18 Venmo scams and how to spot them

Venmo is a popular payment app used by millions, but its popularity also attracts scammers. Learn about some of the most common Venmo scams and get tips to avoid them. Then, enhance your online security and help protect against scammers with Norton 360 Deluxe, which includes advanced AI-powered scam detection features.

Venmo is generally safe, provided you take the right precautions. However, the platform’s popularity means it can also be a target for scammers hoping to catch vulnerable users off guard.

This is true of practically all payment apps, with around 65,000 complaints about payment app fraud made to the FTC in 2023, and total consumer losses reaching $210 million. Learning how to spot the warning signs of a Venmo scam can help prevent you from adding to those statistics.

Keep reading to discover common Venmo scams and top tips you can use to avoid them, keeping your finances safer.

1. Fake call from Venmo

If you receive a call “from Venmo,” don't pick up. Venmo only initiates phone calls in very rare cases, so any unsolicited calls claiming to be from the company are likely part of a vishing scam where a fraudster impersonates a Venmo representative to lower your defenses.

They typically claim there’s an issue with your account and ask for your password or a verification code sent to your phone. Their goal is to bypass Venmo's multi-factor authentication feature and take control of your account.

2. Scam text from Venmo

In this smishing scam, you’ll receive a text message impersonating Venmo and urging you to log in to your account to resolve an issue or authorize a payment. The text will include a link that leads to a fake version of the Venmo site that’s designed to trick you into entering your Venmo password or other sensitive information.

The scam often mimics Venmo’s multi-factor authentication process, making you think that you’re verifying your identity when, in reality, you’re handing over your login credentials. It typically relies on creating a sense of urgency or panic to make you act without thinking.

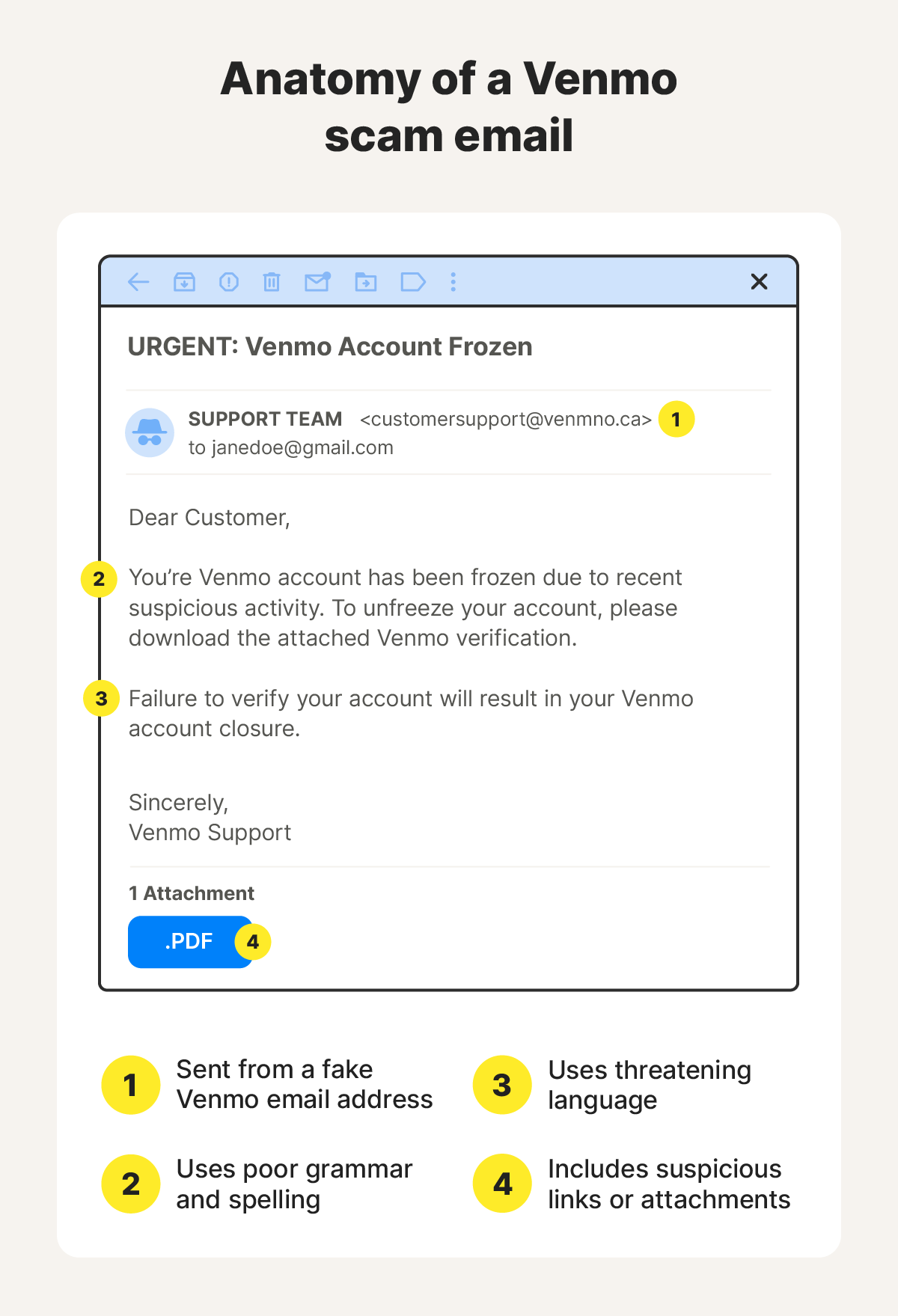

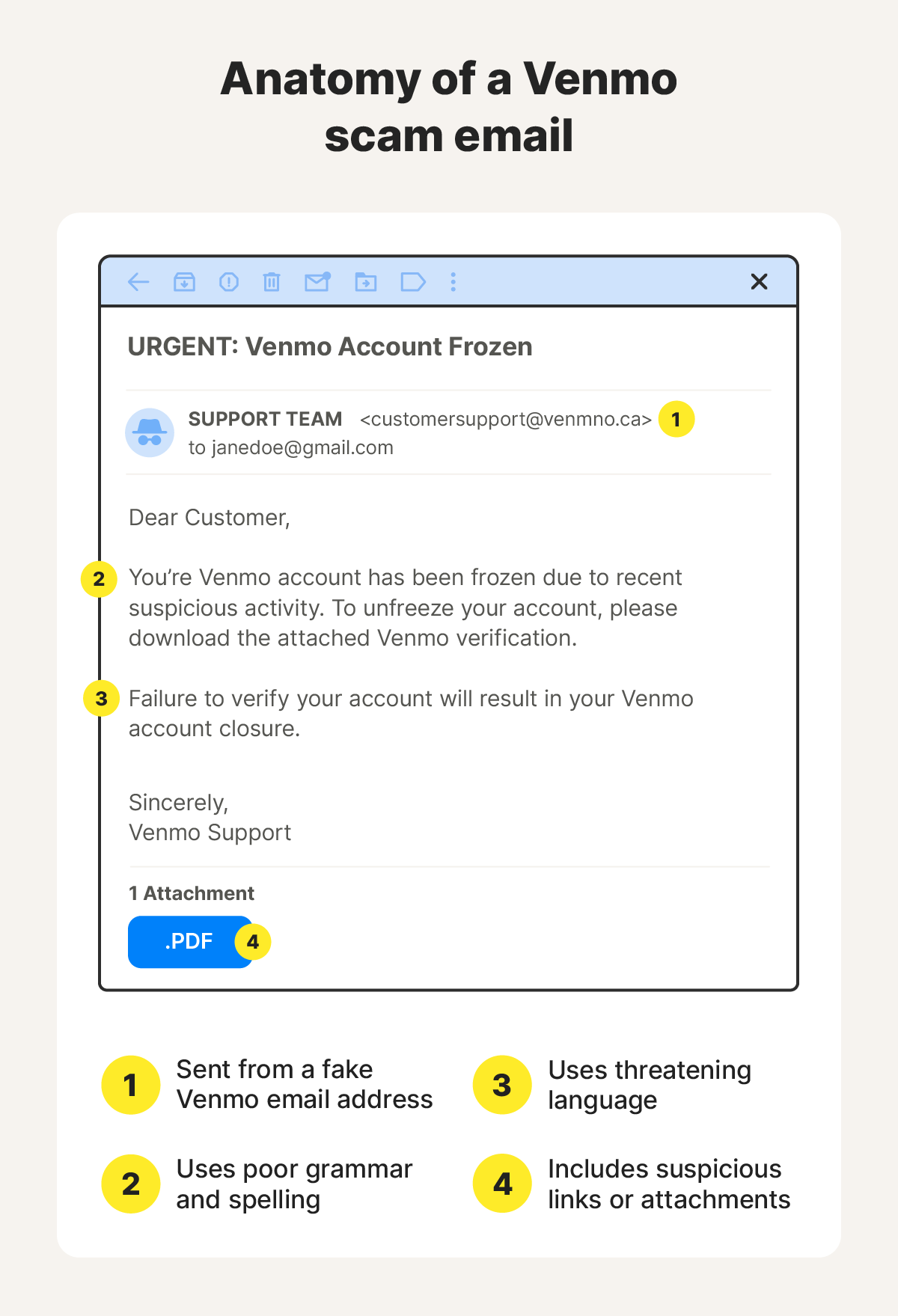

3. Venmo scam email

Venmo email scams typically involve fraudsters sending you phishing emails where they pretend to be customer service or technical support representatives. These emails use social engineering techniques to create a sense of urgency, often claiming there’s a problem with your account security or a recent payment to trick you into clicking a malicious link.

These links lead to a fake version of the Venmo website where you may be prompted to enter your Venmo login credentials or financial information, inadvertently enabling the scammer to take over your account. Some scams may also request that you send money to "verify" your account or resolve a supposed issue, ultimately leading to financial loss.

4. Fraudulent payment requests

In Venmo payment request scams, fraudsters impersonate someone you know or a business you might buy from, changing their Venmo username and profile picture to match the account they’re imitating.

Scammers often use details from Venmo’s public feed to identify who you’ve recently interacted with. By mimicking someone you’ve recently paid or received money from, they hope to get you to send money without double-checking the account is authentic.

5. Accidental transfer scam

If you receive an unexpected Venmo payment from a stranger, ignore it and block the user. Scammers may send you money, then claim they made the transfer accidentally and ask you to return it. They’ll often request that you send the money back via a different app or to another account.

While it may seem like you’re helping correct an error, the scammer is likely hoping you’ll send the money so they can reverse the original transaction, leaving you out of pocket. In some cases, these scams are part of money laundering schemes where the scammer tries to use your account to “clean” illicit funds.

6. Overpayment scams

In an overpayment scam, a fraudster sends you more money than the agreed-upon amount for a purchase, often using a stolen or hacked credit card. They’ll then ask you to return the money they overpaid to another account.

If you send them the excess money, they may try to reverse the original transaction, or it could be flagged as fraudulent, meaning you’ll lose both the original transaction funds and any money you sent to the scammer to refund their “overpayment.”

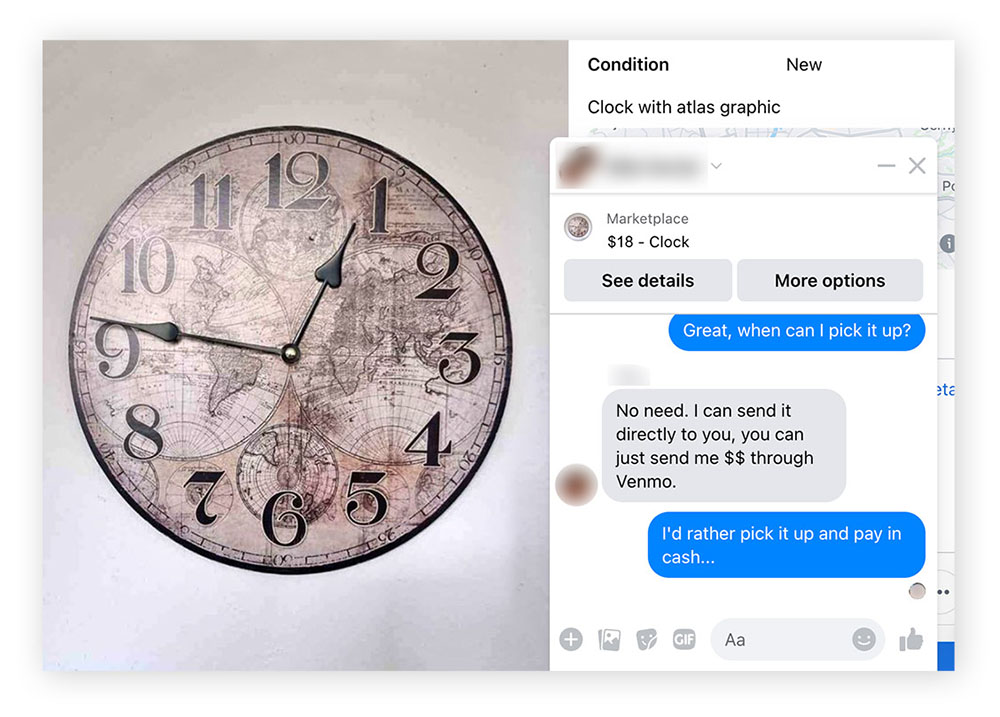

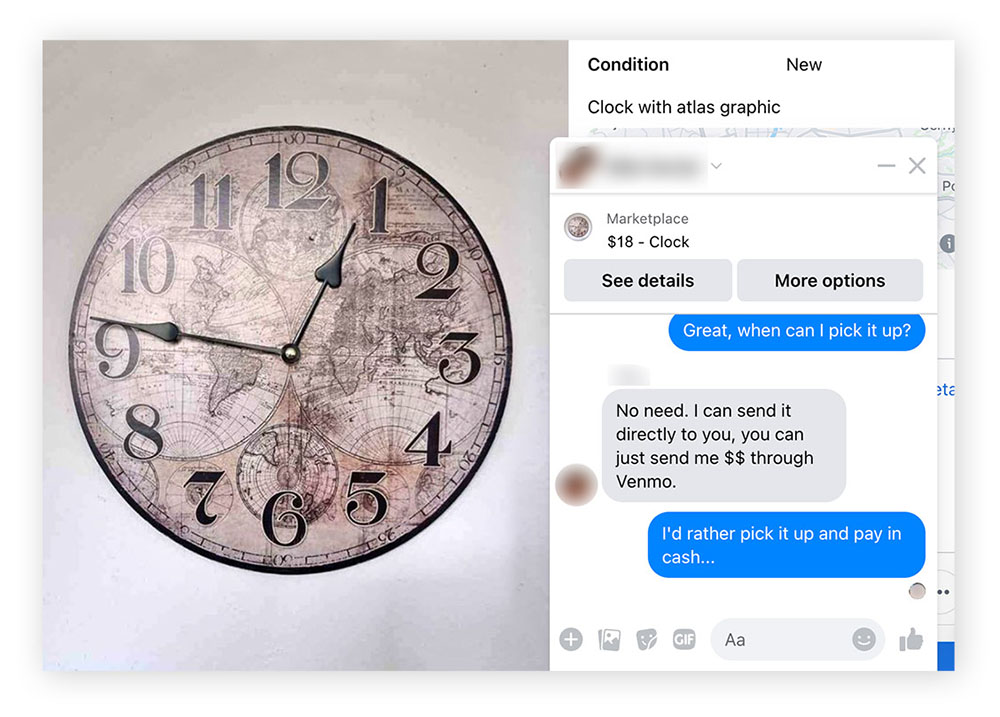

7. Purchase scams

Some scammers create fake product listings on online marketplaces to run Facebook Marketplace scams, eBay scams, or Etsy scams. They may request payment via Venmo to sidestep any fraud protection measures available on the marketplace.

If you purchase a product from one of these scammers, you’ll be prompted to complete the payment on Venmo. However, once you’ve transferred the money, they’ll cut contact and leave you without the product you’ve paid for.

8. Scam buyers on Facebook Marketplace

Somewhere between a Facebook Marketplace scam and a Venmo scam, fraudsters posing as a buyer on Marketplace may agree to purchase an item you’ve listed for sale, but claim there’s an issue sending payment through Venmo.

If they’ve managed to find your email address — whether on your profile or elsewhere — they might contact you claiming to be from Venmo Support and instruct you to send money to “unlock” or “upgrade” your account before you can receive the payment. If you fall for the scam and pay the fee, the scammer will disappear and you’ll soon realize there was no pending payment.

9. Fraudulent in-person Venmo transfers

While most Venmo scams occur online, some particularly brash scammers may try an in-person scheme. One form of Venmo fraud involves a scammer approaching you on the street, asking to use your phone to make a quick call. If you give them your phone, they’ll try to access your Venmo app and transfer funds to their account.

A 2024 CBS report highlights another type of Venmo fraud, where a woman from NYC was targeted by an in-person scam. Two teenagers approached her, asking for a small Venmo donation for their sports team. When she opened the app to send a few dollars, one teen took her phone while the other distracted her. Within seconds, they transferred $2,500 from her account before walking away.

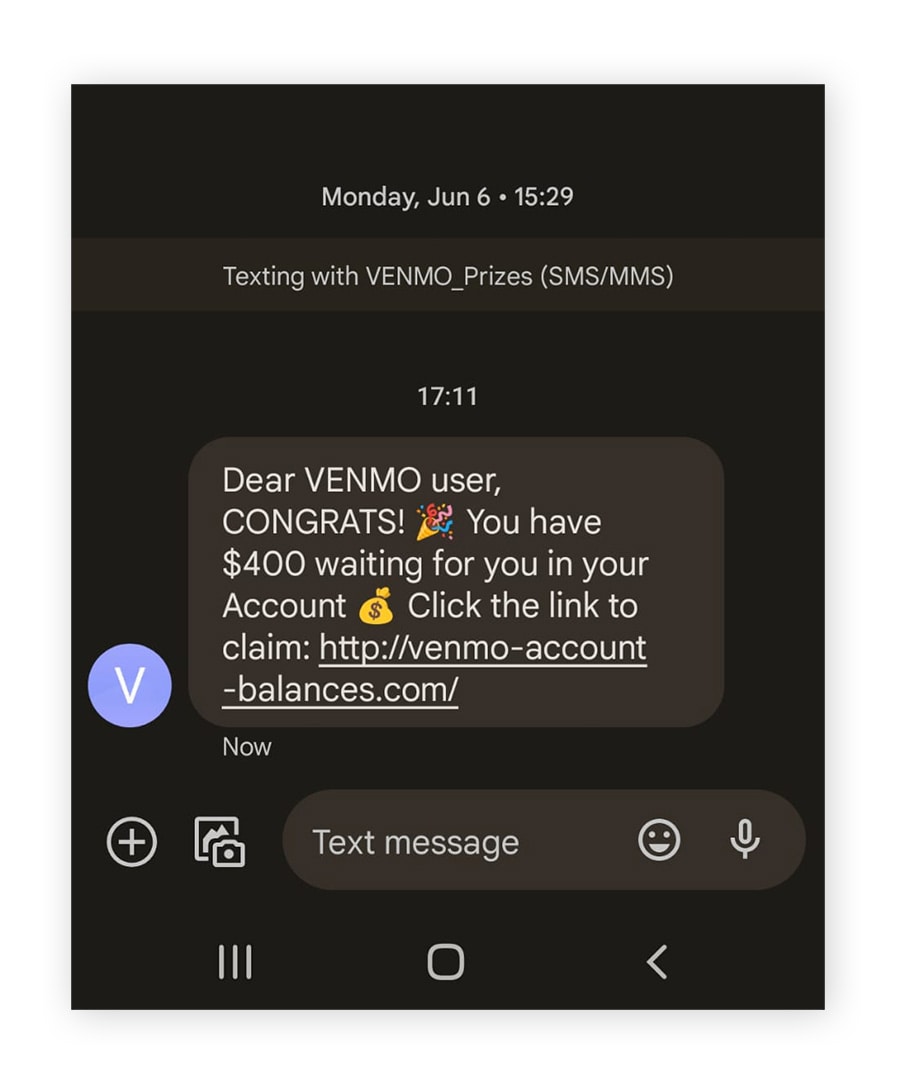

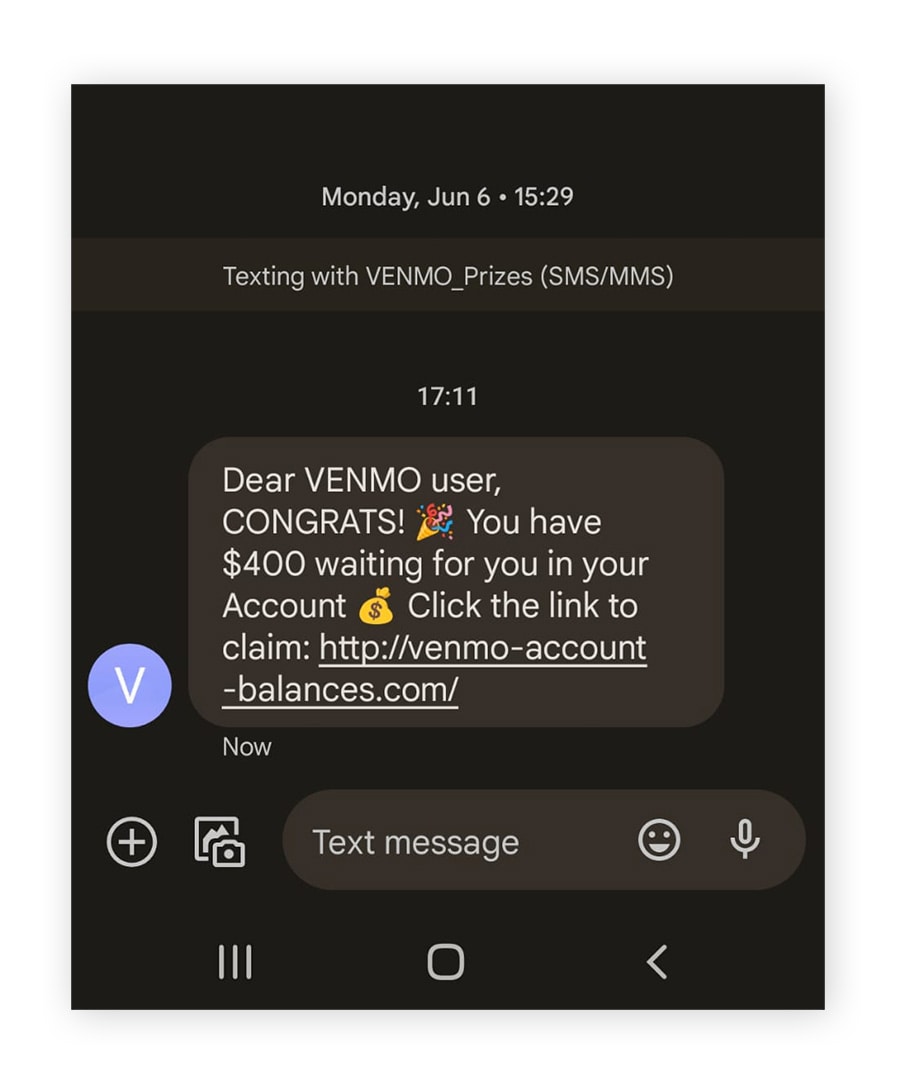

10. Fake prizes or giveaways

Fake prizes and giveaways are a type of phishing scam that claim you've won free money or a gift card, which will be delivered to you via Venmo. These scams typically start with a scammer sending you a “congratulations” message via email or text, including a link to a website where you can "claim" your winnings.

This link will actually lead you to a malicious fake website that aims to steal your sensitive information, get you to pay a fee to collect your prize, or infect your device with malware.

11. Fake payment receipt

Some scammers target Venmo business accounts by sending fake payment receipts, trying to trick you into thinking an incoming payment is temporarily on hold. If you’re targeted by this scam, you may receive details of the fake payment alongside a message or email claiming the payment will be processed when you ship an item.

The scammer hopes you’ll feel pressured into sending the item before receiving payment. However, once the item is shipped, you’ll never get paid and the scammer will get away with a free product.

12. Get rich quick scams

Money circle scams are a type of investment scam where scammers approach you with a “get rich quick” scheme, promising big returns on a comparatively small investment. This type of scam often relates to cryptocurrency investment “opportunities” and involves transfers on mobile payment apps like Venmo.

The scammer could be a stranger or appear to be someone you know (whose account or phone was likely hacked). While they promise your small contribution will turn into big bucks, you won’t get anything back.

13. Romance scams

In romance scams, fraudsters set up fake profiles to catfish you, faking romantic interest to win your trust. Once a relationship has been established, they ask for a Venmo transfer to cover an emergency or travel costs to “meet in person.” They may even promise to pay you back.

These scammers often keep the scam going for as long as possible, siphoning as much money as possible from you. When you can’t pay them more or they think their cover is blown, they’ll ghost you.

14. Fraudulent websites

Some fraudsters create fake copies of the Venmo website designed to steal personal or financial information, like your login credentials or banking details. They may aim to access your Venmo account so they can steal your funds, hack one of your other financial accounts, or even use your information to steal your identity.

The website may be spoofed so well that it looks nearly identical to the real thing. However, upon closer inspection, subtle differences like a slightly misspelled URL or a lack of an SSL certificate should reveal that it isn’t safe.

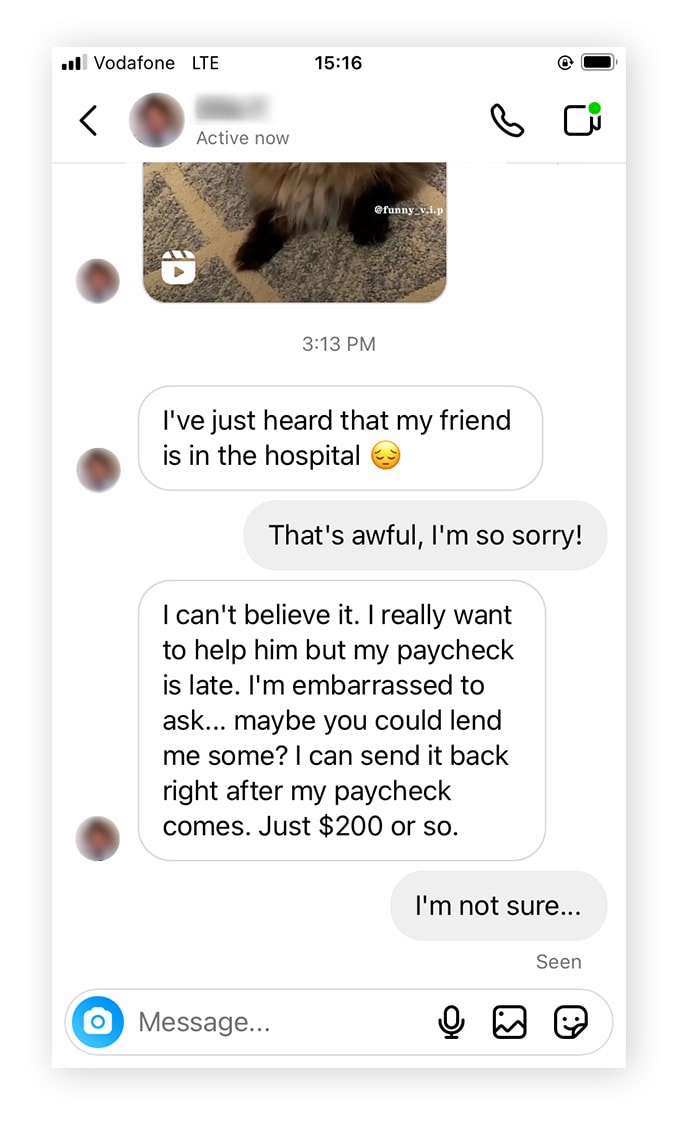

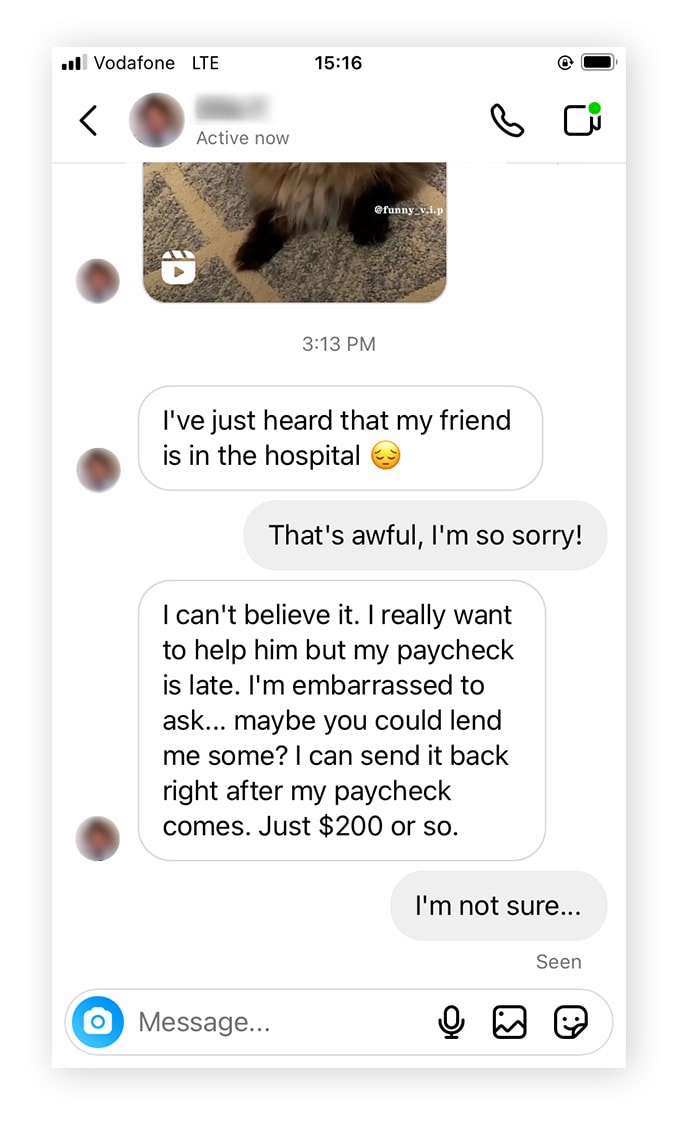

15. Friend-in-need scams

In this scam, a fraudster impersonates a friend in urgent need of financial help. They may use a fake or hacked account to make it seem like someone you know is reaching out, tricking you into trusting them and sending money.

One Venmo user shared their experience on Reddit after falling for a fake friend scam. They received a Venmo request from what appeared to be their roommate, asking for $300 for groceries. Without double-checking, they sent the money, only to realize later that the request came from an impersonator using the same profile picture as their roommate.

16. Fake job offers and postings

This kind of scam preys upon people’s desperation when searching for a job. In fake job scams, a scammer poses as a recruiter with an offer for what sounds like a great job, often featuring a high salary and the option to work from home. You might come across them in fake job postings or be contacted directly by a scammer hoping to lure you in.

Once the scammer has offered you the fake job, they’ll request an upfront Venmo payment to assist with onboarding or cover an administrative processing fee.

17. Fake checks

While most payments occur online these days, some scammers still like to do things the old-fashioned way. In a fake check scam, you’ll receive a fake paper check in the mail. Soon after, the scammer will contact you, claiming they sent it by accident.

They might suggest that you cash the check and return their funds via Venmo instead, but the check will bounce when you try to cash it. That leaves you out of pocket if you’ve already paid the scammer back via Venmo.

18. Rental deposit scams

In this rental scam, a fraudster posts a fake rental listing and asks you to pay in advance via Venmo to reserve the property. They often insist on payment without a viewing, though some elaborate scams may include fake tours. The scammer disappears once you send the money, leaving you without a rental and your payment.

How to spot Venmo scams

A few telltale signs that you’re dealing with a Venmo scammer include urgent or threatening language, unexpected messages or unsolicited requests for payment, demands for personal information, and suspicious links or attachments.

While some fraudulent schemes can be sophisticated, being on the lookout for common warning signs of online scams will help you spot them if you’re targeted. Here are some common hallmarks of Venmo scams:

- A sense of urgency: Messages from scammers will pressure you to make a decision quickly or act without thinking, often with a fake deadline upping the stakes.

- Requests for personal information: A scammer may ask for personal information they don’t need to know. Think critically about why somebody would require the information they’re asking for, and refuse to give it if you’re ever suspicious.

- Suspicious links or attachments: Oddly-spelled or particularly long URLs are a giveaway that a message is a scam trying to direct you to a fake website. Always check that the URL you’re being sent to matches the real website, and don’t download unexpected attachments.

- Unsolicited communication: A total stranger messaging you with an offer you didn’t ask for, and often one that seems too good to be true, is a strong warning sign of a scam.

- Spelling and grammatical errors: Some scams are operated by non-native English speakers in other countries, so they may make strange spelling or grammatical errors.

How to help avoid scams on Venmo

Knowing how to spot a Venmo scam can help you avoid falling for one in the first place. However, taking extra steps to protect yourself can add an additional layer of defense, keeping your finances safer.

These are some of the best ways to protect against fraud on Venmo:

- Update your Venmo privacy settings: Adjust your privacy settings to help prevent unsolicited contact or payment requests from Venmo users you’re not connected with, to help keep potential scammers away.

- Only Venmo people you trust: Upholding a policy of only ever transacting with friends or family on Venmo can help protect you against most Venmo scams.

- Don’t accept unsolicited payments: Blocking unknown users who request payment from you and canceling unexpected transactions that appear on your account can stop some scams.

- Safeguard your personal information: Avoid sharing personal information online where it could be publicly visible. Otherwise, this could give scammers the opportunity to contact you and initiate a scam.

- Use a strong password: Create a strong password for your Venmo account, ensuring it’s 15+ characters long and completely unique for the best protection.

- Enable 2FA: Enable two-factor authentication to create an extra verification step to access your Venmo account, making it harder for a scammer to hack into it, even if they have your password.

- Keep your phone to yourself: Don’t share your phone with strangers or anyone you don’t trust. Giving your phone to a stranger, even if only briefly, can open you up to being hacked or scammed.

- Use antivirus software: Install antivirus software like Norton 360 to help protect your device from malware that compromises your sensitive information, like Venmo login credentials. It also includes AI-powered scam detection features to help spot even the most sophisticated scams.

What to do if you’re scammed on Venmo

Even with precautions in place, it’s still possible to fall for a scam if you’re caught off guard. However, acting quickly can help mitigate the potential damage.

Here’s what to do if you get scammed on Venmo:

- Report the scam to Venmo: Contact Venmo Support to report the scam, including screenshots of the scammer’s profile and any messages they sent, if possible.

- Change your Venmo password: Change your Venmo password to prevent anyone with access to your old one from accessing your account. Then, enable 2FA for an added layer of security.

- Contact your bank or credit card company: If the scammer has access to your bank or credit card information, contact your bank or issuer immediately to report the scam and put temporary holds on affected accounts.

- Report the scam to the FTC: File a fraud report with the FTC by visiting reportfraud.ftc.gov. You’ll receive a personalized recovery guide, and your report could support wider investigations to help prevent future victims.

Safeguard against scams

Venmo is popular for a reason — it makes sending or receiving money with friends and family quick and easy. However, the risk of scams on payment platforms means you should always use caution.

For added protection, get Norton 360 Deluxe. You’ll benefit from AI-powered scam detection features that can help you spot and avoid scams across the internet, along with powerful security features that can help keep your device safer from malware and viruses.

FAQs

Will Venmo give me my money back if I’m scammed?

Venmo has a purchase protection policy that means transactions made to an authorized business or charity account may be eligible for a refund in certain cases. However, transfers to personal accounts won’t be refunded or reversed, meaning you’re unlikely to get your money back from a scam.

Is it safe to give someone your Venmo username?

While Venmo is generally safe, it’s mostly designed to facilitate sending money to friends or family. Accordingly, it’s not advised that you share your username with strangers, as they may be able to use it to target you with a scam.

Is Venmo safe to use with strangers?

It’s generally recommended that you avoid transacting with strangers on Venmo, as this might make you more vulnerable to scams. Try to limit your usage to friends and family or trustworthy authorized businesses to help protect your finances.

Venmo is a trademark of PayPal, Inc.

Editorial note: Our articles provide educational information for you. Our offerings may not cover or protect against every type of crime, fraud, or threat we write about. Our goal is to increase awareness about Cyber Safety. Please review complete Terms during enrollment or setup. Remember that no one can prevent all identity theft or cybercrime, and that LifeLock does not monitor all transactions at all businesses. The Norton and LifeLock brands are part of Gen Digital Inc.

Want more?

Follow us for all the latest news, tips, and updates.