Is Apple Pay safe? What to know before double-clicking

Apple Pay makes shopping fast and easy, but can you trust it with your personal and financial data? In this guide, we’ll unpack Apple’s built-in security features and offer tips to strengthen your mobile payment protection. For added peace of mind, we’ll also show how Norton 360 Deluxe can help secure your Apple devices against cyber threats.

Apple Pay is a contactless mobile payment system that allows users to make purchases with the tap of their iPhone, Apple Watch, or other device. With more than 60 million users in the US, using Apple Pay is becoming the norm. But if you’re security conscious, you might hesitate before loading your credit card into your phone.

In this article, we’ll break down Apple Pay’s security features and examine whether it’s as secure as it seems.

How secure is Apple Pay?

Apple Pay is considered a secure way to make purchases, thanks to built-in privacy and security features that prevent merchants — and even Apple — from seeing your card details. That said, no payment system is totally risk-free. Scammers can exploit user mistakes or weak security practices, so Apple Pay users still need to take precautions to keep their digital wallet safe.

Is Apple Pay safer than a credit card?

In many scenarios, Apple Pay is more secure than using a physical credit card. That’s largely because Apple Pay uses tokenization, which replaces your real card number with a one-time code during each transaction. That means your actual card details are never shared with merchants, reducing the risk of data theft from compromised payment systems or card skimmers.

Physical cards expose your card number with every swipe or tap and can easily be used fraudulently if lost or stolen, especially now that most issuers no longer require signatures. Apple Pay, on the other hand, adds a robust layer of protection by requiring Face ID, Touch ID, or a passcode, making unauthorized transactions significantly harder.

Apple Pay’s security features explained

Apple Pay protects user data with multiple built-in security features, including passcode and biometric authentication, encryption, tokenization, and its Lost Mode feature. Here’s a closer look at the safeguards that help keep your information secure when using Apple Pay.

Passcode and biometric authentication

Apple Pay uses secure authentication methods like passcodes and biometrics to protect your payments. To enroll in Apple Pay, you must first set up a passcode on your device. You can also use Face ID or Touch ID to authorize payments quickly and securely.

These authentication methods help ensure that only you can access and use Apple Pay on your device, so your finances are protected even if your device ends up in the wrong hands.

For physical cards, you’d need an RFID blocking wallet to get anything close to this level of unauthorized payment protection, and even that won’t help if your wallet gets lost or stolen.

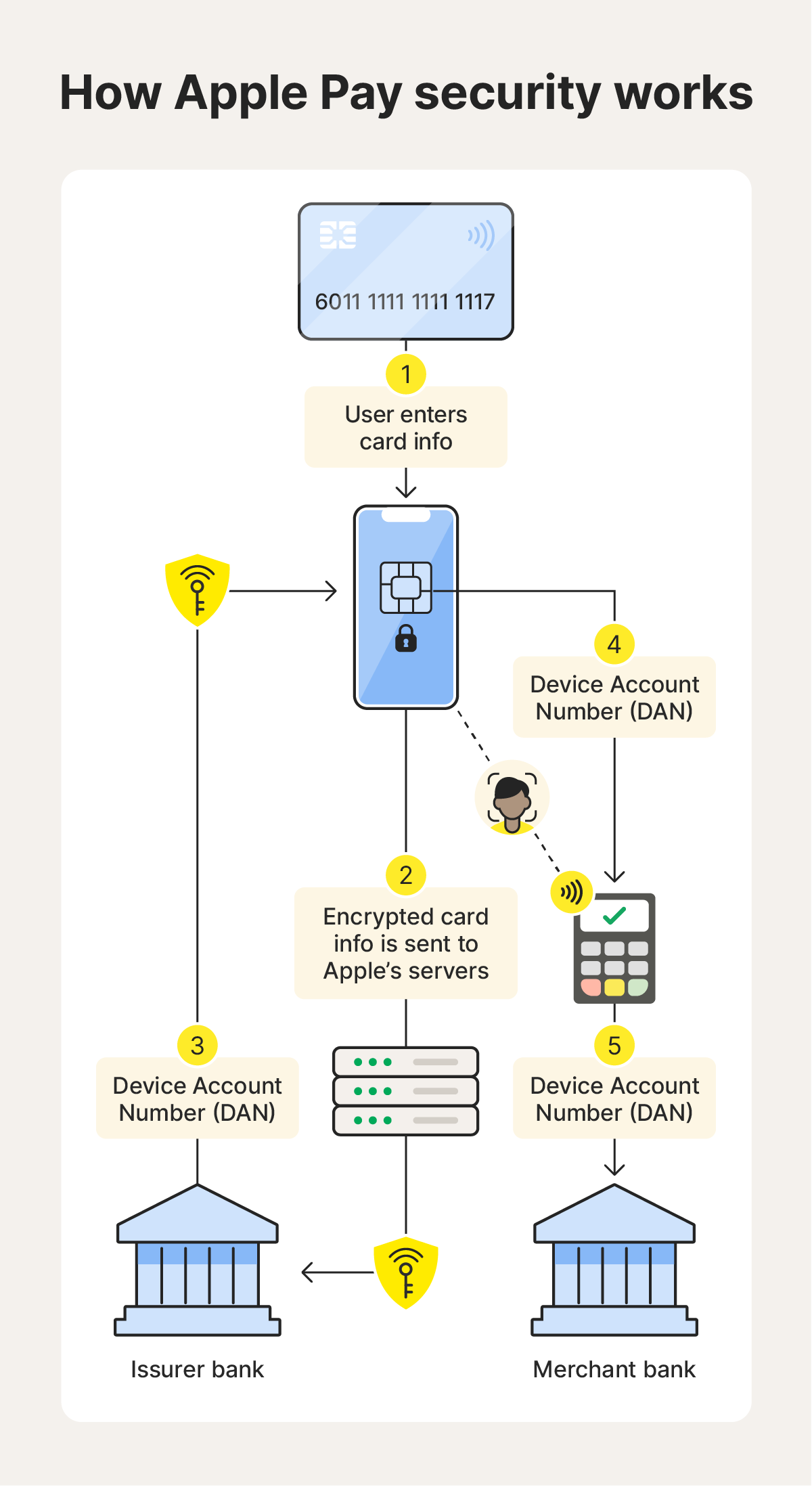

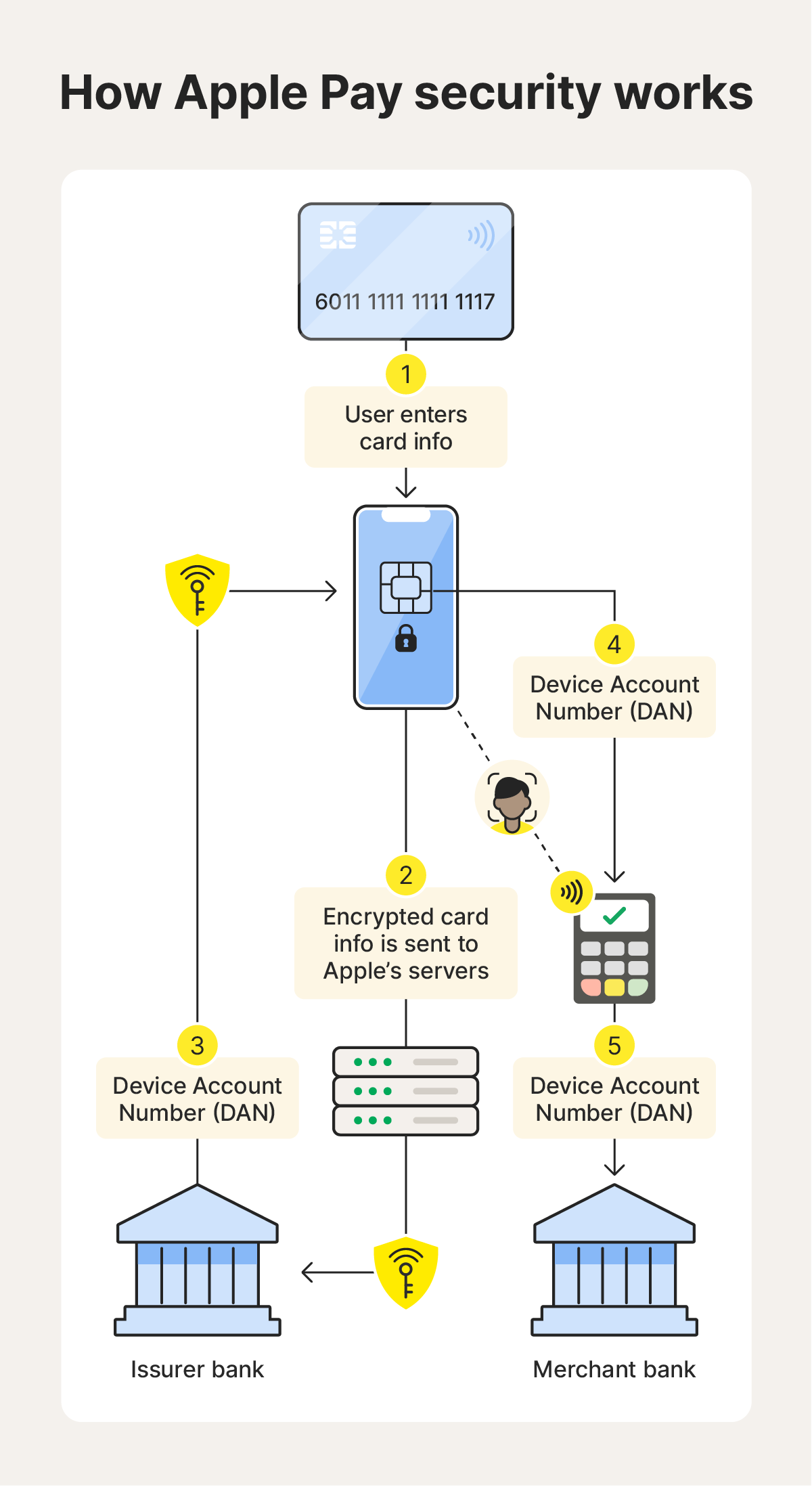

Apple Pay uses tokenization to protect your card details and other sensitive information. Instead of storing or transmitting your actual card number, Apple Pay generates a device-specific token that’s securely stored on your device.

During a purchase, that token is combined with a unique transaction code, ensuring your real card number is never shared with merchants or stored on Apple’s servers. Think of it like using a poker chip at a casino — it represents real value but can't be used outside that system.

By replacing sensitive data with randomized tokens, Apple Pay significantly reduces the risk of unauthorized access and data breaches. Even if a breach occurs, these tokens are useless to cybercriminals.

Encryption

Apple Pay also uses end-to-end encryption to safeguard your payment information. When you add a card to Apple Pay, your device encrypts the card details before sending them to Apple’s servers. Apple decrypts the information to determine your card’s payment network, then re-encrypts the data using a key that only your bank can unlock.

Your bank or card issuer then generates a unique, encrypted Device Account Number as a stand-in for your actual card number and sends it back to Apple. This number is stored securely on your device in the Secure Element, and even Apple can’t decrypt it.

Encryption is a cornerstone of Apple Pay’s security architecture, helping to ensure that sensitive data stays protected and reducing the risk of credit card fraud or identity theft — even if the data is intercepted during transmission.

Lost Mode feature

Apple’s Lost Mode feature, available in the Find My app, helps protect your device and Apple Pay if your iPhone, iPad, or Apple Watch goes missing. When you enable Lost Mode, your device locks remotely with a passcode, displays a custom message with a contact number, and disables payment cards and passes in your Apple Wallet.

You should activate Lost Mode as soon as you notice your device is missing by following these steps:

- Navigate to iCloud.com/find.

- Select the lost device from the All devices list.

- Tap Mark As Lost, then follow the on-screen instructions.

If you recover your device, you can easily resume using Apple Pay by turning off Lost Mode via the Find My app.

Are there risks to using Apple Pay?

While Apple Pay is widely regarded as a secure mobile payment option, it’s still important to understand the potential risks, many of which stem from user behavior and social engineering rather than flaws in the technology itself.

Here are some of the most common threats:

- Apple Pay scams: Scammers may use social engineering techniques to pose as a friend, family member, or seller to trick you into sending money. These scams often occur through text messages, emails, or social media.

- Phishing: Hackers may attempt to steal your Apple ID login credentials through phishing emails or fake websites. With access to your Apple ID, they could potentially make unauthorized purchases or access Apple Pay.

- Malware and spyware: Contrary to popular belief, Apple devices are not immune to malware — especially if the device is jailbroken or used to install apps from untrusted sources. Malware can expose personal data or compromise device security.

- Device theft: If your iPhone or Apple Watch is stolen and secured with a weak passcode (e.g., 1234) or no biometric protection, a thief could potentially use Apple Pay. This risk increases if you don’t activate Lost Mode quickly.

- Data breaches: Although Apple hasn’t had a major data breach affecting Apple Pay, no system is entirely immune. That said, the risk remains low because Apple doesn’t store actual card details or personal data on its servers — everything is encrypted and securely stored on the device itself.

How to use Apple Pay safely

To use Apple Pay safely, it’s essential to secure your device, stay vigilant against scams, and regularly monitor your transactions. While Apple Pay includes strong built-in protections, your personal cybersecurity habits play a critical role in maintaining security.

Here are key practices to help you use Apple Pay safely:

- Choose a strong passcode: Opt for a six-digit passcode instead of the standard four-digit code to make unauthorized access harder.

- Enable Face ID or Touch ID: Biometric authentication adds another layer of security and is more difficult to bypass than a passcode alone.

- Set up Find My iPhone: Make sure Find My is enabled on your devices so you can activate Lost Mode if your phone is lost or stolen.

- Keep iOS up-to-date: Always install the latest iOS software updates, which often include vital security fixes that help protect your device and data.

- Watch out for Apple Pay scams: Be cautious of payment requests and suspicious links, especially if they’re from unknown sources.

- Monitor your transactions: Check your Apple Pay activity regularly to catch any unauthorized charges early. Consider enabling payment alerts from both your bank and Apple Pay.

- Hide your email: With Apple’s “Hide My Email” feature, you can mask your real email during online purchases. It’s a smart way to protect your privacy and reduce tracking.

- Avoid unsecured networks: Don’t manage payment settings or send money over unsecured public Wi-Fi. If necessary, use a secure VPN to protect your data from interception.

Protect your payments with Norton 360 Deluxe

Apple Pay offers strong built-in security, but adding an extra layer of protection is always a smart move. Norton 360 Deluxe helps secure your devices and financial data with powerful tools like a secure VPN, AI-driven scam detection, and advanced antivirus. It’s an all-in-one solution to help keep you and your money safer online.

FAQs

How does Apple Pay work?

Apple Pay uses Near Field Communication (NFC) technology to enable secure, contactless payments. When you hold your iPhone or Apple Watch near a compatible payment terminal, the NFC chip transmits encrypted payment data to complete the transaction. A unique Device Account Number and a one-time security code are used for each purchase — your actual card number is never shared.

Can your Apple Pay get hacked?

The Apple Pay system itself has never suffered a hack, but if your device is compromised through phishing, weak passcodes, or malicious apps, someone could potentially use it fraudulently. That’s why it’s essential to secure your device with strong authentication and keep your software up to date.

Can card skimmers read Apple Pay?

No, card skimmers are designed to capture data from the magnetic stripe on physical cards, which Apple Pay doesn’t use. Since Apple Pay transmits encrypted data via NFC, it cannot be skimmed in the same way as a traditional credit or debit card.

Does Apple Pay have fraud protection?

While Apple doesn’t offer its own buyer protection, Apple Pay transactions are typically covered under your card issuer’s fraud protection policy. This means if you experience unauthorized transactions, you can usually dispute them just as you would with your physical card.

Is Apple Pay safe if I lost my phone?

Yes, Apple Pay remains secure if you lose your phone, as it requires Face ID, Touch ID, or your passcode to authorize payments. However, if someone can guess your passcode, there is a risk. To prevent misuse, activate Lost Mode using the Find My app to lock your device and disable Apple Pay remotely.

Apple Pay is a registered trademark of Apple Inc.

Editorial note: Our articles provide educational information for you. Our offerings may not cover or protect against every type of crime, fraud, or threat we write about. Our goal is to increase awareness about Cyber Safety. Please review complete Terms during enrollment or setup. Remember that no one can prevent all identity theft or cybercrime, and that LifeLock does not monitor all transactions at all businesses. The Norton and LifeLock brands are part of Gen Digital Inc.

Want more?

Follow us for all the latest news, tips, and updates.