The “dirty dozen” IRS scams taxpayers should know

Don’t let scammers walk away with your refund — or identity — this tax season. Learn the “dirty dozen” IRS scams that fraudsters use to steal your money and personal information, then get trusted Cyber Safety software for powerful protection against malware and scams that could lead to identity theft.

IRS scams surge during tax season. According to an IRS Criminal Investigation report, $4.49 billion in tax fraud was identified in 2025 alone. Not to mention, a study by Gen (the company behind Norton) found that AI technology is making tax scams harder to detect than ever before. In one alarming trend, scammers use AI to realistically mimic IRS agents over the phone.

Each year, the IRS compiles a list of the “dirty dozen” scams that taxpayers might encounter. In this guide, we’ll break down each one and share prevention tips to help you protect yourself and file securely.

IRS scam |

How it works |

|---|---|

Phishing and smishing |

Fake communications mimicking the IRS that aim to steal personal data. |

Bad social media advice |

“Tax hacks” on TikTok or YouTube promoting illegal deductions and loopholes. |

IRS online account help scam |

Scammers offering to “help” you set up an IRS account to steal your personal data. |

Charity impersonators |

Fake charities exploiting tax deadlines to steal donations. |

False Fuel Tax Credit claims |

Fraudulent preparers claiming fuel credits for ineligible personal vehicles. |

Credits for Sick Leave and Family Leave |

Fraudsters promoting COVID-19 credits that are no longer available in 2026. |

Bogus self-employment tax credit |

Rebranded expired COVID-19 credits marketed under a misleading name. |

Improper household employment taxes |

Inventing fictional household employees to claim fraudulent refunds. |

Overstated withholding scam |

Fake W-2 or 1099 forms with inflated withholding to trigger refunds. |

Offer in Compromise (OIC) mills |

Predatory companies charging huge fees for services you can get free online. |

Ghost tax preparers |

Unlicensed preparers who refuse to sign your return or provide their PTIN. |

New client scams |

Scammers impersonating clients to send tax pros malware-infected emails. |

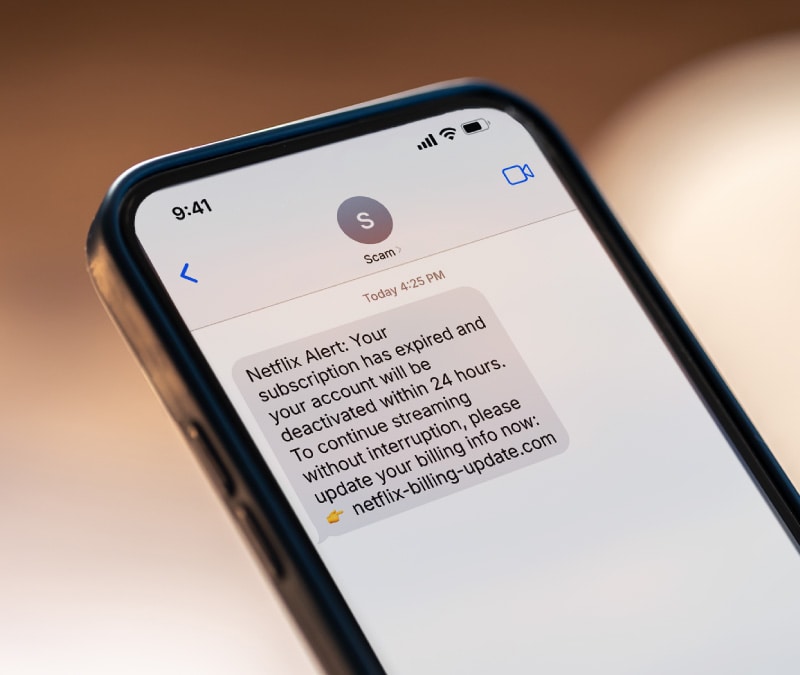

1. Phishing and smishing

Phishing and smishing (SMS phishing) scams are among the most common IRS-related threats targeting taxpayers. These scams aim to trick you into clicking on a malicious embedded link that gets you to reveal sensitive personal data or download malware or spyware.

These days, scammers can use AI to mimic official IRS language and eliminate the spelling or grammar errors people once relied on as warning signs of phishing. And if you click on a phishing link after falling for a fake message, you could be directed to a fake IRS website designed to capture any sensitive information you enter, like your Social Security number (SSN).

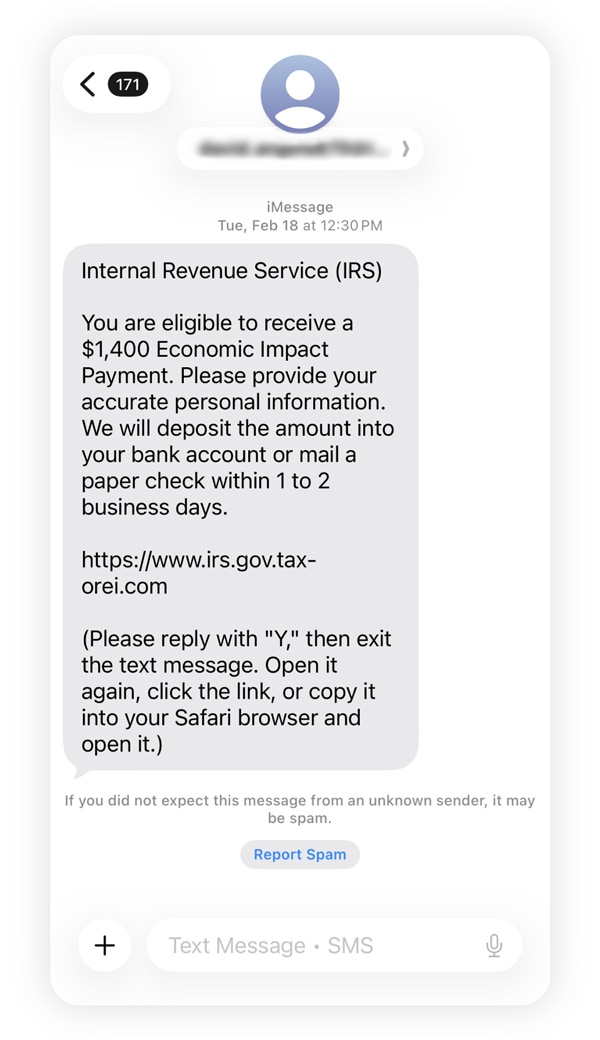

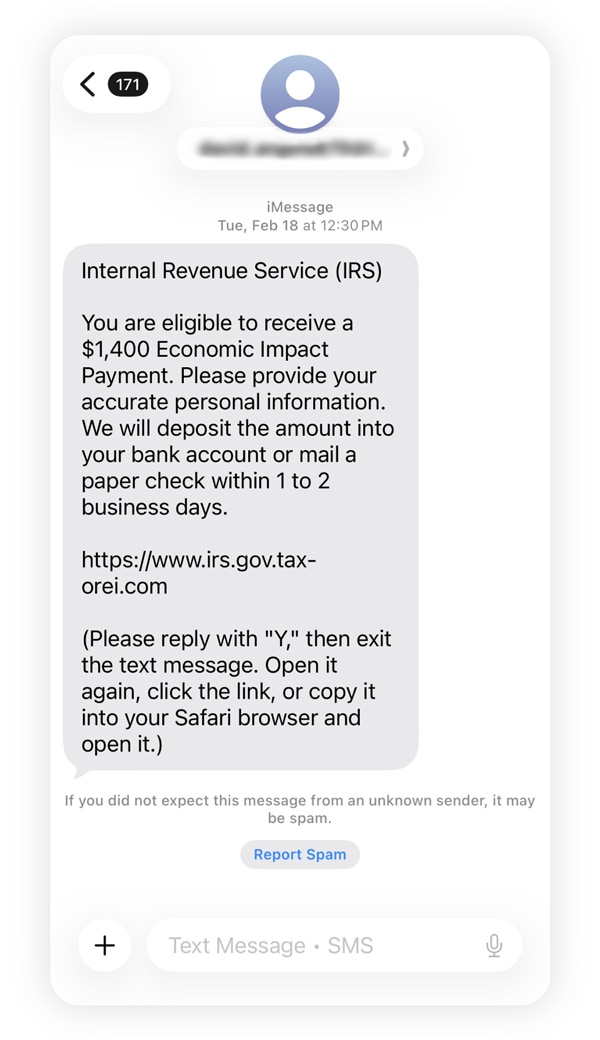

Scammers may claim you owe money or are due a refund. For example, I recently received a text claiming I was eligible for a $1,400 Economic Impact Payment. It urged me to click a link and provide personal information for a direct deposit. However, a quick check of the sender’s address and the suspicious URL confirmed it was a scam.

In the workplace, tax-related phishing scams often center around W-2 forms. Fraudsters use AI to impersonate senior executives and target HR or finance staff, asking them to send employee tax documents containing information they can use to file fraudulent tax returns and steal refunds.

What to know: The IRS initiates most contact through the U.S. Postal Service. They will generally only text or email you if you have provided explicit prior permission.

AI vishing scams

In addition to more traditional phishing schemes, researchers at Gen Digital have reported an alarming rise in AI-powered IRS voice phishing scams. A 2025 study found that 56% of survey respondents had encountered AI-powered tax scams featuring realistic voices.

Voice phishing, or vishing, is when a fraudster impersonates a trusted entity over the phone in order to trick the victim into handing over sensitive information. With AI, scammers can mimic phone calls from IRS agents or tax preparers more realistically than ever. Disclosing information like your SSN to a voice phisher can expose you to identity theft risks.

2. Bad social media advice

So-called tax gurus post all kinds of “hacks” and loopholes on social media and YouTube, but following bad advice can lead to serious tax issues and even penalties.

For example, there are risky TikToks promoting tax myths like writing off beauty maintenance expenses if you work a client-facing job, or claiming personal expenses as business deductions. If you follow this scammy social media advice and get audited, you could face penalties and a hefty tax bill.

What to know: Only take tax advice from qualified tax professionals who are registered with the IRS and hold a valid Preparer Tax Identification Number (PTIN). You can verify a tax preparer's credentials using the IRS Directory of Federal Tax Return Preparers.

3. IRS online account help scam

Scammers impersonating the IRS or a third-party might offer to “help” you create your online account at IRS.gov. Their real goal is to steal your personal information. Some may even already have some of your information on hand to make their pitch sound more convincing. If you are contacted by someone offering to help in this way, don’t verify any of your personal data, even if they seem legitimate. Hang up immediately.

What to know: To create your IRS online account, click Sign in to your online account and follow the instructions. Make sure to have a photo ID handy since the IRS uses ID.me to verify your identity.

4. Charity impersonators

Scammers create fake charities to exploit taxpayers seeking legitimate tax deductions. These fraudulent organizations typically pop up near the December 31st donation deadline or following natural disasters, such as the 2025 California wildfires. The scammers build spoofed websites that mimic legitimate charities, collecting donations while victims believe they’re supporting a good cause.

Similarly, fraudsters can take advantage of IRS tax extensions granted to disaster-affected individuals, posing as officials in order to steal sensitive information or collect fraudulent payments. The urgency and confusion surrounding relief efforts make both victims and would-be donors especially vulnerable to these scams.

What to know: Charitable donations only qualify for tax deductions if they go to IRS-recognized, tax-exempt organizations. Before donating, verify the charity’s legitimacy using the official IRS Tax Exempt Organization Search Tool.

5. False Fuel Tax Credit claims

The IRS warns against fraudulent tax preparers who convince you that you’re eligible for the Fuel Tax Credit, which is only available for businesses that purchase fuel for off-highway activities like farming, construction, and landscaping. Regular personal driving doesn’t qualify, and if you claim this credit improperly, you could face a penalty of $5,000.

What to know: The Fuel Tax Credit is available only for off-highway business and farming use, and the vast majority of taxpayers aren’t eligible. If you don’t operate heavy equipment or farm machinery, you can’t take advantage of this credit.

6. Credits for Sick Leave and Family Leave

An ongoing fraud tactic riding the coattails of the COVID-19 pandemic involves wrongly claiming credits for Sick Leave and Family Leave (Form 7202). During the pandemic, self-employed taxpayers could claim these credits, but they are no longer available. Despite this, bad social media advice urging taxpayers to claim these expired credits is still circulating online.

What to know: As of 2026, credits for Sick Leave and Family Leave are no longer available. Don’t file Form 7202 or claim these credits.

7. Bogus self-employment tax credit

Another tactic incorrectly promoting credits for Sick Leave and Family Leave involves rebranding them as a “self-employment tax credit.” Dubious tax preparers convince self-employed taxpayers that they qualify for this credit when they don’t, often charging hefty fees to file the fraudulent claim on their behalf.

What to know: There’s no general “self-employment tax credit” available as of 2026, so be wary of anyone promising you large refunds through credits related to self-employment.

8. Improper household employment taxes

In this scheme, taxpayers make up household employees that don’t exist, like nannies or house cleaners, in order to file Household Employment Taxes. They then fraudulently claim refunds based on false sick and family medical leave wages they never actually paid.

What to know: You should only claim household employment taxes if you legitimately employ someone in your home and pay their wages.

9. The overstated withholding scam

The IRS cautions that bad actors on social media are promoting a scheme where taxpayers file W-2 and 1099 forms with made-up income and fake withholding amounts to get bigger refunds. These scammers convince people to fabricate or alter their tax documents, which is tax fraud.

Variations of overstated withholding schemes typically target the following forms:

- Forms W-2 and W-2G.

- Forms 1099-R, 1099-NEC, 1099-DIV, 1099-OID, and 1099-B.

- Alaska Permanent Fund Dividend (Form 1099-MISC).

- Schedule K-1 with falsely reported withholding.

- Unspecified sources of withholding credits.

What to know: Always file complete and truthful tax returns using only legitimate information returns, such as employer-issued W-2 forms and official 1099s.

10. Offer in Compromise (OIC) mills

Offer in Compromise (OIC) is an IRS program designed to help people settle their federal tax debts for less than the full amount owed when they can’t afford to pay in full.

However, shady tax resolution companies prey on unsuspecting taxpayers, claiming they can settle debts for “pennies on the dollar.” These mills charge exorbitant fees and often target taxpayers who don’t even meet the requirements in the first place.

What to know: If you owe the government taxes, use the IRS OIC Pre-Qualifier tool to see if you’re eligible. If you do qualify, you can file your offer in your IRS online account — no help from a predatory company needed.

11. Ghost tax preparers

Ghost tax preparers are unlicensed tax professionals who prepare returns without disclosing their identity. Legitimate tax preparers are required to have a valid Preparer Tax Identification Number (PTIN) and must sign any return they complete.

If a tax preparer refuses to sign your return, this is a red flag that they’re operating as a “ghost” — someone who only wants to collect their fee before disappearing. You could be left liable for any errors or fraud on your return.

What to know: Watch for warning signs of a ghost tax preparer, like urgent or threatening language, requiring payment in cash only, and promising unusually large refunds.

12. New client scams

In addition to taxpayers, scammers are also targeting tax professionals with new “client scams.” These are a type of spear phishing scheme where cybercriminals impersonate potential clients and send emails to tax pros containing malicious links or attachments.

Their goal is to steal sensitive data from the tax professional or their clients, often to commit identity theft.

What to know: If you’re a tax professional, be cautious of unsolicited emails from “new clients,” especially if they contain attachments or links. Set up a verification call with new clients before opening any files, and use trusted antivirus software and multi-factor authentication to protect your systems.

How to identify and avoid tax scams

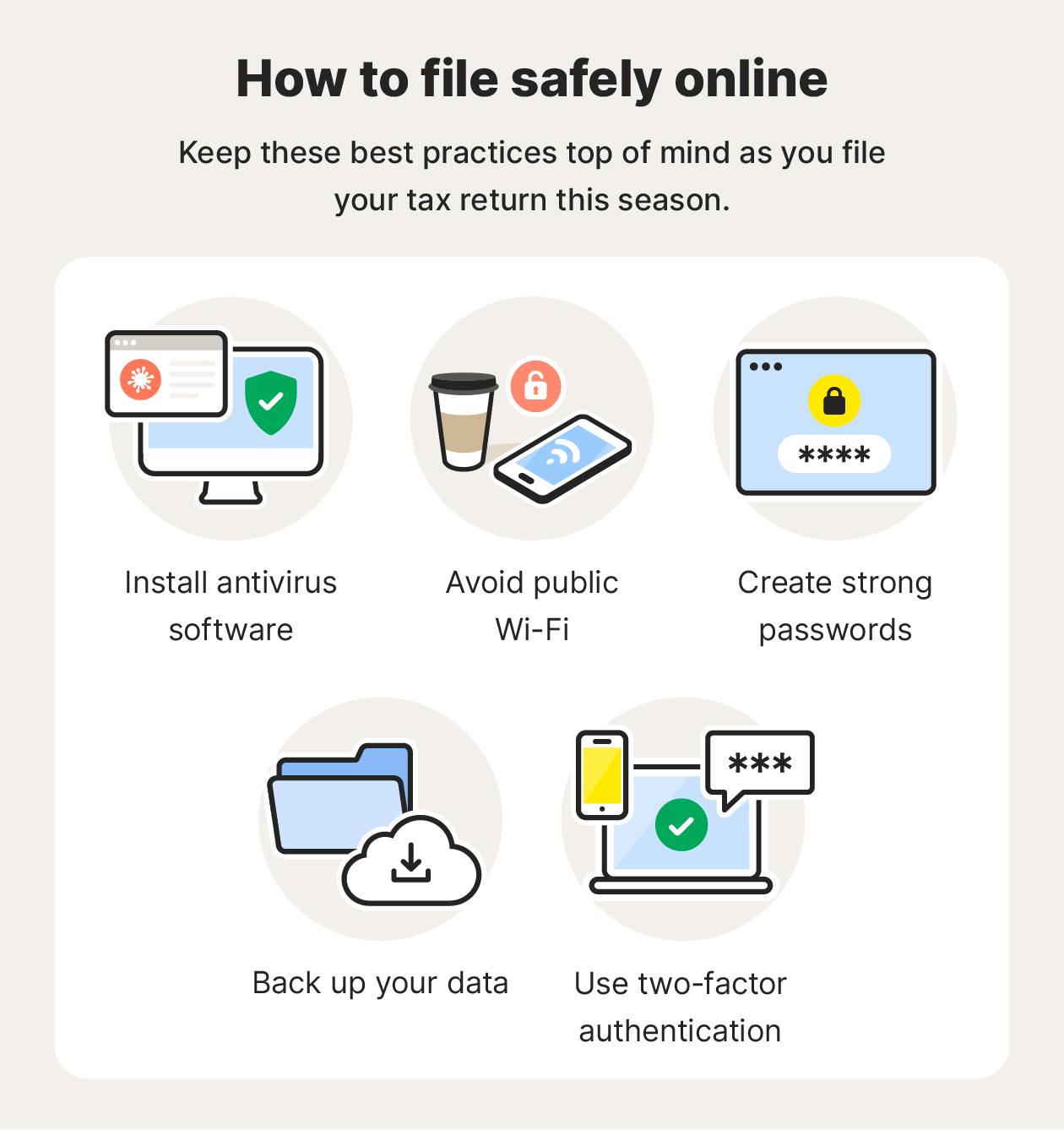

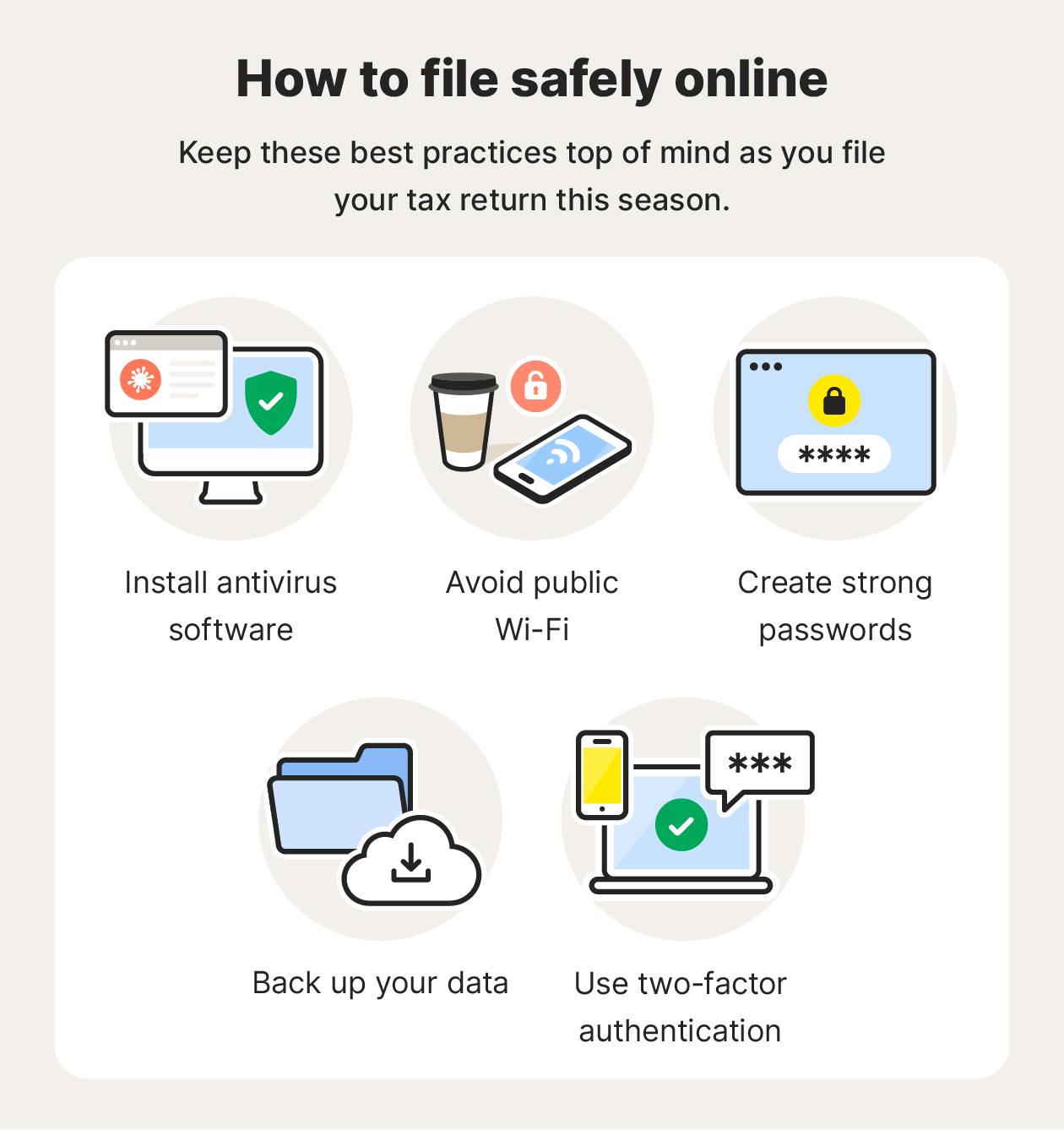

If becoming a victim of IRS fraud isn’t on your to-do list this tax season, use these scam prevention tips to file safely and protect your sensitive information.

- File early: The sooner you submit your tax return, the less likely it is that a cybercriminal can file it in your name.

- Ignore IRS emails: Remember that the IRS will never contact you via email without your permission. If there is a problem with your taxes, you will receive a letter in the mail to notify you about the issue.

- Verify communications: Don’t blindly trust people who contact you claiming they’re your tax preparer or from the IRS. If you’re ever in doubt, call the person claiming to be contacting you directly using an official phone number.

- Don’t click suspicious links: Key warning signs of malicious links include misspellings in the URL and top-level domains that are anything other than “.com,” “.gov,” or “.org”.

- Report lost or stolen cards: This can help limit the damage a criminal could cause if they were to come across your credentials after you’ve lost your wallet, for example.

- Don’t trust caller ID: Scammers may try to spoof the caller ID of the IRS to look more realistic. Remember that the IRS will never call you to demand payments or verify your credentials.

- Safeguard your personal information: Protect your Social Security number, bank account details, tax documents, and other personally identifiable information.

- Use reputable tax preparation services: To avoid scams like ghost tax preparers, ensure your tax professional has a valid Preparer Tax Identification Number.

What to do if a tax scammer targets you

If you’re the target of an IRS scam or suspect you’ve fallen victim to tax fraud, act quickly to minimize the damage and protect your identity. Follow these steps:

- Stop engaging: If a scammer contacted you via email or phone, don’t respond or answer. Block the number or email address if possible.

- Notify your bank: Alert your bank or credit card company about the situation, especially if you shared any financial information. They can monitor your accounts for suspicious activity.

- Report it to the legitimate IRS: Report tax fraud to the IRS online, forward phishing emails and texts to phishing@irs.gov, and report IRS scam calls to the Treasury Inspector General for Tax Administration (TIGTA) by calling 800-366-4484.

- Submit Form 14039: If your personal information was compromised, submit Form 14039 (Identity Theft Affidavit) to the IRS. You can also visit IdentityTheft.gov to build a personalized recovery plan.

- Contact the Taxpayer Advocate Service: Reach out to the Taxpayer Advocate Service for free assistance with next steps tailored to your specific situation.

- Monitor your credit and financial accounts: Check your credit report regularly for any unexpected changes to your credit score or unexplained accounts. Consider placing a fraud alert or credit freeze on your accounts for added protection.

Spot tax scams before they cost you

Tax scammers are getting more sophisticated every year, finding new ways to trick people into handing over their personal information and hard-earned refunds. Stay vigilant and recognize the warning signs of IRS scams to protect yourself this tax season.

For added protection, try Norton 360 Deluxe. It helps alert you to phishing attempts with AI-powered scam protection. It also helps stop malware that cybercriminals may try to sneak onto your device through fake tax websites or malicious email attachments.

FAQs

Is it safer to file taxes online or by mail?

Filing taxes online through the IRS Free File tax preparation software is generally safer than mailing paper returns. Electronic filing is encrypted, processes faster, and reduces the risk of your return being intercepted or lost in the mail.

How does the IRS actually contact taxpayers?

The IRS typically contacts taxpayers through official letters sent via U.S. mail. They’ll never unexpectedly call, email, or text you to demand immediate payment or threaten arrest.

What are the signs that my identity was used for tax fraud?

You’ll likely find out your identity was used for fraud when you try to file your tax return and the IRS rejects it because someone else has already filed with your Social Security number. Other red flags include receiving an unexpected tax transcript in the mail or IRS letters about returns you never filed.

Editorial note: Our articles are designed to provide educational information for you. They may not cover or protect against every type of crime, fraud, or threat we write about. Our goal is to increase awareness about Cyber Safety. Please review the complete Terms during enrollment or setup. Remember that no one can prevent all identity theft or cybercrime, and that LifeLock does not monitor all transactions at all businesses. The Norton and LifeLock brands are part of Gen Digital Inc. For more details about how we create, review, and update content, please see our Editorial Policy.

- 1. Phishing and smishing

- 2. Bad social media advice

- 3. IRS online account help scam

- 4. Charity impersonators

- 5. False Fuel Tax Credit claims

- 6. Credits for Sick Leave and Family Leave

- 7. Bogus self-employment tax credit

- 8. Improper household employment taxes

- 9. The overstated withholding scam

- 10. Offer in Compromise (OIC) mills

- 11. Ghost tax preparers

- 12. New client scams

- How to identify and avoid tax scams

- What to do if a tax scammer targets you

- Spot tax scams before they cost you

- FAQs

Want more?

Follow us for all the latest news, tips, and updates.