17 job scams to look out for

Postings on job boards can seem exciting, lucrative, and even easy. Sadly, some are scams. Learn 17 types of job scams and how to spot them. Then, get protection against common scams and resulting malicious threats from Norton, the #1 most trusted brand in consumer Cyber Safety, which blocks millions of cyberthreats daily.

Online job scams are a growing threat to job seekers. Often promising easy remote work or quick cash, many of these fake postings are veiled attempts to steal your personal information or fool you into paying upfront fees.

Since 2020, online job scams have surged dramatically. One type of job scam, the so-called “task scam,” went from zero FTC reports in 2020 to over 20,000 in the first half of 2024 alone.

Now more than ever, it’s important to be vigilant when browsing job listings online. In this article, we’ll walk you through 17 common job scams and share practical tips to help you stay safe.

1. Fake job listings

Fake job listings are just that — ads for nonexistent jobs posted on legitimate job boards, designed to steal personal information or solicit upfront fees for applications or training. These common online scams target a vulnerable population — job seekers and unemployed people — who may be so desperate to find work that they don’t notice subtle red flags.

Fake job listings can appear on sites like Indeed, Trabajo, and even LinkedIn. Some may copy-paste real job listings posted mere months before, changing the contact information so job seekers contact scammers instead of the actual company.

2. Imposter scams

In impostor scams, fraudsters pose as a legitimate, well-known company as a form of social engineering. However, closer inspection often reveals that the company’s website, email domain, and modes of communication don’t look so legit.

One Redditor was contacted by a scammer who was posing as a legitimate German company. While the scammer had gone to great lengths to impersonate the organization, the would-be victim suspected fraud when asked for their bank details — an immediate red flag for a scam.

3. Work-from-home and remote job scams

Scammers love to advertise remote work, often promising easy income from the comfort of your home. These offers may appear in job listings, emails, social media posts, or messaging apps like WhatsApp. But behind the appealing pitch, scammers are usually after your money or personal information.

Some remote job scams may involve sketchy multilevel marketing schemes promising to let you “be your own boss” — as long as you first purchase large amounts of products to resell or recruit others to join the same scheme.

One work-from-home scam offered an easy, too-good-to-be-true travel agent job that involved paying for your own training and convincing your friends and family to let you book their travel through the sketchy organization.

In another recent incident, the applicant landed a remote data entry job with surprising speed. After a brief interview with someone who spoke poor English, they were offered the job and told to purchase equipment upfront, with the promise of reimbursement. Fortunately, they were able to guess that something was fishy before moving forward with the job offer.

If you are working from home or looking to work from home, review our work-from-home security tips to ensure you’re working securely.

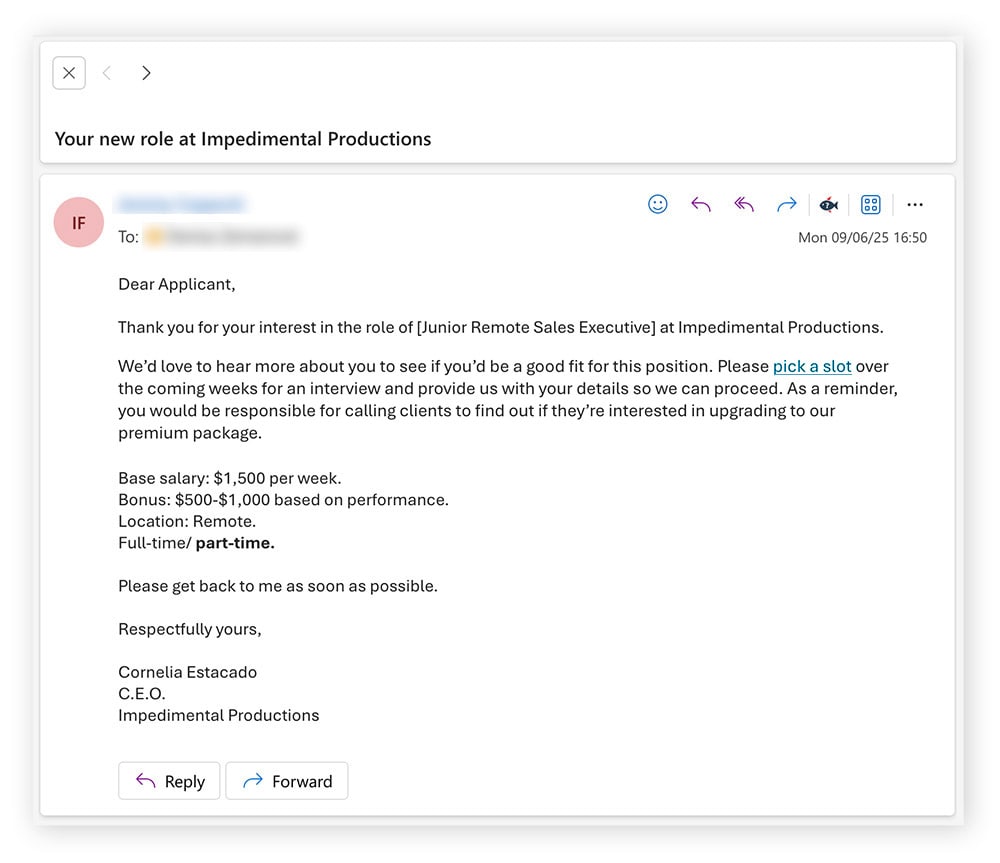

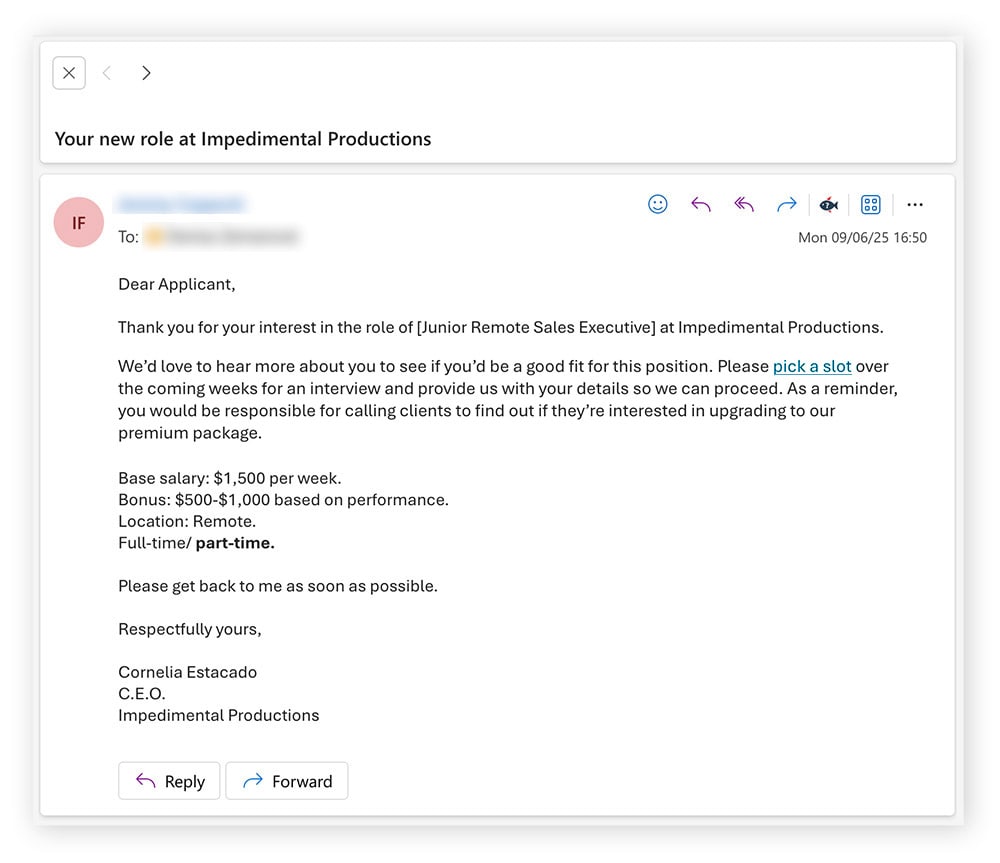

4. Fake job emails

Unsolicited job offers sent via email often promise high pay with minimal effort — but in truth, they’re phishing scams meant to entice you to send money or personal information.

One example is the website edhcareers.com, which started sending out job offers via email just days after registering its domain name. The emails promised a check to cover equipment costs if the recipient signed a letter and submitted copies of their ID. In truth, the site was run by scammers seeking sensitive personal data.

Email scammers may target job hunters who make their email visible to the public on employment websites, so be very cautious about what information you share online. The Privacy Monitor feature included in Norton 360 with LifeLock plans can help you remove personal information from the internet, helping you mitigate your exposure to scams and spam.

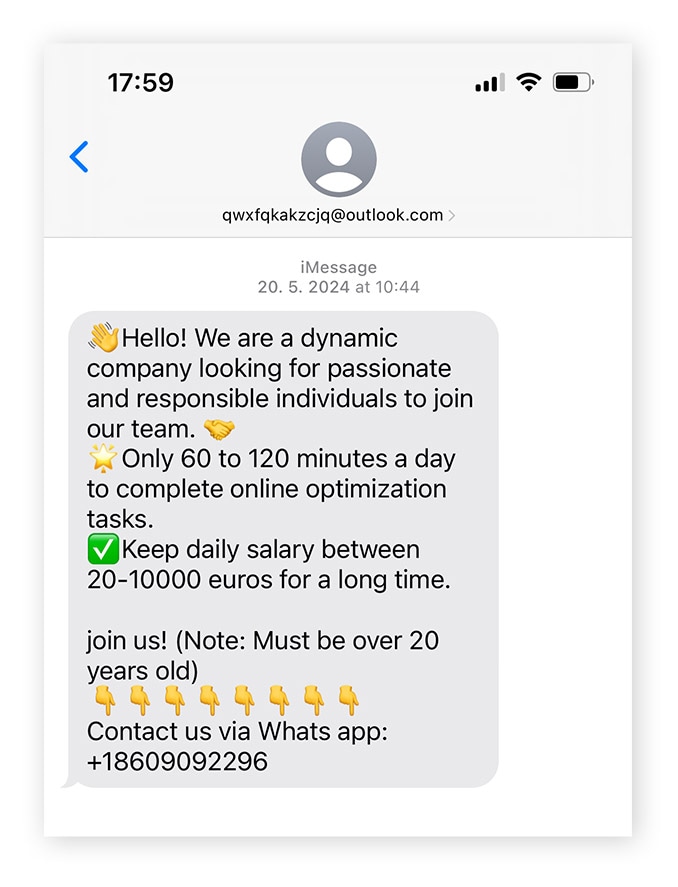

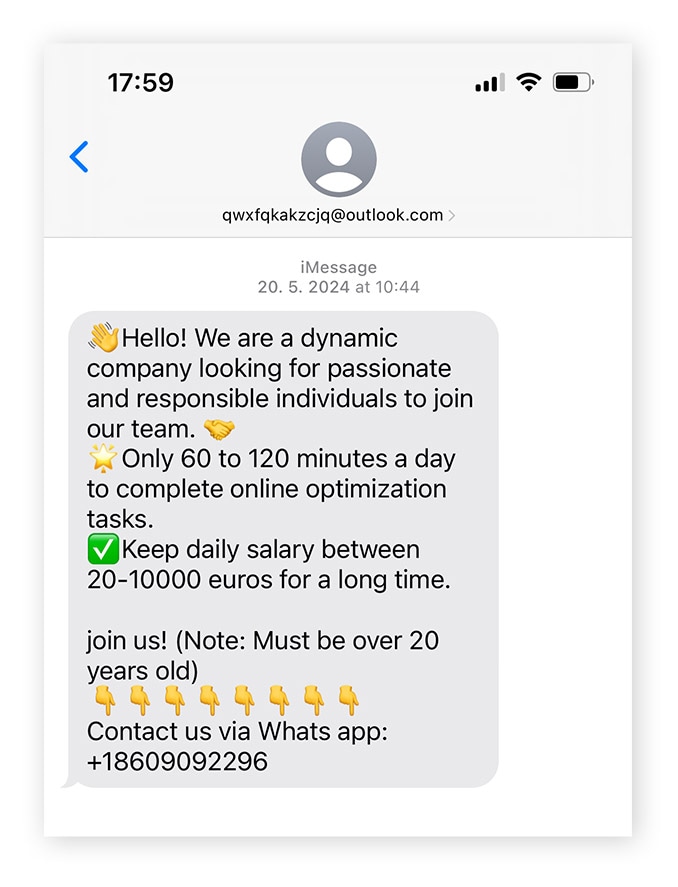

5. Fake job text messages

You may receive scam job offers via SMS in a type of phishing attack known as smishing. Whether it’s an invitation to apply or a straight-up job offer, these text messages want you to act quickly so you don’t think twice. Usually, the end goal is to steal your personal information or get you to click on malicious links.

Below is a real-life example of a fake job text proposing a big payout for easy work, complete with eye-catching — but unprofessional — emojis.

6. Fake check scams

In fake check scams, fraudsters posing as employers send bad physical checks or e-checks to “pay” for work, equipment, or training. The check may be accepted at first, but within a few days, your bank will flag it as a fake and reverse the deposit.

This type of scam is often accompanied by a remote job scam, and involves an “employer” demanding you order your work equipment from a specific site, then they’ll reimburse you for whatever you buy. But, the scammer runs the site, and once you order the equipment, the “reimbursement” check never arrives.

One company hiring a video editor sent a check over email for the purchase of a laptop and editing software. The awkward wording in the “employer’s” communications, along with the emailed check, are major red flags of a scam.

7. Fake job consultations

Scammers posing as career consultants may charge fees for fake coaching, job placements, or resume services. Unfortunately, instead of a polished resume or better interview preparation, you end up hundreds or even thousands of dollars poorer with nothing to show for it.

In one job consultation scam, a victim was scammed out of $500 after paying for fake career consultation services.

8. Informational material scams

Much like career consultant scams, these schemes charge a fee for job-hunting or career advancement materials that are either useless or readily available for free online. Job seekers eager for an edge — especially those feeling desperate — are particularly vulnerable.

9. Fake certification training

These scams mirror fake job consultations and informational material schemes, but with a specific hook: paying for certification training. You’re promised credentials or expert hands-on experience that will boost your job prospects, often with a sense of urgency like “limited-time discounts” or claims of industry recognition. But once you pay, you either receive nothing or access to low-quality content that’s freely available elsewhere.

In one example, an online course promoted on Facebook claimed to offer certification backed by two official-sounding governing bodies. The course came with a discounted price and polished marketing, but the material turned out to be low-effort, AI-generated content with no real value or accreditation.

10. Mystery shopper scams

A job as a mystery shopper might sound easy and rewarding, but it’s also a common trap used by scammers. In these scams, you’re asked to make purchases or send money upfront with the promise of reimbursement. But the payment never comes, or the reimbursement check bounces. Mystery shopping is also a common Amazon scam.

In one example, a victim was hired as a “phone shop evaluator” and instructed to sign up for a phone contract as part of the assignment. Instead of being reimbursed or paid, they were left with a binding contract and monthly payments that they had to cover themselves.

11. Fake grants

This scam offers government-backed grants or scholarships to pay for higher education or career development. Usually sent via email, fake career advancement grants often include links to official government sites and promise direct deposits into your account. However, the application isn’t real, and you may end up receiving a bad check or being fooled into disclosing sensitive personal information.

In one fake grant scam disguised as a scholarship offer, the scammer sent a check and asked the recipient to forward a portion of the funds to a “person in need.” To make the scam sound legitimate, they even cited a fake federal law authorizing the grant. Had the recipient followed through, the check would have bounced, and the money supposedly meant for charity would have gone straight to the scammer.

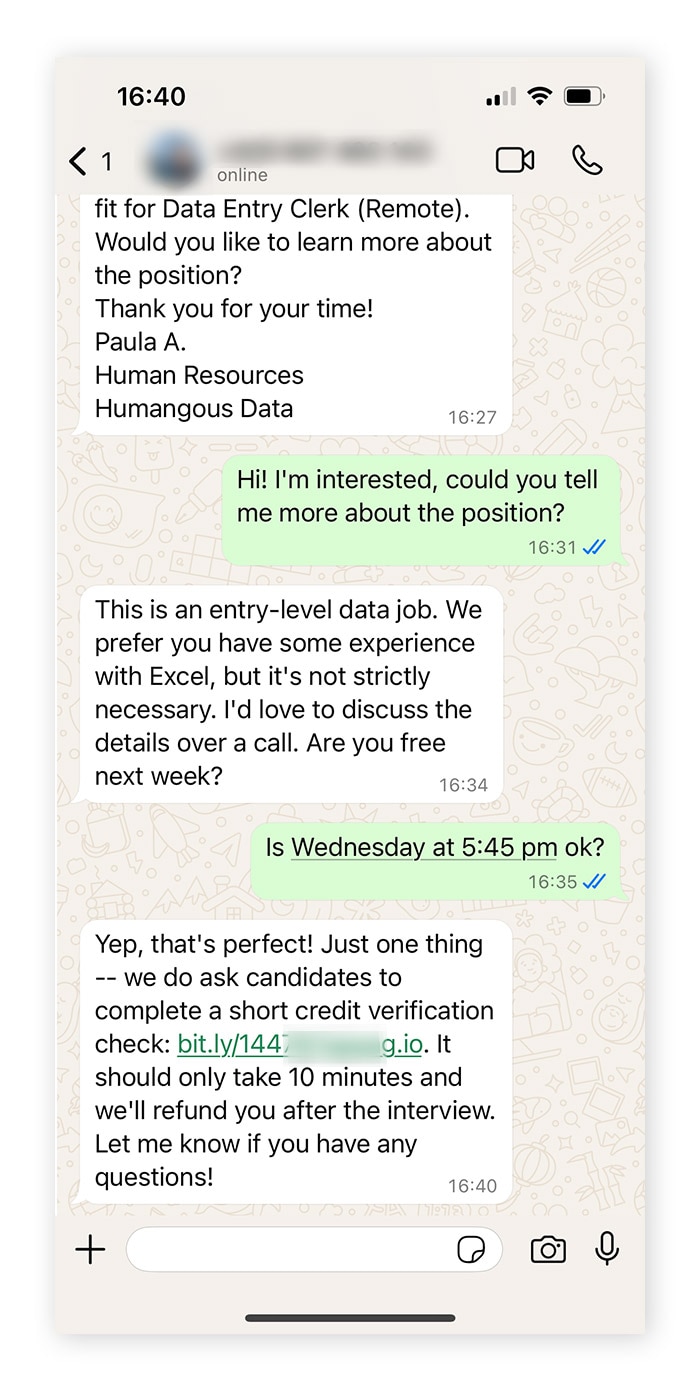

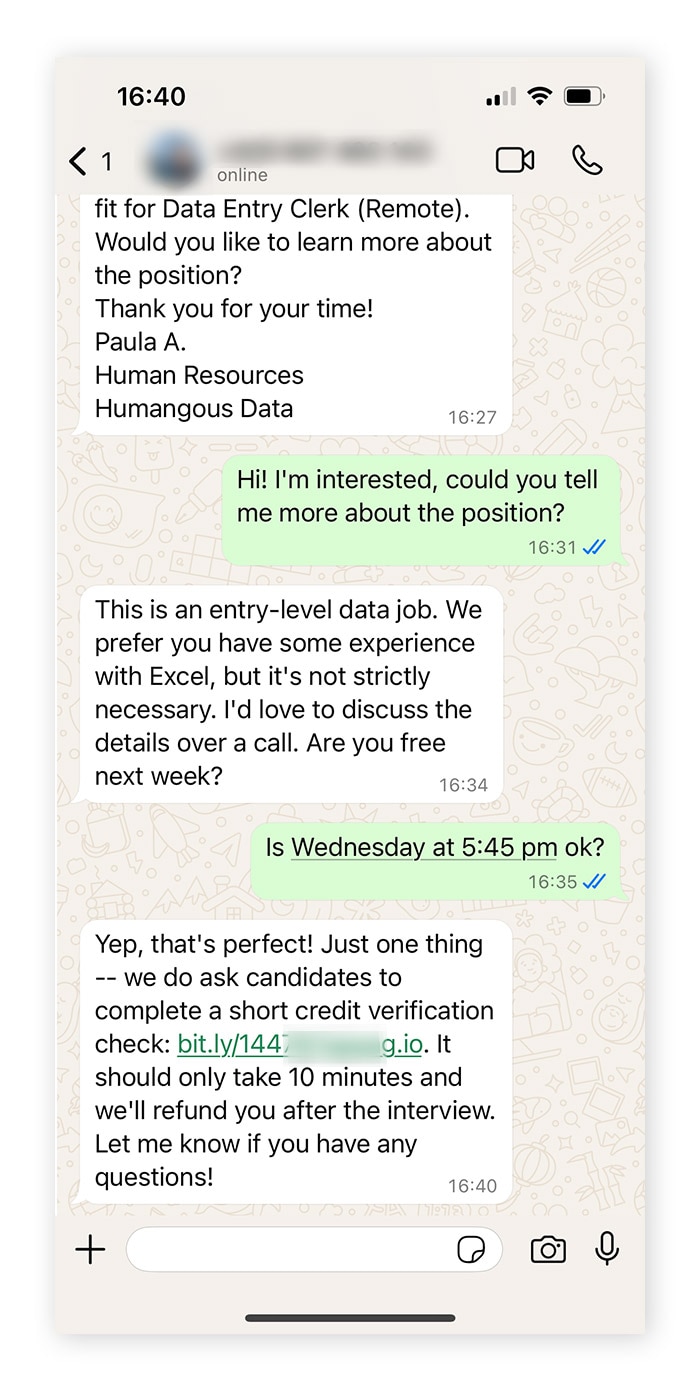

12. Credit report verification scams

In credit report verification scams, fake employers claim they need a credit check, tricking victims into paying for unnecessary reports or revealing personal information. In one example, a fraudulent employer sent a text message, requiring a candidate to pay for a credit check, and promised to refund the cost.

13. Money laundering scams

Money laundering scams often appear as legitimate job offers — usually with titles like “financial agent,” “payment processor,” or “transfer manager.” These roles typically promise easy money for simple tasks, such as receiving payments into your bank account and forwarding the funds elsewhere, often overseas.

What scammers are really doing is using your personal bank account to “clean” stolen money. Even if you’re unaware of the scheme, participating in these transactions can expose you to serious legal consequences. In one example, an innocent victim in the UK ended up getting their personal bank account frozen for accidentally laundering money.

14. Online interview messaging scams

In this type of scam, the “interview” is conducted entirely through an online messaging platform — often one that asks you to submit personal information just to join. Scammers use this setup to collect the data they’re really after, such as your address, Social Security number, or banking details.

Some versions of this scam may also involve vishing (voice phishing), where the scammer calls or messages you under the guise of an interview to pressure you into handing over sensitive information or money.

For example, one victim interviewed for a remote data entry job via Zoom, but only through the text chat feature. During the exchange, the interviewer requested their bank account details and promised to send a check to reimburse equipment costs. The check never came.

15. Reshipping scams

Often advertised as work-from-home opportunities, reshipping scams offer an attractive salary for repackaging and reshipping goods, plus compensation for shipping fees. These items are often stolen goods, and you may not receive the compensation you were promised — all while facilitating criminal activities.

In one reshipping scam, a company called Framizar sent some possibly-stolen gold to a victim as part of a “home store manager” position, a job they hadn’t even applied for. The recipient of the gold was advised to contact law enforcement and refrain from reshipping the package.

16. Fake government jobs

These scams mimic real government job postings, using the appearance of authority to lure in victims. The scammer may impersonate a federal agency and request sensitive information or upfront fees for processing, background checks, or training — none of which are required for legitimate government roles.

In one example, a scammer advertised a job with a fake division of the Department of Homeland Security via text message. The message was riddled with red flags, including vague job details, urgent language, and a request for personal documents before any formal hiring process had begun.

17. Task scams

A growing type of remote job scam involves so-called task-based jobs, where you're asked to download an app and complete simple tasks for money. Some versions require you to make a deposit into the app upfront or after completing a few initial tasks.

As you progress, your displayed “earnings” appear to grow, creating the illusion of real income. But eventually, you’re told you must deposit more money, often in cryptocurrency, to unlock your next tasks or withdraw your earnings. Of course, those earnings never materialize, and your deposit is gone.

In one task scam, a company calling itself Loyalty Lion offered product review work, and the victim did several tasks before being told to deposit money into their account to access earnings. Luckily, the would-be victim caught on to the task scam before they deposited any money.

How to identify fake job offers

Fake job scams may be varied, but the telltale red flags are often similar. Here’s how you can identify pretty much any fake job scam:

- The offer sounds too good to be true: If the salary seems unusually high for the job title, or the role promises big pay for little effort, it’s likely a scam.

- Interviews conducted via messaging apps: Legitimate employers typically conduct interviews in person, over the phone, or through video platforms like Zoom — not via messaging apps like WhatsApp or Telegram.

- Unprofessional emails with no contact details: Although AI helps scammers create more convincing fraudulent messages, you should still be wary of emails that contain unnatural phrasing, emojis, overly casual (or overly formal) language, or lack contact information for the company. These are common signs of fraudulent communication.

- Vague or inconsistent job descriptions: Scammers often use unclear or copy-pasted job descriptions, sometimes even listing different job titles within the same posting.

- Requests for personal information too early: Real employers only request essential personal details after a job offer has been made, and while the official contract is being drafted. Never provide sensitive information like your Social Security number or bank details during the application or interview stage.

- Upfront payment requests: You should never have to pay to apply for a job, access training, or purchase equipment. If payment is requested for these things, it’s a scam.

- Unsolicited offers for consultation or training services: If you're approached out of the blue with a job or consultation offer, especially one asking for money, it’s a red flag.

- The job doesn’t match the posting: If the job you’re interviewed for turns out to be completely different from what you applied to, proceed with caution.

- AI scam detection tools flag it: Upload the job offer or communications you receive to a free AI scam detector like Norton Genie, which will let you know within seconds if it’s likely to be a scam.

How to protect yourself from job scams

Whether you’re actively searching for jobs or just received an unexpected offer, it’s important to stay alert. Here’s how to protect yourself from job scams:

- Research the company: Before engaging with any offer, do a quick online search. Look for a professional website, physical address, and contact information. Add terms like “scam” or “fraud” to your search to see if others have reported suspicious activity.

- Don’t share personal information too early: Never provide sensitive details like your Social Security number, bank information, or a copy of your ID before you’ve officially been hired and signed a legitimate contract.

- Never pay a potential employer: Legitimate employers do not require upfront payments for training, equipment, or application processing. If you're being asked to pay, it’s almost certainly a scam.

- Avoid filling out questionable online forms: Don’t enter personal or financial information into forms or apps unless you’ve thoroughly verified the employer and received a formal job offer.

What to do if you’re a job scam victim

If you’ve fallen victim to a job scam, act fast to minimize the damage and prevent further problems. Here’s what you should do if you’re a job scam victim:

1. Stop all further communication: Don’t respond to emails or calls from the scammer. If necessary, block scammers’ email addresses and phone numbers.

2. Report job scams to:

3. Freeze your credit: If you shared bank account details, alert your bank and freeze your credit to prevent further damage to your accounts and credit.

4. Report identity theft: Go to IdentityTheft.gov and report the theft, especially if you shared your Social Security number or copies of ID with the scammer. Make sure you monitor your credit to keep an eye out for suspicious activity done in your name, and consider placing a fraud alert if there are signs of identity theft.

5. Warn others: Don’t let shame keep you from sharing your experience. Leave reviews, report fake listings, and talk about your experience with job scams to prevent others from falling victim.

Spot job scams before they get you

Stumbling onto a fake jobs website or falling for a scam job offer is easier than you might think. Norton 360 Deluxe offers a robust arsenal of digital protection tools designed to help keep and your identity safer from scammers and other digital threats.

Get real-time alerts if you land on a suspicious website or receive a phishing text, and upload job listings to Norton Genie — your personal scam-detection assistant — for instant insight into whether a posting is legit. Plus, you’ll get a secure VPN, advanced malware protection, and Dark Web Monitoring that alerts you if your personal data is found online, even on the dark web, so you can hunt for jobs with less fear of falling prey to cybercriminals.

FAQs

How do you tell if a recruiter is scamming you?

You can tell a recruiter is scamming you if they use generic email addresses, offer unrealistic salaries for a role, ask for upfront payments, or request personal information before you’re even hired. Scammers also avoid in-person interviews, lack a verifiable company website, and put pressure on you to make a decision quickly.

How do you verify a job?

Check the company’s official website and job postings. Look up reviews on Glassdoor, LinkedIn, or BBB (the Better Business Bureau). Verify the recruiter’s email domain using a website like Whois and cross-check their LinkedIn profile. If possible, call the company directly to confirm the job listing to dispel remaining doubt.

How do I know if a job is scamming me?

You will know a job is scamming you if they ask for money or personal information upfront. You should never have to pay for a job. Trust your intuition and investigate further if something seems off about the job or employer.

What are the most common job scams?

The most common job scams include fake job listings, work-from-home and remote job scams, and fake jobs impersonating legitimate companies. Task-based job scams are also increasingly common, making up nearly 40% of reported job scams in 2024.

Editorial note: Our articles provide educational information for you. Our offerings may not cover or protect against every type of crime, fraud, or threat we write about. Our goal is to increase awareness about Cyber Safety. Please review complete Terms during enrollment or setup. Remember that no one can prevent all identity theft or cybercrime, and that LifeLock does not monitor all transactions at all businesses. The Norton and LifeLock brands are part of Gen Digital Inc.

Want more?

Follow us for all the latest news, tips, and updates.