What is the Nigerian prince scam, and how can you protect yourself?

The Nigerian prince scam is one of the oldest tricks in the book. You get an email from African royalty promising a huge reward for a small fee, but the promised money never materializes. Learn the scam’s hallmarks, and find out how Norton 360 Deluxe can help you detect cleverly disguised phishing attacks.

The Nigerian prince scam starts with an intriguing email from the “prince” himself, saying he needs a little assistance securing his fortune. He trusts you with this important task and promises a handsome reward in return.

This “assistance” usually involves you sending him money or revealing your banking details. The scammer then takes the money and runs – if you’re lucky. In worse cases, they keep up the lie and try to scam you again or steal your identity. This scheme is literally older than the internet itself (it’s originator, the Spanish Prisoner scam, may date to the late 18th century), and it can cost you thousands.

Are Nigerian prince scams still a thing?

Yes, Nigerian prince scams are still very much a thing, and many people still get emails soliciting money this way. Some sources estimate these scams may rake in as much as $700,000 a year.

You might think everyone knows about these internet scams. After all, there are even memes about Nigerian prince scams. But they are still surprisingly effective at fooling people, even today. It just takes a compelling email and a little bit of temptation for people to fall victim.

These scam emails are now even easier for fraudsters to write: with scammers leaning on AI to mount more realistic and convincing phishing campaigns, you can bet that unexpected emails from generous Nigerian strangers won’t go away any time soon.

Nigerian prince scam history

The Nigerian prince scam originated as the Spanish prisoner scam back in the late 1700s. Victims were persuaded to help smuggle a wealthy individual out of a prison, after which they’d be rewarded. The sender was often a relative of that prisoner, hoping to get their cousin out of jail.

Just like in today’s version of the scam, no reward ever came.

The modern Nigerian prince scams started in the 1980s; they referenced sketchy deals made in the wake of the declining oil industry in Nigeria, and they reached their targets via fax or mail. By the mid-’90s they had evolved into scam emails.

These days, scammers use this story in phishing scams, where clicking a dangerous link can download malware to your device or take you to a malicious website.

Did you know? The Nigerian prince scam is also known as the 419 scam or 419 fraud, named after the section of the Nigerian penal code that deals with fraud. The constant association with Nigeria has stuck despite the fact that these scams are also common in the Netherlands, South Africa, and Spain, for example.

How the Nigerian prince scam works

These scams work by promising something appealing, usually money, supported by a (theoretically) convincing pretext. In addition to the Nigerian prince scam, similar tactics are used in romance scams. What both have in common is that they exploit human emotions such as greed, desperation, flattery, and urgency.

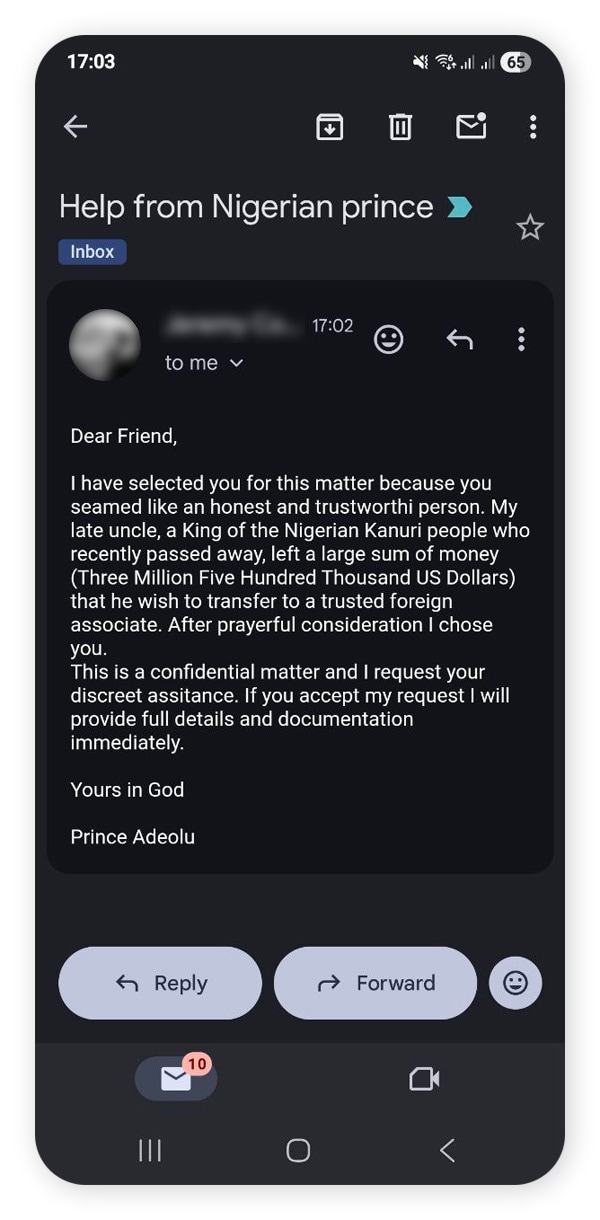

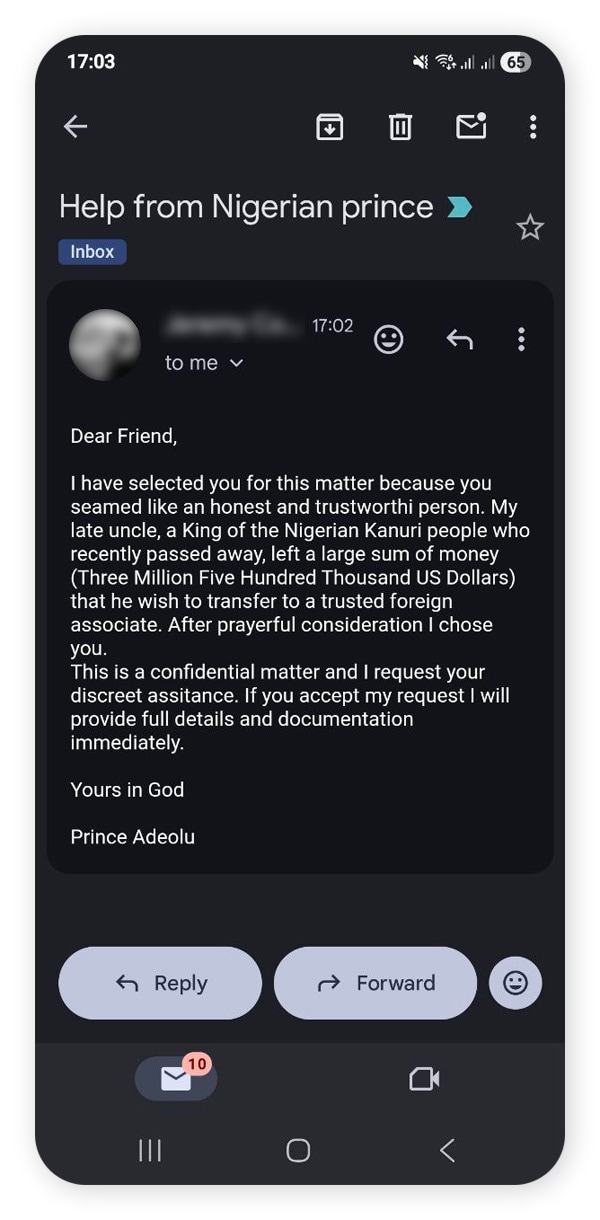

1. Initial contact

The scammer collects a list of contacts and sends these targets a message claiming to be a Nigerian prince. If your email has been exposed in a data breach and is therefore circulating on the dark web, you are more likely to end up on a scammer’s mailing list. Lists of names and emails can also be harvested from websites, posts, and social media accounts.

Only a small percentage of recipients is likely to respond – but that’s all it takes for the scammer to gain a sizable sum. Those who respond are more aggressively targeted, while those who don’t respond are simply abandoned.

2. Crafting the story

The email usually says something along the lines of “send a little money to help me retrieve my royal inheritance and I’ll give you a share of the fortune.”

The story is intriguing and confidential, making the recipient feel like they have an important, lucrative role to play. It’s this excitement that stops critical thinking. The promise of a large monetary reward is so tempting that the victim doesn't want to doubt it.

While the email may seem like an obvious example of phishing to some, scammers know that if the recipient answers it, they’re likely to send money, too.

3. Advance fee request

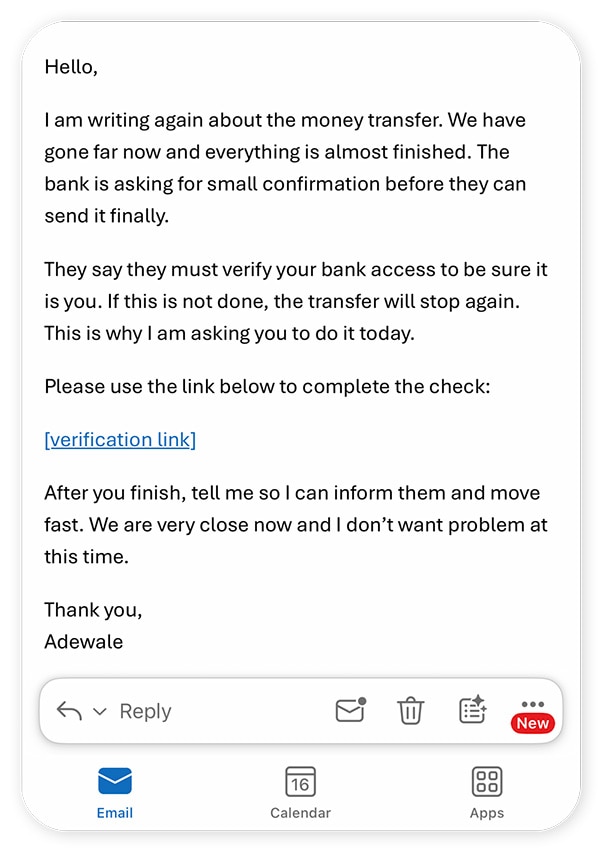

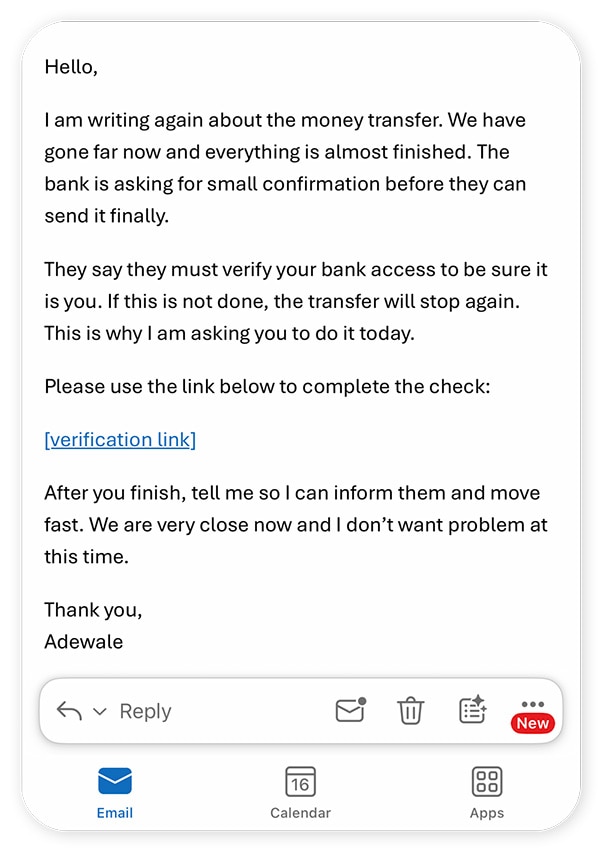

After a gradual social engineering campaign, in which the scammer manipulates the victim into trusting them, the actual payment is requested.

The scammer may say they just need a “processing” fee or have encountered some other costly hiccup due to the complex bureaucracy of their situation. In the end, they’re just taking your money. No reward arrives. They may even manage to get more payments out of you by updating you on their “situation” – but they’re just stringing you along even further.

4. Escalation and exploitation

The longer you correspond with a “Nigerian Prince,” the more they’ll take advantage of your trust. The danger starts to escalate here, as they may even try to steal your login information and take over your bank account, claiming that they need your personal or banking details for “verification.”

If they get you to click a link or download software for any reason, it could be malware designed to extract information or take control of your accounts. This could be catastrophic, potentially leading to identity theft.

Nigerian prince scam red flags

Spotting red flags of scams early helps to prevent scams from escalating. And not just Nigerian prince scams, but also fake charity scams, investment scams, and lottery scams – basically any scam that solicits a money transfer has similar red flags.

- Unexpected emails from unknown senders: If you don’t know the sender and you can’t verify any sort of connection to friends or family, there’s no reason to respond.

- Promises of money: Why would someone promise you money for doing nothing? Be wary of offers too good to be true.

- Poor grammar or spelling errors: These errors can sometimes be intentional, to filter for less skeptical recipients. You might think the sender seems unintelligent and you can mess with them, but this is actually very risky. Scammers can be dangerous.

- Requests for upfront fees or bank details: Never provide payment to a random person for something that’s promised to come later. It’s likely an advance fee fraud.

- Suspicious sender email address: If the email address looks strange, has random characters, or is pretending to be official — despite having a generic domain like gmail or aol — ignore it completely.

- Requests that you log in by clicking a link: You can always log in to the website in question by manually typing the correct URL in the address bar.

- Sense of urgency: Scammers want to rush you into clicking a phishing link before you can even think twice. No email is so urgent that you can’t look it over a few times before acting on it.

- Claims to a title or position of authority: Scammers often pretend to be government officials, executives, law enforcement, or even princes to intimidate or impress you into complying without question. Legitimate organizations don’t pressure you through unexpected emails.

- Preference for payments that can’t be refunded: Ignore scammers’ justifications for using strange payment methods, like gift cards, wire transfers, or Cash App. If they respected you or wanted to work with you fairly, they would use a reliable payment platform.

How to protect yourself from Nigerian prince scams

You can protect yourself from Nigerian prince email scams by being careful about who you respond to and what you click. Don’t reply to messages from someone you don’t know, and don’t click on any links in unanticipated messages or emails.

- Don’t click suspicious links: Don’t click links in messages or emails you aren’t expecting, even if the email looks legit at first glance. If you have an account security question, you can log in through the website by typing in its URL in your browser.

- Use spam filters: These can block many emails containing phishing links, which reduces the risk of accidentally clicking something dangerous.

- Use a scam detection tool: If you’re unsure if a message is a scam, you can use a free AI-powered scam detector to analyze it and flag potential threats.

- Never share personal or financial information with strangers: Be protective of your personal data — even seemingly harmless info like your birthday and city of residence.

- Verify suspicious messages independently before responding: Don’t reply directly to the message. Instead, contact the person or organization through a trusted channel, such as an official website, phone number, or known email address.

For more tips, read our guide on how to protect yourself from phishing.

What to do if you fall for a Nigerian prince scam

Act quickly if you fall for any scam. If you sent money on a safe platform like PayPal, you may be able to recover the funds, though it’s not guaranteed. Here’s what you should do if you’ve fallen for an email scam:

- Stop all communication with the scammer: The more you talk to them, the more chances they have of tricking you into giving up more information.

- Keep all the evidence that you can: Don’t delete messages or block the scammer yet. Screenshot as much as you can in case they suspect you’re onto them.

- Contact your bank: Explain that you’ve been scammed and ask if they can reverse the payment. Wire transfer services like Western Union should also have fraud hotlines to help.

- Freeze your credit card: If you’ve disclosed your credit card information to a scammer, freeze or block the card in question.

- Try to recover the money: If you used a payment platform like PayPal, contact their support team and see if they can reverse the payment. Also, be cautious of other possible PayPal scams.

- Report the scam: You’ll want to report to the Internet Crime Complaint Center and other relevant authorities like the FTC.

- Change your passwords and turn on two-factor authentication: You may have given them enough information to take over your accounts, especially if you clicked on a phishing link, so make moves to protect those accounts ASAP.

- Monitor financial accounts: Keep track of all transactions on your compromised accounts and your credit report. If you’ve disclosed personal information like your SSN, consider a credit freeze, too.

- Get identity theft protection: Sign up for a service that will help you reduce or even reverse the damage of identity theft. You’ll gain peace of mind knowing a team of experts has your back.

Stay a step ahead of scammers with Norton

Falling for a scam can be a massive emotional and financial headache, so you can never be too careful when it comes to prevention. Fortunately, Cyber Safety software can help reduce the guesswork when you’re sussing out scams in your inbox.

Norton 360 Deluxe combines powerful device security with AI-powered scam detection that can help warn you about dangerous links, messages, and websites — even when they look totally legit to the naked eye.

FAQs

When did the Nigerian prince scam start?

The Nigerian prince scam started back in the 1700s. At that time it was by mail and the story involved a wealthy relative stuck in a Spanish prison. Help pay the bribe, get the cousin out, and receive the reward. Same scam, different characters.

How do you know if you’re chatting with a scammer?

You can tell you’re chatting with a scammer if they’re pressuring you, they’re making the situation seem urgent, their story is inconsistent, they can’t video chat or provide proof of their identity, and they change the subject quickly (to investments and trading, for example).

Do Nigerian prince scams actually come from Nigeria?

Not necessarily. You’re just as likely to be scammed from someone in another country, like the Netherlands, Ghana, India, or Germany. Scammer rings can be based anywhere. Worse, a scam operation can employ dozens of people, all working hard to steal your money.

Can opening a Nigerian prince scam email infect my computer?

No, nothing can infect your device if all you’ve done is open the email or text message. The danger comes when you respond, click a phishing link, or download an attachment.

Editorial note: Our articles are designed to provide educational information for you. They may not cover or protect against every type of crime, fraud, or threat we write about. Our goal is to increase awareness about Cyber Safety. Please review the complete Terms during enrollment or setup. Remember that no one can prevent all identity theft or cybercrime, and that LifeLock does not monitor all transactions at all businesses. The Norton and LifeLock brands are part of Gen Digital Inc. For more details about how we create, review, and update content, please see our Editorial Policy.

Want more?

Follow us for all the latest news, tips, and updates.