How to retire early: Financial planning tips and strategies

Achieving early retirement isn’t easy, but it’s certainly not impossible. Find out how much money you need to retire young — at 60, 55, or even 40 — and learn some financial planning strategies that can help you reach your goal. Then, get an all-in-one personal finance app to help monitor your financial health when planning your retirement.

What age is early retirement?

The “normal” retirement age in the U.S., as set federally by the Social Security Administration (SSA), is 67 (if you were born in or after 1960). If you retire before this age, the federal government considers that early retirement.

If 67 is too long for you to wait, you can claim Social Security once you turn 62, but your monthly payments will be reduced. If you retire up to 36 months in advance of the official retirement age, your benefits will be reduced by 5/9 of one percent (0.555%) for each month. If you retire more than 36 months early, benefits are reduced by 5/12 of one percent (0.417%) for any additional months.

As such, if you retire five years early at age 62, your Social Security benefits will be reduced by 30% — meaning Social Security may not cover all of your expenses. Note that the normal retirement age may increase in the future, and social security benefits can be modified by federal law.

If you want to retire before 67 with enough money to support yourself and even thrive, financial planning is essential.

How much do I need to retire early?

How much you need to retire early will depend on your financial and personal situation after you stop working. It also depends on how much of your retirement funds are invested, as those funds can continue to generate earnings during your retirement years.

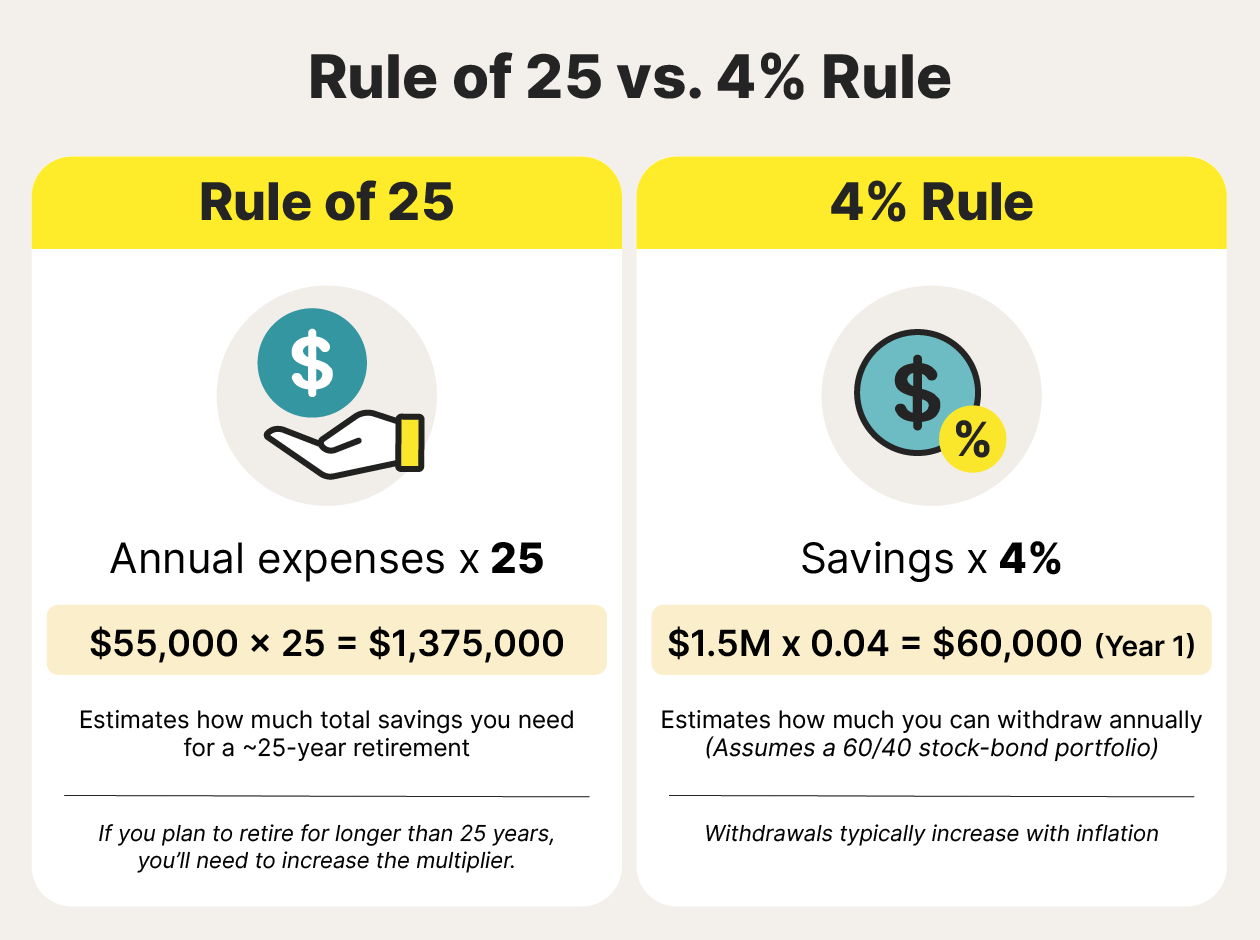

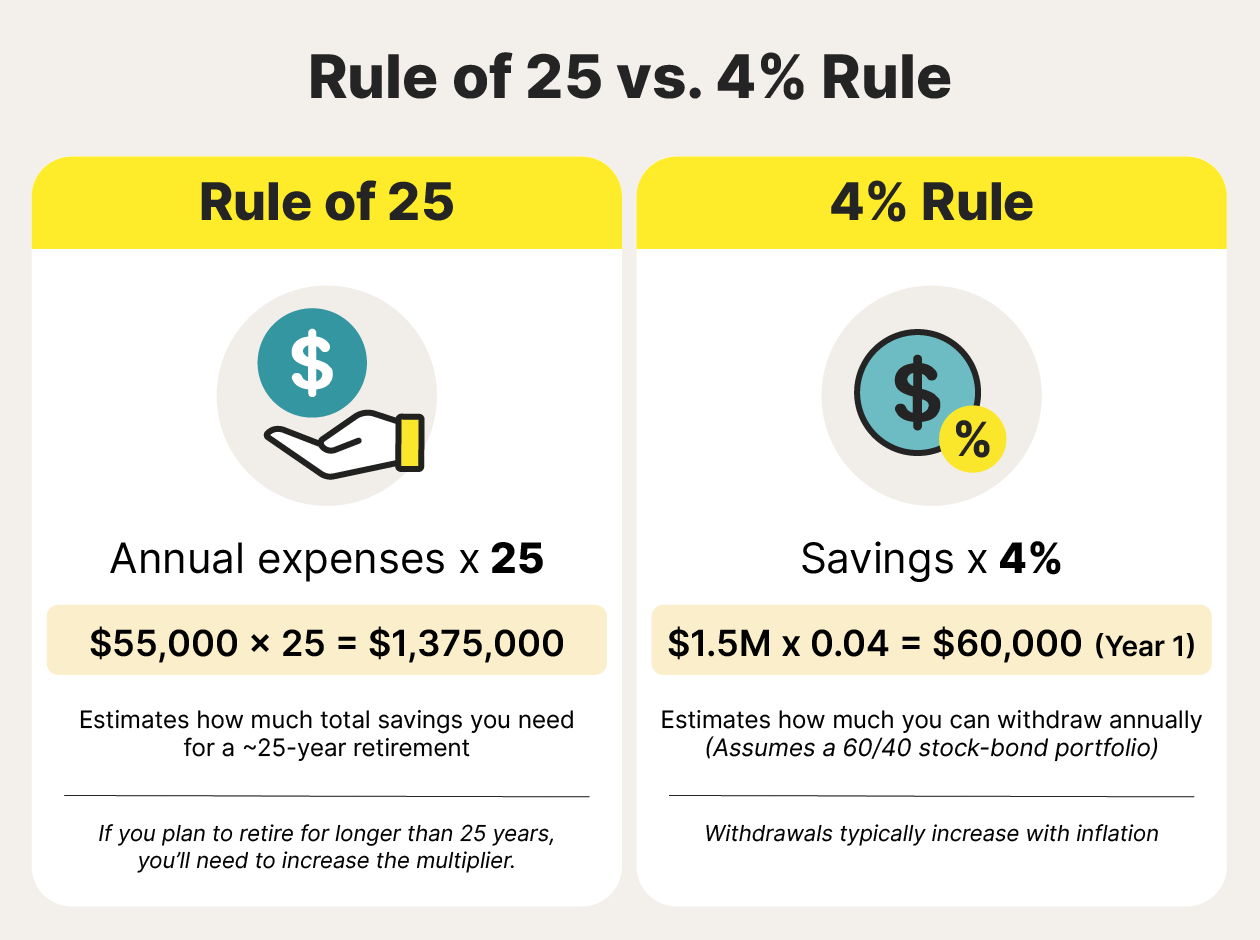

There are two calculations you can use to estimate how much you’ll need: the first is a savings-based approach called the Rule of 25. The next is the 4% Rule, which assumes the majority of your retirement funds are generating compounding earnings.

The Rule of 25

Take your estimated annual retirement expenses and multiply it by 25 to work out the total savings you need. For example, if your estimated required annual income is $55,000 a year, you would need $1,375,000.

However, this rule is based on a rough assumption that you’ll be retired for about 25 years. As you are planning to retire early, you’ll need to consider how you can boost this figure with additional income during retirement.

The 4% Rule

This determines how much of your invested savings you will likely withdraw each year of your retirement. It’s based on the assumption that you have an investment portfolio that is made up of 60% stocks and 40% bonds.

For example, if your total retirement budget is $1.5 million, you’d be able to take out $60,000 (4%) during the first year of retirement. For every year after you would simply multiply that amount by that rate of inflation.

Although these rules are useful, they can’t guarantee a financially stress-free retirement. Many factors can impact your retirement, such as retirement age, the economy, international trade tariffs, stock market volatility, and so on.

10 steps to achieve early retirement

Retiring early is all about planning. There are a variety of financial strategies to think about, including savings, investments, income expansion, and lifestyle changes.

Some people follow a movement called FIRE (Financial Independence, Retire Early) to take control of how long they work and when they retire. FIRE centers on extreme budgeting, savings, and investing practices. For example, someone practicing FIRE may never eat out or take a vacation, instead prioritizing saving 50-70% of their income.

But FIRE is not feasible or desirable for everyone. Fortunately, you can still plan for early retirement without having to follow practices as extreme as FIRE. The below strategies can help you take a holistic approach to early retirement planning.

So, get a head start on securing your retirement funds with these 10 steps.

Note: Following these strategies doesn't guarantee an early retirement. Factors such as income, investment markets, and life events are hard to predict. Consider speaking to a financial advisor to get advice tailored to your needs and goals.

1. Set a high savings target

Setting a high savings target is one of the most important steps for retiring early, but how much you can and should save will depend on your current income, expenses, inflation, and how long you live.

In 2024, the average American saved between 4% and 5% of their earnings. Although there is no perfect savings target, some experts suggest saving at least 10-15%.

For example, if you have an annual salary of $50,000 and save 5%, you’ll only add $2,500 a year to your retirement funds. At 15%, you can save $7,500 per year. Over twenty years, this difference is substantial.

Other experts suggest having 10-15 times your salary saved by the time you retire. If you make $50,000 a year, that would mean saving $500,000 to $750,000 before retirement. However, this strategy doesn’t necessarily factor in inflation, length of life, or when in your career you start saving for retirement.

You can also return to the Rule of 25 or 4% Rule to determine your savings goal. Regardless of your approach, significantly increasing the amount you save (without increasing your earnings) will likely require a lifestyle and mindset shift.

To make the adjustment easier, you could:

- Increase your savings over several months or years: For example, if you have an annual salary of $50,000 and save 5% already, you could increase this by 2.5 percentage points per year until you reach a goal of 15%. In the first year, you’d save $3,750 at 7.5%. In the second year, you’d save $5,000 at 10%, and so on.

- Eliminate specific spending habits and redirect the money savings: For example, cutting out an unnecessary expense like an afternoon latte could help free up money for savings. If you eliminate a daily $5 coffee from your spending, you could redirect that $1,825 to your savings each year.

Remember that the amount you should save depends on your goal retirement age and fixed expenses. A financial advisor can help you set and meet your target.

2. Find ways to boost your income

Boosting your income means you can contribute more money to your retirement savings or investment accounts. You may be able to earn more money without changing your current employment, or you may need to look elsewhere for a job. Some strategies include:

- Work overtime: In many jobs, hours worked in overtime pay more than the standard rate. For example, if your standard pay is $30 hourly, your overtime rate may be $45. This means a standard eight-hour day plus one hour of overtime would earn you $285 instead of $240. Over a month, this adds up to an extra $900 toward your retirement fund.

- Start a side hustle: A small side job or business can include anything from dog walking and tutoring to renting out a spare room. Side hustles can vary greatly in financial returns, but they all contribute to saving for retirement sooner.

- Sell unwanted goods: Second-hand shopping platforms like eBay, OfferUp, and Facebook Marketplace are a great way to make money from items you no longer want or need. You might be surprised at how much you can make, especially if you have any collectibles hidden away in your loft or basement — just beware of Facebook Marketplace or eBay scams.

- Ask for a raise: Increasing your earnings may be as simple as asking your employer. If you have a good reputation, have taken on more responsibilities, or have produced good results in your role, you’re likely in a good position to ask for a raise. Some employers also consider rising inflation when considering employee raises.

- Develop a new skill: Using your free time to develop a new skill can help you gain qualifications for another, higher-paying position. Skills like web development, coding, graphic design, video editing, and Excel may open up new opportunities for higher-paying jobs without having to invest in schooling or paid courses. You could also try experimenting with AI to automate tasks, build small projects, or explore emerging tools.

- Make a lateral movement: Moving to another company may lead to higher earnings even if your salary stays the same. A different employer may have more promotion opportunities, better retirement benefits, or additional offerings like bonuses, stock options, or sales commissions.

More permanent ways to increase your income include investing in assets and real estate, which we’ll cover later on.

3. Reduce your spending

In most cases, if you want to save more, you need to spend less. Assess your expenses and look for ways to reduce what you spend. Even small purchases add up over time.

Here are some ways to reduce your spending:

- Cut down on subscriptions: Whether it’s magazines or video streaming services, subscriptions can seem affordable individually but together could add up to hundreds of dollars per month. Consider if you really need Netflix, Amazon Prime, Disney+, and Hulu, or can stand to just have one or two. If you don’t want to part with a subscription, see if you can reduce to a lower tier.

- Take public transportation: If your city has a public transit system, take the bus or subway more often. In some cases, you may be able to do away with your car entirely. Switching to public transit can help you save money on costly car expenses like insurance and repairs.

- Eat home-cooked food more often: Reduce how much you eat at restaurants or use takeout services like DoorDash. Most big-brand grocery stores offer takeout-inspired food that you could use instead. For example, a takeout pizza could add up to $20 once you pay service and delivery fees. Instead, you could buy a cook-at-home pizza from Walmart for just $4.

- Buy used goods: Need a dining table? Consider resale options like Facebook Marketplace or your local thrift store instead of buying something brand new. You might have to wait longer for the right product to become available, but you can often find high-quality items with a significantly lower price tag.

- Go on domestic vacations: Consider taking a cheaper local trip rather than flying out of state or internationally. Doing so could save you thousands of dollars. You could even do a vacation in your own town or city. Get a massage, go to the theater, or attend a local festival. The amount spent on these activities will likely be less than an overseas vacation.

4. Make some lifestyle changes

Another way to reduce your spending habits and save for retirement is to make lifestyle changes. Here are some ideas to adopt a healthier lifestyle and save some cash:

- Find alternatives to the gym: Commercial gyms can cost $30-$70 a month, with some high-end gyms reaching over $100 a month. Quitting the gym can save money — but doesn’t mean quitting exercise entirely. Consider running, hiking, following exercise workouts on YouTube, or even taking up a physical hobby like gardening.

- Quit expensive habits: Habits like smoking or drinking are bad for your wallet as well as your health. The average cost of cigarettes in 2025 is more than $10 a packet, although it can be more depending on where you live. Quitting or even cutting down on smoking, vaping, and drinking will help you money in the short-term and could even help you save money on medical expenses later in life!

- Drive less: If you live in a city, walk to nearby locations whenever possible. Instead of driving to the convenience store two blocks away, why not take 10 minutes to walk there? The savings on gas can add up over time, and walking more throughout the day is good for your overall health.

- Say goodbye to brand names: For many people, branded goods are appealing because of the status that comes with them. But if you want to retire early, choosing generic goods can help you reduce your expenses. If you don’t want to forgo your Nike or Gucci altogether, look for second-hand options.

5. Create a budget

Creating a detailed budget today can help you take control of your spending so you have the funds you need to retire early.

Setting a budget can help support all of the steps in this article: saving more, spending less, and investing. It’s also helpful for reducing debts. In a 2024 Budgeting Survey, 89% of people claimed that budgeting “helped them get out or stay out of debt.”

There are many ways to set a budget, but a common approach is the 50/30/20 rule. It recommends dividing your after-tax income into three categories:

- 50% for needs: Necessary expenses like rent, insurance, groceries, and utilities fall under the needs category. Half of your budget should go to these essential living expenses.

- 30% for wants: Activities like eating out, traveling, and shopping are all unnecessary expenses, but you may enjoy them. Dedicating a part of your budget to your “wants” allows you to leave money for the things you love to do right now while still saving for retirement.

- 20% for savings: Including savings as a line item in your budget (rather than relying on whatever is leftover), can help you save more and save consistently.

These percentages are not always feasible for everyone. For example, if you live in an area with a high cost of living, you may be forced to spend more than 50% of your budget on needs. However, steps like getting a roommate may help you lower your costs in this category.

Setting a budget is much easier than sticking to one, as unexpected costs always arise. There may be times when you have to readjust your split.

Review your credit card statements and checking accounts at the end of each month to see whether you’re maintaining your 50/30/20 allocations or are overspending in specific categories. You can then decide what actions you need to take to get back on track.

6. Make good investment decisions

There are multiple ways to invest that can help you to retire early. The earlier you invest, the greater the potential payoff. However, there is no guarantee of success and there are inherent and significant risks. Always invest with caution and consider getting advice from a financial advisor before making potentially risky decisions.

Here are some common types of investments, ordered from least risky to most risky, that might help you retire younger.

Retirement funds

Paying into or even maxing out your 401(k) can be beneficial, as the financial institution that manages your account invests your savings in assets like bonds and mutual funds to help grow your savings over time. Your employer may also match your 401(k) contributions, further boosting your investment value.

Similarly, heavy investing in individual retirement accounts (IRAs) or health savings accounts (HSAs) can also yield beneficial retirement funds. These are different from typical savings or current accounts, which aren’t designed for long-term growth.

Investment-based accounts typically allow you to adjust the investment approach based on your goals and needs.

Avoid withdrawing from your 401(k) before you retire, unless you have no alternative.

Trading

There are many approaches to trading. Short-term trading is high-risk and unlikely to produce significant returns for the average investor (and more likely to result in losses). Longer-term, lower-risk trading is more likely to result in positive returns, but can still result in losses.

Here are some popular lower-risk trading options to consider:

- Bonds trading involves buying and selling debt securities. You make or lose money through interest or capital gains.

- Commodity trading involves buying and selling physical goods and materials. You make or lose money from price changes.

- Mutual funds involve pooling money from multiple investors for other types of investments, like bonds and stock trading. You make or lose money based on the overall performance of the fund.

- Exchanged Traded Funds (ETFs) include a group of securities that can be traded collectively like single stocks. They offer built-in diversification, often exposing you to multiple asset classes in one package, making them less volatile than stocks. They can also be more tax-efficient.

Higher risk options that you might want to consider learning more about include:

- Stock trading involves buying and selling company shares. You make or lose money based on price changes and dividends.

- Forex trading (or currency trading) involves buying and selling currency on the foreign exchange market. You make or lose money based on fluctuating exchange rates.

Getting started in trading may require a minimum investment. However, some apps like E*Trade, eToro, and Robinhood allow you to buy and sell company stock, and in some cases, bonds and mutual funds, on your phone, without minimums. Typically, once you have registered, you add funds to your account and then select which companies you want to invest in.

Cryptocurrency

Cryptocurrency was invented in 2009 and gained popularity steadily until exploding into mainstream attention in 2017. There are now thousands of cryptocurrencies in existence, with Bitcoin, Ethereum, and Dogecoin among the most prevalent. But because it is a relatively new form of investment, crypto can be volatile — it is a high-risk investment strategy, especially for long-term savings goals.

People make (or lose) money through cryptocurrency trading based on price appreciation. This is when the value of your money increases in times of high demand and decreases in times of low demand. Some trading platforms also allow you to lend your crypto in return for rewards or dividends.

Crypto trading regulations are being rapidly introduced and developed, which adds to the volatility of the market. As with any investment strategy, always seek expert advice before handing over your hard-earned cash. Also, be very wary of cryptocurrency scams, which are rife in this developing financial sector.

7. Buy real estate

Purchasing a property as young as possible will help you maximize the return when you sell, assuming property market values increase.

Yes, home prices can fluctuate. But the past twenty years have shown that purchasing real estate generally offers a good return on investment over long-term time horizons. From 2003 to 2023, the average home price grew from $140,000 to $340,000, significantly outpacing the inflation rate of 2.5% during the same period.

Let’s say you purchased a house for $350,000 in October 2023. In October 2024, Zillow reported a 2.6% value increase over the previous 12 months and a 2.9% value increase for the following 12 months. Your house would now be worth approximately $369,565, before taking into account any renovations. That’s a $19,565 increase in value in just one year.

Investing in real estate can also be used to generate monthly income if you choose to rent out your property. You can work out your potential yield (gross return) by dividing your predicted annual rental income by the property’s value and multiplying it by 100.

For example, maybe you decide to move in with your partner and rent out your house for $2500/month. Using the above calculation (and your home’s current value of $369,565), you can estimate an 8.11% gross return on your property.

In March 2024, America Mortgages used ATTOM data to report that annual gross return (for counties with at least 1 million people) ranged from 3% in Santa Clara County, CA to 12% in Wayne County, MI.

So, even just a single rental property, once acquired, can aid your early retirement plans and even provide income during your retirement. However, you must factor in house insurance, maintenance costs, and property taxes. Speak to a mortgage advisor for more advice.

8. Pay off and avoid high-interest debts

Not all debt is inherently bad. For example, if the interest you pay is less than the inflation rate and you use the borrowed money to earn higher returns elsewhere, taking on debt could actually be a good financial decision.

However, there are some kinds of debt you should pay off and avoid if you want to retire early. Debt accumulated via payday loans and credit cards should be paid off as quickly as possible due to the high interest rates they tend to feature.

Get advice from an independent financial advisor before borrowing money so you can ensure your repayment plan is feasible.

Examples of debts to avoid:

− Payday loans: Notorious for their high interest rates, payday loans should be repaid as soon as you are able to.

− Credit card debt: Credit card debt has the potential to spiral out of control quickly due to high interest rates and the ease of access. To avoid this, aim to pay the full balance on your credit card statements every month.

− Bills: Falling behind on payments for essentials like rent or utilities can lead to billing debt. Fluctuations in the energy market can exacerbate this issue.

Examples of debts that can have positive returns:

+ Mortgages: Mortgages give you an asset and a foothold on the property ladder, putting you in an advantageous financial position, depending on the long-term housing market.

+ Refinanced debt: Refinancing existing debt can be a smart move, as it may mean you can get better interest rates (or even interest-free welcome periods) and easier-to-manage monthly payments.

+ Business loans: A successful business loan can not only boost your credit score but could help you generate significantly more income in the long run.

9. Plan for medical expenses and other unexpected life events

Life has a habit of surprising you with a crisis or opportunity when you least expect it. Being financially prepared for unexpected events is critical to ensure you don’t have to dip into your retirement funds.

Here are some ways to plan for medical expenses:

- Get a comprehensive medical insurance policy: Be aware of what your policy does and doesn’t cover and get pre-approval for expenses to avoid surprise bills.

- Pay into a Health Savings Account (HSA): This is a government-backed savings account specifically designed to help you pay for medical costs.

- Protect your mortgage: Critical illness insurance can help you pay your mortgage if you are diagnosed with a life-changing, chronic condition and have a loss of income.

- Buy a specialist policy: If you have a chronic illness or are predisposed to one (for example, due to your family history), speak to an insurance advisor about specialist providers that may cover this.

- Check your Medicare eligibility: Your eligibility for Medicare before retirement will depend on factors like income and benefits. You can access Medicare from age 65 if you have contributed to Medicare taxes for a certain period.

Medical emergencies are not the only life events that need to be planned for if you wish to retire early. Redundancy can, for example, severely limit your ability to save efficiently during periods of unemployment. Speak to an insurance advisor about the best products for your financial situation and retirement goals.

10. Be wary of scammers

If you’re trying to save a significant amount of money quickly, you may be an attractive target for scams and identity theft.

Here are just some examples of internet scams you should be aware of to protect your retirement funds:

- If you receive an urgent text from the government, for example about your 401(k), don’t reply or click any links — speak to your plan provider or speak directly to the government office.

- Cryptocurrency returns that seem too good to be true usually are! Don’t be fooled by get-rich-quick schemes.

- Verify that emails and texts from companies are legitimate before clicking anything. It could be a phishing scam.

Learn how to avoid risky behaviors online and invest in antivirus or security software to protect your personal devices and online data.

Is retiring young worth it?

Retiring young is worth it for some people, but it depends on your goals, lifestyle preferences, and even luck. Here are some pros and cons of early retirement:

Advantages

- More time to pursue your interests: Whether it’s painting, golf, hiking, pickleball, or music, you’ll have plenty of time to indulge in your hobbies or even find new ones. Additionally, by retiring early, you will likely be in better physical condition to enjoy more active pursuits, such as traveling, to their fullest potential.

- More time to spend with loved ones: Time spent with a partner, family, or friends is priceless to many. Retiring early will enable you to spend more time fostering connections with those who matter most in your life.

- Reduced stress: Being retired means no more late shifts, stressful deadlines, or poor work-life balance. Additionally, if you had a job where you needed to commute, you could say goodbye to getting up early to sit in traffic or wait in the cold at a bus stop.

Disadvantages

- Potential loneliness: Retiring early without people around you who are doing the same can be very isolating. While close friends and family are out working, you may end up with long stretches of the day without significant human interaction.

- Saving is difficult: The earlier you wish to retire, the more you will have to save. This can make your lifestyle difficult for a significant amount of time. It may sometimes feel like you are sacrificing a large portion of your adulthood — choices that you may regret further down the line.

- You can’t predict your lifespan: You don’t know how long you’ll live and with medical advancements happening all the time, people are living longer and longer. Without careful planning, you could save too little and run out of money at an advanced age, particularly when factoring in health and social care costs. It’s also possible that you will pass away younger than you expected due to an accident or terminal illness.

Take control of your financial wellness with Norton

Retiring early takes dedicated financial planning and careful consideration. Boosting your income, both temporarily and through sensible investments, is essential. With Norton Money, you can get better insights into your financial health and learn how to make smarter, more informed decisions about your money when planning for retirement. Manage your money with confidence, with Norton.

Editorial note: Our articles provide educational information for you. Our offerings may not cover or protect against every type of crime, fraud, or threat we write about. Our goal is to increase awareness about Cyber Safety. Please review complete Terms during enrollment or setup. Remember that no one can prevent all identity theft or cybercrime, and that LifeLock does not monitor all transactions at all businesses. The Norton and LifeLock brands are part of Gen Digital Inc.

Want more?

Follow us for all the latest news, tips, and updates.