounts.

Wants

Wants are expenses that make life more enjoyable, but aren’t necessary for survival. You can typically reduce or eliminate these expenses when needed. Examples include:

- Entertainment.

- Luxury clothing or home goods.

- Travel.

- Gym memberships or fitness classes.

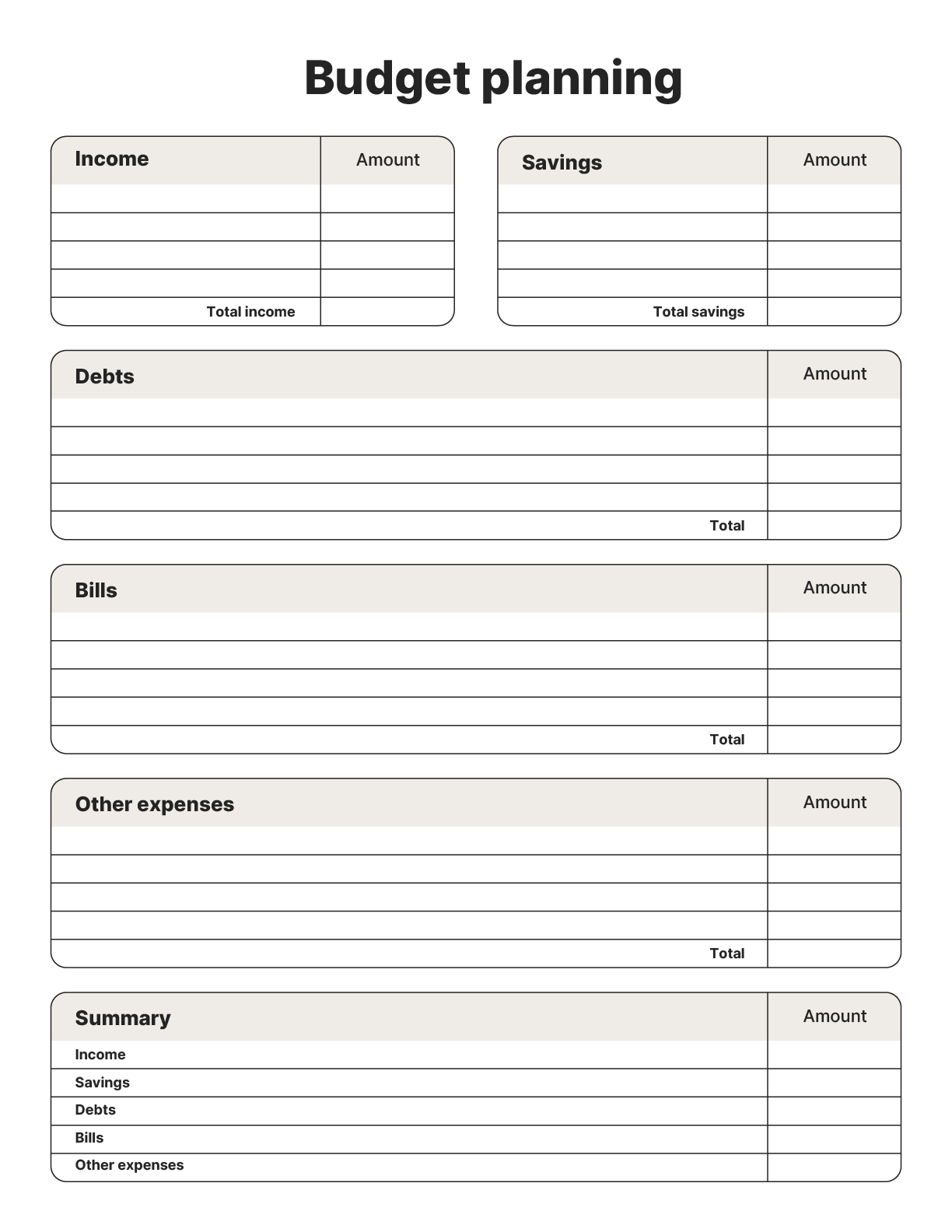

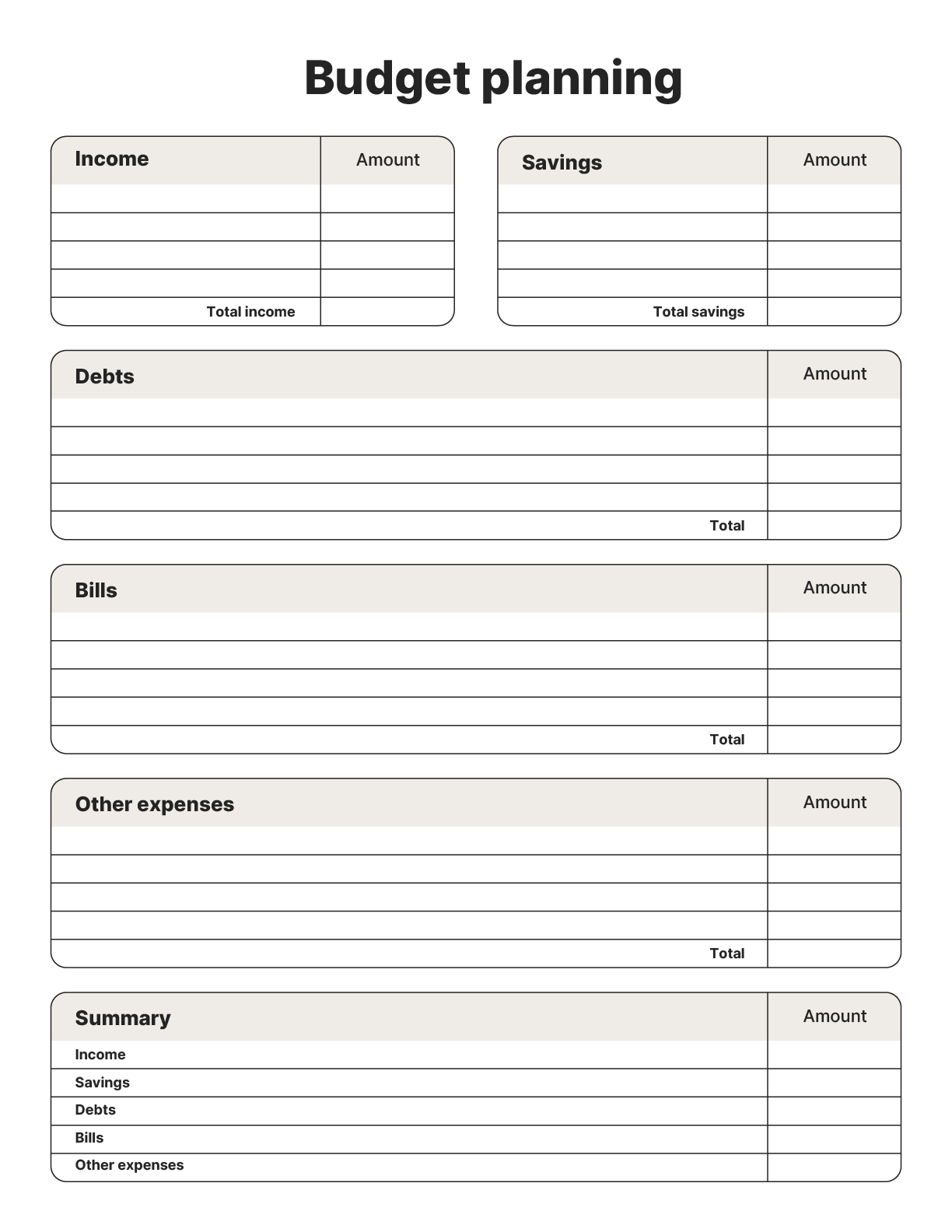

You can use a downloadable budget template, like the one shown below, to help you categorize your expenses.

3. Track your spending in real time

After you’ve analyzed your monthly and yearly expenses, start monitoring your spending in real time. Look for patterns, spot impulse purchases, and see where you might be overspending. This will allow you to make adjustments and stay within your budget.

4. Set your goals

Budgeting goals are personal; they can vary based on your current situation and long-term aspirations. If you have a significant amount of debt, your primary goal might be paying it down. Others may be saving for a down payment on a home or car.

Setting financial goals when creating a budget creates parameters for your monthly expenses so you can adjust your spending habits. Reflect on how you want your budget to enhance your life and which goals will help improve your financial well-being. Then allocate money accordingly.

5. Choose a budgeting method

Four common budgeting methods include the 50/30/20 method, the zero-based budget method, pay-yourself-first budgets, and the envelope system.

50/30/20

The 50/30/20 budgeting method divides your net income into three categories:

- 50% for needs.

- 30% for wants.

- 20% for savings and debt repayment.

This approach works well if you’re looking for a straightforward way to balance your finances.

But, this method may not work if you live in an area with a high cost of living or have significant debt to pay off. In such cases, you may need to adjust your budget by reducing the amount you spend on “wants” and increasing your budget for needs and debt repayment.

Zero-based budget

In a zero-based budget, also called a zero-sum budget, you determine how you’ll spend every dollar of your net income in the month ahead — be it on savings, debt repayment, rent, travel, or new clothes. This method can help you become more intentional about spending and saving your money.

A Zero-based budget offers more customization than the 50/30/20 method. However, it can get confusing if your income is unpredictable, and it requires you to spend time each month deciding how you will spend your money.

Pay-yourself-first budget

A pay-yourself-first budget, allows you to set aside a portion of your income for savings or investment goals before you spend a dime. Afterward, you can use the remaining money for bills, expenses, and “wants.” This method is great for building savings.

But, a pay-yourself-first budget isn’t ideal if you still need to pay off debt. High-interest debt can grow quickly, so it’s important to prioritize paying it off before you set money aside for savings.

The envelope system

With the envelope system, you put cash into labeled envelopes, each marked for a specific expense category, like groceries, entertainment, or transportation. Once the money in an envelope is gone, you can’t spend any more in that category for the month. This method helps control overspending by creating clear limits for each category.

While this method can be effective for controlling expenses, it isn’t great for digital wallet users, or if you rely heavily on credit card transactions instead of cash.

6. Adjust as needed

If you encounter unexpected expenses, your income changes, or you notice you’re overspending in certain categories, you’ll have to adjust your budget. This could mean reallocating funds from one category to another. For example, if you get a raise, you may be able to allocate more money to savings. Conversely, if you lose your job, you’ll have to cut back on “wants.”

Maintaining some budget flexibility will help ensure your budget stays aligned with your current needs and goals.

Budgeting tips to stay on track

Even the most money-savvy people occasionally struggle to budget. Use the following budgeting tips to help keep yourself on track:

- Use a money management app: Money management apps like Norton Money automatically track your spending. This makes it easier to monitor your expenses in real time, categorize your purchases, and identify areas where you might be overspending.

- Avoid impulse purchases: Impulse purchases can quickly derail your budget, and the old adage “sleep on it” is actually backed by science. If you still want the item after a good night’s rest, check your budget one more time to make sure it fits.

- Check your subscriptions: It’s easy to lose track of subscriptions and forget about ones you aren’t using. Review your credit card statements to track subscriptions, making it easier to cancel the ones you don’t want.

- Find ways to earn extra money: Look for opportunities to earn money online, like freelance work, selling handmade products, or participating in surveys. Extra income can help you cover expenses, pay off debt, or boost your savings.

Start budgeting with Norton

Budgeting doesn’t have to be scary. Following the simple steps above can help you plan and stick to a realistic budget. Then, use Norton Money to make managing your finances even easier. This free financial wellness app lets you connect your accounts and track spending and upcoming payments, so you can see how your budget is working in real life and adjust as you go.

FAQs

What are some key components of successful budgeting?

When setting a budget, consider your income, fixed and variable expenses, savings goals, debt obligations, and unexpected or emergency expenses. Then, adjust spending and saving categories every few months based on your current financial priorities. Prioritize essentials and ensure your income can cover your needs while leaving room to work toward your financial goals.

How often should you check your budget?

You should check your budget at least once a month to track your spending and make adjustments. Revisit your budget whenever you anticipate major changes in income or expenses.

Are budgeting apps safe?

Budgeting apps from trusted providers, like Norton Money are safe. When choosing a budgeting app, ensure that you trust the provider. Check what security features it includes — ideally, it should be encrypted, have two-factor authentication, and protect your personal data.

Editorial note: Our articles provide educational information for you. Our offerings may not cover or protect against every type of crime, fraud, or threat we write about. Our goal is to increase awareness about Cyber Safety. Please review complete Terms during enrollment or setup. Remember that no one can prevent all identity theft or cybercrime, and that LifeLock does not monitor all transactions at all businesses. The Norton and LifeLock brands are part of Gen Digital Inc.

Want more?

Follow us for all the latest news, tips, and updates.