Scam got you spiraling? Here’s how to reset, recover, and move on

You got scammed. Now you’ve got two options: either dwell on it, or start getting your footing back. And if you need a little support while you rebuild, Norton 360 can help keep scammers out of your way for good.

A scam can knock the wind out of you fast. One minute you’re going about your day, the next you’re wondering how someone managed to swindle you. If you got scammed, take a moment to get your head straight and try to move on without dragging that “Ugh, I can’t believe this happened” feeling everywhere.

And just to be clear: Getting tricked doesn’t mean you're careless. Scammers fool grandparents, gamers, CEOs, college kids — basically anybody with a pulse. We’ve outlined four simple steps to help you understand how to get over being scammed and regain your confidence.

1. Lock things down fast

Getting scammed can leave you feeling lost, ashamed, and, yes, even depressed. One Redditor shared their feelings after being scammed:

“I’m not coping well after being scammed. I feel so ashamed and haven’t told anyone yet.”

It's okay to feel that way, but know that you're not alone — you're in the majority. In fact, 73% of American adults have experienced some form of online scam or attack

You may be hit with a wave of anxiety after a scam and try to fix everything as fast as possible, but you don’t have to deal with everything instantly. Tackle one thing at a time, starting with the basics:

- Change your passwords and turn on 2FA: If a scammer gets into one account, the others become easy targets. Setting secure passwords and enabling two-factor authentication can help mitigate their access.

- Contact your bank or card company: They can flag your account and stop any extra damage before it snowballs.

- Freeze your credit: If someone has your info, they may try to open new accounts in your name — a credit freeze stops this before it starts.

- Monitor your accounts: Watch for suspicious logins or transactions so you can catch unauthorized access early.

2. Report it and fight back the right way

Once you’ve secured your accounts and finances, report the scam, even if the amount was small or you’re convinced nothing will come of it. These reports build a paper trail that helps investigators connect the dots, shut down repeat offenders, and warn others.

Here's what you can do:

- File a complaint with the FTC: It helps build a record and enables investigators to spot patterns.

- Submit details to the IC3: Use this option if the scam occurred online or involved any digital aspect.

- Alert your local police: They can investigate the incident and provide an official report if you need one.

- Loop in your bank: They can flag your account, track suspicious activity, and support your claim.

Also, be aware of recovery scams. Scammers might circle back pretending to be an investigator, a bank rep, or even a tech support agent, claiming they can get your money back or recover your accounts.

For example, one romance scam victim who lost hundreds of thousands of dollars was targeted a second time after joining a Facebook support group for help. Scammers posing as FBI agents messaged her, saying they could recover her money for a fee.

If anyone reaches out promising to fix your situation for cash, it’s a trap. Don't fall for it. Report that, too, then walk away.

3. Don’t be too hard on yourself

Getting scammed hits harder than people admit. Anger, embarrassment, and guilt show up fast and loud, and those feelings are all completely normal.

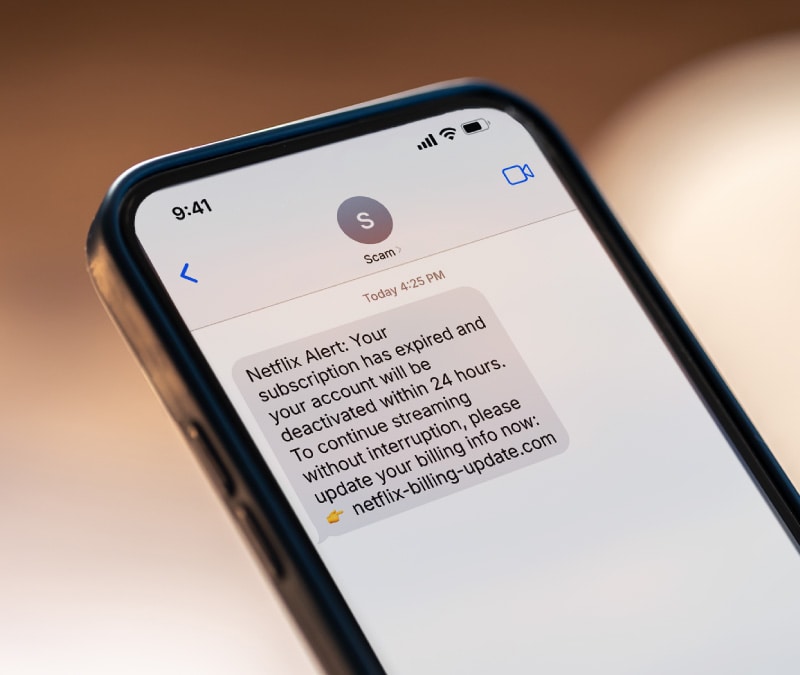

To sort things out, understand that scammers are masters of emotional manipulation. They know exactly how to cloud your judgement, and they usually do it by:

- Cranking up urgency: Making it feel like you have seconds to react

- Stirring fear: Convincing you that something terrible will happen if you don’t respond

- Faking authority: Using official-looking logos, uniforms, and polished language to lower your guard

These tactics work on anyone — that's why scammers use them. It's not about being too trusting; it's about someone deliberately exploiting normal human responses. Take time to process what happened without beating yourself up over it.

4. Rebuild your confidence and security

After a scam, it's normal to feel shaken, but you can take concrete steps to regain control. Start by tightening your login security, learning how common scams work, and identifying the scammer tactics you didn't catch before.

What happened can also help others. Sharing your experience with friends, family, or online communities might prevent someone else from falling into the same trap. People might share their own stories of being scammed, too.

Take back control and protect what’s yours with Norton

After dealing with the immediate fallout of being scammed, it’s time to lock in long-term protection.

Norton 360 Deluxe keeps you covered with the comprehensive protection you need to make sure scammers don't get another opening. In addition to a secure VPN and antivirus protection, it includes an AI-powered scam detection tool that analyzes messages and detects potential scams before you engage.

FAQs

Can the police do anything about a scammer?

Yes, the police can help, especially if there’s money involved or the scam is part of a larger pattern. They may not catch the person overnight, but filing a report helps build a case and protects others.

Can a scammer be traced?

Yes, you can sometimes trace a scammer. If they slip up with phone numbers, bank accounts, or IP addresses, investigators can follow the trail. Skilled scammers hide well, but they’re not invisible.

What should you never say to a scammer?

Never share one-time codes, passwords, banking details, or any other information that could help them verify your identity. The moment they ask for sensitive info, disconnect the call.

What if I get contacted again after being scammed?

Cut it off immediately — it’s likely a recovery scam. Don’t reply, don’t pay anything, and report the contact. Scammers love a second shot, so block them before they try.

Editorial note: Our articles provide educational information for you. Our offerings may not cover or protect against every type of crime, fraud, or threat we write about. Our goal is to increase awareness about Cyber Safety. Please review complete Terms during enrollment or setup. Remember that no one can prevent all identity theft or cybercrime, and that LifeLock does not monitor all transactions at all businesses. The Norton and LifeLock brands are part of Gen Digital Inc.

Want more?

Follow us for all the latest news, tips, and updates.