CCSPayment scams: How to recognize fake CCS notices

If you receive an unexpected message from CCSPayment, don’t pay right away; first, make sure it’s not a scam. Learn how to spot CCSPayment scams, then use Norton Money to connect your accounts, track transactions, and keep a closer eye on your finances so surprise “debts” are easier to question and verify.

An unexpected message from a debt collection agency like CCSPayment can leave you feeling panicked that you owe money. But it’s important to pause before you pay. Many scammers take advantage of that moment of fear to trick people into handing over cash or personal information. In fact, the Federal Trade Commission received over 200,000 debt collection scam reports in 2024.

Read on to learn how to spot and avoid the CCSPayment scam and what steps you should take if you receive a CCSPayment notice.

Is CCSPayment legit?

CCSPayment is a legitimate online payment portal operated by Credit Collection Services (CCS) — the debt collection division of CCS Companies. CCS is recognized as a major U.S. debt collector, with clients in sectors like banking, healthcare, education, insurance, and cable services.

However, scammers often impersonate CCS, sending fake payment requests that appear convincing. Complicating matters, CCS Companies maintains a relatively low online profile and has received over 3,700 complaints on its Better Business Bureau (BBB) page, prompting skepticism among consumers. Despite this, the company does operate a physical office at 725 Canton Street, Norwood, Massachusetts.

If you receive a debt notice from CCS or CCSPayment, don’t assume it’s legitimate by default. Always verify the claim by checking your credit report and contacting the original creditor directly before making any payments.

Why is CCS Offices calling me?

You may receive calls from CCS Offices if a creditor has hired them to collect a past-due debt. Or, the call may be a vishing (voice phishing) scam from fraudsters attempting to scam you out of money or reveal sensitive personal information. Either way, hang up the phone and take steps to confirm whether the collection attempt is legitimate or part of a scam before proceeding.

What are CCSPayment scams?

Scammers sometimes impersonate debt collection agencies, like CCS, to trick people into handing over personal information or money. These scammers may call, send spam emails, or send fake letters claiming you owe a debt and demand immediate payment.

Their goal is to pressure you to pay or provide personal information before you have time to verify the claim. They then disappear with your money or use your personal information to commit identity theft.

Here are some scammer tactics that may indicate you’re the target of a CCSPayment scam:

- Debts you don’t recognize: If the debt doesn’t appear on your credit report, you’re likely dealing with a scammer.

- Requests for unconventional payment methods: Demands for gift cards, wire transfers, or cryptocurrency are a major red flag. Legitimate agencies offer secure, traceable payment options.

- Requests for sensitive information: Scammers may claim they need your full Social Security number, bank login, or other private data upfront. Real debt collectors don’t need this information to verify or collect a debt.

- Contact at unreasonable times: Under U.S. law, debt collectors can’t call before 8:00 a.m. or after 9:00 p.m. in your local time zone. Calls outside these hours are likely scams.

- Threatening language: Scammers often use urgent, threatening language to persuade you to send money. Unfortunately, debt collectors may do the same. Either way, know your rights as a debtor and contact the Federal Trade Commission if you are being unfairly harassed or threatened.

Legitimate debt collectors are legally obligated to identify themselves and provide written validation of the debt they’re attempting to collect. They are also prohibited from using abusive, threatening, or deceptive tactics. If anything feels suspicious, you have the right to request written proof and take time to verify the legitimacy of the claim before taking any action.

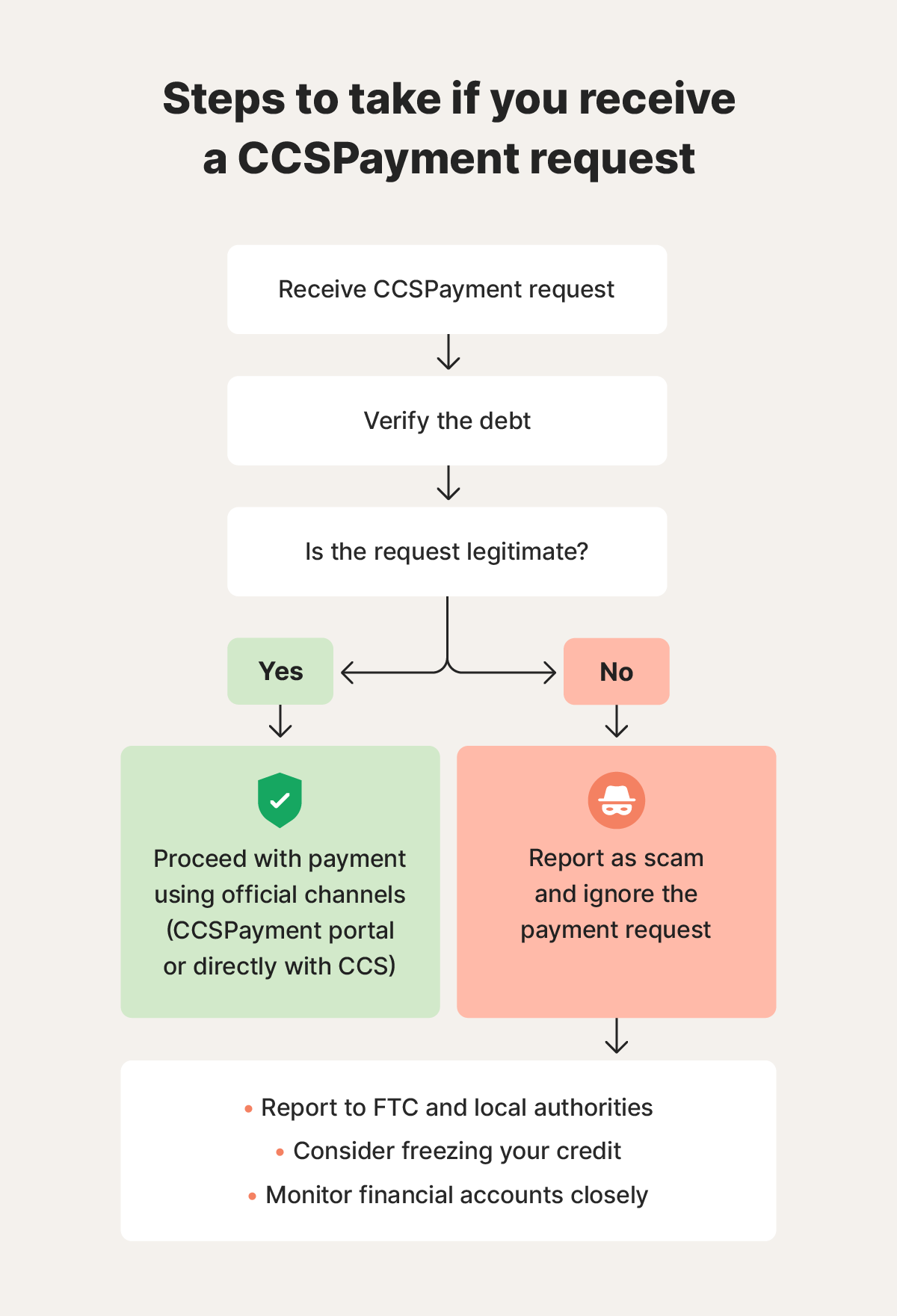

What to do if you encounter a CCSPayment request

If you receive a CCSPayment request, do not pay it immediately. Instead, take the following steps to verify whether the request is real:

- Pause before you pay: Scammers rely on urgency. Before acting, take a moment to step back and investigate the request.

- Review your credit report: Look for any accounts in collections that match the debt you’re asked to pay. If the debt isn’t listed, it’s likely a scam.

- Contact the original creditor: Reach out to the company the debt is supposedly from. They can confirm whether they’ve sent your account to collections and which agency they’ve authorized.

- Send a debt verification letter: Request written proof of the debt from CCS. Collection agencies are legally required to provide details such as the amount owed, the original creditor, and your right to dispute the claim.

To confirm that a CCSPayment request is legitimate, check that the communication includes your correct account details and contact information, and that it aligns with a real debt listed on your credit report.

You can also visit the official Credit Collection Services website or contact them directly to verify any payment request. If the details don’t line up, ignore the request and report the incident.

What to do if you fall for a CCSPayment scam

If you responded to a fake CCSPayment, taking quick action, like freezing your credit, changing your passwords, and monitoring your financial accounts, can help minimize the damage and protect your personal information. Here’s what to do:

- Report the scam: File a complaint with the Federal Trade Commission (FTC) at reportfraud.ftc.gov and notify your local law enforcement.

- Freeze your credit: Contact the major credit bureaus (Equifax, Experian, and TransUnion) to freeze your credit and prevent new accounts from being opened in your name.

- Change your passwords: If you shared any login details, immediately update passwords for your email, bank accounts, and any other affected services.

- Monitor your financial accounts: Keep a close eye on your bank statements and credit card activity. Consider using a credit monitoring service for added protection.

Help protect your finances with Norton Money

Knowing how to spot a CCSPayment scam and other fraud tactics is a great first step. But with new schemes emerging all the time, it helps to have more visibility into your day‑to‑day finances.

Norton Money is a free financial wellness app that lets you connect your accounts in one place, track spending and upcoming payments, and monitor your credit score over time. That way, unexpected changes are easier to spot, question, and address before they derail your financial goals.

FAQ

Is CCSPayment a scam?

CCSPayment itself is not a scam — it’s the online payment portal for Credit Collection Services (CCS), a debt collection agency. However, scammers sometimes impersonate CCS or use the CCSPayment name to trick people into paying fake debts.

What happens if I ignore CCS?

If you ignore CCS, outstanding debt obligations may be reported to credit bureaus, which can lower your credit score. They may also continue contacting you or escalate the account, potentially leading to legal action or wage garnishment. Take the time to verify and respond to debt repayment requests rather than ignore them entirely.

How can I tell if a debt collector is real?

Ask for a written validation notice detailing the debt amount and original creditor. Then, verify the debt by checking your credit report and contacting the original creditor directly. If someone is pressuring you to pay immediately or making threats, those are red flags that you’re dealing with a potential scammer.

CCSPayment is a trademark of Credit Collection Services (CCS), a debt collection agency.

Editorial note: Our articles provide educational information for you. Our offerings may not cover or protect against every type of crime, fraud, or threat we write about. Our goal is to increase awareness about Cyber Safety. Please review complete Terms during enrollment or setup. Remember that no one can prevent all identity theft or cybercrime, and that LifeLock does not monitor all transactions at all businesses. The Norton and LifeLock brands are part of Gen Digital Inc.

Want more?

Follow us for all the latest news, tips, and updates.