How to pay off credit card debt quickly and safely

Credit cards can be a blessing and a curse: they’re certainly useful, but high interest rates can turn small purchases into costly debt. Explore strategies for paying off credit card debt, even when you don’t have any money. Then, use Norton Money to connect your accounts, track spending, and monitor your credit score as you work on improving your financial health.

It can start as a single purchase, like a new phone or TV, but turn into years of making payments and hundreds of dollars or more lost on high interest rates. Missed payments and accumulated debt can ruin your credit score and make it harder to rent an apartment, borrow money, or buy a house in the long run. They can also result in even higher interest rates, quickly putting you in a vicious debt cycle.

But there is hope for those trying to get rid of their credit card debt. While no one-size-fits-all solution will guarantee you’ll get out of debt, there are some strategies worth trying. Discover the most effective strategies to eliminate credit card debt and help you stay debt-free in the future.

How to get out of credit card debt: a step-by-step guide

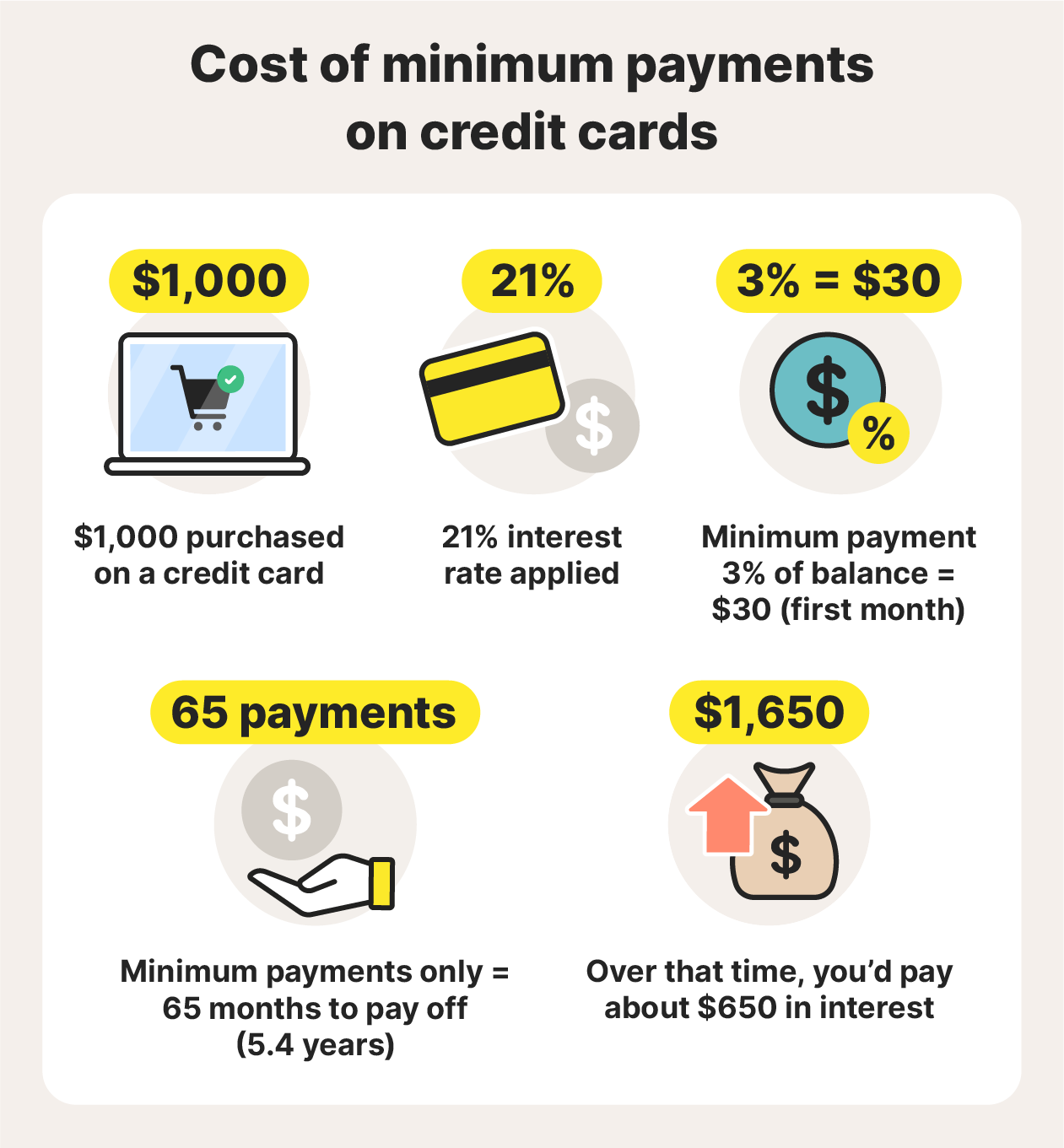

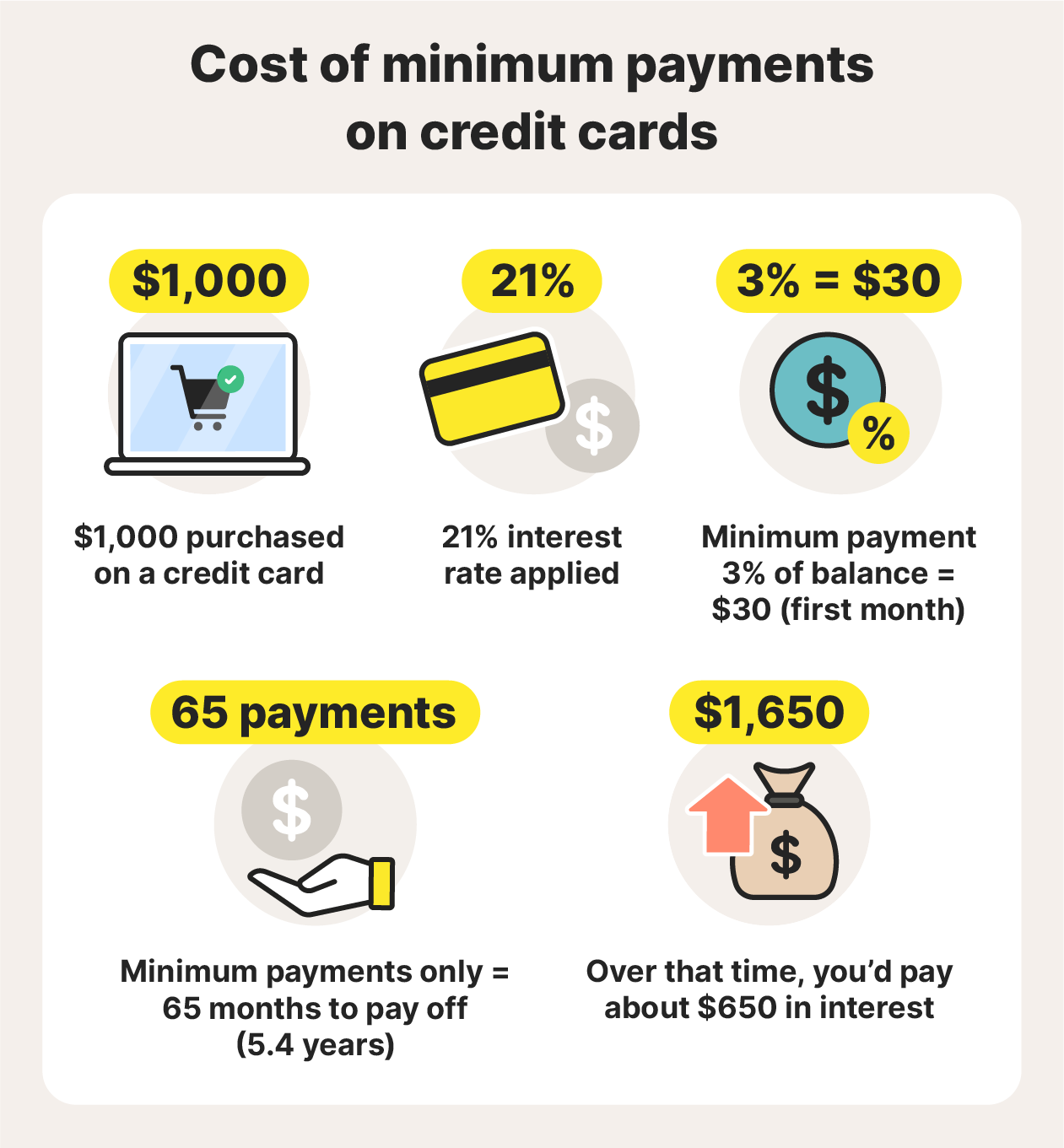

The best way to pay off credit cards is to do it as quickly as possible. That’s because the interest rates credit cards carry cause your debt to increase over time. The slower you pay off your debt, the more interest you pay, and the more money you lose. This is especially true if you’re only making the minimum payments every month.

Credit card debt is a common problem. In fact, according to a report by the Federal Reserve Bank of New York, in the first quarter of 2025, Americans had about $1.18 trillion in debt on their credit cards. While it’s a common problem, it’s also one that many people have dealt with successfully. In this guide, you’ll read about a few of the best, proven strategies for paying off credit card debt.

Step 1: Calculate your total credit card debt

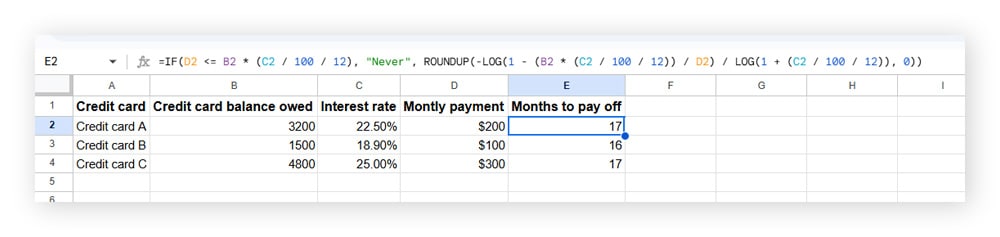

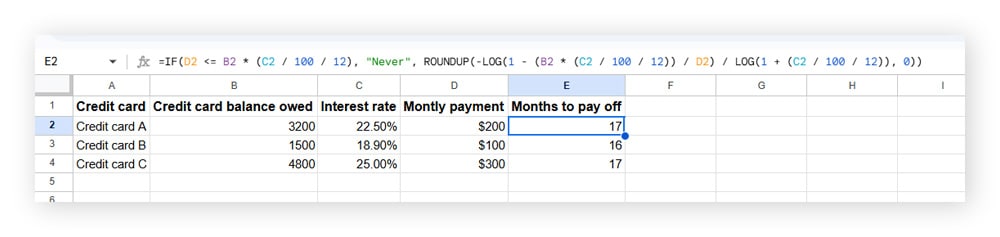

The first step is to determine how much you owe across all your credit cards. Gather together your statements for each card and check the balance you owe, the interest rate for each balance, and the minimum monthly payment.

Next, create a spreadsheet in Excel or Google Sheets to help you organize your debts, plan your payments, and determine how long it will take you to pay them off. You can use Google or ChatGPT to figure out how best to set up the spreadsheet and which formulas to use. Alternatively, use a money management app to help you budget.

If you’re not certain how many credit cards you have in your name, check your credit report. You can get a free weekly credit report from the three main credit bureaus: Equifax, Experian, and TransUnion. They will show you which credit cards you’ve been issued and how much you owe.

Step 2: Choose a repayment strategy

Next, think about which repayment strategy would be best for you. There are two main ways to pay down credit card debts — the snowball method and the avalanche method — both of which start with setting a budget. If you’ve never budgeted before, it’s pretty simple to do in just a few steps.

The key elements are:

- Add together all your sources of income: This includes your paychecks, revenue from rentals, money from side gigs, inheritance, and even gifts.

- Group your expenses: Separate your expenses into categories, like necessities, debts, savings, and wants.

- Prioritize repayments: After you’ve budgeted for necessities, see how much money is left each month for paying off your credit card debt.

Then, ask yourself some questions: Are you a person motivated by small wins? Then the snowball method is for you. Or are you expecting a financial windfall? Then you can try the avalanche method.

Snowball Method: Work on paying off the smallest debt you have first, while also continuing to make the minimum payments on all other accounts. Once the smallest debt is paid off, roll over the money that you would have budgeted for it to the next smallest debt. Keep doing this until all your debts are paid off.

Avalanche Method: Choose the debt with the highest interest rate and pay as much as you can toward it each month, while continuing to pay the monthly minimum on your other debts. Once that big debt is paid, roll over what you would have budgeted to pay it off to the debt with the next highest interest rate, and so on.

Step 3: Reduce expenses and redirect savings to debt repayment

After choosing the best repayment method for you, it’s time to take a hard look at your expenses. Remember: every dollar you save can be used to lower your debt and bring you to financial freedom more quickly. You can try using a budgeting app to help you stay organized.

There are two kinds of expenses: Fixed expenses are monthly bills and costs that are nearly identical each month and almost impossible to avoid. Good examples are rent, mortgage payments, car payments, and phone bills. Variable expenses change every month and are easier to adjust. They could include groceries, utility bills, and clothing. Here’s how to cut both.

Ways to cut fixed expenses:

- Switch up your phone or internet plan: Change providers or get a cheaper plan. For example, revisit whether you really need unlimited mobile data or lightning-fast Wi-Fi.

- Downsize your rental: If you’re renting, move to a smaller home or relocate to a less desirable neighborhood.

- Share your space: Consider getting a roommate or moving in with friends or relatives.

- Try vacation rental sites: If you own your home, try renting out a room via Airbnb — just be careful to avoid Airbnb scams.

- Refinance your mortgage: It may be possible to get a lower interest rate depending on the current market.

- Reduce subscriptions: Look at your bank statement and take note of all your monthly subscriptions, from gaming to streaming services. Then cancel the ones you don’t need.

Ways to cut variable expenses:

- Buy second-hand: Items from clothing to tools to household appliances can often be bought for a fraction of the price secondhand. Look in thrift stores, at garage and estate sales, flea markets, or clothing swaps. Or, go online and check out Facebook Marketplace or websites like Mercari or Poshmark.

- Buy generic foods: Instead of name brands, try store-brand items. Make sure to use rewards cards and apps to get special discounts — just be sure you avoid store credit cards.

- Don’t eat out: Instead, cook meals for yourself. If you don’t know how, start with simple things like breakfast foods. Or buy a cheap slow cooker that will do most of the work for you. Cook enough meat, beans, rice, pasta, or vegetables in it for several days at a time.

- Reduce spending by planning better: This is especially true for quick bites to eat or beverages on the go. Do meal prep for work lunches, buy snacks in bulk, carry a water bottle, and bring coffee in a thermos from home.

- Reduce utility bills: Take shorter showers and lower the thermostat in the summer. Make sure to turn off lights you aren’t using, and switch out lightbulbs for energy-efficient ones.

Step 4: Contact your credit card provider

If your debt is large or you are still struggling to pay it off for some other reason, contact your credit card provider. You might qualify for a lower interest rate, hardship program, or another plan.

The repayment options your credit card provider might give you could also include:

- Debt relief agencies: Reputable debt relief agencies can put you on a debt management program or plan. These agencies negotiate with credit card companies to reduce your interest rates and payments. Then, you pay a single monthly payment into the plan. However, you must pay an agency a fee, and your credit score could be temporarily affected.

- Hardship programs: These are a temporary solution to reducing credit card burdens. If you are sick or lose your job, credit card companies may sometimes agree to reduce your payments for some time. But remember, this will not eliminate your debt, and you will need to start paying off your debts at normal rates eventually.

Step 5: Consider debt consolidation or debt settlement

If you have multiple credit cards to pay, you can try taking out a debt consolidation loan. This means you take out a single loan with a lower interest rate, and pay off all your credit cards with that. Then, you begin paying off that loan. Theoretically, this winds up being cheaper and easier to manage: the interest rate is lower, and you only have a single monthly payment to worry about. This can also boost your credit score.

However, not everyone can qualify for such loans, and there are some pitfalls to avoid, too. Consider these points before taking out a debt consolidation loan:

- Will you qualify? Not everyone qualifies for a debt consolidation loan. Most people need a good credit score to begin with.

- What kind of fees are there? You may need to pay fees for taking on new loans.

- Is the interest rate lower? For this option to be worthwhile, the interest rate on your new loan should be lower than the average rate across all your existing credit card debts.

- How will it affect your credit score? While consolidated loans can improve your credit score in the long term, they can have a negative short-term impact, since they lower the number of your accounts and add a hard inquiry to your credit file.

- Can you pay it off? If you’re tempted to spend more or can’t make your payments, you will only fall deeper into debt, and this strategy is not for you.

Debt settlement is a last-resort option for people struggling to pay off their credit card debts. When you have a lot of debt to pay down and you can’t tackle it any other way, you may be able to negotiate to pay a single lump sum that’s lower than the total amount you owe. In exchange, the credit card company will eliminate your debt.

For-profit debt relief agencies or lawyers can help you reach an agreement with credit card companies, or you can try negotiating on your own. This wipes your debt, though it has a very negative effect on your credit score.

Debt settlement comes with many risks, for example:

- The agency may not reach a settlement for you: Often, debt settlement agencies tell you to stop paying off your credit cards so you can save up for the settlement payment. But if they don’t reach an agreement with the credit card companies, you’ll have late fees to pay.

- It damages your credit score significantly: Debt settlement can have a major negative impact on your credit score, although ignoring your debt has a much worse effect.

- You could default on your payments to the agency: If you’re unable to keep up with the payment plan, the settlement may fall through, leaving you with even more debt, now including penalties from both the credit card companies and the settlement agency.

- You may owe taxes on forgiven debt: The IRS typically considers forgiven debt as taxable income. If a portion of your debt is canceled through settlement, you could receive a 1099-C form and may have to pay income tax on the forgiven amount. Talk to a tax professional to understand your obligations.

- You can get scammed: There are many scams related to debt settlement. Be careful. Don’t pay an agency before it settles your debts.

Step 6: Increase your monthly income to pay off debt faster

Sometimes, cutting expenses isn’t enough to tackle credit card debt: you also need to increase your revenue. When you make extra income, apply it toward repaying your debt. You may be surprised how quickly your side gigs add up to paying down your debt. There are lots of ways to boost your income, and some of the best ways to make extra money are online.

Here are some ideas for boosting your income:

- Get a side gig. There are plenty of them out there. You can provide a service that people find on an app, such as dog-walking on apps like Rover or ridesharing on apps like Uber.

- Try freelance work. If you have skills in writing, teaching, or design, advertise your experience on websites like Upwork or Fiverr, or apply for positions listed.

- Find a part-time job or seasonal work. This could be babysitting, tutoring, or waiting tables. If you work in a sector like education, try finding a summer tutoring or camp counselor job. If you have weekends off, look for extra work then.

- Sell some of your belongings. Downsizing is usually possible; try signing up for an app like eBay to sell some of your stuff online — just be mindful of eBay scams.

- Ask for a raise. If you’ve been performing well at work, talk to your employer about increasing your salary.

How to pay off credit card debt when you have no money

You need money to pay off credit card debt, but what if you’re broke? This may seem like an impossible task, but you still can lower your debt and start paying it off. Here are some things to try.

- Contact your credit card company. You don’t necessarily need to pay an agency to negotiate a debt management program for you. Try doing it yourself to save money and help avoid scams. Find your credit card company’s number on your credit card statement and give them a call. Be polite but persistent, and you might get a payment plan that works for your budget.

- Try a non-profit credit counseling organization. Reputable non-profit credit counseling organizations offer free or low-cost help, like workshops or personalized counseling, to people struggling to pay off their credit cards. Before you turn to these organizations, verify their legitimacy. Check your state attorney general’s office and local consumer protection agency for any complaints against the organization, and to see if they are licensed. When working with credit counselors, get everything in writing and don’t pay for services in advance. You may also find help through your university, credit union, or military benefits.

- Get on a hardship program for temporary relief. If you really can’t manage the payments on your credit cards because of circumstances like an illness or job loss, contact your credit card provider and explain the situation. Be prepared to offer documentation, such as medical bills. The company might offer you a hardship program, making your payments smaller for a period of time.

- Consider bankruptcy if nothing else works. Paying off credit card debt isn’t easy, and if you’re up to your ears in large debt and can’t pay it off by any means, you might need to consider filing for bankruptcy. Bankruptcy is a court order that says you don’t need to pay your debt, but filing for it hurts your credit for up to 10 years. You may find it difficult to borrow money, buy a home, or even get a job during that time. Still, it’s a necessary step for some people to eliminate their debt.

Common mistakes to avoid when paying off credit card debt

Don’t fall into a bigger trap while looking for ways to fix your credit card debt. Here are some common mistakes and how to avoid them.

- Paying the minimum repayment: Paying the bare minimum on your debts will keep you in debt longer and waste your money.

- Missing payments: Missed payments mean late fees and falling further into debt.

- Taking on new debts: It may seem tempting to charge more to your credit card, but this will only make it harder to pay off. It’s best not to use credit cards if you have more debt than you can manage.

- Ignoring interest rates: High interest rates will cost you more money in the long run. Consider paying off the card with the highest interest first, or negotiating with your credit card company to lower your interest rate.

- Falling for scammers: Watch out for loan sharks who charge high fees for debt management programs, unlicensed credit counseling organizations, and phishing scams that target indebted individuals. Tools like Norton Genie, can help alert you to phishing attacks and malicious websites masquerading as debt relief agencies.

Staying debt-free after paying off your credit cards

So you paid off your credit cards. Congratulations! Welcome to your new, debt-free life. But how will you manage your finances so you don’t get in this situation again? Here are some highlights to help you stay out of debt for good:

- Use a debit card instead of a credit card, or try paying for things with cash. This way, you only spend what you have.

- If you do use a credit card, be prepared to pay off the full balance every month.

- Create a budget for your expenses and stick to it. Track every expense.

- Budget for emergency expenses so that unexpected life events don’t set you back.

Take control of your financial wellness

Credit card debt can feel like an enormous burden to overcome, but once you’ve learned to manage it, you’re well on your way to financial wellbeing. Good money habits, like budgeting and saving, can help keep you debt-free. But there are other smart tools to keep in your box, too.

Norton Money can help you stay on top of your financial health by connecting your accounts, tracking your spending, and monitoring your VantageScore credit score over time. As you work to pay down debt and build better habits, Norton Money gives you a clearer picture of how your day‑to‑day money decisions may affect your overall financial situation and credit profile.

Editorial note: Our articles provide educational information for you. Our offerings may not cover or protect against every type of crime, fraud, or threat we write about. Our goal is to increase awareness about Cyber Safety. Please review complete Terms during enrollment or setup. Remember that no one can prevent all identity theft or cybercrime, and that LifeLock does not monitor all transactions at all businesses. The Norton and LifeLock brands are part of Gen Digital Inc.

Want more?

Follow us for all the latest news, tips, and updates.